- Core Entities and Services User Guide

- Core Maintenance

- Maintenance of Treasury Customer Details

1.8 Maintenance of Treasury Customer Details

This topic describes the systematic instructions to maintain the additional details of the customer.

- On the Home page, specify STDTRCIF in the text box, and click next arrow.

The Treasury Customer Additional Detail Maintenance screen is displayed.

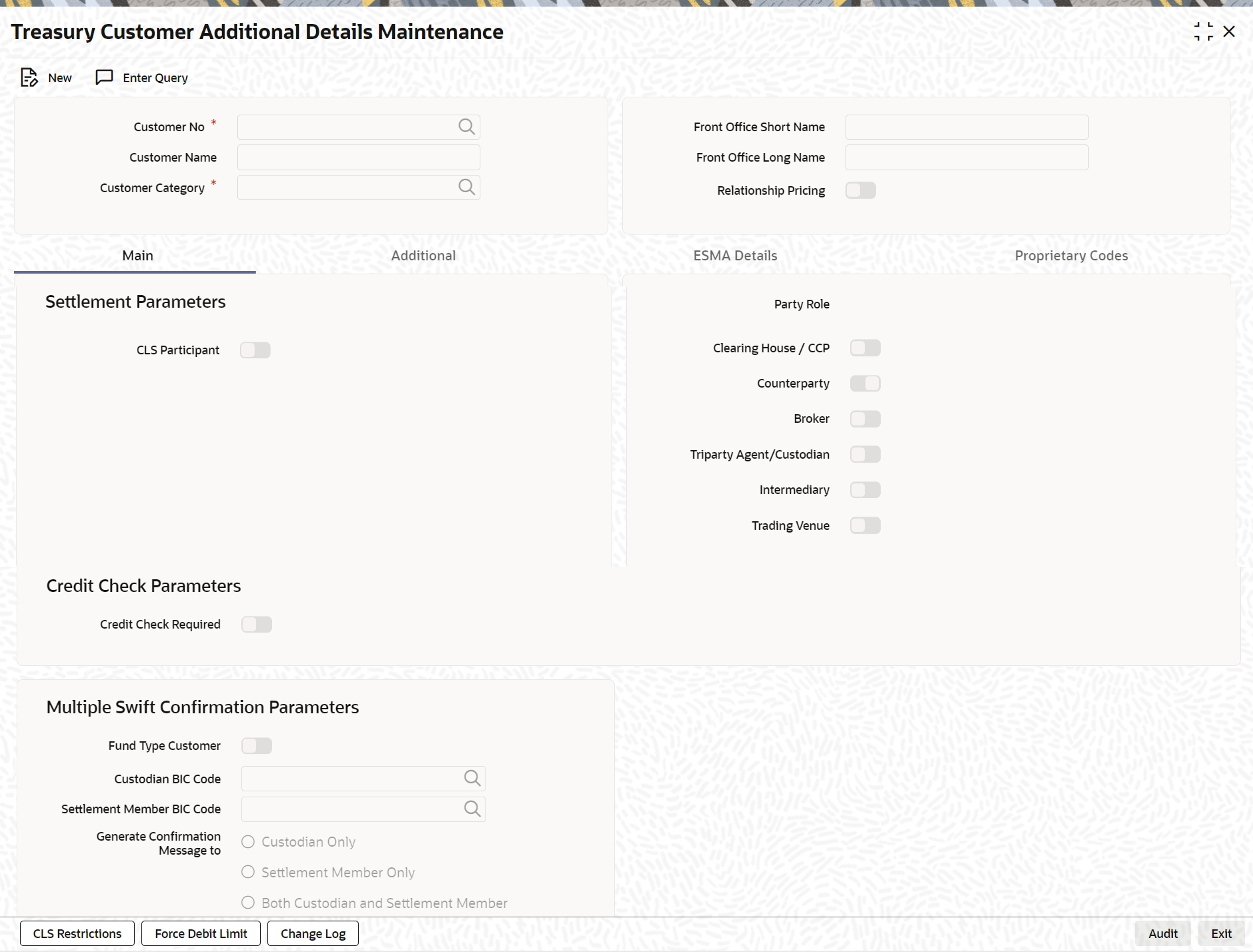

Figure 1-6 Treasury Customer Additional Detail Maintenance

Description of "Figure 1-6 Treasury Customer Additional Detail Maintenance" - On the Treasury Customer Maintenance screen, specify the fields.

