9 Apply for Add-On Card

This topic provides the systematic instructions to the primary cardholders to submit applications for add-on cards online.

Add-On cards, also known as supplementary cards, are cards issued to additional cardholders such as a spouse or a child, at the request of the primary card holder. The Add-On card holder might have the same limit as that of the primary card holder and cannot be held legally responsible for credit card payments. All expenses incurred on an Add-On card are billed to the primary card holder.

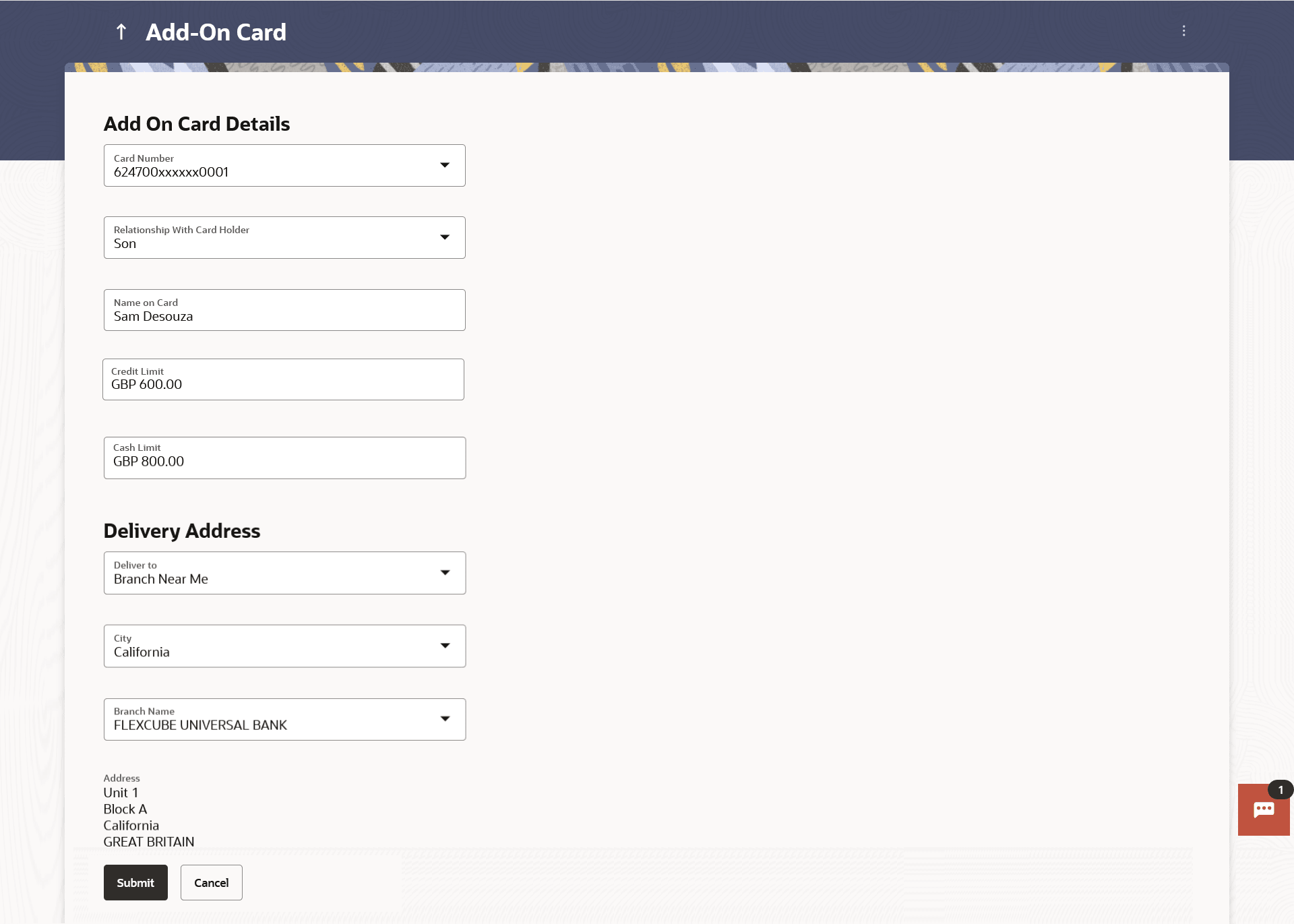

The user can apply for an Add-On card by selecting the option provided. The user can customize the Add-On card by specifying the name to be embossed on the card and also by defining the credit and cash limits of the card.

Note:

- In case user is having an Add-on, and it is active card, he will be able to see the card details, Request pin for his card only, and block his card only.

- In case user is having an Add-on Card, and it is inactive, he will be able to see the card details and able to block his card.

- In case user is having an Add-on Card which is hotlisted, then he will be able to see just his card details.

- In case user has Add-on Card is cancelled, then he will be able to see just the card details.

To apply for an Add-On card: