- Current Account Origination User Guide

- Initiating Current Account Opening Process

- Application Entry Stage

- Collateral Details

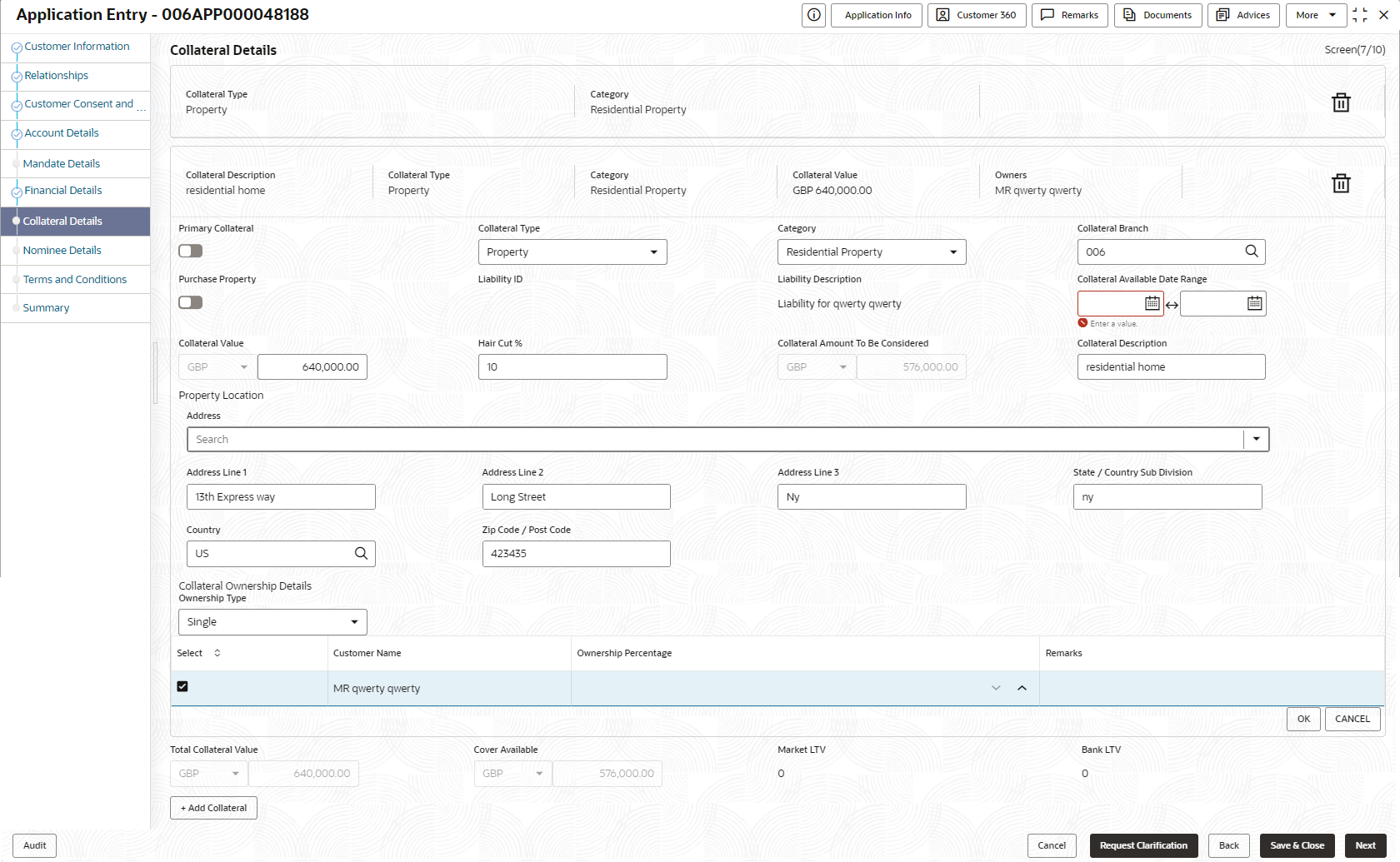

2.1.8 Collateral Details

This topic provides the systematic instructions to capture the collateral which is offered by the customer as security for Overdraft limit.

Collateral details is a data segment to capture the collateral which is offered by the customer as security for Overdraft limit. Collateral details will be sent to the host to be made available under local collateral. The relevant service APIs will be made available for both Push and Pull details of collaterals.

Capturing of Collateral details in Oracle Banking Origination is also enabled with an option to onboard collateral using the Oracle Banking Credit Facility Process Management integration services. In such cases, the collateral details will be sent to the Collateral onboarding systems for performing the Valuation, obtaining the Legal opinion and recording the perfection details. These details will be made available on Oracle Banking Origination in the respective Data segments in read only mode.

To add the collateral details:

- Click Next in the previous data segment to proceed with next data segment, after successfully capturing the data.

- Click Add Collateral to capture the collateral

details.

The Collateral Details screen displays.

If the Collateral Type is selected as Term Deposit, the following warningmessage displays when the OD Limit expiry date is more than the Maturity Date of the term deposit.

The Warning Message popup screen displays.