For more information on fields, refer to the below table.

Table 1-6 Treasury Customer Additional Detail Maintenance- Main- Field Description

Field Description Customer No Specify a customer code for the customer. The customer code is assigned to identify a customer. It is also referred to as the customer CIF Number. This code should be unique across branches. It can be 9-characters long

For example, Assign a code using a maximum of 9 characters, alphanumeric. Also, assume your customer is XYZ Corporation, US. You can assign him a code, which could either be a number representing the customer’s serial number or an alphabetic code like xyzp or an alphanumeric code like XYZ1000US or XYZ1000 / 1000XYZUS, if the user is the 1000th customer to approach your bank.

Customer Name Indicates the name of the Customer.

Customer Category Select the customer category from the available list of values. The option list displays the values maintained in customer categories maintenance. Choose the appropriate one.

Note:

You need to capture the basic details for each customer, regardless of the type of customer you are maintaining.You need to capture the basic details for each customer, regardless of the type of customer you are maintaining.

Front Office Short Name Specify the front office short name.

Front Office Long Name

Specify the front office long name.

Relationship Pricing Select the Relationship Pricing check box to enable relationship pricing option.

CLS Participants

Select the CLS Participants check box to allow the customers to do CLS trades by marking the customer as a CLS Participant.

Customers of your bank can settle their FX deals via the CLS (Continuous Linked Settlements) bank to reduce the risks associated with such transactions.

However, you have to ensure that the branch at which the customer operates is also qualified to process CLS deals that is the branch should also be marked as a CLS Participant before allowing the same for the customer. Further, you can also capture currency restrictions for your customers by maintaining a list of allowed or disallowed currencies for CLS trading.

Click CLS Restrictions available at the bottom of this screen to maintain this CLS participants list.For more information, refer to the Continuous Linked Settlements chapter of the Foreign Exchange User Manual on maintaining currency restrictions and other maintenance required for processing CLS deals in Oracle Banking Treasury Management.Note:

The currency restrictions will be allowed only for customers who are CLS participants.Party Role Select any of the following party role options.- Clearing House/CCP

- Counterparty

- Broker

- Triparty Agent/Custodian

- Intermediary

- Trading Venue

Credit Check Required

Select the Credit Check Required check box to indicated whether the credit check is required or not.

Fund Type Customer

Select the Fund Type Customer check box, if the customer is to be identified as the Fund type Customer.

For cases, when the counter-party to a trade is a Fund, Oracle Baking Treasury management allows to generate multiple confirmations to custodian and settlement member associated with that fund. Populating of specific tag for MT 320 and MT 300 with fund details is also supported for such cases.

Custodian BIC Code

Select the custodian BIC code from the available list of values.

Settlement Member BIC Code

Select the settlement member BIC code from the available list of values.

Generate Confirmation Message to

Select any of the following options to whom the confirmation message has to be generated.

- Custodian Only

- Settlement Member Only

- Both Custodian and Settlement member

Address 1–5

Specify the mailing address of the customer. In each line, all characters should conform to SWIFT standards.

- On the Treasury Customer Maintenance screen, click Additional.

The Additional Parameters, MISC Details, and Restriction Details are displayed.

