- Interest User Guide

- Building Interest Classes

- Introduction

2.1 Introduction

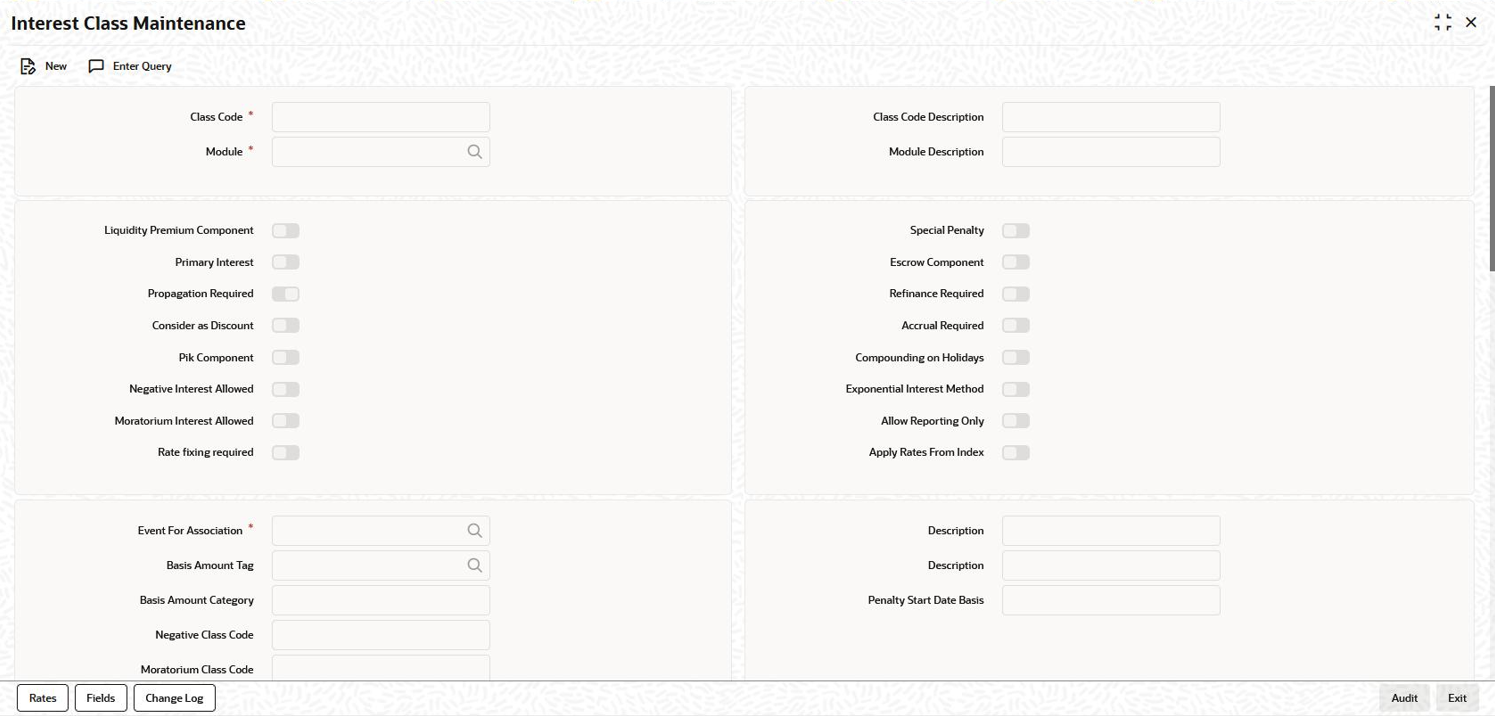

To capture details of interest class maintenance screen

Specify the User ID and Password, and login to Homepage.- On the Homepage, type LFDINTCL and click

next arrow.The Interest Class Maintenance screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - Before defining the attributes of an interest class, you should assign the class a unique identifier, called the Class Code and briefly describe the class. A description helps you easily identify a class.

- You can enter below details in this screen. For information on

fields, refer to the field description table.

