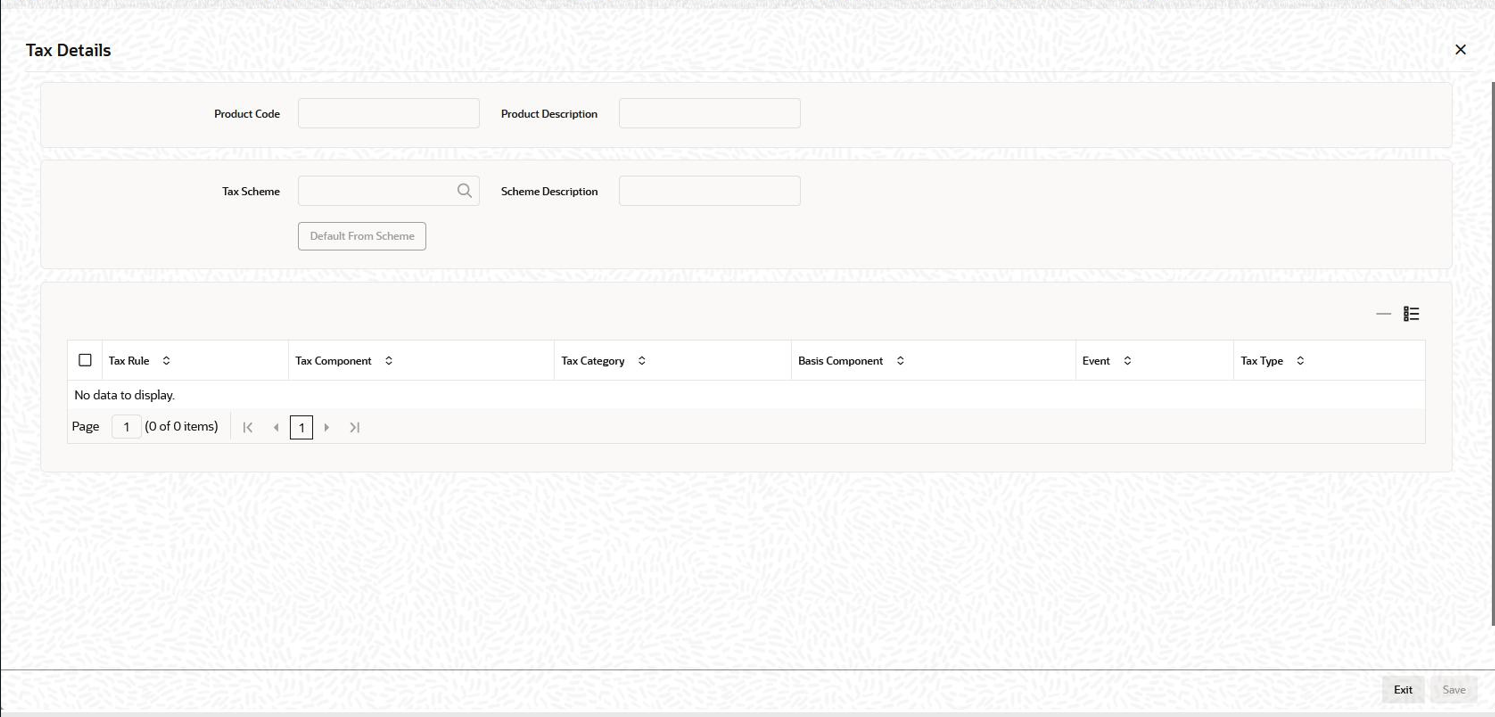

3.5.4 Specifying Tax Details

You can click Tax option to tax components with a product. The Loan Syndication - Facility Product Definition (FCDPRMNT) is used for a facility product, whereas Loan Syndication - Borrower Product Definition (LBDPRMNT) is used for both tranche and drawdown product.

You can specify the following details in this screen. For information of fields, refer to the field description table.

Table 3-14 Tax Details

| Fields | Description |

|---|---|

| Tax Scheme | A tax scheme can consist of a set of tax rules that can be applied to

a product.

A tax scheme is made applicable to a product when it is linked to the product. Select the applicable scheme from the list. The tax schemes maintained through the Tax Scheme Maintenance screen are available in the option list provided. When you select a scheme, the following defaults:

|

| Tax Rule | A tax rule represents the method in which a specific tax has to be

applied. Thus, for a tax component to be levied on a contract, you

should specify:

|

| Tax Category | You can specify tax category for each tax rule that is linked to a tax scheme. The categories defined through the Tax Category Maintenance are available in the option list provided. Select the appropriate one from this list. |

| Basis Component | Tax can be applied on the basis of any component that is taxable according to the laws in your country. This component is called the Basis Component. The method of tax application defined for the tax rule is applied on this component. |

| Event | You should specify the event upon which the tax is to be applied. For instance, if you specify that the tax be to be applied at the time the fess is collected from the customer, then the entries for tax are passed when the fee component is liquidated. |

| Tax Type | The type of tax, decides the bearer of the tax. It could be the bank

or the customer. A customer bears withholding type of tax and the tax

component is debited to the customer’s account. The bank bears an

expense type of tax and the tax component is booked to a tax expense

account.

Note: If you have selected the product type as Collateral Online or Collateral Settlements, Tax is disabled. |

| Specifying Accrual Fee Details | You can maintain accrual fee details for a product. These values get defaulted to Amortization Fee Details (LFDACFIN) screen |

Parent topic: Creating Participant Products