3.1 Process Income Distribution Setup Detail

This topic provides the systematic instructions to setup the income distribution option for an investor.

When investors put their capital into any funds of the AMC, they derive earnings out of any dividend declared by the fund at any juncture.

Also, an intermediary (such as a broker) designated for a fund derives commission earnings from the transactions in the fund.

Investors may wish to choose the manner in which they could use the dividend income. Similarly, brokers could wish to choose the manner in which they could use their commission earnings.

- Receive the entire earnings, dividend or commission, as payment, either entirely through checks or account transfer, or a combination of both.

- Not receive the earnings by way of payment, but invest the earnings back into the funds of the AMC. This is known as Reinvestment. The earnings could be reinvested either back into the same fund, or different funds. Also, the reinvestment could be made into any other investor’s account too.

- Receive a portion of the earnings by way of payment, and reinvest the remaining portion.

The option chosen by the investor to use dividend or commission earnings, as the case may be, is known as the Income Distribution Setup (IDS) option for the investor or broker.

- UT transactions

- Policy transactions

- On Home screen, type UTDUHIDS/

UTDFHIDS in

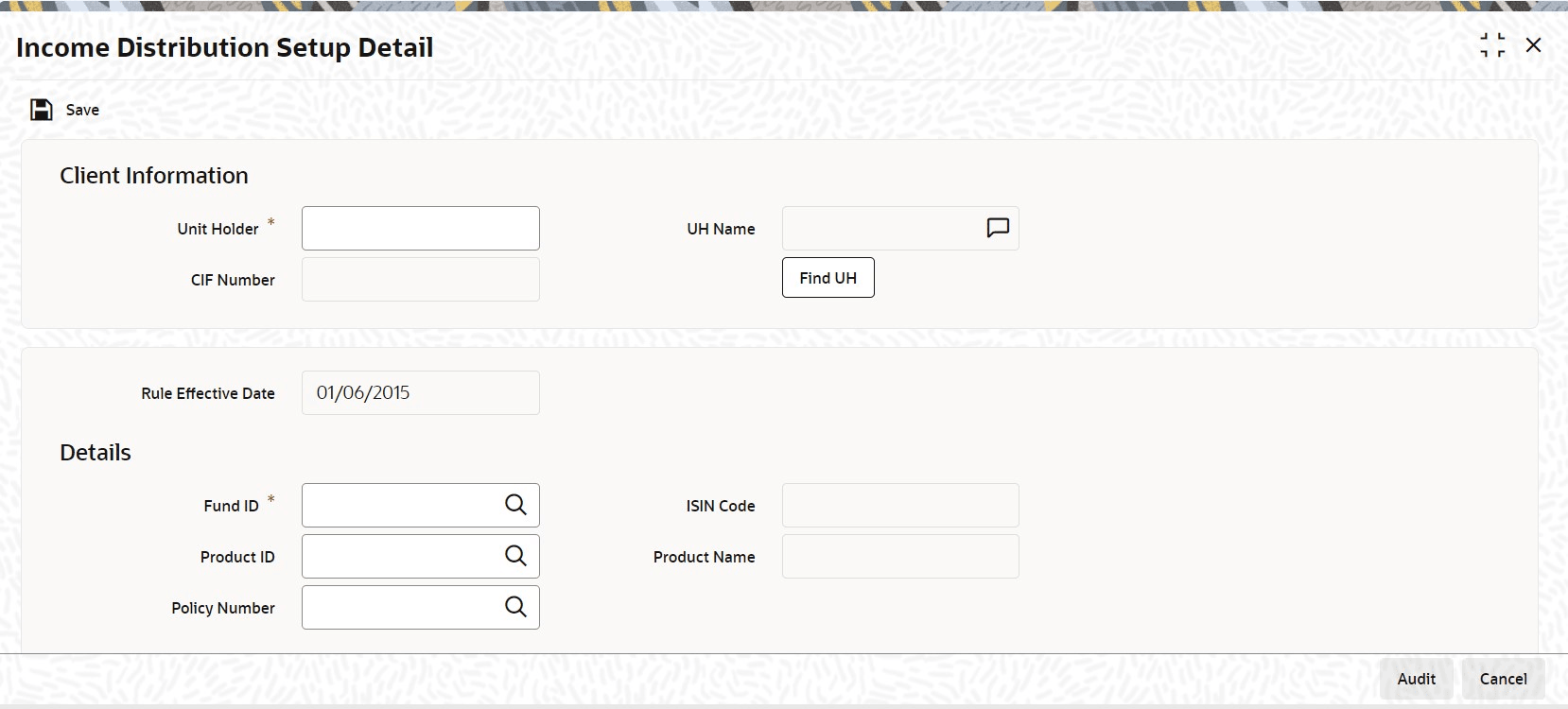

the text box, and click Next.The Income Distribution Setup Detail screen is displayed.

Figure 3-1 Income Distribution Setup Detail

- You can set up the IDS option in this screen.Specify the investor for whom the option is being set up, by indicating the CIF account associated with the unit holder, or the unit holder ID.

Note:

Income distribution options are only setup at a unit holder account level, and not at a CIF account level.- Specify the fund for which the option is applicable, in the Fund ID field. You can also specify the ISIN Code for the fund. For LEP transactions, you can specify a combination of fund, policy and product, for which the option is applicable. The option you will set up will be applied only for dividend earnings on the fund/ combination of fund, product and policy you select here.

- Specify the broker for whom the pattern is being setup, in the Broker Code field.

- Specify the mode of distribution, in the Distribution Mode field.

- Specify the percentages that represent the portions of dividend earnings to be paid and reinvested, as desired by the investor, in the Payment Percentage and Reinvestment Percentage fields.

- Specify the payment details for the paid portion, in the Payment Details section, and the reinvestment details, for the reinvestment portion, in the Reinvestment Details section.

- Save your changes.

- On Income Distribution Setup Detail screen, click