Table 2-1 Interest Class Maintenance

Field Description Module An interest class is built for use in a specific module. This is because, an interest component can be applied on different basis amounts, in different modules. Note:

Basis Amount Tags available depends on the module for which you build the class.Events The term Event can be explained with reference to a deal. A deal goes through different stages in its life cycle, such as: - Contract Booking

- Money Settlement of contract

- Reversal of a contract

- Cancellation of a contract

The event at which you like to associate the interest component, being defined, to a contract is referred to as the Association Event.

Basis Amount Tag The basis on which an interest is calculated is referred to as the Basis Amount. When building an interest class, you have to specify the tag associated with the Basis Amount. The attributes defined for an interest class, is defaulted to all products with which you associate the class. When maintaining interest details for a product, you can change these default attributes. Contracts maintained under a product acquires the attributes defined for the loan product.

Note:

The amount tag SCH_AMT_OS is the basis for calculation of late payment charge. It constitutes the total amount outstanding across all components due on a particular schedule date, provided late payment charge is applicable to these components. If you select the Basis Amount Tag as SCH_AMT_OS, then the following check boxes are disabled.- Primary Interest

- Consider as Discount

- PIK Component

Rate fixing Required Select this check box to indicate whether the rate fixing is applicable for a particular component. This is applicable for Bilateral Loans and Loan Syndications. Moratorium Interest Allowed and Moratorium Class code In case Moratorium Interest Allowed check box is selected for main interest component, then on save the system creates Moratorium Class Code (Class Code field value is appended with _M). Note:

If Rate Type is Floating for main component, then the system creates moratorium interest component with Fixed/Userinput.Amount category Indicate the category of the component on which the interest has to be applied. The available options are: - Expected

- Overdue

- Normal

- Outstanding

- Overdue OS

- Sch-Overdue

If Overdue is selected, the balance on which interest has to be applied is the amount that is outstanding, based on the repayment schedule defined for the contract. An example of this category is the application of penalty interest, on the principal or interest, when a repayment has not been made as per the schedule.

If Outstanding is selected with the amount category as principal, the interest is calculated on the balance of the total principal outstanding amount.If Overdue OS is selected with the amount category as principal, the interest is calculated on the principal overdue outstanding.

If SCH-Overdue is selected, then the basis amount refers to amount outstanding on a particular schedule due date. If you select the Basis Amount Tag as SCH_AMT_OS, then system defaults the Amount Category as Sch-Overdue and disables this field.Select the applicable category using the drop-down list. The system defaults to Normal.

Penalty Start Date basis Oracle Lending calculates the penalty in case the loan payment is not made on the principal schedule date. However, if the payment date falls on a holiday, the penalty can be calculated depending on the start date that you specify in this screen. If you have specified that penalty start date basis as the Due Date, the penalty is calculated from the due date of payment even if it falls on a holiday.

If you have specified that the penalty start basis be Next Working Day, the penalty is calculated from the working day following the holiday. Thus the system waives the penalty for the holiday(s).

Example

Assume a loan principal payment schedule falls on 11th October 2003, which is maintained as a holiday in Oracle Lending.

In addition, there is a deficit of funds in the customer’s account for making the payment.If you have selected the due date option, Oracle Lending calculates the penalty from 11th October 2003.

If you have selected the next working day option, the system calculates the penalty from 13th October 2003 and waives the penalty for 11th and 12th October.Accrual Required You can choose to accrue the interests due on a contract. To accrue the interest payable on a contract, choose the Accrual Required option. The accrual details that you define for an interest class defaults to all products with which you associate the class. When maintaining interest accrual details for a product, you can change these default details. Contracts maintained under a product acquires the accrual details defined for the product. However, you can define unique accrual details for a contract.

- You can enter below rate details in this screen. For

information on fields, refer to the field description

table.

Table 2-2 Rate Details

Field Description Rate Type The interests paid on contracts can be at a Fixed Rate, or on the basis of a Floating Rate. If you indicate that interests should be calculated on the basis of a Floating Rate, you must specify the Periodic Floating Rate Type. For all contracts maintained under products, associated with a class, the interest is by default calculated using the specified Rate type.

