3.1.1 Simulation

You can add the basic TD details to simulate the interest and maturity value for the TD account.

To perform TD simulation:

Note:

The fields marked as Required are mandatory.- On the Homepage, from the Retail Deposit

Services mega menu, under Term Deposits

and Transactions, click Account

Opening, or specify Term Deposit Account

Opening in the search icon bar and select the screen.The Term Deposit Account Opening screen is displayed.

- On the Term Deposit Account Opening screen, click the

icon or specify the customer number in the Customer

ID field, and press Enter or

Tab.

icon or specify the customer number in the Customer

ID field, and press Enter or

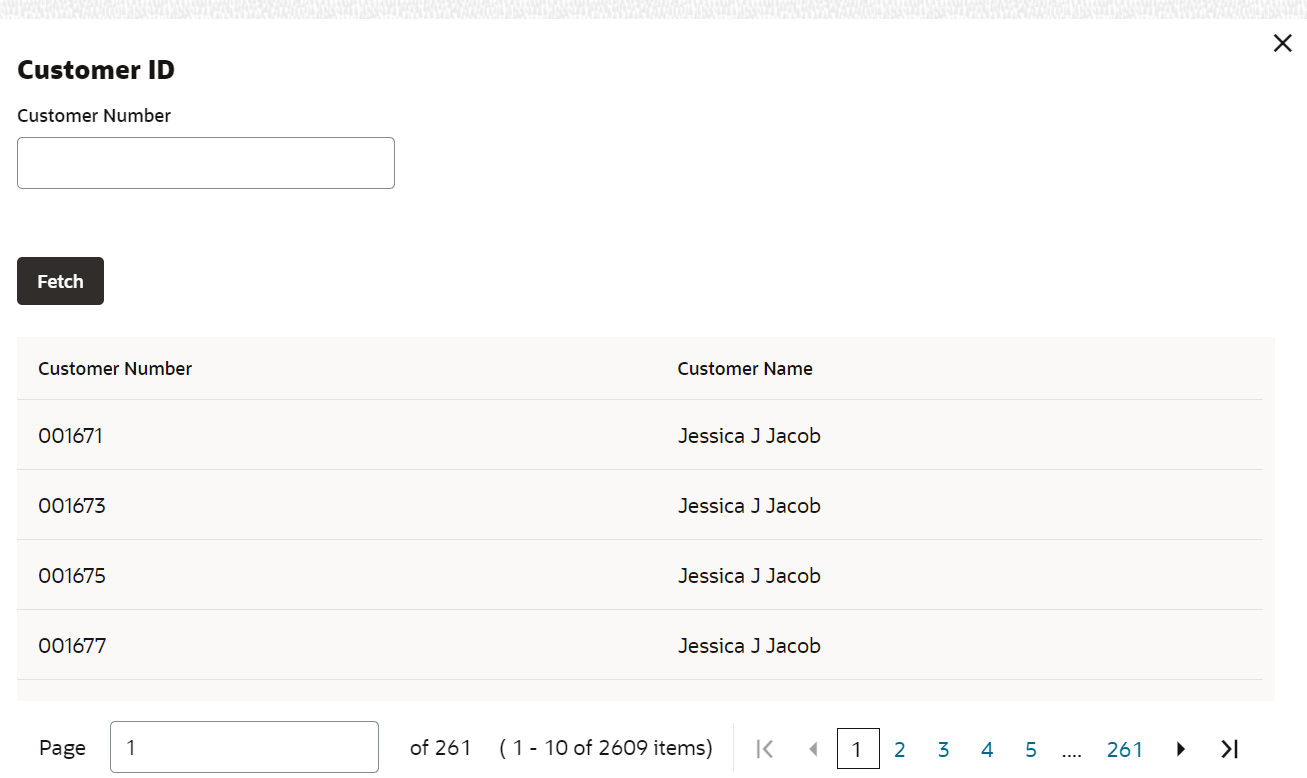

Tab.- If you click the

icon, then the following section is displayed:

icon, then the following section is displayed: - Specify the customer ID in the Customer Number field.

- Click Fetch.The customer number and name are displayed in the table.