New to enter the details.For more information on fields, refer to the field description table.

Table 3-1 Income Distribution Setup Detail - Field Description

Field Description Client Information Select the ID of the unit holder for whom you are creating an income distribution setup record in this section.

Unit Holder Alphanumeric; 12 Characters; Mandatory

Select the CIF unit holder for whom you are creating an income distribution setup record from the list.

CIF Number Display

The system displays the number of the CIF Account under which the unit CIF Number is displayed when you select/ locate a unit holder by clicking Find UH button.

UH Name Display

The system displays name of the unit holder.

Click Find UH button to query for unit holder details.

Rule Effective Date Date Format; Mandatory

Select rule effective date from the adjoining calendar.

Details In this section, you can indicate the fund, policy and product, the income earnings from which will be distributed according to the IDS options you are creating for the selected unit holder.

Various combinations at which the Unitholder IDS options can be set up, in order of preference are:

Product + Policy + Fund level

Product + Fund level

In case of LEP transactions, if the UH IDS is not available, the dividend earnings will be reinvested into the default reinvestment fund maintained for the product in the Product Maintenance Detail screen. However, if the reinvestment fund is not defined, then the dividend is reinvested into the source fund itself.

You can also indicate the manner in which the income must be distributed.

Fund ID Alphanumeric; 6 Characters; Mandatory

Select the ID of the fund from which the selected investor derives income, which will be distributed according to the IDS options you are creating in this screen.

If the selected investor receives income from many funds, then you must create the IDS options for the income from each fund in this screen as applicable, if so requested by the investor.

When you specify the ID of the fund, the ISIN code of the fund is displayed in the ISIN Code field.

ISIN Code Display

The system displays the ISIN Code for the selected Fund ID.

Product ID Alphanumeric; 10 Characters; Optional

Select the ID of product from which the investor derives income, which will be distributed according to the IDS options you are creating in this screen.

This field is not applicable if you are setting up IDS options for UT transactions.

Product Name Display

The system displays the name of the product for the selected product ID.

Policy Number Alphanumeric; 16 Characters; Optional

Select the policy from which the investor derives income, which will be distributed according to the IDS options you are creating in this screen.

This field is not applicable if you are setting up IDS options for UT transactions.

