- Enterprise Collateral Management User Manual

- Collaterals

- Collaterals Maintenance

- Collateral Perfection

2.11.12 Collateral Perfection

This topic provides more information on collateral perfection details of collateral maintenance.

Banks have a right over the collateral in case of default by the customer so charges are recorded on customer collaterals. These charges need to be registered as part of charge perfection with relevant authorities.

Collateral perfection can be done as part of customer collateral creation and as also part of amendment.

Based on the charge status, data is generated for sending a notice to an external registration authority at the time of charge registration, charge renewal and charge termination.

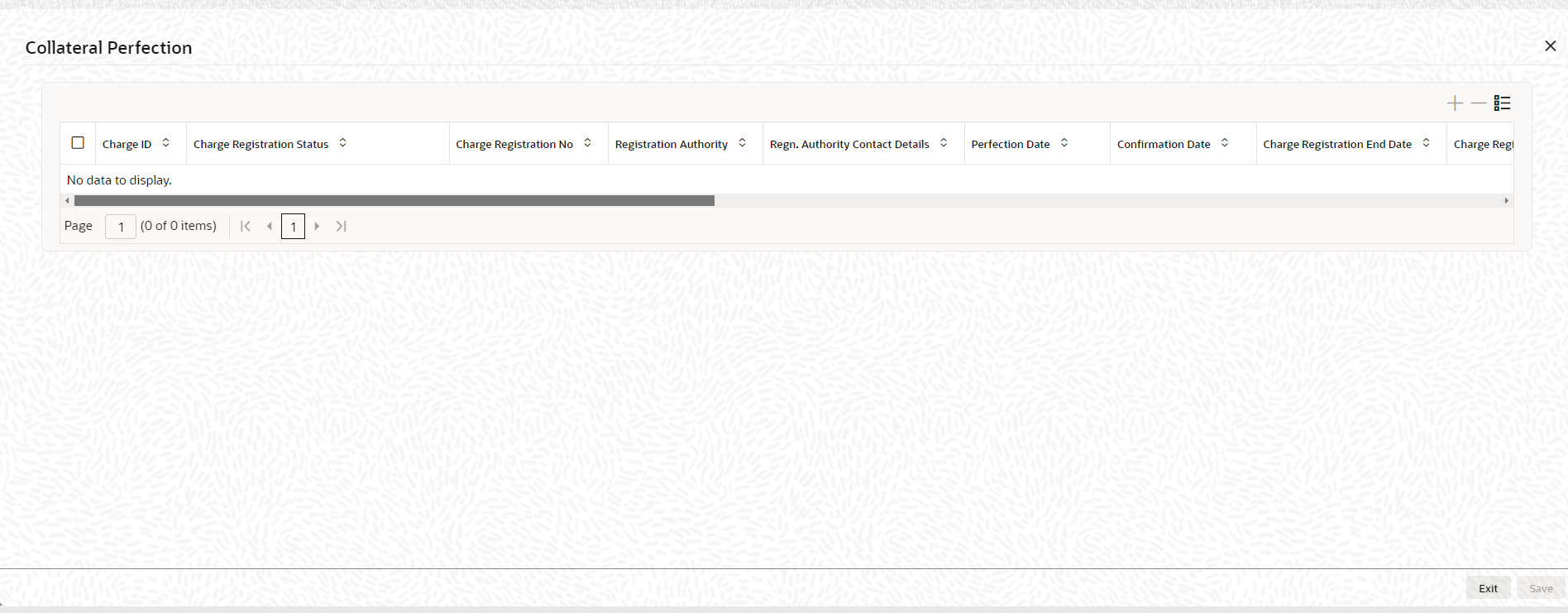

- On Collaterals Maintenance screen, click the

Collateral Perfection tab.The Collateral Perfection screen is displayed. For more information on fields, refer to the field description table.

Table 2-36 Collateral Perfection - Field Description

Field Description Charge ID Charge ID is generated by system. This ID is generated only if charge status is Registered and charge perfection details are entered and saved, wherever Charge registration required toggler is enabled. Charge Registration Status Select the registration status from the drop-down list. The charge status is used to track the status of the charge registration process. The available options are: - Proposed - The initial charge status

- Registered - When charge perfection details are entered and saved, charge status gets updated as ‘Registered’ and the data required for sending notice to the charge registration authority is generated.

- Renewal - Registered charge can be renewed upfront during lead days before charge end date by opting renewal. Charge can be renewed for a further period as per renewal frequency and unit configured. Charge status gets updated as 'Registered' once renewal is complete. Subsequent to renewal, charge renewal notice can be generated with the required data available.

- Expired - Charge status is updated as ‘Expired’ by the system in case charge is not renewed during lead days period. Once the Charge Registration End Date is crossed, the system updates the status as ‘Expired’ by running the Scheduler ‘ELCMPERFSTAT’. An expired charge can be renewed by entering the registration details. On renewal, the charge status will be updated as ‘Registered’ with a new charge end date.

- Discharged -

When a loan provided for the collateral is repaid in

full, charge noted for the collateral can be

discharged.

Note: Once charge is discharged on a customer collateral, no further updates can be performed on the same. Charge status is updated as Discharged, then the system generates a discharge notice that needs to be sent to the registration authority.

Charge Registration No Specify the unique charge registration number. Registration Authority Specify the registration authority with which collateral is perfected. Regn. Authority Contact Details Specify the contact details of registration authority. Perfection Date Specify the date on which bank’s charge has been registered. Confirmation Date Specify the date on which you received confirmation of perfection. That is, confirmation received from the registered authority. This date cannot be prior to perfection date. Charge Registration End Date Once charge perfection details are entered and saved, based on Charge Perfection Date and Charge Renewal Frequency multiplied with Unit, charge registration end date is calculated by the system. For example, if Frequency is selected as Monthly and Unit is selected as 2, then the system updates the charge end date considering perfection date + 2 months.

Charge Registration Amount Specify the charge registration amount. Mortgagee Name Specify the name of mortgagee. Documents Status Specify if the perfection documents are received from registration authority. Filing Lead Date Specify the filing lead date. Notes Specify notes, if any. Stamping Required Select this check box if stamping is required with relevant authority. Stamping Date Specify the stamping date. Stamping Amount Specify the stamping amount. Reference Number Specify the reference number for the collateral. Charge Holder Name Click the  icon and select the name of Bank holding charge on

the collateral.

icon and select the name of Bank holding charge on

the collateral.

Charge Release Date If the bank released charge on the collateral by executing release deed or release letter, specify the execution date of such document. Underlying Document Click the  icon and select the name of documents executed to

create charge on the collateral. The options available are:

icon and select the name of documents executed to

create charge on the collateral. The options available are:

- Deed of Hypothecation

- Mortgage Deed

Underlying Document Date Specify the date of the underlying document. - Click Save to save the record.

Parent topic: Collaterals Maintenance