- Specify the details in the relevant data fields. For more information on fields, refer

to the field description table below.

Table 2-15 Collateral Details - Field Description

Field Description Primary Collateral Specify the primary collateral. Collateral Type Select the collateral type. Available options are:

- Property

- Guarantee

- Vehicle

- Precious Metal

- Deposits

- Bonds

- Stocks

- Insurance

- Accounts Receivable

- Inventory (Stock of Material)

Category Select the collateral category. Available options are:

If Collateral type is selected as Property

- Residential Property

- Vacant Land

- Under Construction

If Collateral type is selected as Guarantee

- Personal Guarantee

- Guarantee and Indemnity

- Government Guarantee

- Family Guarantee

If Collateral type is selected as Vehicle

- Passenger Vehicle

- Commercial Vehicle

If Collateral type is selected as Precious Metal

- Precious Metal

If Collateral type is selected as Deposits

- Term Deposit

If Collateral type is selected as Bonds

- Secured Bonds

- Unsecured Bonds

- Investment Bonds

If Collateral type is selected as Stocks

- Domestic Stock

If Collateral type is selected as Insurance

- Life Insurance

If Collateral type is selected as Accounts Receivable

- Bill Receivable

- Trade Receivable

If Collateral type is selected as Inventory (Stock of Material)

- Stock of Raw Materials

- Finished Goods

- Packaging Materials

Collateral Branch Displays the branch of the collateral. Term Deposit Number Select the Term Deposit Number from the list.

The Term Deposit which has crossed the maturity date and the “Allow Collateral Linkage” disabled, will not appear in the list.

Maturity Date Select the Maturity Date of the term deposit. Available Linkage Amount Specify the available linkage amount. Linked Amount Specify the linked amount. Linkage Currency Displays the linkage currency. Guarantee Type Specify the type of guarantee.

This field appears only if the collateral type is Guarantee.

Currency Specify the currency of the collateral value. Collateral Value Specify the collateral value. Collateral Description Specify the collateral description. Mark Collateral For Refinance Specify if an added collateral should be consider for refinance. Applicants This section displays the applicants name and remarks that are involved in the loan application. These applicants are also related to the added collateral. Guarantor This section displays the guarantor name. Purchase Property Specify whether the collateral property being added is being purchased.

This field appears if the Property option is selected from the Collateral Type list.

Liability ID Displays the Liability ID Liability Description Displays the Liability description. Collateral Available Date Range Select the date range of the collateral. The range indicates the date from and date up to, which the collateral is available. Collateral Value Specify the value of the collateral. Hair Cut % Specify the percentage of Hair Cut. Collateral Amount To Be Considered Displays the collateral amount to be considered.

Collateral Amount = (Hair Cut % Collateral Value)

Collateral Description Specify the collateral description. Property Location In this section you can enter property address which is added as collateral. This section appears only if you select Property from the Collateral Type list.

The fields appears if you select the Property option from the Collateral Type list.

Address Specify the address to search already captured address.

Based on configuration, on entering few letters, the system fetches the related address that are already captured.

Based on the selection, the fields are auto populated in the address section.

Address Line 1 Specify the building name. Address Line 2 Specify the street name. Address Line 3 Specify the city or town name. State / Country Sub Division Specify the state or country sub division. Country Select and search the country code. Zip Code / Post Code Specify the zip or post code of the address. Collateral Ownership Details In this section you specify the ownership details of the collateral property. This section displays all the customers that are involved in the loan application.

The fields appears if you select the Property option from the Collateral Type list.

Ownership Type Select the ownership type of the property.

The available options are

- Single

- Joint

The fields appears if you select the Property option from the Collateral Type list.

Select Select the appropriate customer as owner from the list.

The fields appears if you select the Property option from the Collateral Type list.

Customer Name Displays the customer name along with title.

The fields appears if you select the Property option from the Collateral Type list.

Ownership Percentage Displays the percentage of the ownership of the customer.

The fields appears if you select the Property option from the Collateral Type list.

Remark Displays the remark of the customer.

The fields appears if you select the Property option from the Collateral Type list.

Market LTV Displays the market LTV. Bank LTV Displays the bank LTV. Collateral Description Displays the description of the collateral. Collateral Type Displays the collateral type. Category Displays the category of the collateral. Collateral Value Displays the collateral value. Owners Displays the owner names of the collateral. <Actions> Displays the actions that you can perform on the added collateral.

- Click delete to delete the added collateral.

- Click down arrow to view the collateral details.

Total Collateral Value Displays the total value of collateral.

This field will be auto updated based on the number of collaterals.

Cover Available Displays the cover available.

This field will be auto updated based on the number of collaterals.

Note:

All the fields are fetched from Oracle Banking Credit Facilities Process Management in read only mode, if integrated with Oracle Banking Credit Facilities Process Management. - Click Next to navigate to the next data segment, after successfully capturing the data. The system validates for all mandatory data segments and data fields. If mandatory details are not provided, the system displays an error message for the user to take an action. The User cannot to proceed to the next data segment, without capturing the mandatory data.

Parent topic: Application Entry Stage