Distribution Mode Mandatory

Indicate the manner in which the selected investor prefers to avail of income earned in the selected fund from the list. This could be any of the following:- Full Payment:

Choose this option to indicate that the investor prefers to receive the entire income derived from an income distribution cycle in the selected fund as a payment.

Further, the investor can choose to avail of payment either in the form of a check, or an account transfer.

- Full Reinvestment:

Choose this option to indicate that the investor prefers to reinvest the entire income derived from an income distribution cycle in the selected fund into another fund.

In such a case, the fund into which the earned income is reinvested must belong to the same fund family as the fund from which the income was earned.

Further, the investor can choose to have the income reinvested either in the investor’s own unit holder account or the account of another investor. In the latter case, the investor in whose account the reinvestment is proposed (i.e., the Reinvestment Unit Holder) must belong to the same AMC as the source investor.

- Both:

Choose this option to indicate that the investor prefers to have the income derived from an entire income distribution cycle in the selected fund divided into two portions, receive one portion as payment, and reinvest the remaining portion.

Note:- In some funds in which reinvestment is not allowed, according to the Corporate Action profile for the fund, the investor cannot choose to have income earnings reinvested. In such cases, this field is validated with the Full Payment option displayed as a non-editable default option. Also, the Payment Percentage field is locked with a default, non-editable value of one hundred percent displayed, and the Reinvestment Percentage field is locked with a default, non-editable value of zero percent displayed.

- If you have chosen the distribution mode as

Full ReinvestmentorBoth, and the reinvestment fund has a restriction on the nationality of the investor as maintained in the Fund Residency Restriction list, then reinvestment is not allowed at all.

For some funds, the option of allowing the investor to decide the income distribution mode is restricted. The default distribution mode specified in the fund rules is considered for such funds, and an investor cannot decide the same at account level by making a specification in this field.

Payment Percentage Numeric; 5 Characters; Optional (Mandatory if distribution mode is either Both or Full Payment)

Specify the percentage of income earned that the investor prefers to receive by way of payment.- If the distribution mode chosen is Both, specify a percentage that is below one hundred percent.

- If the distribution mode chosen is Full Payment, this field contains one hundred percent as a default value. If so, you cannot specify any other value.

- If the distribution mode chosen is Full Reinvestment, and the reinvestment is disallowed for the selected fund, this field contains one hundred percent as a default value. If so, you cannot change it.

Reinvestment Percentage Display

The system displays the percentage of income earned that the investor prefers to reinvest into another fund.- If the distribution mode chosen is Both, the system displays a percentage that is below one hundred percent.

- If the distribution mode chosen is Full Reinvestment, this field contains one hundred percent as a default value. If so, you cannot specify any other value.

- If the distribution mode chosen is Full Reinvestment, and the reinvestment is disallowed for the selected fund, this field contains zero as a default value. If so, you cannot change it.

Payment Currency Alphanumeric; 3 Characters; Optional

Select the currency in which the unit holder wishes the payment to be made. All currencies maintained in the system are available for selection.

In case Payment Mode is transfer then the system looks for a bank account in the opted payment currency for the unit holder. If such an account does not exist, you can choose (in Transfer Details section) any multi-currency account maintained for the unit holder subject to the following conditions:- The Distribution

Mode is

Full Payment/ Both - The Mode of

Payment is

Transfer - The Payment

Type is

Self

Also the fund should have a bank account in this currency. In the event of failure of any one of the two criteria an error will be displayed.

Note: The default value here would be the unit holder base currency.

Currency Name Display

The system displays the name of the currency for the selected payment currency.

Note: If client country UHFUNDRESTRICT is turned ON, the system will validate:- The investor for whom income distribution setup is done (Unit Holder) must belong to the same AMC as the fund from which income is derived.

- The investor in whose account the reinvestment is proposed (Examples, the Reinvestment Unit Holder) must belong to the same AMC as the fund from which income is derived.

- Full Payment:

- Payment Details Tab

This topic explains the payment details tab of Income Distribution Setup Detail screen. - Reinvestment Details Tab

This topic explains the reinvestment details tab of Income Distribution Setup Detail screen. - Routing Details Tab

This topic explains the routing details tab of Income Distribution Setup Detail screen.

Parent topic: Entities - Set Up Investor Preferences