18.2 Loan Eligibility Calculator

This topic provides the systematic instructions for user to determine their loan eligibility.

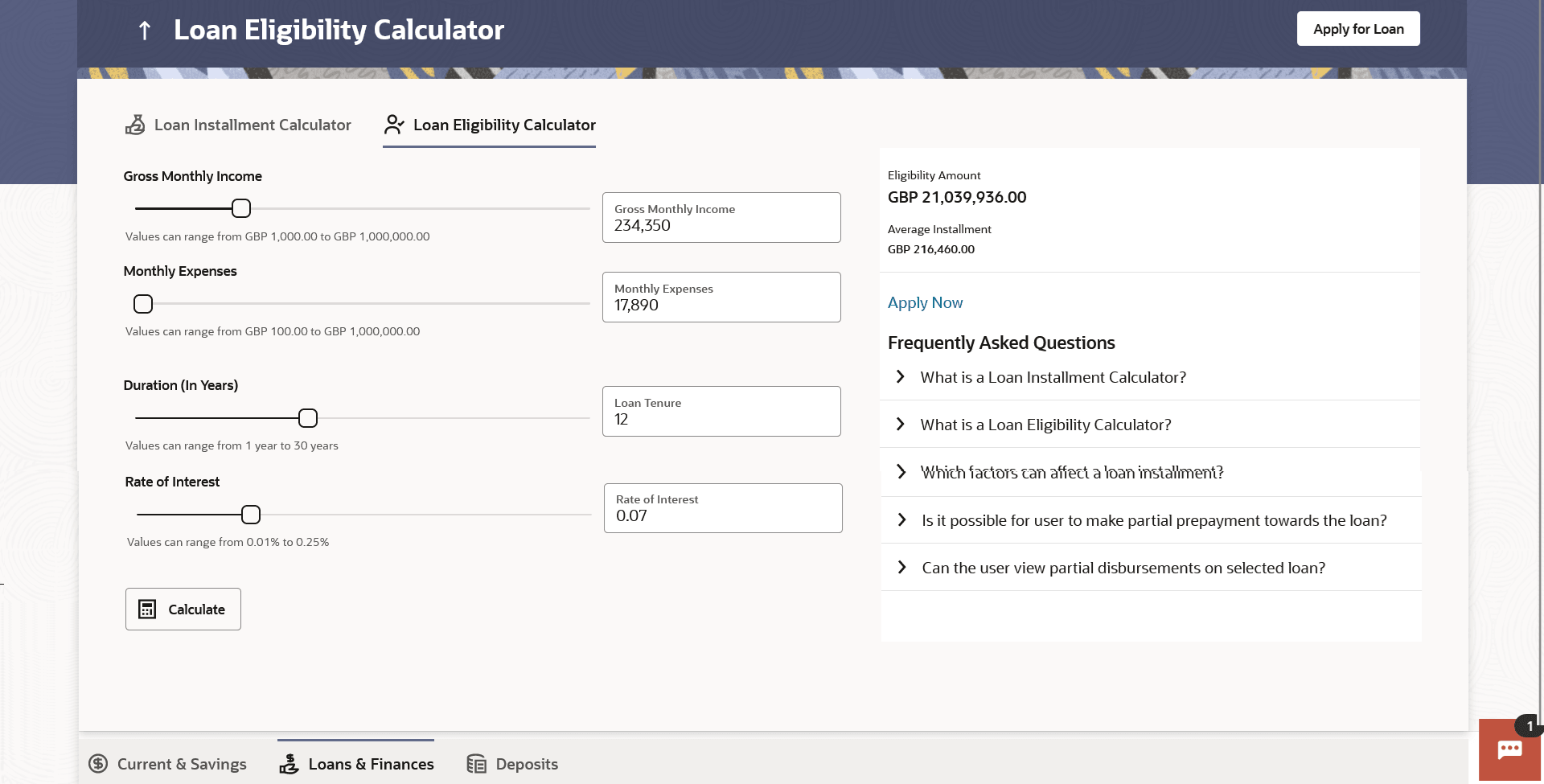

Loan eligibility calculator plays an important role in helping a customer understand their current position with respect to their borrowing capacity.

The calculator enables customers to gain an understanding of their loan eligibility, considering their average monthly income and expenditure. It computes the loan amount and repayment amount based on income, expense, interest rate and tenure of the loan. Loan eligibility is calculated by the application and is displayed to the customer.

The eligibility is calculated on the basis of:

- The customer’s average monthly income

- The customer’s average Monthly Expenditures

- Tenure of the loan being inquired applied

- Estimated rate of interest

Parent topic: Calculators