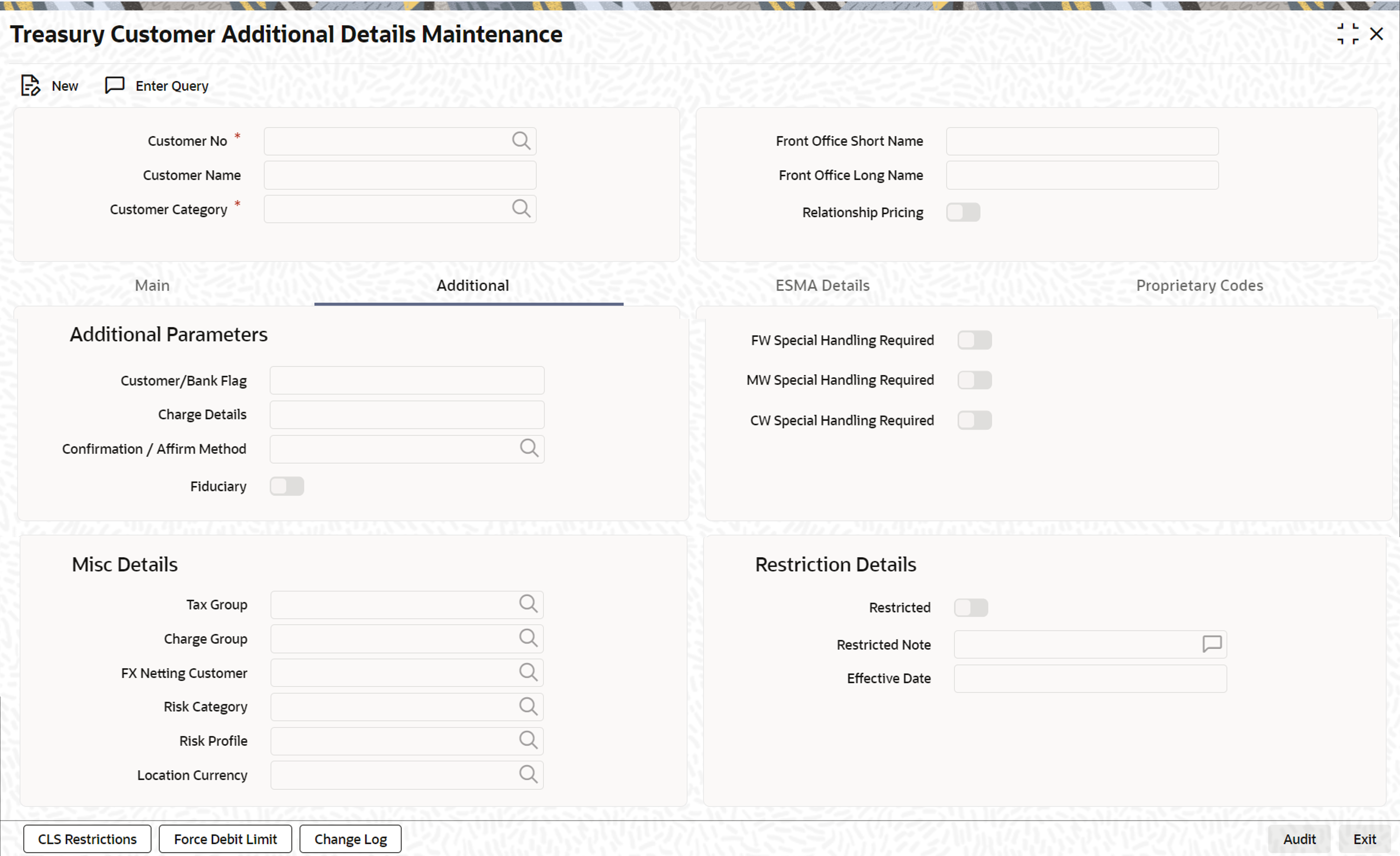

Figure 1-7 Treasury Customer Maintenance- Additional

Description of "Figure 1-7 Treasury Customer Maintenance- Additional" - On the Treasury Customer Maintenance screen, under Additional, specify the fields. For more information on fields, refer to the below table.

Table 1-7 Additional- Field Description

Field Description Customer/Bank Flag

Select the Customer or Bank flag from the drop-down field.

