2 New Recurring Deposit

This topic provides the systematic instructions for user to apply for new recurring deposits.

New Recurring Deposit page enables the customer to book a new recurring deposit account. The multiple Recurring Deposit products are maintained at bank level. The customer can select any product offer in order to apply for a recurring deposit of choice.

While applying for a recurring deposit, the customer is required to identify the installment amount for which the deposit is to be opened, the tenure i.e. the term of the deposit and the holding pattern i.e. single or joint. Additionally, the customer is also required to select the current or savings account from which funds are to be debited in order to fund the deposit.

In case of joint accounts, Recurring Deposit is booked by default on joint name if single holding pattern is not selected by the customer. It also allows customer to select the holding pattern to singly for creating a new RD so that he/she can liquidate my Recurring Deposit's online conveniently.

In case of single RD account, customer can also add a nominee in the recurring deposit who will be entitled to receive the money upon death of the account holder.

Note:

It is mandatory to update the PAN number (valid for India specific region) :

- If the customer creates a new recurring deposit installment of value more than or equal to Rs. 50,000.

- If at any given point of time while creating a new recurring deposit the cumulative deposits (Fixed plus recurring) for a customer in that financial year is more than Rs. 5,00,000.

Figure 2-1 New Recurring Deposit

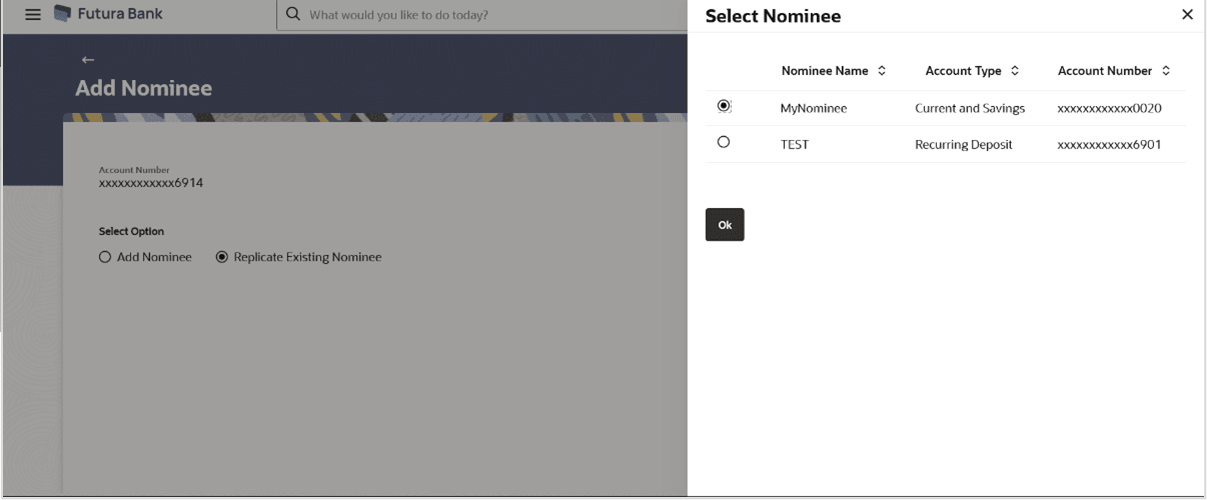

Figure 2-2 New Recurring Deposit - Replicate Existing Nominee

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 2-1 New Recurring Deposit - Field Description

| Field Name | Description |

|---|---|

| Source Account | The current or savings account to be debited with the recurring

deposit installment amount.

All the active current and savings accounts of the customer are displayed. For more information on Account Nickname, refer Account Nicknamesection. |

| Balance | The balance in the account with the account currency. |

| Recurring Deposit Product | Lists all the recurring deposit products available for application creation. |