- Select the Customer Number from the table.The details related to the selected customer number are displayed in the tabs.

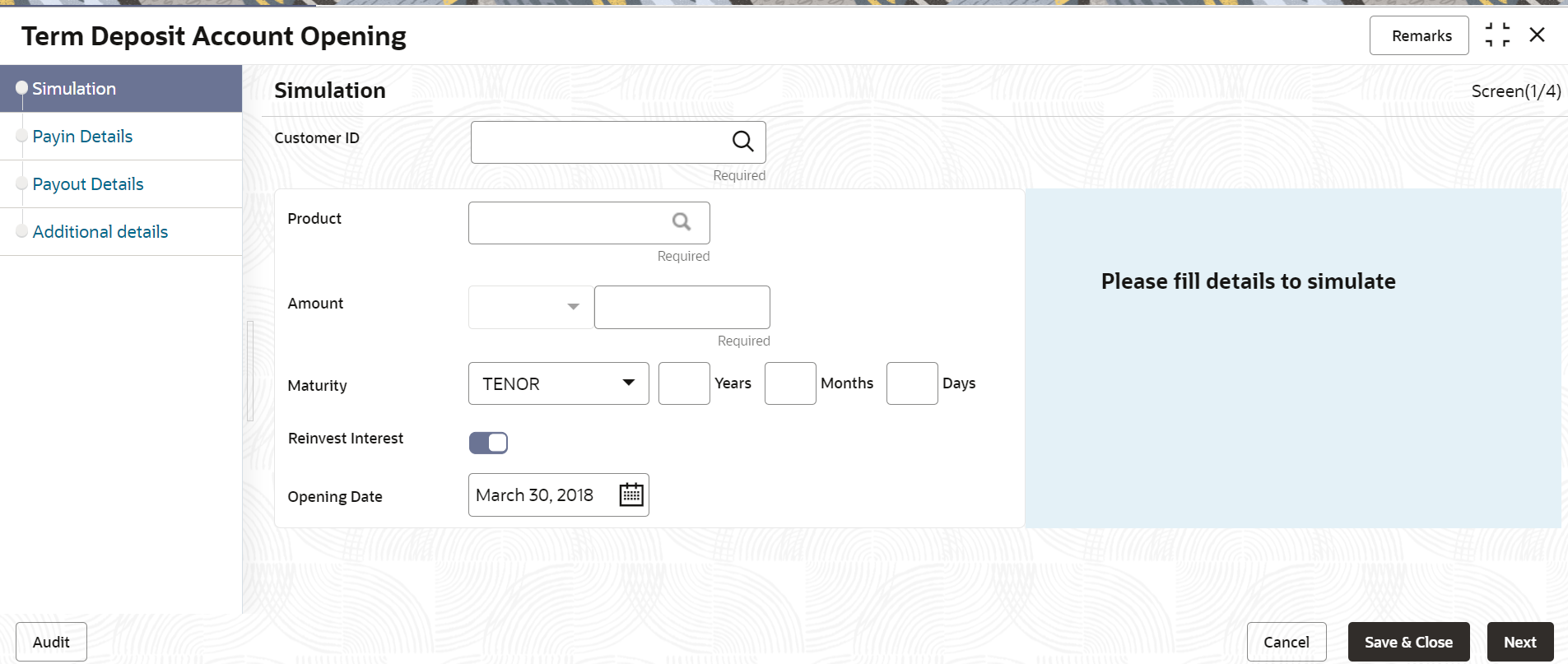

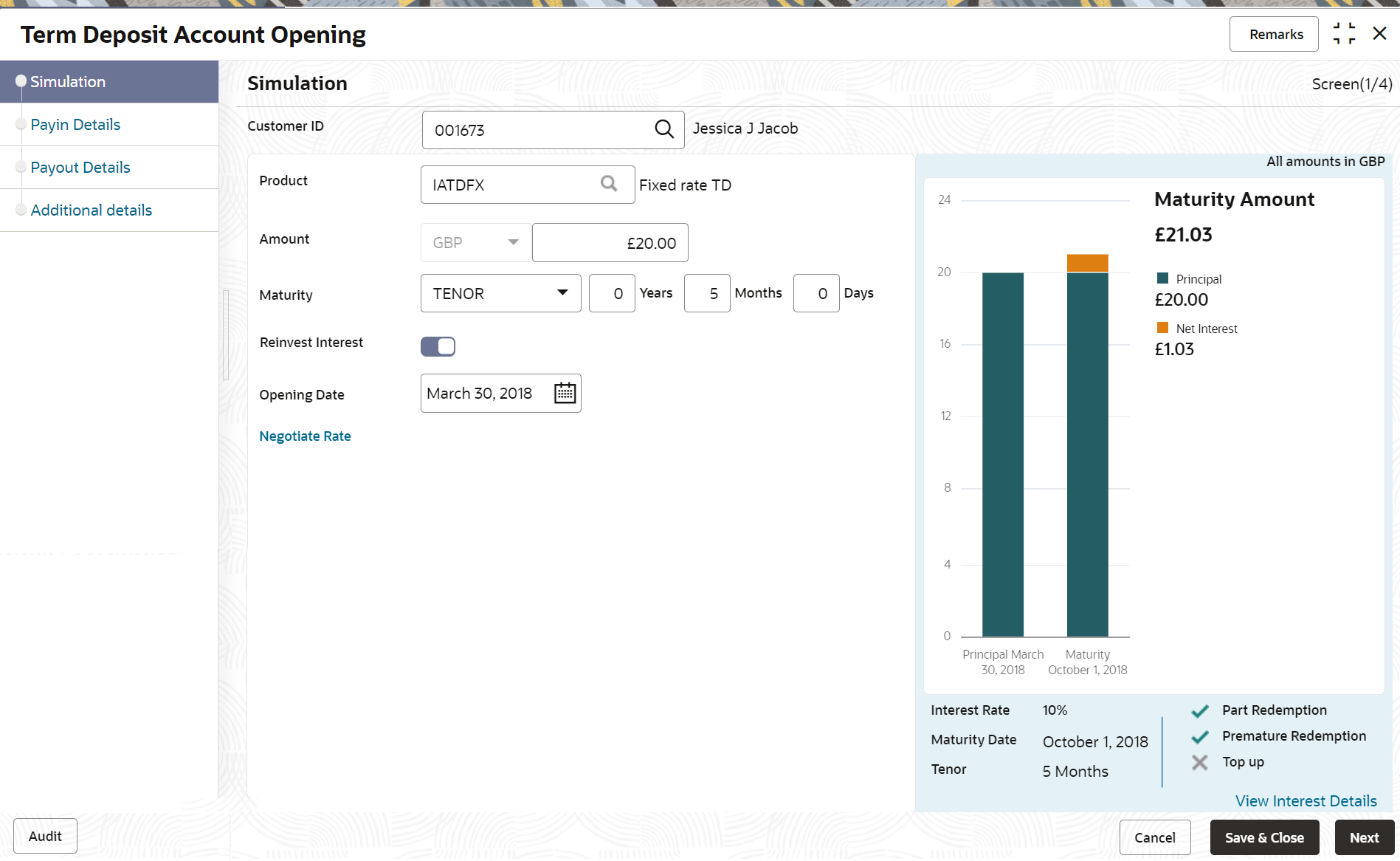

Figure 3-3 Term Deposit Account Opening - Simulation

Description of "Figure 3-3 Term Deposit Account Opening - Simulation" - If you click the

- Perform the required actions on the Simulation tab. For more information on fields, refer to the field description

table.

Table 3-1 Term Deposit Account Opening - Simulation – Field Description

Field Description Customer ID

Specify the customer for whom the TD is to be opened. Note:

The customer name is also displayed adjacent to the field.Product

Select the deposit product under which the TD is to be created. Note:

For information, on the Product section, refer Fetch Product.Product Description

Display the description of the deposit product selected. Amount Specify the deposit amount. Note:

By default, the amount currency will be of product selected.Maturity Select the option for TD maturity. The options are: - Tenure: If you select this option, then specify the tenure for maturity in years, months, and days in the fields displayed adjacent.

- Date: If you select this option, then specify or select the date.