Charge Details

Select the charge details from the drop-down list. The available options are:- Shared

- Beneficiary

- Bank

Confirmation/Affirmation

Select the confirmation or affirmation method from the available list of value.

Tax Group

Select the tax group of the customer from the option list provided. Only the Group Codes maintained with type Tax will appear for selection.

Charge Group

Select the charge group of the customer from the option list provided. Only the Group codes maintained with type Charge can appear for selection.

FX Netting Customer

Select the FX netting customer from the available list of values.

Risk Category

Select the risk category from the available list of values.

Risk Profile

Select the risk profile from the available list of values.

Location Currency

Select the location currency from the available list of values.

Restricted Note

Select the restricted note from the available list of values.

Effective Date

Select the effective date from the calendar.

- On the Treasury Customer Additional Maintenance screen, click ESMA Details.

The ESMA Details fields are displayed.

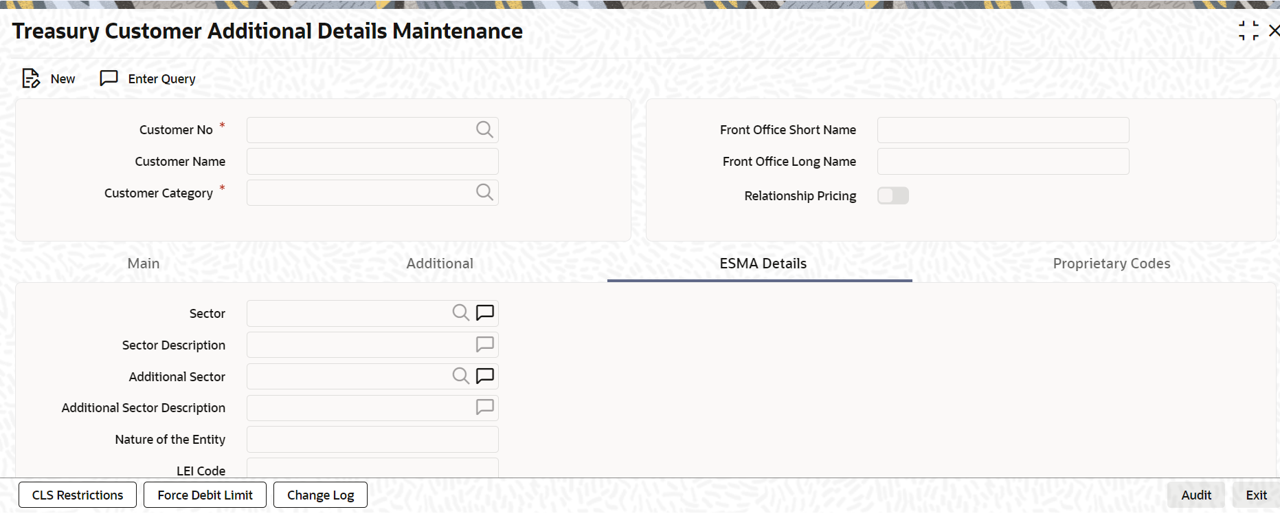

Figure 1-8 Treasury Customer Additional Maintenance- ESMA Details

Description of "Figure 1-8 Treasury Customer Additional Maintenance- ESMA Details" - On the Treasury Customer Additional Maintenance screen, under ESMA Details, specify the details.

For more information on fields, refer to the below table.

Table 1-8 Treasury Customer Additional Details Maintenance- ESMA Details- Field Description

Type Description Sector

Select the unique code of the sector from the displayed list of values for identifying a counterparty.

Sector Description

The brief description of the selected sector of counterparty is displayed in this field.

Additional Sector

Select the unique code of the additional sector from the displayed list for identifying a counterparty.

The reporting counterparty is an Undertaking for Collective Investment in Transferable Securities (UCITS) or Alternative Investment Fund (AIF).

Additional Sector Description

The brief description of the selected sector of counterparty is displayed in this field.

Nature of the Entity

Select the counterparty’s nature of the entity from the drop-down list. The drop-down list shows the following options:

- Financial

- Non Financial

LEI Code

Specify the LEI code of the counterparty.

