- Current Account Origination User Guide

- Initiating Current Account Opening Process

- Manual Credit Decision Stage

- Summary

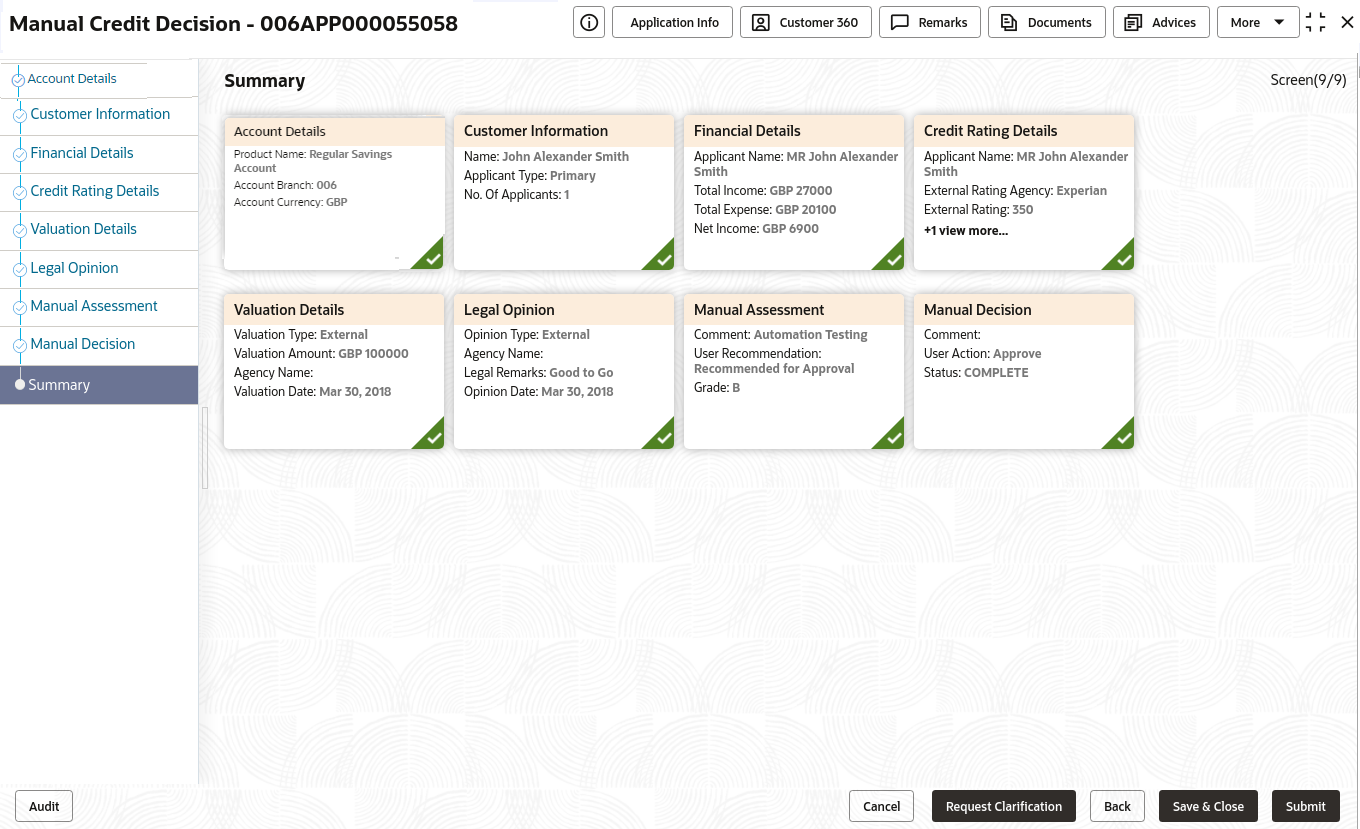

2.9.2 Summary

This topic provides the systematic instructions to view the summary of each of the data segmentsin as many tiles as the number of data segments in the given stage.

The system will display the summary of each of the data segmentsin as many tiles as the number of data segments in the given stage.

- Click Next in the previous data segment to proceed with the next data

segment, after successfully capturing the data.

The Summary screen displays.

Each of these summary tiles are clickable and the user will have the option to view all the details captured under the given data segment.

For more information on fields, refer to the field description table.Table 2-46 Summary - Manual Credit Decision – Field Description

Field Description Account Details Displays the account details. Customer Information Displays the customer information. Financial Details Displays the financial details. Credit Rating Details Displays the credit rating details. Valuation Details Displays the valuation details. Legal Opinion Displays the legal opinion. Manual Assessment Displays the manual assessment. Manual Decision Displays the manual decision. - Click Submit to reach the OUTCOME, where the overrides, checklist and documents for this stage can be validated or verified. The Overrides screen is displayed.

- Click Accept Overrides & Proceed. The Checklist screen is displayed.

- Click Save & Proceed. The Outcome screen is displayed.

- In the Outcome screen, select appropriate option from the Select to

Outcome field.

- Select the Proceed to proceed with the application. It will logically complete the Manual Credit Decision stage for the Saving Account (with overdraft) Application. Upon submit, a Pricing call will be made by Oracle Banking Origination to Decision Service to get the Interest rate. The Workflow Orchestrator will automatically move this application to the next processing stage, Account Parameter Setup stage. The stage movement is driven by the business configuration for a given combination of Process Code, Life Cycle and Business Product Code.

- Select the Return to Application Entry Stage to make application entry stage available in free task for edit.

- Select the Return to Application Enrichment Stage to make enrichment stage available in free task.

- Select the Return to Assessment to make overdraft limit details stage available in free task.

- Select the Return to Initial Funding Details to make account funding details stage available in free task

- Select the Return to Overdraft Limit Details to make overdraft limit details stage available in free task.

- Select the Return to Application Underwriting Stage to make underwriting stage available in free task.

- Select the Reject by Bank to reject the submission of this application. The application is terminated, and an email is sent to the borrower or customer with a rejection advice.

- Select the Return to Manual Credit Assessment Stage to make underwriting stage available in free task. It will logically complete the Manual Credit Assessment stage for the Current Account (with overdraft) Application. The workflow will automatically move this application to the next processing stage, Manual Credit Decision stage.

- Enter the remarks in Remarks.

- Click Submit. The Confirmation screen is displayed.

- Click Close to close the window. OR

Click Go to Free Task. The system successfully moves the Application Reference Number along with the sub process reference numbers [Current Account] to the Account Parameter Setup stage. This application will be available in the FREE TASK list. The user who has the access rights will be able to acquire and proceed with the next processing stage of the application.

Parent topic: Manual Credit Decision Stage