Reinvest Interest Switch to

to reinvest the interest in TD.

Switch to

to reinvest the interest in TD.

Switch to to be paid out the interest.

to be paid out the interest.

Note:

The interest amount is paid out during interest liquidations.Opening Date Specify the deposit opening date. Branch Code Displays the branch code of the teller’s logged in branch. - To fetch Product:

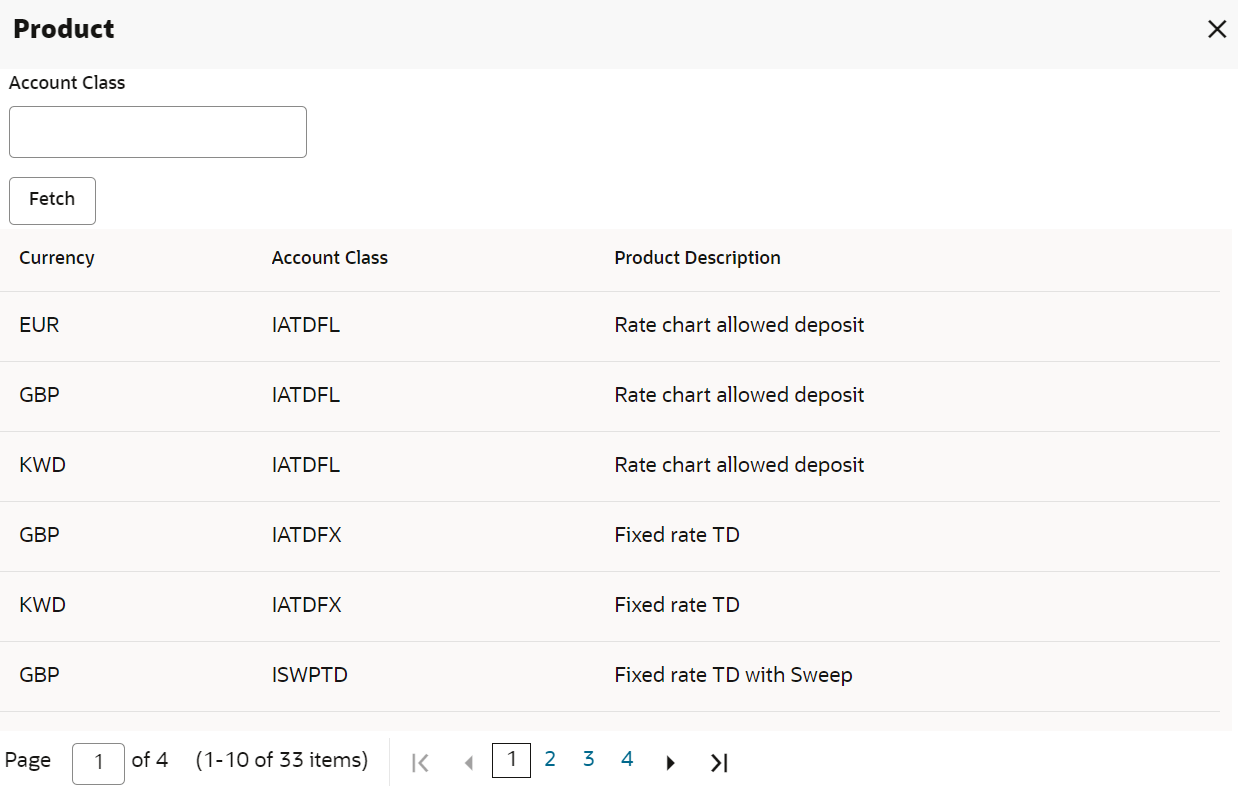

- Click

icon from the Product field.The Product section is displayed.

icon from the Product field.The Product section is displayed. - Specify the number in the Account Class field.

- Click Fetch.The details are fetched and displayed in a table.

- Select the account class from the table.