If you select the Basis Amount Tag as SCH_AMT_OS, then system defaults the Rate Type as Special and disables this field.Special Rate Type Select the special rate type from the adjoining drop-down list. This list displays the following values: - Fixed Rate

- Flat Amount

Fixed Rate Type If the rate type is Fixed, you have to indicate whether the rate is entered by the user or needs to be picked up from the rate maintenance table. The following options are available: - User Input (U) – This option may be used if you need the user to specify the rate of interest applicable on the contract.

- Standard (S) – If you opt for this option, the system pick-ups the rate from the Standard Rate Maintenance screen. This rate is combination of the Standard Rate, Amount-Slab- Wise Spread and Tenor-wise Spread. However, you can change this rate at the contract level.

- For contracts involving fixed rate interest components, your bank may require choosing the applicable rate from historical floating rates for a floating rate code that has been maintained for a treasury source. For such requirements, select the TREASURY option in the Fixed Rate Type field. This option is applicable only for interest classes that you define for the Loans module.

Borrow Lend Indicator You can select the following option from the drop-down list. By default, Mid is selected. - Borrow

- Lend

- Mid

Interest Computation You need to specify the method to be used for computation of interest. The available options are: - Simple - Indicates that the interest is computed using the Simple Interest formula.

- Compound - Indicates that the interest is compounded.

Compounding on Holidays You can opt to compound interest on holidays. Select the Compounding on Holidays option to indicate the same. An example to show compounded interest calculation is given under the section titled Defining interest details.

Exponential Interest Method If main interest component is of exponential method for the loan product, the system validates that the day’s basis mentioned for main interest and penalty interest components are same during contract save/modification. Allow Reporting Only By default, this check box is not selected. If Allow Reporting Only is selected then the component does not have any schedules and it is liquidated when the main interest is liquidated. For COSIF the accrual is always be on a Actual/360 basis, for RAP the amount is deducted upfront and reverted during the accruals. COSIF and main Component always have the same amount due on the schedule dates which are achieved by adjusting the effective rate for COSIF using the below logic rate_act360 =(((((?Rate?_bu252/100)+1)^( #budays /252))^(360/#days))-1)*100 Special Penalty Comp System automatically selects this box if you select the Basis Amount Tag as SCH_AMT_OS and you cannot modify it. Default Fixed Rate Code If you opt for Standard rate type, you have to select rate code based on which rate pick-up is done. All the rate codes maintained through the Standard rate code maintenance screen is available for selection in the option-list provided. The Standard rates maintained (in the Standard Rate Maintenance screen) for the selected rate code is applicable on all products associated with the Interest class being maintained.

Prepayment Penalty Rate Code Likewise, select the rate code based on which the system picks-up the prepayment penalty rate for all contracts under the product. Whenever a prepayment is processed, the prepayment penalty rate maintained for the selected rate code is applied on all the contracts associated with this interest class. Rate Basis The following options are available for rate basis. - Per Month – This option is used for fixed per month rate.

- Per Annum/Not Applicable – This option is used for annual rate input. The value input is considered as resolved rate.

- Quote Basis – This option is used for float rate input for all quote basis.

Default Floating Rate Code Interest payable on contracts is calculated at specific rates. When building an interest component, you have to specify the rate at which the interest should be computed. When associating a rate code (that you have maintained in the Rate Codes Maintenance screen) with the interest component that you are building, the rates corresponding to the code is used to compute interest. The details defined for an interest class defaults to all products with which the class is associated. When maintaining interest details for a product, you can change this default information. Contracts maintained under a product acquires the interest details defined for the contract product. However, you can define unique interest details specific to a contract.

When maintaining a contract, you can choose to waive the rate code altogether or amend the properties of the code to suit the security.If you allow amendment of a rate code, you can specify if you like to allow rate code amendment after the association event.

