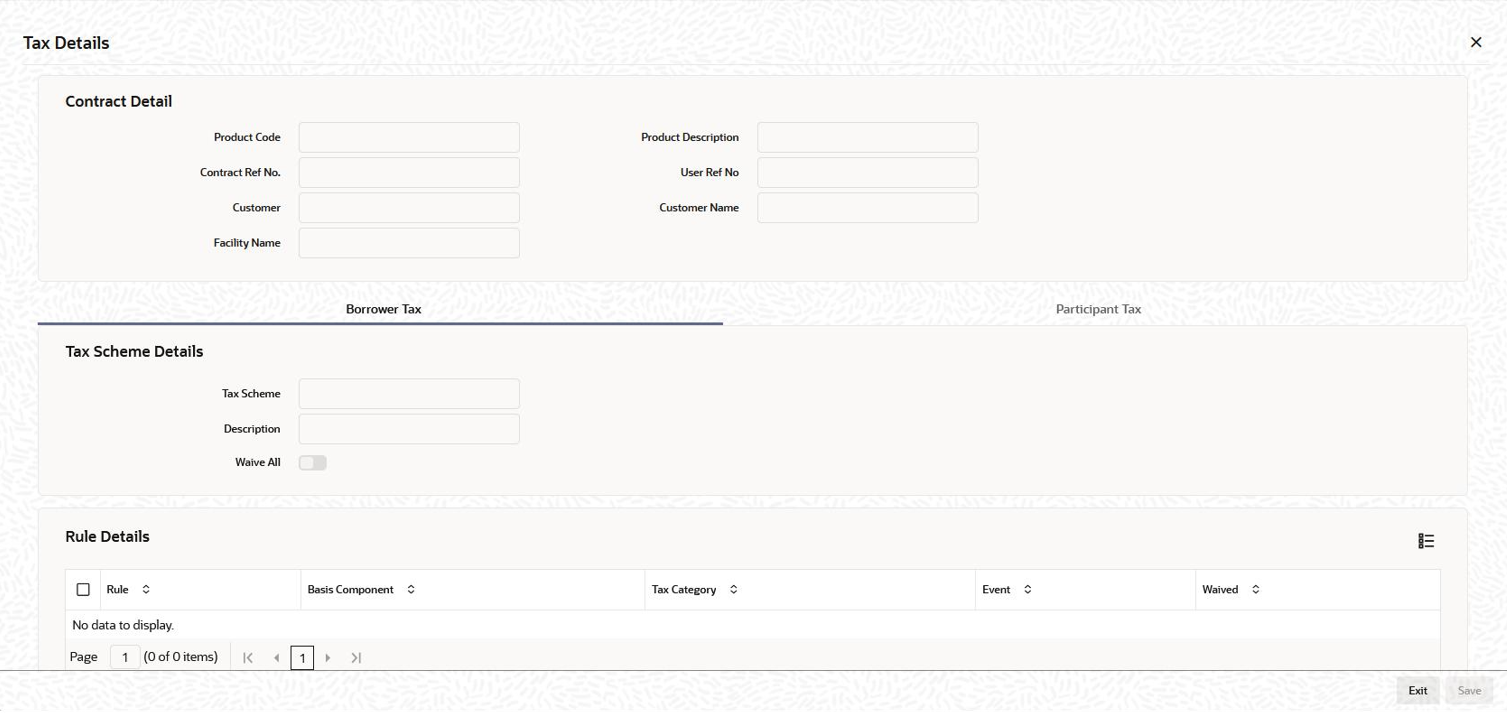

4.9.23 Tax Details

At the tranche level, tax is applicable only on the fee component.

The taxes that apply on a contract are of two types, Expense and Withholding.

The tax that is borne by the bank is referred to as an Expense type of tax. This tax is booked to a Tax Expense account. The tax that is borne by counter party of a contract is referred to as a withholding tax, whereby you debit the counter party’s account and credit the tax component into a Tax Payable account (to be paid to the government on the counter party’s behalf).

The Tax sub-screen displays the tax rule details associated with the tranche product.

You can view both borrower and participant tax details associated with the tranche.

You can waive the subsequent tax that is applied for a borrower/participant and tax rule combination.The system passes the entries for tax based on the event you specify in the Product Tax Linkage screen.

Typically, tax on fee is calculated upon liquidation of the fee (event FLIQ is associated with the rule).

Parent topic: Processing a Borrower Tranche Contract