- You can negotiate the rate by performing the following action if

required:

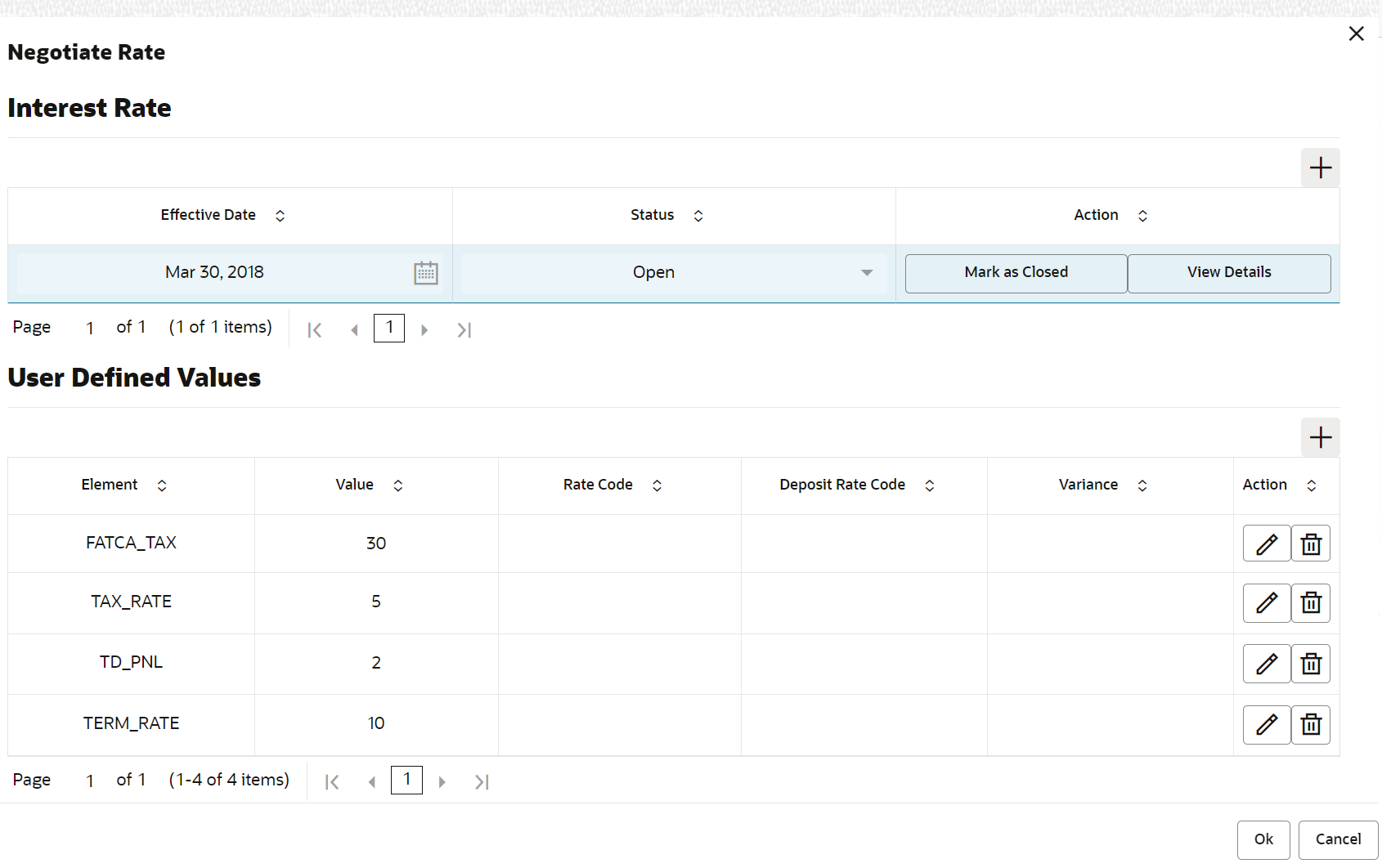

- Click the Negotiate Rate link.The Negotiate Rate section is displayed.

- On the Negotiate Rate screen, perform the

required action. For more information on fields, refer to the field description

table.

Table 3-2 Negotiate Rate – Field Description

Field Description Interest Rate This section displays the interest rate details. Effective Date Displays the date from which the interest rate is effective. Status Displays the status of the interest. Action Click Mark as Closed, to close the interest rate.