Indicates whether the reporting counterparty is a financial or non-financial counterparty.

- On the Treasury Customer Additional Maintenance screen, click Proprietary Code.The Proprietary Code fields are displayed.

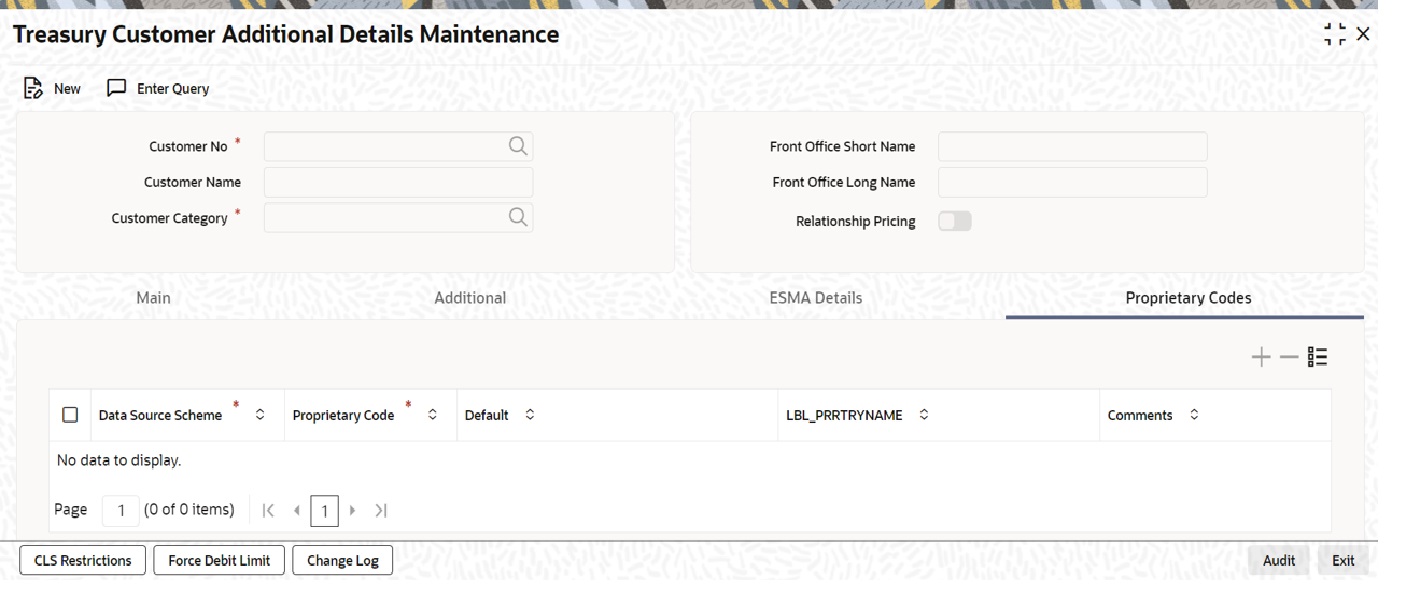

Figure 1-9 Proprietary Code

- On the Treasury Customer Additional Maintenance screen, under Proprietary Code, specify the details.

For more information on fields, refer to the below table.

Table 1-9 Treasury Customer Additional Details Maintenance- Proprietary Code- Field Description

Field Description Data Source Scheme Select the data source scheme of the counterparty from the available list of values to identify the delivering agent of securities which must be appeared in counterparties database.

Proprietary Code Specify the proprietary code.

Default Select the default option to enable the default proprietary code of the counterparty.

LBL_PRRTRYNAME Specify the proprietary name.

Comments Specify the additional comments.

