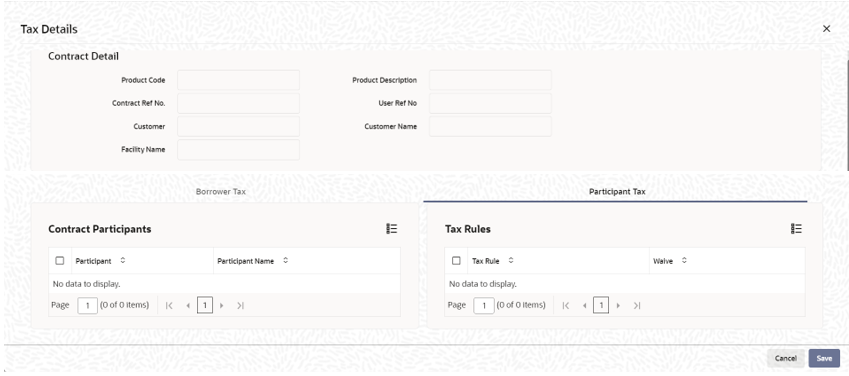

4.9.24 Viewing Tranche Tax Details

The tax details defaults from the facility contract if a tax rule is associated

with the participant product linked to the facility product. You can view the tax

details for the contract in the Participant Tax Details

screen.

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to LB Tranche Contract Online screen.

From the LB Tranche Contract Online screen, click Tax.

Parent topic: Processing a Borrower Tranche Contract