You can also allow the amendment of the rate value (corresponding to a rate code).Default Tenor Each rate code is associated with a tenor. For instance you have a Rate Code LIBOR. You can link any number of tenor codes to the same rate code. When building an interest component, you can specify a Tenor Code that you like to associate, with the Floating Interest Rate Code. Interests for contracts (maintained under a product with which you associate the class) is calculated using the rate corresponding to the Rate Code and the Tenor Code. No interest on premature withdrawal You can opt to waive Interest on premature withdrawal of the loan. Select the No interest on premature withdrawal option to indicate that interest needs to be waived if premature withdrawal (partial of full) is done for the loan. Reapplying interest rate on prepayment If the Fixed rate type is Standard, you can opt to reapply interest when a prepayment is made. You can reapply interest on one of the following:- On Prepaid Amount – Select this option to indicate that interest on the prepaid amount is recalculated during prepayment based on the rate applicable for the current tenor of the loan.

- On Outstanding Balance – This option indicates that interest is recalculated on the outstanding balance during prepayment based on the rate applicable for the current tenor of the loan

Consider as Discount While defining an interest class for either the loans or the bills module, you can indicate whether the interest component is to be considered for discount accrual on a constant yield basis and whether accrual of interest is required. If you select the Consider as Discount option the interest received against the component is used in the computation of the constant yield and subsequently amortized over the tenor of the associated contract. By checking this option, you can also indicate whether the component should be included in the Internal Rate of Return computation.

If you select the Accrual Required option, the interest is accrued depending on the accrual preferences defined for the product.

If neither option is selected, the interest is not accrued, but is recognized as income on interest liquidation.

Consider as Discount option is not available if the amount category is Penalty.

Note:

- For bearing contracts, if the option Consider as Discount is checked then the option Accrual Required also has to be checked. If the option Accrual Required is not checked, the option Consider as Discount is disabled.

- For Discounted contracts, you can select either one of the options or both together. If the options Accrual Required and Consider as Discount are selected then discounted interest is considered for IRR calculation. If the option Accrual Required is not selected and Consider as Discount is selected, then discounted interest is considered a part of the total discount to be accrued.

- The Consider as Discount option is not available if the amount category is Penalty.

Reporting Component Type By default, the value is blank. You can select RAP, COSIF and blank from the drop-down list. This is applicable only when Allow Reporting Only is selected. Payment Delay Days You can define the payment delay days in this screen and the same is defaulted to product and contract screens. Payment delay days is used to capture the number of days between Schedule Due Date and Pay By Date.

For example, for a contract payment scheduled for Principal and Main Interest component is 05 Feb 2017, and the Payment Delay Days is 5, then you can 5 days buffer to do the repayment, that is till 10 Feb 2017. In case of non-payment till Pay By Date, that is, till 10 Feb 2017, penalty is calculated from Pay By Date only not from Schedule Due Date.Holiday treatment is applicable for Pay By Date. If Pay By Date falls on holiday and holiday treatment is enabled for the contract then Pay By Date gets adjusted according to holiday treatment.

Example, 10 Feb 2017 undergoes same holiday treatment as the due date (as defined in product)Alternative Risk-Free Rate If you select this check box then only you can select options available in the Alternative Risk- Free Rates Preferences screen. Select this check box to define floating rate as Alternative Risk Free Rate. Note:

Look back and Look out methods can be selected in combination. None of the other methods are selected in combination.Look Back Apply X days prior rate, where the X number of look back days is configurable. Payment on due date continues with no change.

Onthe booking date of a contract, X days prior rate is considered & applied. The no of prior days is captured on Look Back Days field. Thus, on this method, the rate to be applied for current day is known on the same day.

Interest calculation behavior

As the rate to be applied for current day is known, the interest calculation & accrual posting works similar to Fixed or existing Floating interest loans.

With the past day's rate available till X day, the subsequent dates calculation is also done up front. For example, Lookback Days = 5 days. On 12 May 20, a contract is booked with current value date, for 1 year term, with monthly schedules. Rate is available till 8 May.

