3 Recurring Deposit Summary

This topic provides the systematic instructions for users to view of all the recurring deposits they hold with the bank.

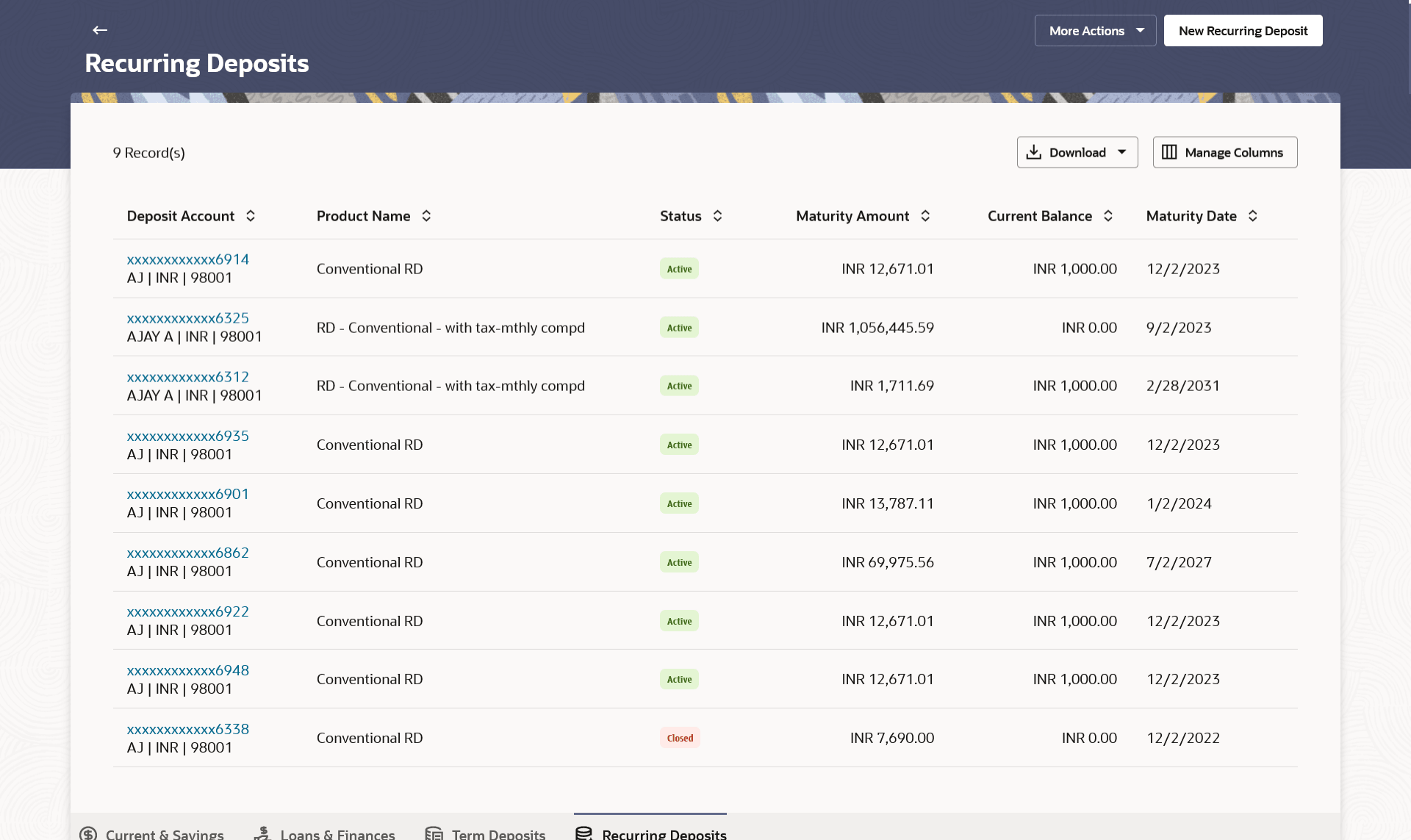

All the active recurring deposits are listed as records. Each record comprises of information such as the recurring deposit account number, account nickname (if assigned), product name, current balance, maturity date and maturity amount.

Note:

- If the retail user does not have any term deposit accounts, system displays the text message and the card which re-directs user to the New Recurring Deposits screen.

- The left swipe and Long Press gesture is implemented on mobile and tablets

devices.

Long press gesture - Users can now press and hold down on a screen for an extended duration, which displays additional options or actions. This feature is available on Account Listing, which triggers Redeem, Edit Maturity Instructions functionalities.

