4 Recurring Deposit Details

This topic provides the systematic instructions for users to view details pertaining to a specific recurring deposit held by the customer.

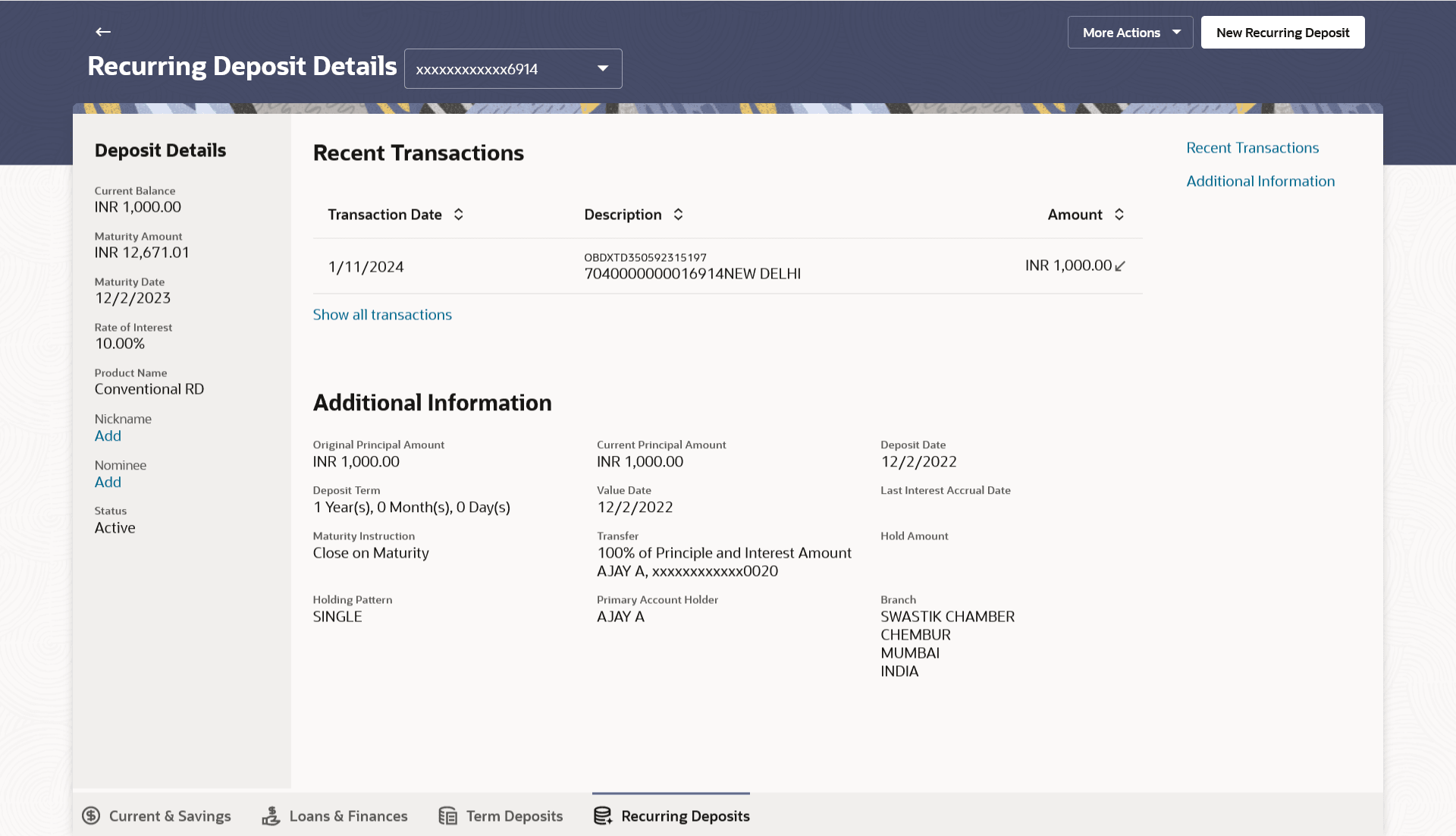

The deposit details page displays details of a specific recurring deposit of the customer. Details such as holding pattern and names of account holders, nomination status, the current status of the deposit, the interest rate applicable and the installment amounts and dates, are displayed.

There are in three main sectionDeposit Details, Recent Transactions, and Additional Information. To navigate between the different sections, Recent Transactions, and Additional Information the user can use the bookmark options available on top right corner.