Rate pickup date is arrived as Tuesday 12 May 20 - 5 working days = Tuesday 5 May 20. So 5 May 20 rate is applied for 12 May. And the already available 6 May to 8 May rates are applied as below.Table 2-3 Rate pick-up dates

Rate fixed Till Rate picked up date Tuesday, May 12, 2020 Tuesday, May 5, 2020 Wednesday, May 13, 2020 Wednesday, May 6, 2020 Thursday, May 14, 2020 Thursday, May 7, 2020 Friday, May 15, 2020 Friday, May 8, 2020 Thus the interest calculation is completed upto 15 May, on 12 May itself. And, on 12 May EOD, as the 11 May rate is received, the same is applied to Monday 18 May. Thus 4 days ahead of due date the calculation for the schedule is completed. Bill notice with actual expected due could be intimated to the borrower.

Interest Liquidation behavior

Liquidation continues to happen on Due Date BOD (if Payment Delay Days = 0) For each day, the rate that was picked up and applied or projected is tracked by the system. And, till what date the interest date is calculated is also tracked. This is applicable for all RFR methods.

Payment Delay Apply current day’s rate. As the current day’s rate is published only on the next day, current day’s interest computation happens on the next day.

Interest calculation behavior

Proceed with Previous Rate Available parameter is turned on : On Day 1, interest calculation happens with latest available rate, which is previous working day’s rate. A projected accrual amount is posted with the same.

Proceed with Previous Rate Available parameter is turned off : On Day 1, interest calculation & accrual is skipped.

On Day 2, as the Day 1’s rate is received, actual calculation for Day 1 is completed, and the difference between the projected accrual amount posted on the previous day & the actual accrual amount that is arrived now, is arrived as an accrual adjustment. This delta amount could be a positive or negative number, depending on the rate fluctuation. And, for Day 2, like any day, the projected calculation happens with latest available rate (which is Day 1’s rate on this case). Thus, the accrual amount posted on Day 2 contains the previous day’s adjustment + current day’s projected amount, This accrual calculation behavior remains same from Day 2 till due date.

Note:

When a period end is crossed, the accrual for the current period needs to be closed Hence, on this case, the latest available rate is forced, for the last day of the period.Example : Say, Friday 28 February 2020 is a working day and Saturday 29 Feb & Sunday 1 March are branch & currency holidays. On this case, on 28 Feb EOD, interest calculation for 27 Feb is completed and adjustment is arrived. Then as 28 Feb is the last working day of the month, 27 Feb rate is forced for 28 & 29 Feb. Thus, interest calculation for 28 & 29 Feb are also completed with 27 Feb rate. This amount + the 27 Feb delta is posted on 28 Feb EOD. Thus the entire calculation & accrual posting for the current period is completed on the same month. Then, on 2 Mar BOD, interest calculation for 1 Mar is projected with 27 Feb rate & posted. And, on 2 Mar EOD, when 28 Feb rate is received, same is applied for 1 Mar, and delta is posted, along with 2 Mar projection.

Interest Liquidation behavior :

As interest calculation for a day is delayed by a day, interest calculation for the last day of the scheduleis arrived on due date. Hence payment date can be configured X days after the due date. The X payment delay days is configurable. Auto liquidation of the payment happens on the pay by date, instead of the due date. Rollovers go by due date.

On overdue case, Grace Days starts from Pay By Date. If schedule is still unsettled on the end of Grace Days, then penal starts from the actual due date. Thus, the delay days is applicable only for payment.

Bill notice with actual due could be sent to the borrower on due date EOD, with pay by date as the expected payment date.

Lockout Apply current day’s rate. However, X days ahead of due / maturity the current day’s rate is frozen and the same is applied till the schedule end date. Thus notice is generated with accurate expected interest amounts. The X lock out days is configurable.

Interest Calculation behavior

Interest rate pickup, calculation & accrual works same as Payment Delay method, as current day’s rate is to be applied for every day. However, for the lockout days are frozen , with current available rate, calculation for this window works same as Look Back method.

For example :

Onbooking current day rate is considered as 0, as not available. Calculation and accrual does not happen on book date EOD (??). On 2nd day EOD, interest calculation for previous day happens. However, X days prior to the due date, the rate is frozen and applied till the due date-1. Hence on Due Date BOD, schedule liquidation is triggered.

For example: Lockout Days = 5. Current dated contract booked on 12 May 20, with 1 year termand monthly schedules. 12th of every month is a schedule due date.