Click on the specific deposit account to view further details of that account or view the summary of transactions undertaken through that account. The More Actions menu on the right top corner of the page lists the relevant allowed actions based on the account status

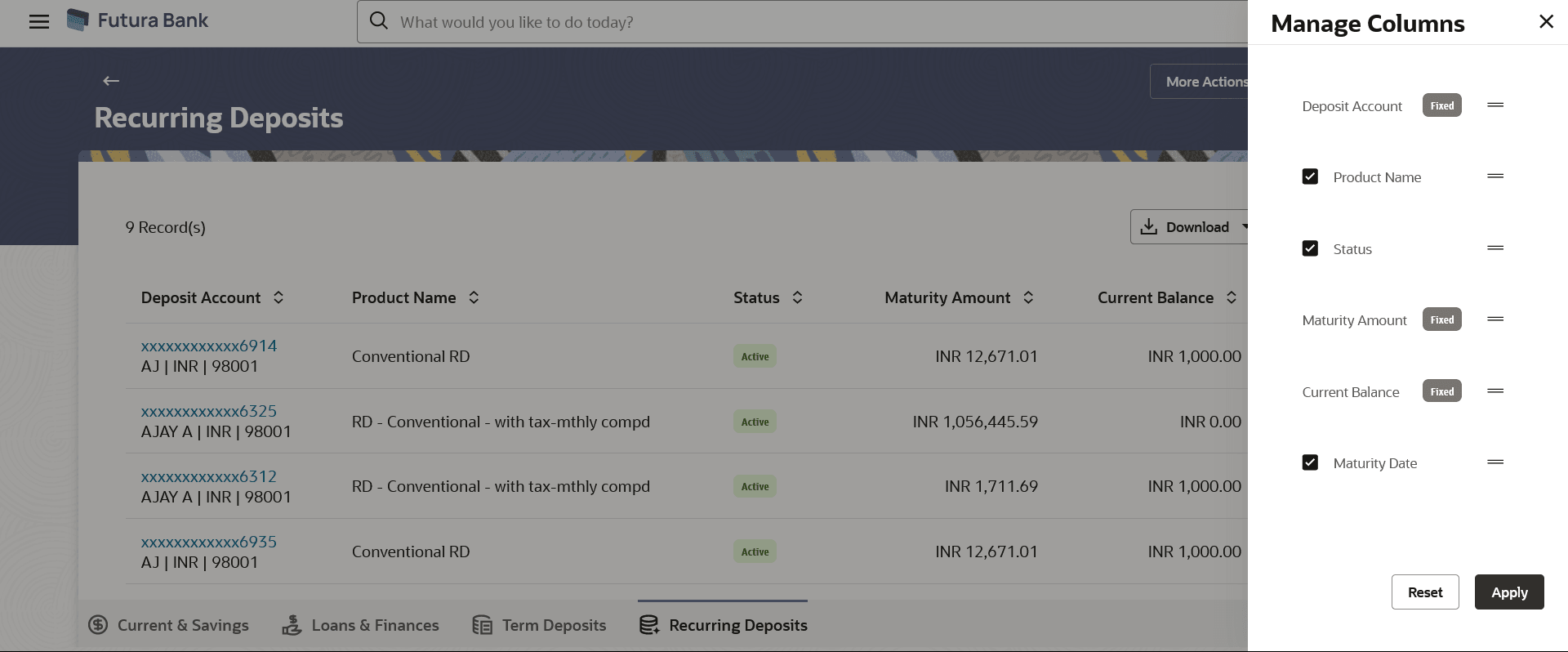

Using the Manage Columns feature, bank can configure and enable customizable UI display/download option for the end users. Using this feature, users can personalize the information to be displayed/downloaded from search grid displayed on the screen.

By clicking on Manage Columns option available on the screen, user can

- Rearrange columns

- Remove specific columns.

Note:

- The downloaded report will have the same columns as displayed on the UI as per user preference as well as there will also be an option to modify the column selection while downloading.

- The column preferences setup by the user will be saved for future reference i.e. in case the user revisits this screen, the preferred columns will only be displayed in the table.

Perform anyone of the following navigation to access the Recurring Deposits Summary screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Recurring Deposits tab.

- From the Dashboard, click Overview widget, click Recurring Depositscard.

- Access through the Recurring Deposits tab available on footer of all pages.

The Recurring Deposits summary screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-1 Recurring Deposits Summary- Field Description

| Field Name | Description |

|---|---|

| Deposit Account | The recurring deposit Account number in masked format

along with the currency.

Click on the link to view the details or transactions summary of the account. |

| Maturity Date | The date on which the recurring deposit will mature. |

| Product Name | The name of the recurring deposit product. |

| Status | The current status of the deposit account. |

| Maturity Amount | The value of the recurring deposit at the time of maturity. |

| Current Balance | The current balance of the recurring deposit account is displayed. |

| Maturity Date | The date on which the recurring deposit will mature. |

Perform one of the following actions:

- Click on the New Recurring Deposit to open a new recurring deposit.

- Click the More Actions menu to access other Deposits account related transactions.

- Click the

icon to download the records in CSV & PDF format.

icon to download the records in CSV & PDF format.

- Click the

icon to setup a column preference by rearranging or

removing columns.

icon to setup a column preference by rearranging or

removing columns.

Figure 3-2 Recurring Deposits - Manage Columns setup

Perform one of the following actions:- Click Apply to apply the new changes to the table.

- Click Reset to clear the data entered.