The Deposit Details section provide general information about the deposit account such as the current balance, nickname, status of the account and product name, maturity amount, maturity date, and rate of interest. The Recent Transactions sections displays the entries along with each amount, transaction date and reference details. The Additional Information section displays the account holding pattern and the names of all the account holders, the branch in which the account is held along with original principal amount, current principal amount, maturity date, maturity amount, rate of interest, hold amount, deposit date, value date, deposit term etc.

Perform anyone of the following navigation to access the Recurring Deposits Details screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Recurring Deposits tab, and then click on the Recurring Deposit Account Number .

- From the Search bar, type Recurring Deposits - Recurring Deposits Details and press Enter.

- From the Dashboard, click Overview widget, click Recurring Depositscard, and then click on the Recurring Deposit Account Number

The Recurring Deposit Details screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 4-1 Recurring Deposit Details - Field Description

| Field Name | Description |

|---|---|

| Recurring Deposit Number | Select the recurring deposit account number in masked format whose details are to be viewed. |

| Deposit Details | |

| Current Balance | The available balance of the deposit account is displayed. |

| Maturity Amount | The value of the recurring deposit at the time of maturity. |

| Maturity Date | The date ocn which the recurring deposit will mature. |

| Rate of Interest | The rate of interest applicable on the recurring deposit. |

| Product Name | Name of the recurring deposit product under which the account is opened. |

| Nickname | Displays the nickname set for the recurring deposit. For more information, refer Account Nickname. |

| Nominee | The registered nominee set for the account.

Click on Add link to add the nominee to the account. |

| Status | The current status of the recurring deposit account. |

| Recent Transactions For more information, refer Transactions screen. |

|

| Transaction Date | Date on which the activity was performed. |

| Description | Short description of the transaction. |

| Amount | The transaction amount. |

| Transaction Type | The type of transaction performed. |

| Show all transactions | To view all the transactions in account.

On clicking the link, the user will be navigated to the Transactions screen. |

| Additional Information | |

| Original Principal Amount | The amount for which the deposit was opened. |

| Current Principal Amount | The current principal amount is the revised principal amount after partial redemption, if done. |

| Deposit Date | The date on which the deposit was opened. |

| Deposit Term | The deposit term which is displayed in terms of years, months and/or days as defined by the customer at the time the deposit was opened. |

| Rate of Interest | The rate of interest applicable on the term deposit. |

| Value Date | Value date of the deposit as maintained by the bank. |

| Last Interest Accrual Date | The last date of accrual until the total amount of interest has been accrued. |

| Maturity Instruction | Maturity instruction set for the specific recurring

deposit at the time of opening the deposit.

The option is:

|

| Transfer |

The details of the account/s to which the maturity amount is to be transferred are displayed. The details include the account number/s in masked format, the transfer type (i.e. own, internal or domestic) and the details of the bank and branch of the account/s. In case the Maturity Instruction is Close on Maturity and subsequently the option Separate Accounts has been selected under Transfer Principal and Interest to, two sets of account information will be displayed – one in which principal amount is to be transferred and one in which interest amount is to be transferred. This field is not displayed, if maturity instruction selected is Renew Principal and Interest. |

| Hold Amount | The nominal deposit balance to be maintained in the deposit account. |

| Holding Pattern | Holding pattern of the recurring deposit.

|

| Primary Account Holder | Name of the primary account holder. |

| Joint Account Holder 1 | Name of the joint account holder.

This field is displayed only if the holding pattern of the recurring deposit is Joint. |

| Joint Account Holder 2 | Name of the second joint account holder.

This field is displayed only if the holding pattern of the recurring deposit is Joint and if multiple joint account holders are defined instead of just one. |

| Branch | Displays the branch complete address at which the recurring deposit account is held. |

The following actions can also be performed from this page:

- Click on the Quick Filters menu to view the transactions of a specific period or of specific transaction type.

- Click on the Recent Transactions, Additional Information links available on the top right corner page to navigate between the sections.

- For more information on Nickname (add/ modify/ delete), the option available under Deposit Details section. Refer Account Nickname section.

- For more information on Nominee option available under

Deposit Details section. Refer Nomination section in Oracle Banking Digital

Experience Retail Customer Services User Manual.

Note:

If a nominee is already defined for the account, then the Edit Nominee option is displayed in kebab menu to modify it. - Click on the New Recurring Deposit to open a new recurring account. The system redirects to the Product Offerings section of the bank portal pa`ge.

- Click on the More Actions menu to access account related transactions.