From 12 May till 4 Jun, the interest calculation works same as Payment Delay method. For 12 Jun 2020 schedule, 5 Jun is the Lock Out freeze start date, considering, 5 working days ahead of the due date. On 5 Jun, as usual, the delta for 4 Jun is arrived. And, then, as current day is the freeze start date, the latest available rate is forced for the rest of the schedule. That is, 4 Jun rate is force applied from 5 Jun to 11 Jun. Thus, the calculation till 11 Jun is completed with the same rate. With this, the Bill notice could be sent out to borrower, with the actual due..

Interest Liquidation behavior

Interest liquidation happens on the due date BOD, as calculation for previous working day has been completed.

Interest Rollover This SOFR method is for bearing loans. Booking and cash flow projection goes with latest available rate. On payment due date EOD re-calculation happens with the actual rates. The difference in interest amount (between projected and actual) is adjusted on the interest on the next schedule. For example, On 12 May 20, current dated contract is booked, for 1year term, with monthly schedules. Calculation and accrual happens with latest available rate (during booking). On payment 12 Jun 20 due date BOD, Instalment get debited and during EOD, system applies the actual rate from booking to end of schedule and the recalculated amount difference (between projected and actual) is adjusted on the interest on the next schedule 13 Jul 20.

Principal adjustment This SOFR method is for amortized loans. Instalment is arrived with latest available rate. On payment due date EOD re-calculation happens with the actual rates. The difference in interest amount (between projected and actual) is adjusted on the interest on the next schedule, thus the principal of the next schedule is also changes to retain the instalment same. For example, On 12 May 20, current dated contract is booked, for 1year term, with monthly schedules. Calculation and accrual happens with latest available rate (during booking). On payment 12 Jun 20 due date BOD, Instalment get debited and during EOD, system applies the actual rate from booking to end of schedule and the recalculated amount difference (between projected and actual) is adjusted on the interest on the next schedule 13 Jul 20, thus the principal of the next schedule is also changes to retain the instalment.

Last reset This SOFR method is for discounted loans and true discounted loans. The SOFR average rate same as the payment periodicity of the loan is linked operationally. Booking and cash flow projection goes with latest available rate of the linked rate code. On payment due date BOD rate revision is triggered to fetch the latest average rate. Re-calculation happens with this rate and the same is liquidated. For example, For a 1 year contract with quarterly liquidation cycle, the 90 days average SOFR rate code is mapped. And, for a loan with monthly payment schedule, the 30 days average SOFR rate code is linked. On booking, latest available average SOFR rate is picked up & applied to the loan. Cash flow projection till maturity goes with this rate. Advance interest collection for the first schedule happens with the same rate, on booking. Every day accrual happens with the same rate. Rate revision is controlled on this method, and triggered only on the payment due dates. On due date BOD, again the latest available average SOFR rate is picked up applied for the subsequent schedules. Rate fixing days is applicable to this method.

For example, For a last reset loan booked on Tue, 12 May 20 with rate fixing days 2, the SOFR average rate of Fri 08 Aug 20 is applied.Last recent This SOFR method is for discounted loans and true discounted loans. The recent SOFR average rate, lesser than the payment periodicity of the loan is linked operationally. Booking and cash flow projection goes with latest available rate of the linked rate code. On payment due date BOD rate revision is triggered to fetch the latest average rate. Recalculation happens with this rate and the same is liquidated. For example, For a 1 year contract with quarterly liquidation cycle, the 30 days average SOFR rate code is mapped. On booking, latest available average SOFR rate is picked up & applied to the loan. Cash flow projection till maturity goes with this rate. Advance interest collection for the first schedule happens with the same rate, on booking. Every day accrual happens with the same rate. Rate revision is controlled on this method, and triggered only on the payment due dates. On due date BOD, again the latest available average SOFR rate is picked up applied for the subsequent schedules. Rate fixing days is applicable to this method. Ex : For a Last Recent loan booked on Tue, 12 May 20 with rate fixing days 2, the SOFR average rate of Fri 08 Aug 20 is applied.

