5 Edit Maturity Instructions

This topic provides the systematic instructions for user to modify the maturity instruction associated with a recurring deposit.

At any point in time, a customer may want to change the Principal & Interest credit account number set at the time of opening this deposit. The Edit Maturity Instruction feature allows a customer to select the new account where he/she wish to take maturity proceeds.

To edit the maturity instructions:

- Perform anyone of the following navigation to access the Edit Maturity

Instructions screen.

- From the Dashboard, click Toggle menu, click

Menu, then click Accounts, and then

click Recurring Deposits tab, and then click

Recurring Deposit Account Number.

From the Recurring Deposit Details page, click on the More Actions, and then click on the Edit Maturity Instructions.

- From the Search bar, type Recurring Deposits – Edit Maturity Instructions and press Enter.

- On the Dashboard, click Overview widget, click Recurring Deposits card, then click Recurring Deposit Account Number. From the Recurring Deposit Details page, click on the More Actions, and then click on the Edit Maturity Instructions

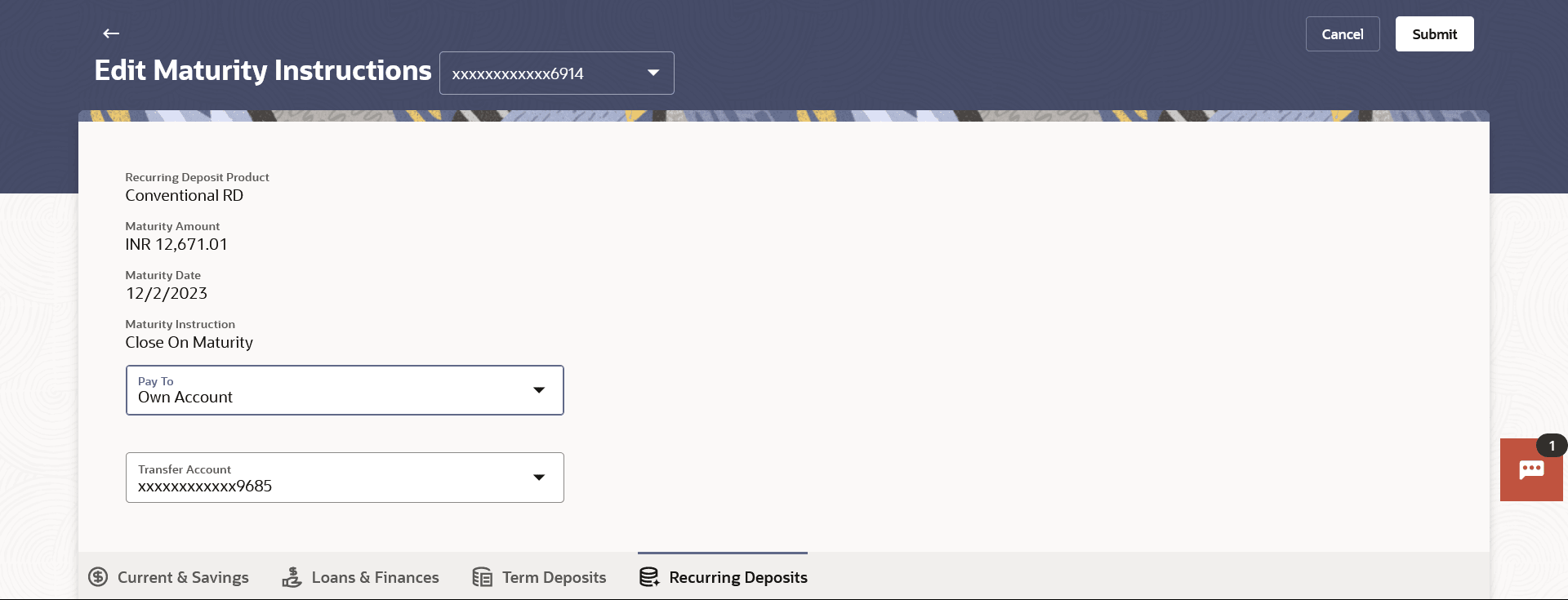

The Edit Maturity Instructions screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 5-1 Edit Maturity Instuctions - Field Description

Field Name Description Deposit Account Select the recurring deposit whose maturity instructions is to be changed. Recurring Deposit Product Name of the recurring deposit product under which the account is opened. Maturity Amount The value of the recurring deposit at the time of maturity. Maturity Instruction Displays the maturity instruction set for the recurring deposit at the time of opening the deposit. The option is:

- Close on Maturity

Pay To The customer is require to select current and savings account of the bank to which the funds are to be transferred. All the customer’s current and savings accounts held with the bank will be listed down and available for selection.

Account transfer options are:

- Own account

- Internal Account

Following fields is displayed if the customer select Own Account option in the Pay To field Transfer Account An Account to which the funds are to be transferred at maturity. All the customer’s current and savings accounts held with the bank will be listed down and available for selection.

Beneficiary Name & Address The name of the holder of the account selected in Transfer Account list will be displayed. The following fields is displayed if the customer select Internal Account option in the Pay To field. Account Number Specify the Account number to which the funds are to be transferred at maturity. Confirm Account Number Re-enter the account number that you have entered in the Account Number field to confirm the same. - From the Dashboard, click Toggle menu, click

Menu, then click Accounts, and then

click Recurring Deposits tab, and then click

Recurring Deposit Account Number.

- From the Deposit Account list, select the recurring deposit whose maturity instructions is to be changed.

- From the Pay To list, select the desired beneficiary

account.

The beneficiary's bank detail along with the beneficiary name appears.

Perform one of the following actions:

- If you select Own Account option in Pay To

field;

- From the Transfer Account list, select the current or savings account in which the maturity proceeds are to be transferred at the time of deposit maturity. The beneficence name and its bank details appear.

- If you select Internal Account option in Pay To

field;

- In the Account Number field, enter an account in which the maturity proceeds are to be transferred at the time of deposit maturity.

- In the Confirm Account Number field, re-enter the account number as entered in the Account Number field.

- If you select Own Account option in Pay To

field;

- Perform one of the following actions:

- Click

Submit.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click

Submit.

- Perform one of the following actions:

- Verify the details and click

Confirm.

The success message appears along with the transaction reference number.

- Click Back to navigate back to the previous screen.

- Click Cancel to cancel the transaction.

- Verify the details and click

Confirm.

- Perform one of the following actions:

- Click Transaction Details to view the details of the transaction.

- Click Deposit Details to view the deposit account details.

- Click on the View Accounts link to visit Recurring Deposit accounts summary page.

- Click on the Go To Dashboard link to navigate back to dashboard page.