2.2.7 Bank Dtls Tab

This topic provides the systematic instructions to specify the bank details for corporate investors in the Unit Holder Maintenance Detail screen.

You can specify any number of preferred bank accounts for an investor, for each currency, but you must designate one of these to be used by the investor as the default bank account for making or receiving payments for a combination of payment mode, transaction type, fund Id and transaction currency.

You can also specify the bank details for a combination of payment mode, fund, transaction type and currency for each unit holder maintained in the system. In addition, you can also maintain the routing details for the combination.

During transaction entry, the payment bank details to be used for the unit holder will be picked up based on the combination of payment mode, fund, transaction type and transaction currency.

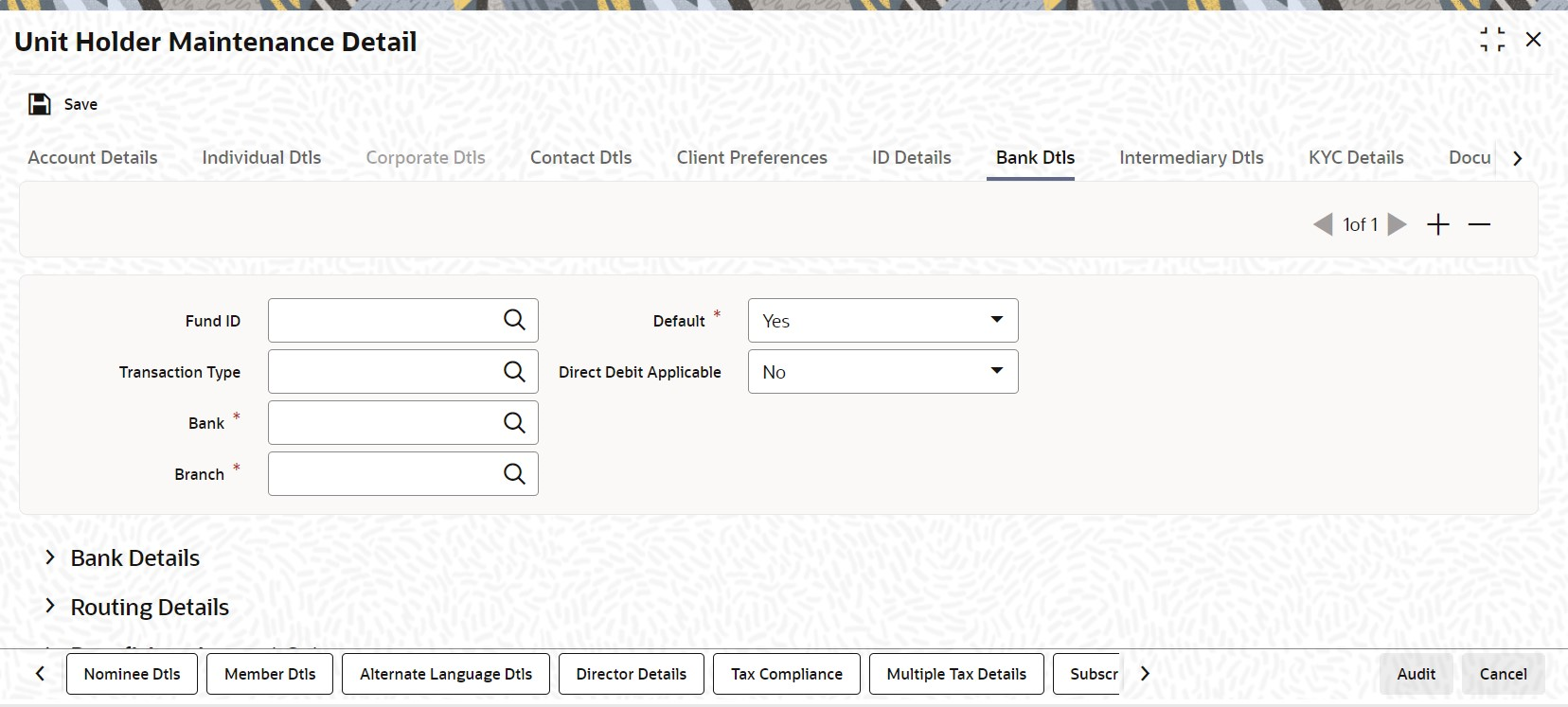

- On Unit Holder Maintenance Detail screen, click Bank Dtls tab.The Bank Details are displayed.

Figure 2-8 Unit Holder Maintenance Detail_Bank Details Tab

- On Bank Dtls tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-10 Bank Dtls - Field Description

Field Description Fund ID Alphanumeric; 6 Characters; Optional

Select the ID of the fund.

Transaction Type Alphanumeric; 3 Characters; Optional (Mandatory if Fund ID is specified)

Specify the type of transaction. Alternatively, you can select the transaction type from the option list. The list displays all valid transaction type maintained in the system.

Note:- If no IDs is maintained for the Unit Holder, then system will take the banking instructions for dividend payment maintained at Unit Holder Maintenance Detail screen (UTDUH).

- If no Dividend Payment banking instructions is maintained for the Unit Holder in Unit Holder Maintenance Detail screen (UTDUH) then the system will take the banking instructions for

Alltransaction types/funds.

Bank Alphanumeric; 12 Characters; Mandatory

Select the name of the bank in which the account is held from the list.

Branch Alphanumeric; 12 Characters; Mandatory

Select the name of the branch of the bank in which the account is held from the list.

Default Mandatory

Use this check box to identify the bank account that is to be reckoned as the default bank account for the investor in the system. In the desired row, check this box.