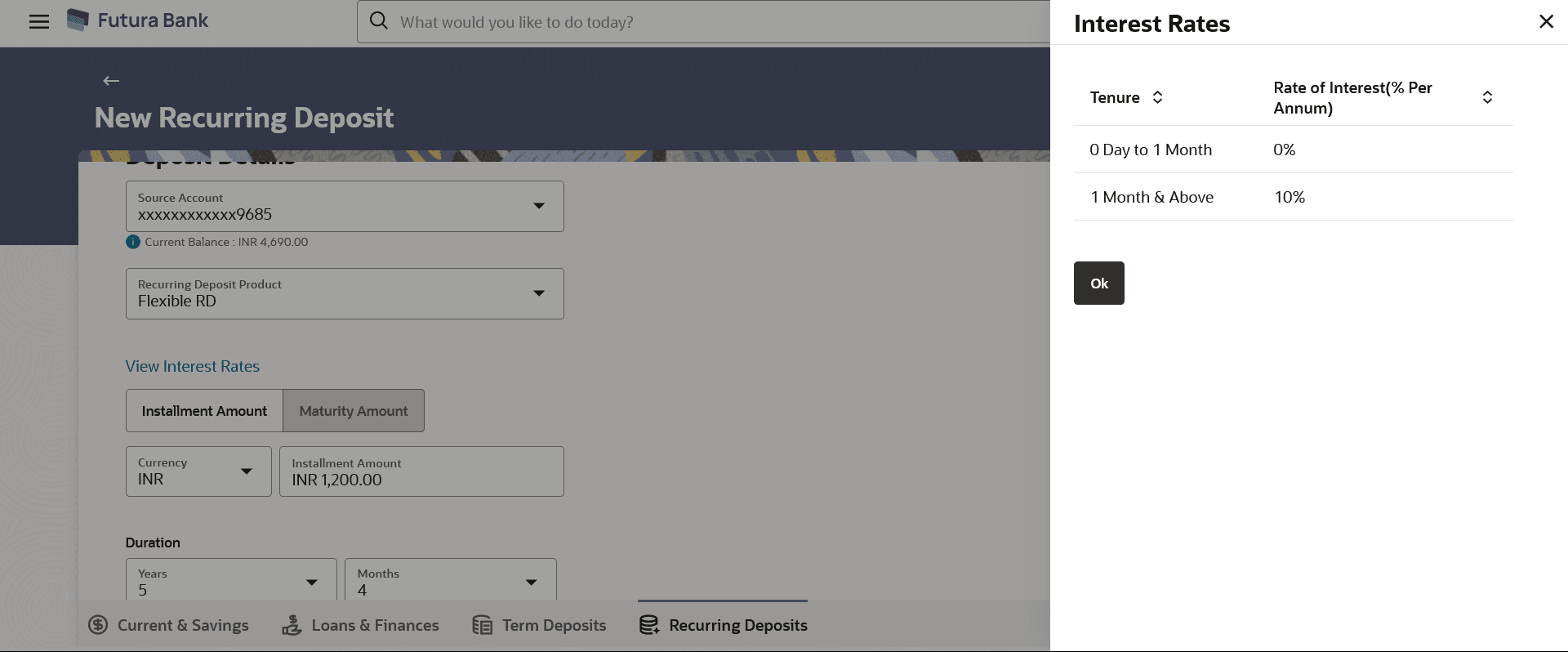

| View Interest Rates | Click on the View Interest Rates link to view the interest rate applicable on the deposit account based on the deposit product. Will come after select product option. |

| Specify Installment Amount or Maturity Amount | Specify the option based on which the recurring deposit is being opened. |

| Installment Amount | Specify the installment amount to be paid by customer.

This field is enabled if the Installment Amount option is selected in the Specify Installment Amount or Maturity Amount field. |

| Maturity Amount | Specify the estimated maturity amount desired by customer after

maturity of the recurring deposit.

This field is enabled if the Maturity Amount option is selected in the Specify Installment Amount or Maturity Amount field. |

| Deposit Tenure | The tenure of the deposit in terms of a period i.e. years/ months

after which the deposit should mature.

Note: The minimum and maximum tenure allowed for which a deposit can be opened. |

| Investment Period | |

| Years | The deposit tenure in years. |

| Months | The deposit tenure in months. |

| Deposit Period Range | The minimum and maximum period within which the deposit account can be opened is displayed below the deposit tenure field once the customer selects a deposit product in the Select Product field. |

| Calculate Installment Amount |

Click on the Calculate Installment Amount link to calculate the installment amount on the deposit account based on the information defined. This link is enabled if the Maturity Amount option is selected in the Specify Installment Amount or Maturity Amount field. |

| Calculate Maturity |

Click on the Calculate Maturity link in order to be displayed the maturity amount and interest rate applicable on the deposit account based on the information defined. This link is enabled if the Installment Amount option is selected in the Specify Installment Amount or Maturity Amount field. |

| Maturity Amount | The system will calculate and display the estimated maturity amount based on the parameters defined by the customer |

| Interest Rate | The interest rate applicable on the deposit account based on the deposit product. |

| Maturity Details | |

| Maturity Instructions |

Maturity instructions set by the customer for the deposit account. The option is:

|

| Pay to |

The account transfer mode through which the amount to be paid out is transferred at the time of maturity. The options are:

|

| Following fields is displayed if the customer selects Own Account option in the Pay To field | |

| Transfer Account | An Account to which the funds are to be transferred at

maturity.

All the customer’s current and savings accounts held with the bank will be listed down and available for selection. |

| Beneficiary Name | The name of the holder of the account selected in Transfer Account will be displayed. |

| The following fields is displayed if the customer selects Internal Account option in the Pay To field. | |

| Account Number |

Specify the Account number to which the funds are to be transferred at maturity.

|

| Confirm Account Number | Re-enter the account number that you have entered in the Account Number field to confirm the same. |

| Add Nominee | Select the checkbox to decide registration of nomination for a recurring deposit. |

| Nominee Details |

This option is available only for Single holding CASA source account. Below details appears if the Add Nominee checkbox is selected. |

| Nomination Type |

The nominee details for recurring deposit. The options are:

|

| The following fields are displayed if the customer selects New Nominee option in Nomination Type field. | |

| Nominee Name | Enter the name of the nominee. |

| Date Of Birth | Enter the date of birth of nominee.