Click View Details, to view the user defined values.

User Defined Values This section displays the user defined values details. Note:

This section is displayed if you click View Details from the Action field.Element Displays the user defined elements that are already linked to the Interest product. Value Displays the user defined value. Rate Code Displays the rate code for the user defined value. Deposit Rate Code Displays the deposit rate code for the user defined value. Variance Displays the variance for the user defined value. Action Click the

icon, to edit the user defined value

details.

icon, to edit the user defined value

details.

Click the

icon, to delete the user defined value

entry.

icon, to delete the user defined value

entry.

Click the

icon, to confirm the edited details. This

icon is displayed, only after you click the edit

icon.

icon, to confirm the edited details. This

icon is displayed, only after you click the edit

icon.

- You can also add new row to the Effective Date

and User Defined Values sections, by clicking the

icon.

icon. - Click OK.

- Click the Negotiate Rate link.

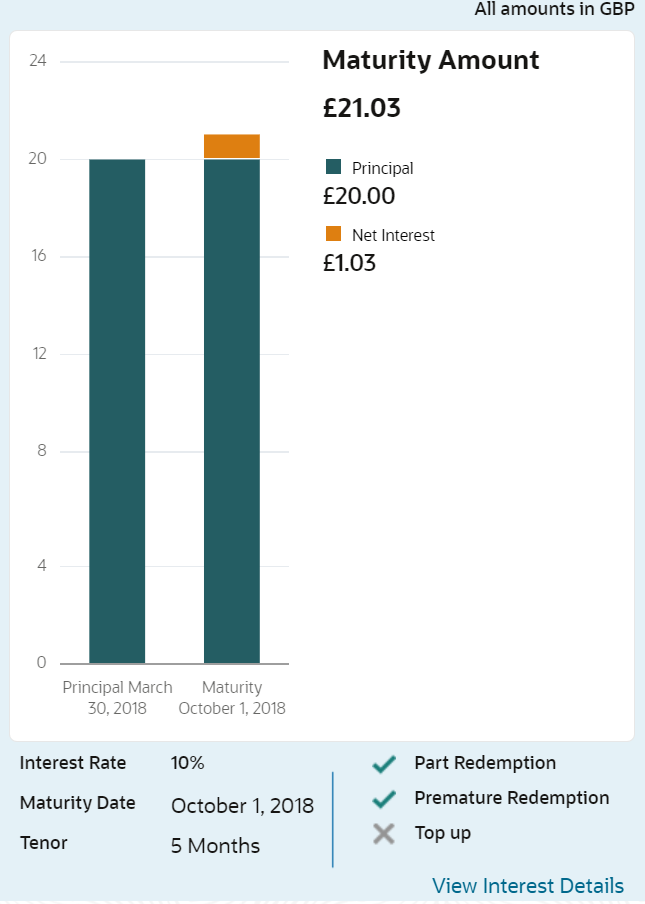

- On providing the inputs, a simulation will be triggered and displayed as

output.The simulation details are displayed.

- Based on the input data provided, the system simulates the details of TD and

displays them in a widget on the right side. For more information on fields, refer to the field description

table.

Table 3-3 TD Account Opening - Output Details – Field Description

Field Description Maturity Amount Displays the maturity amount for the TD. Principal Displays the total principal of the TD. Net Interest Displays the Net interest on the principal (Interest – Tax). Interest Rate Displays the Interest rate applicable for the TD. Maturity Date Displays the maturity date of the TD. Tenor Displays the tenor of the TD in Years, Months & Days. Part Redemption Displays whether the part redemption is allowed for the deposit. Premature Redemption Displays whether premature redemption is allowed for the deposit. Top-up Displays whether the top-up is allowed for the deposit. View Interest Details Click this link if the interest details are required to be viewed. Date Displays the date of interest payout / compounding date. Reinvested Interest / Paid out Interest Displays the reinvested interest / paid out interest. Principal Displays Principal amount after the interest liquidation on this date. Note:

Once the deposit simulation is completed, you can provide the simulated details to the customer. - Click Next.The Payin Details tab is displayed.

Parent topic: Account Opening