Note: For HSBC customers, accounts for a specific currency and payment type combination can be marked as default accounts only if they are maintained for

Allfunds andAlltransaction types. Also, for a currency where the default has already been specified, other accounts maintained for specific funds and specific transaction types for the same currency cannot be designated as the default account for that currency.In case the default account for a particular payment type and currency combination has not been maintained and you designate an account maintained for a specific fund and transaction type as the default account, the system displays the following message (at the time of saving unit holder details) Default accounts can be maintained only for fund

Alland transaction typeAll.For Default Account Maintenance for various Currency and Payment Type, refer to the table Table 2-11.

Direct Debit Applicable Optional

Select

Yesto indicate if whether direct debits are allowed for the account.Bank Details The section displays the following fields.

Account Type Alphanumeric; 1 Character; Mandatory

Select the nature of the account held by the investor from the list. The list provides all account types that have been set up in the Account Type Maintenance records.

Account Type Description Display

The system displays the description for the selected account type.

Account Number Alphanumeric; 34 Characters; Mandatory

Specify the number of the account held by the unit holder in the selected bank.

Payment Type Optional

You can select the payment type whether it is

SelforThird Partyfrom the drop-down list.Last Name Alphanumeric; 105 Characters; Optional

If you select the Account Category field as

Selfthen the Last Name and Initials will be defaulted.Identification Type Alphanumeric; 20 Characters; Optional

Select the identification type from the option list.

Identification Number Alphanumeric; 50 Characters; Optional

Specify the identification number of the identification type.

Relationship Alphanumeric; 40 Characters; Optional

The system displays the relationship status.

Description Display

The system displays the description for the selected relationship status.

IBAN Alphanumeric; 40 Characters; Optional

Specify the International Bank Account Number (IBAN) of the account holder.

Note: If you select the Account Category field as Third Party, the system will not verify the third party bank accounts using the details such as Initials, Identification Number and so forth.

Account Name Alphanumeric; 140 Characters; Mandatory

Specify the name in which the investor holds the specified bank account.

By default, the system reckons this to be the specified name of the unit holder, and the same is displayed here. It will be accepted into the database as the account holder’s name if you do not specify any other.

Account Currency Alphanumeric; 3 Characters; Mandatory

Select the currency of the bank accounts that you are designating for the unit holder. You can maintain any number of accounts in each currency; however, you must designate one default bank account for each currency.

The system also allows you to maintain Multi-Currency (MCY) accounts for unit holders/ agents. The system uses this account if payment currency account is not available. As with accounts in other currencies, you can have multiple accounts for MCY. You should, however, specify one as the default one to be used for payments.

Account Currency Description Display

The system displays the description for the selected account currency.

Initials Alphanumeric; 10 Characters; Optional

Specify the initials of the unit holder.

UH BIC Code Alphanumeric; 24 Characters; Optional

Specify the UH BIC Code.

Routing Details FCIS provides the option to capture the bank routing details as well while maintaining the bank details. At the time of transaction input, the routing details specified here are picked up for the combination of fund, transaction type and transaction currency.

Swift Format Optional

Select the format of the Swift message from the drop-down list. The options are:- MT 103

- MT 202

Bank Charged Optional

Indicate whether the bank charges must be levied upon the beneficiary, the emitter or must be shared between the two.

Beneficiary Account Category The section displays the following fields.

Beneficiary Alphanumeric; 35 Characters; Optional

Specify the beneficiary details.

Beneficiary Address1-3 Alphanumeric; 105 Characters; Optional

Enter beneficiary address.

Beneficiary IBAN Alphanumeric; 40 Characters; Optional

Specify the beneficiary IBAN details.

Beneficiary BIC Code Alphanumeric; 24 Characters; Optional

Enter beneficiary BIC code.

Beneficiary Account Number Alphanumeric; 34 Characters; Optional

Enter beneficiary Account Number.

Beneficiary Code Alphanumeric; 24 Characters; Optional

Enter beneficiary code.

Beneficiary Info Alphanumeric; 100 Characters; Optional

Enter beneficiary information.

Intermediary Details The section displays the following fields.

Intermediary Alphanumeric; 35 Characters; Optional

Enter the intermediary details.

Intermediary Address 1-3 Alphanumeric; 105 Characters; Optional

Enter intermediary address.

Intermediary IBAN Alphanumeric; 40 Characters; Optional

Enter intermediary IBAN details.

Intermediary BIC Code Alphanumeric; 24 Characters; Optional

Enter intermediary BIC code.

Intermediary Account Number Alphanumeric; 34 Characters; Optional

Enter intermediary account number.

Intermediary Code Alphanumeric; 24 Characters; Optional

Enter intermediary code.

Intermediary Info Alphanumeric; 100 Characters; Optional

Enter intermediary information.

Further Credit Details The section displays the following fields.

Further Credit Name Alphanumeric; 35 Characters; Optional

Enter further credit name.

Further Credit Account Number Alphanumeric; 35 Characters; Optional

Enter further credit account number.

Reference Section The section displays the following fields.

Reference 1-2 Alphanumeric; 35 Characters; Optional

Enter the reference details.

Example on Default Account Maintenance for various Currency and Payment Type

Consider the following table which shows the default account maintenance for various currency and payment type combinations.Table 2-11 Default Account Maintenance for various Currency and Payment Type

Payment Mode Fund ID Transaction Type Currenc y Default Account? Transfer ALL ALL HKD Yes Transfer ALL ALL MCY Yes Payment Mode Fund ID Transaction Type Currency Default Account? Transfer Fund 1 02 HKD No Transfer Fund 1 02 MCY No Here, for the currencies HKD and MCY and payment mode transfer, you can maintain different accounts as the default account (for the All funds and All transaction type combination).

You cannot, however, maintain the account specified for

Fund 1and Transaction type 02 as the default account for the currencies MCY and HKD and Payment mode Transfer.

Parent topic: Process Unit Holder Maintenance Detail