Parent topic: Core Maintenance

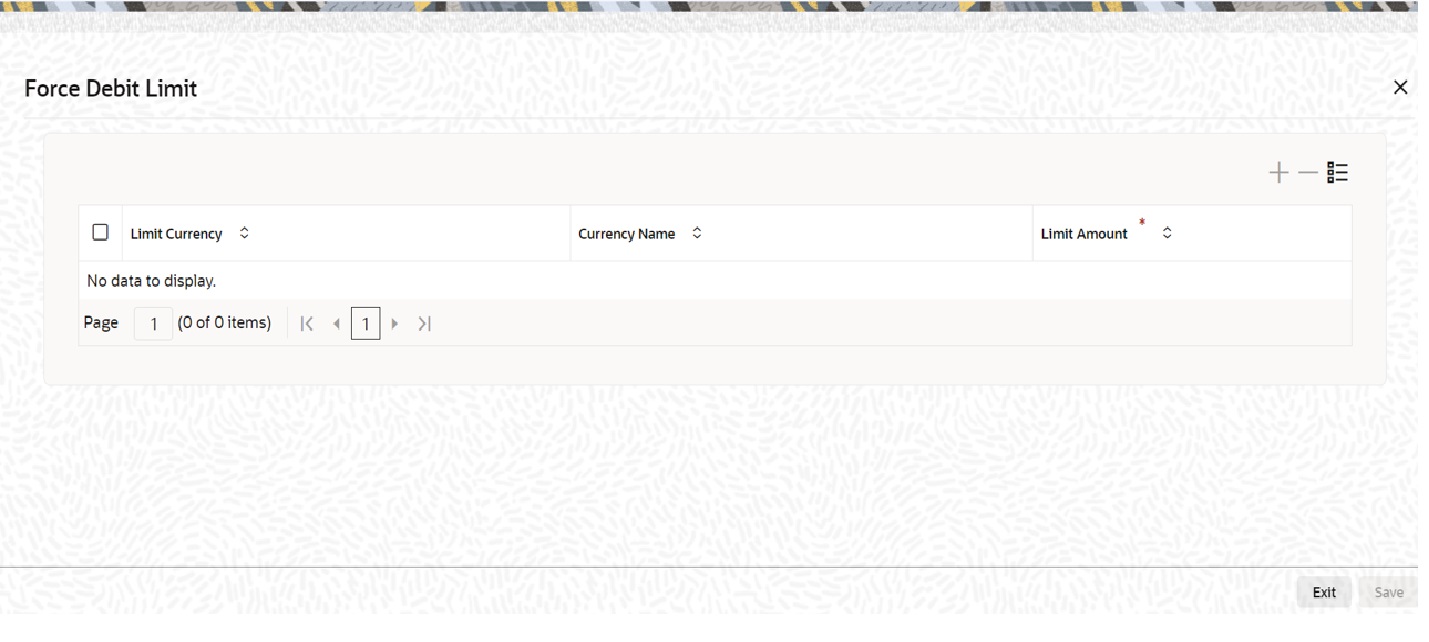

1.8.1 Force Debit Limit

The Treasury Customer Additional details Maintenance screen is enhanced with a new sub system Force Debit Limit for each currency along with the limit amount. The application performs force debit only if the limit amount is mapped to the respective currencies, else the force debit limit is failed.

When account has an insufficient balance to meet the requested block amount, there must be a facility to decide whether the block can be created forcefully.

- On the Treasury Customer Additional Details Maintenance screen, click Force Debit Limit available in the bottom of this screen.

The Force Debit Limit screen is displayed.

Figure 1-10 Treasury Customer Additional Details Maintenance- Force Debit Limit

Description of "Figure 1-10 Treasury Customer Additional Details Maintenance- Force Debit Limit" - On the Force Debit Limit screen, specify the fields.For more information on fields, refer to the below table.

Table 1-10 Treasury Customer Classification Maintenance- Field Description

Field Description Limit Currency

Select the limit currency code from the displayed list of values.

Currency Name

The system displays the currency name based on the selected limit currency code.

Limit Amount

Specify the limit amount. This limit amount is the maximum transaction debit amount allowed for force block during ECA request.

Parent topic: Maintenance of Treasury Customer Details