Plain Apply current day’s rate. Due amount for the schedule is arrived on the due date EOD as previous day’s rate is received today. The payment follows on the same EOD, i.e. on due date. (Payment on due date BOD is skipped on this method).

Interest Calculation behavior

Interest rate pickup, calculation & accrual works same as Payment Delay method, as current day’s rate is to be applied for every day.

Interest Liquidation behavior

Interest liquidation is skipped on due date BOD, as calculation for previous working day is not completed yet. On the due date EOD, once previous day’s rate is received, same is calculated & liquidation happens on the same EOD.

For example: Payment Delay Days = 0. Current dated contract booked on 12 May 20, with 1 year termand monthly schedules. 12th of every month is a schedule due date.

From 12 May till 11 Jun, the interest calculation works same as Payment Delay method. On 12 Jun BOD, as it is the due date, the interest liquidation for Plain component is skipped. On 12 Jun EOD, once 11 Jun rate is received, same is completed & liquidation is executed. Thus liquidation happens on due date EOD.

Note:

For Penalty component, the allowed RFR methods are either Look Back or PlainRate Compounding Rate Compounding is another method of compounding the interest in SOFR calculation along with amount compounding. Rate Compounding approaches accurately compound interest when principal is unchanged within an interest period or, if principal is paid down, when any accompanying interest is paid down at the same time. Index Value To apply index related rate code along with amount compounding, index value method to be selected. The RFR index measures the cumulative impact of compounding the RFR on a unit of investment over time, with the initial value set to 1.00000000 on a particular date. The Index is compounded by the value of each RFR thereafter. The following formula can be used to calculate compounded averages of the SOFR over custom time periods between any two dates within the SOFR publication calendar. Observation Shift In RFR Look back method, when a back dated rate is applied for the current date, the weightage of the rate, based on its applicable days, is considered while arriving the rate factor, and applied to the current rate application date. Lookback Days- This option is applicable only for Look Back method. Lockout Days This option is applicable only for Lockout method. Base Rate/Spread Margin/ Spread Adj Computation Method You can select Simple or Compound. For compounding, interest calculation on week days go with compounded P, while for week ends its on simple P. Rate Compounding Method You can either select NCCR or CCR methods. The rate compounding happens in these two methods for RFR rate types (Normal and Index value rate types). - CCR - Cumulative Compounded Rate calculates the compounded rate at the end of the interest period and it is applied to the whole period. It allows calculation of interest for the whole period using a single compounded rate.

- NCCR - Non Cumulative Compounded Rate is derived from Cumulative Compounded Rate, that is, The Cumulative Compounded Rate is first un-annualized. And then the cumulating is removed by subtracting previous day rate with current day & the same is annualized.. This generates a daily compounded rate which allows the calculation of a daily interest amount. For OL module, this value gets defaulted to Bilateral Loans - Product Definition (OLDPRMNT) from Interest Class Maintenance screen. If required, you can define rate compounding method at component level in these product screens. Similarly, rate compounding method is defaulted to Loan and Commitment -Contract Input (OLDTRONL) screen based on the selection at the product level. If required, you can define rate compounding method at component level in these contract screens.

RFR Rounding Unit This option is applicable only for Rate compounding method. This contains the Risk Free Rate rounding unit as agreed with the borrower. The CCR is rounded with this parameter. Margin Application You need to specify the method of applying interest margin for the selected interest component, for contracts using the product. Margin Basis You can define the Margin basis either Tranche/Drawdown/Facility/Customer. Based on this, margin gets calculated with the rate to compute the final rate for the interest component at contract level. Table 2-4 Tenor Code Details

Tenor Code Description 1W One week rate 2W Two week rate 2M Two months rate 6M Six months rate 1Y One year rate Table 2-5 Rate pick-up dates

Rate fixed Till Rate picked up date Tuesday, May 12, 2020 Tuesday, May 5, 2020 Wednesday, May 13, 2020 Wednesday, May 6, 2020 Thursday, May 14, 2020 Thursday, May 7, 2020 Friday, May 15, 2020 Friday, May 8, 2020

Parent topic: Building Interest Classes