Note: If nominee is minor, it is mandatory for customer to fill guardian details. |

| Relationship with Account Holder | Select the relationship of the nominee with the applicant. |

| Address | Specify nominees address details. |

| Zip Code | Enter the zip code of nominee's residence. |

| Country | Select the country where nominee resides. |

| State | The name of the state where nominee resides. |

| City | Enter the name of the city where nominee resides. |

| Enter Guardian details since nominee is a minor below 18 years: |

Below fields are displayed if nominee is minor or below 18 year age. |

| Name | Enter the name of the guardian of the nominee. |

| Address | Enter the guardians address details. |

| Zip Code | Specify the zip code of guardian's residence. |

| Country | Select the name of the country where guardian resides. |

| State | Specify the name of the state where guardian resides. |

| City | Enter the name of the city where guardian resides. |

| Existing Nominee | The option to select an existing nominee already mapped to any other account of the user, to the new recurring deposit being opened. |

| All the existing nominees that are mapped to accounts of the user are listed down in an overlay, as follows, if the Existing Nominee option is selected. | |

| Choose Nominee Name | The name of the nominee who is already maintained in application for the associated customer accounts. |

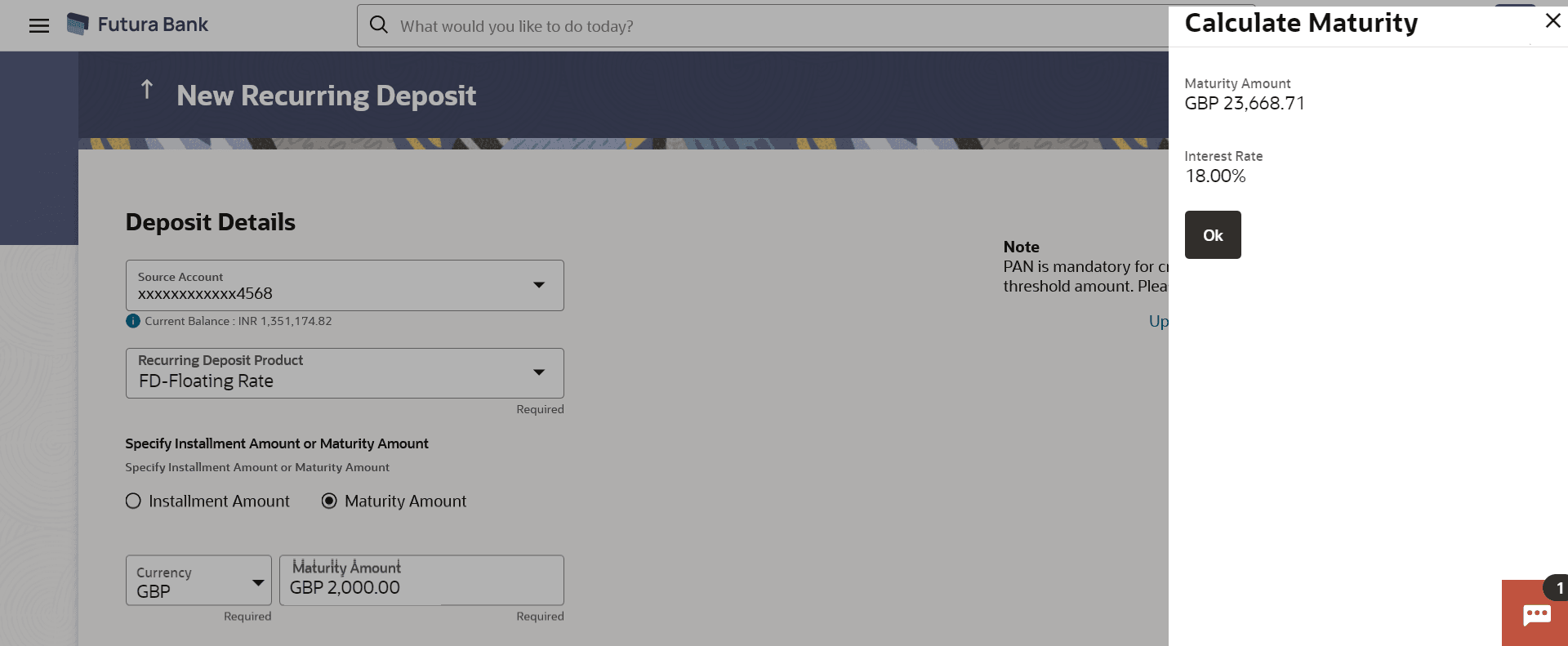

Figure 2-3 Calculate Maturity

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 2-2 Calculate Maturity - Field Description

| Field Name | Description |

|---|---|

| Maturity Amount | The system will calculate and display the estimated maturity amount based on the parameters defined by the customer. |

| Interest Rate | The interest rate applicable on the deposit account based on the deposit product. |

To open a new recurring deposit: