- Tax User Guide

- Building Tax Components

- Defining Tax Rules

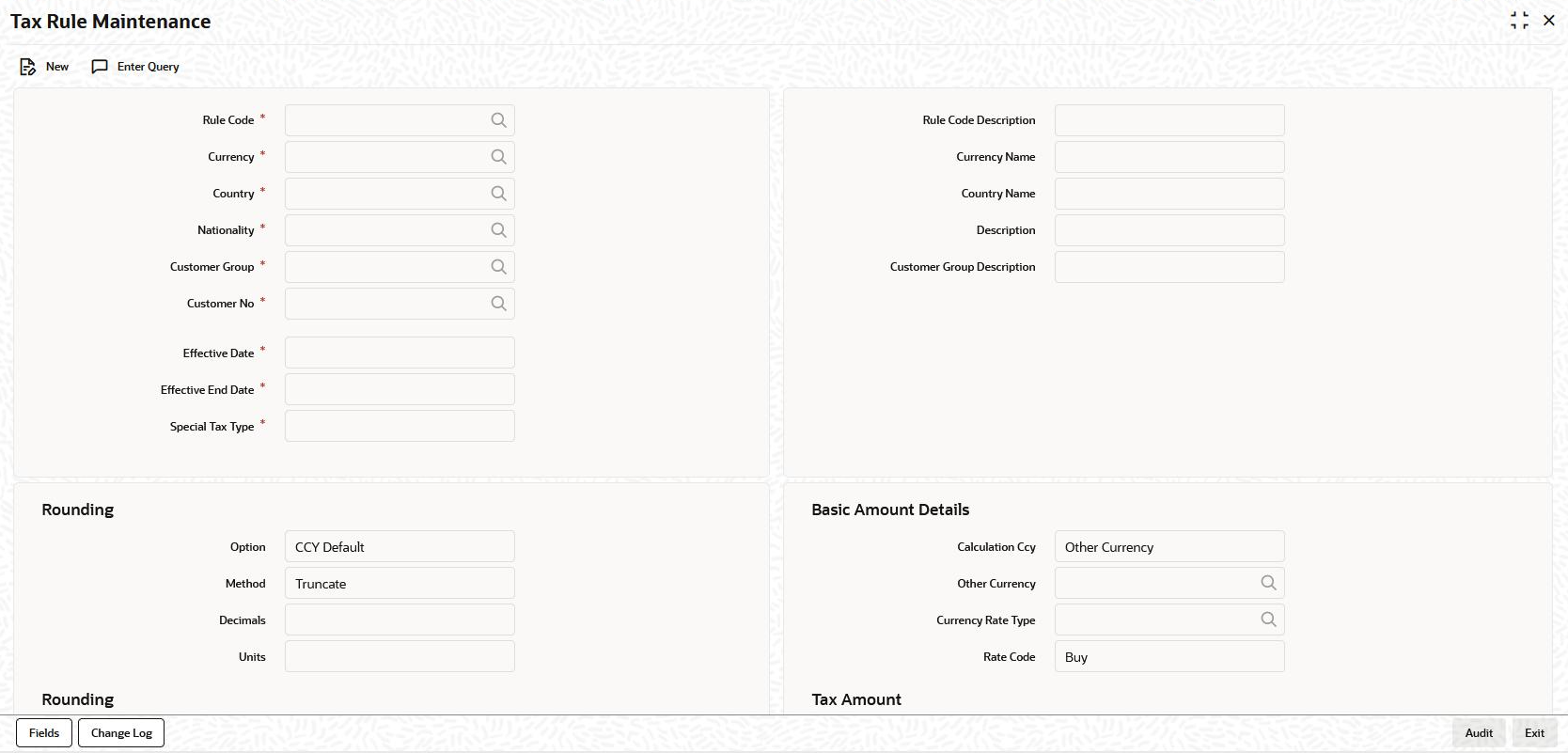

- Tax Rule Maintenance screen

1.2.2 Tax Rule Maintenance screen

To capture details of tax rule maintenance screen

- On the Homepage, type TXDRULES and click next

arrow.The Tax Rule Maintenance screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can enter below details in this screen. For information on fields, refer to

the field description table.

Table 1-2 Tax Rule Maintenance

Field Description Rule Code Specify the valid tax rule ID that you maintain in your bank. The adjoining option list displays the list of all rule IDs available in the system. You can select the appropriate one. These rule IDs are fetched from Rule Master Definition screen. The tax rule is maintained for a combination of Rule ID + Currency + Country +Nationality + Customer Group + Customer Number + Effective Date.

Rule Code Description The Rule Code Description appears based on the rule ID. Currency The currency selected indicates the transaction currency. You also have the option to select ALL to indicate that the rule is applicable to transactions in any currency. It is mandatory to specify the currency to save the Tax Rule. Then define the attributes of the rule, such as the Effective Date, the Tax Currency and the application method.

Customer Group You have maintained Charge and Tax type of customer groups through the Customer Group Maintenance screen and categorized customer’s into different charge and tax groups through the Customer Information Maintenance screen. While building a tax rule, you can indicate whether the rule is to be made applicable on a charge type customer group or whether it is to be made applicable on a tax type of customer group.

If a transaction charge/tax is defined for a charge/tax type of customer group, the transactions involving customers in the group automatically acquire the charge/tax unless you choose to override it by creating a specific charge/tax set-up for the particular customer.Customer No Customer numbers are maintained by your bank in the Customer Information Maintenance screen. You can choose the customer for whom the tax rule is being defined. You can also choose to define the tax rule for all the customers of your branch. Effective Date for a Tax Rule Every tax rule is associated with an Effective Date. On the specified Effective Date, the rule becomes applicable. When more than one rule is linked to a Tax Scheme, a rule is applied till the next rule for the same component, with a different Effective Date comes. Example

The following example illustrates how the different rules in a Tax Scheme are applied.You have defined the following Tax Rules (only the fields relevant to the example are discussed): When these rules are linked to a single tax scheme, the tax is applied in the following manner:From 1 January 1999 to 31 March 1999, the interest paid on contracts are taxed at 0.5%. From 1 April 1999 onwards, the interest paid is taxed at 0.75%.

Interest continues to be taxed at 0.75% till another rule with a different Effective Date is added to the scheme.Special Tax Type Select the special tax type from the drop-down list. The list displays the following values. - Chapter 3

- FATCA

- Normal tax

- Financial Operations Tax

Table 1-3 Tax Rule 1

Rule Code TxD1 Effective Date 1 January 1999 Component Interest Tax Rate 0.5% Table 1-4 Tax Rule 2

Rule Code TxD2 Effective Date 1 January 1999 Component Interest Tax Rate 0.75% This topic contains following sub-topics: