2.23 Global Exposure Parameter Details

This topic describes about the detailed information on global exposure parameter details.

Note:

The fields, which are marked with an asterisk, are mandatory.User can specify certain parameters related to the End Of Day operations in the Limits & Collaterals Parameter Details screen.

- On the Home screen, specify

GEDPARAM in the text box and click the

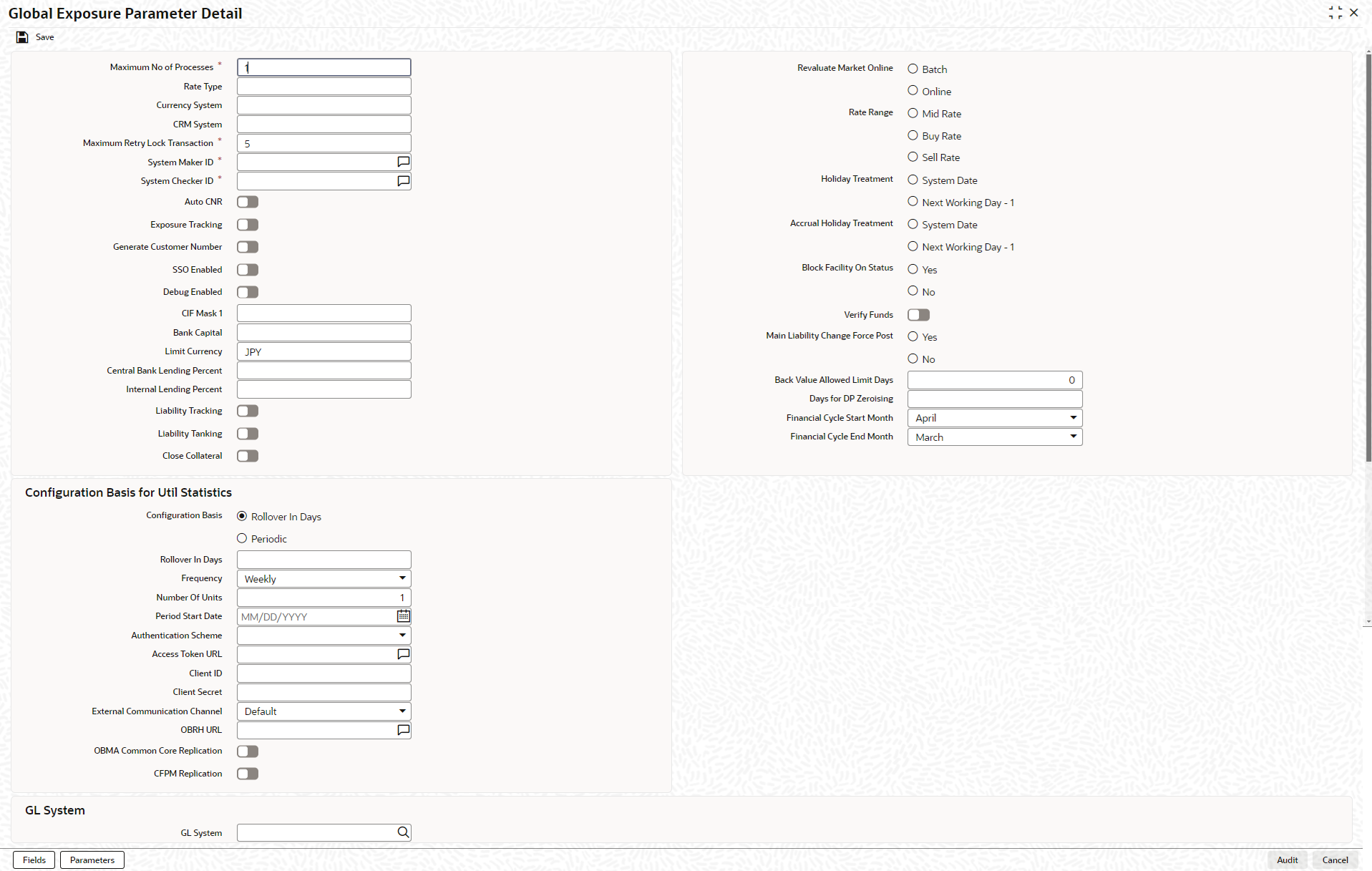

icon.The Global Exposure Parameter Detail screen displays.

icon.The Global Exposure Parameter Detail screen displays.Figure 2-60 Global Exposure Parameter Detail

- On Global Exposure Parameter Detail screen, click

New and specify the fields.For more information on fields, refer to the field description table.

Table 2-77 Global Exposure Parameter Detail - Field Description

Field Description Maximum No of Processes Multi threading feature in can be controlled by specifying the max number of processes here. In case of load balancer during End Of Day batch operations the maximum process for load sharing can be specified using this field. Rate Type Specify the rate type that has to be considered for all amount conversions in . Currency System Specify the external currency system if the Bank is using a external currency system other than the one provided in . CRM System Specify the external CRM system if the Bank is using an external CRM system other than the one provided in . Maximum Retry Lock Transaction Specify the number of times authorization can be tried before the transaction is locked. System Maker ID and System Checker ID During the processing of user entries, if the maker ID and checker ID is not mentioned, then IDs specified here are recorded. Auto CNR (Auto Closure of Non-Revolving and Non-Revolving Special Lines) Switch to

for auto closure of non-revolving and

non-revolving special lines.

for auto closure of non-revolving and

non-revolving special lines.

Switch

to prevent auto closure of non-revolving and

non-revolving special lines.

to prevent auto closure of non-revolving and

non-revolving special lines.

Exposure Tracking Switch to

for tracking the exposure.

for tracking the exposure.

Switch to

for not tracking the exposure.

for not tracking the exposure.

Generate Customer Number Switch to

for generating the customer number.

for generating the customer number.

Switch to

for not generating the customer number.

for not generating the customer number.

Debug Enabled Switch to

for enabling the debug.

for enabling the debug.

Switch to

for not enabling the debug.

for not enabling the debug.

CIF Mask 1 If user have selected Generate Customer Number option, user need to specify the customer mask. The customer mask is maximum nine characters length, out of which it is mandatory to use three characters from the branch code of the customer number and the rest six can be numbers. E.g. bbbnnnnnn. If branch code is not part of customer mask, then maximum characters of number digit will be nine else it would be six characters and minimum characters of number digit would be four.

E.g. nnnnnnnnn. If the customer number is less than nine digits, then the system left pad it with 0 that is, zero.

Note: Character b indicates the branch code and character n indicates number digits.

Bank Capital Specify the amount to calculate internal lending equivalent amount. Limit Currency The system defaults the local currency of the bank. Central Bank Lending Limit Percent Specify the percentage of central bank lending limit. Central Bank Lending Limit percentage of the bank capital is considered as limit amount allowed by the central bank. The central bank lending limit percentage should be between 0 and 100. Internal lending Limit Percent Specify the percentage of internal lending limit. The internal lending limit percentage should be between 0 and 100. Note: If Bank Capital is specified then Central Bank Lending Limit% and Internal Lending Limit% fields are mandatory.

Liability Tracking Switch to

for tracking the liability.

for tracking the liability.

Switch to

for not tracking the liability.

for not tracking the liability.

Liability Tanking Switch to

for tracking the liability tanking.

for tracking the liability tanking.

Switch to

for not tracking the liability tanking.

for not tracking the liability tanking.

Close Collateral Switch to

for closing the collateral.

for closing the collateral.

Switch to

for not closing the collateral.

for not closing the collateral.

Revaluate Market Online Indicate whether market price revaluation should be Online or Batch. Market price based security revaluation takes place online if the parameter is set to online. Rate Range Specify the rate range. The options are: - Mid Rate

- Buy rate

- Sell rate

Holiday Treatment The revaluation process for the securities, collaterals and covenants may fall on a bank holiday. User can specify which of the following actions must be taken in such cases: - System Date – Choose this to indicate that only collaterals with a Reval Date prior to or same as the system date is considered for revaluation.

- Next Working Date -1 – Choose this to indicate that all the collaterals with the Reval

Date prior to or same as the day before the next working date is considered.

The EOD process closes all the active non-revolving lines automatically when the check box Auto CNR is checked.

For more infiormation on limits, refer Table 2-83.

System Date - 15-Jul-2009

Next Working Day - 17-Jul-2009

On 15-Jul-2009 EOD, the system closes FACILITY1 and FACILITY3.

Note: This process does not close the following lines:- If there are any underlying active transactions on that line .

- If there are any active sub lines reporting to this main line.

If particular line is not closed on expiry date due to the above exception then same line is taken up for auto closure process on next EOD.

Accrual Holiday Treatment Specify the holiday treatment for accrual. The options are: - System Date

- Next Working Date -1

Block Facility on Status Indicate whether, depending on the worst status of a liability, the EOD process should block the facility or not. Verify Funds Switch to

for verifying the funds.

for verifying the funds.

Switch to

for not verifying the funds.

for not verifying the funds.

Main Liability Change Force Post Indicate whether the system should force post the transactions while processing the main liability change request, if the available balance in new parent liability is not sufficient. Note:- This parameter is applicable only for ascertaining the available balance in new main liability which is equal to (Overall limit (Utilization + Block)).

- If the overall limit of new main liability is not sufficient, then the main liability change request will not be processed even if the Main Liability Change Force Post flag is enabled.

- Exceptions that arise due to insufficient overall limit in the new main liability will be logged in the exception table GETM_PARENT_LIAB_CHG.

Back Value Allowed Limit Days Specify the number of days up to which the back dated transactions (limit block, limit utilization, facility amendment, rate change, backdated facility creation) can be allowed. Days for DP Zeroising Specify the number of days to zeroise the DP amount (in DP backed facilities). DP amount at facility will be zeroised after the configure number of since last stock submission date. Financial Cycle Start Month and Financial Cycle End Month Select the financial year starting and ending months. This is mandatory in case you support back dated transactions like back dated facility creation, utilization, block, limit amendment, and fee rate change. While posting a back dated transaction, the system will validate the transaction value date with this financial cycle. Note:- The system will allow backdated transactions only if the value date of transactions is within the configured period (Back Value Allowed Limit Days) and the current financial year.

- Backdated transactions that are within the configured number of days but not within the current financial year can be handled as exceptions by setting the flag BD_FINANCIAL_ TXN in GETB_PARAM table as N. By default, the BD_FINANCIAL_ TXN flag is set as Y to not allow the backdated transactions beyond current financial cycle.

Table 2-78 Configuration Basis for Util Statistics - Field Description

Field Description Util Calculation Period Utilization calculation period can be either in days or specific frequency. If user want to specify the number of days for utilization calculation, select Rollover Days option.

To select the predefined frequency for utilization calculation, select Periodic option.

User can change the Util Calculation Period at any time, if required. If you change from Rollover Days to Periodic, changes will be considered on the same day for utilization calculation.

If user change the Util Calculation Period from Periodic to Rollover Days, changes will be considered only at the end of current period for utilization calculation.

Rollover In Days Specify the number of days for which the peak and average utilization are to be calculated, if the Util Calculation Period is selected as Rollover Days. By default, the system displays 30 in this field. User can increase or decrease the days based on your business needs.

Changes in Rollover In Days value will be considered on the same day for utilization calculation.

Frequency Select the frequency for utilization calculation from the drop down list, if the Util Calculation Period is selected as Frequency. The options available are: - Weekly

- Fortnightly

- Quarterly

- Half Yearly

- Yearly

User can change the Frequency at any time, if required. Changes will be considered only at the end of current period for peak and Average utilization calculation.

Number Of Units Specify the number of units, if the Util Calculation Period is selected as Periodic. The frequency will get increased by the number of units mentioned. For example, if the Frequency is selected as Weekly and 2 is entered in Number Of Units field, then the utilization calculation period is every two weeks.

Period Start Date Specify the start date of the utilization calculation period. If the facility is created in between the period configured in Configuration Basis for Utilization Statistics section, then the system will consider the facility creation date as period start date.

Authentication Scheme Authentication scheme can be OAUTH, JWT, FLEXCUBE, or CUSTOM. Access Token URL URL to validate JWT or OAUTH token. Client ID Client ID to validate JWT or OAUTH token. Client Secret Client Secret to validate JWT or OAUTH token. External Communication Channel Communication channel can be OBRH or empty. OBRH URL OBRH URL for inter product calls. OBMA Common Core Replication This field is to replicate Enterprise Limits and Collateral Management maintenance data to Oracle Banking Microservices Architecture core. User can configure the period for calculating peak and average utilization of the facility in this section.

Scenario for rollover days (Greenfield implementation):

Table 2-79 Rollover In Days (Greenfield implementation)

Rollover In Days Period Start Date Facility Start Date 7 01 September 03 September For the above configuration, the outstanding utilization from facility start date (3rd September) onwards will be considered for daily peak and average utilization calculation. Thus, on 06 September, peak and average utilization will be calculated considering the outstanding balances on 3rd, 4th and 5th September.

Scenario for rollover days (migration / upgrade implementation):

Table 2-80 Rollover days (migration / upgrade implementation):

Rollover In Days Period Start Date Facility Start Date 7 01 September 03 August For the above configuration, outstanding utilization from the date the change is introduced (1st September) onwards will be considered for daily peak and average calculation. Thus, on 6th September, peak and average utilization will be calculated considering the outstanding balances from 1st to 5th September.

Scenario for frequency (Greenfield implementation):

Table 2-81 Scenario for frequency (Greenfield implementation):

Frequency Period Cycle Facility Start Date Weekly 01 - 07 September 03 September For the above configuration, outstanding utilization from facility start date (3rd September) till period end date (7th September) will be considered for peak and average calculation. Thus, on 8th September, peak and average utilization will be calculated considering the outstanding balances from 3rd to 7th September.

Scenario for frequency (migration / upgrade implementation):

Table 2-82 Scenario for frequency (migration / upgrade implementation):

Frequency Period Cycle Facility Start Date Weekly 01 - 07 September 03 August For the above configuration, outstanding utilization from the date the change is introduced (1st September) till cycle end date (7th September) will be considered for peak and average calculation. Thus, on 8th September, peak and average utilization will be calculated considering the outstanding balances from 1st to 7th September.

GL System

Select the external system code from the LOV. External system can be FCUBS or any ROFC system.

Currency Revaluation Upward Propagation

The Currency Revaluation Upward Propagation screen displayed below:

This parameter allows the exchange rate specified either as part of each transaction for the same contract (GEDUTILS / GEDBLCKS - Exchange Rate field) or as part of facility in FX Rate Revaluation, to be propagated up the facility hierarchy.

The below scenarios explains the behavior in detail.Note:

Currency revaluation will not happen for such contracts for which exchange rate is provided as part of the utilization.Scenario 1 - DIRECT EXCHANGE RATE IN GEDUTILS

The Loan contract is sent to Oracle Banking ELCM system for utilization, which are linked to this Credit Line FACILITY2. Exchange rate is specified as part of contract utilization (GEDUTILS - Exchange Rate field). The line utilization for subline and mainline is computed based on the flag configuration and exchange rates specified as shown in SCENARIO 1 DIRECT EXCHANGE RATE IN GEDUTILS section in the attached SCENARIO 1_and_SCENARIO 2.xlsx file.

SCENARIO 2 - FX RATE REVALUATION IN GEDFACLT

The Loan contract is sent to Oracle Banking ELCM system for utilization, which are linked to this Credit Line FACILITY2. Exchange rate is specified as part of subline facility – FX Rate Revaluation (GEDFACLT – FX Rate Revaluation). The line utilization for subline and mainline is computed based on the flag configuration and exchange rates specified as shown in SCENARIO 2 - FX RATE REVALUATION IN GEDFACLT section in the attached SCENARIO 1_and_SCENARIO 2.xlsx file.Note:

Refer SCENARIO 1_and_SCENARIO 2.xlsx file attached in the attachment section for SCENARIO 1 and SCENARIO 2 details.Table 2-83 Limits

Facility Expiry Date Revolving FACILITY1 15-Jul-2009 N FACILITY2 16-Jul-2009 Y FACILITY3 16-Jul-2009 N FACILITY4 15-Jul-2009 N - Click Save to save the record.

Parent topic: Limits and Collateral