2.2.5 Client Preferences Tab

This topic provides the systematic instructions to specify the client preferences for corporate investors in the Unit Holder Maintenance Detail screen.

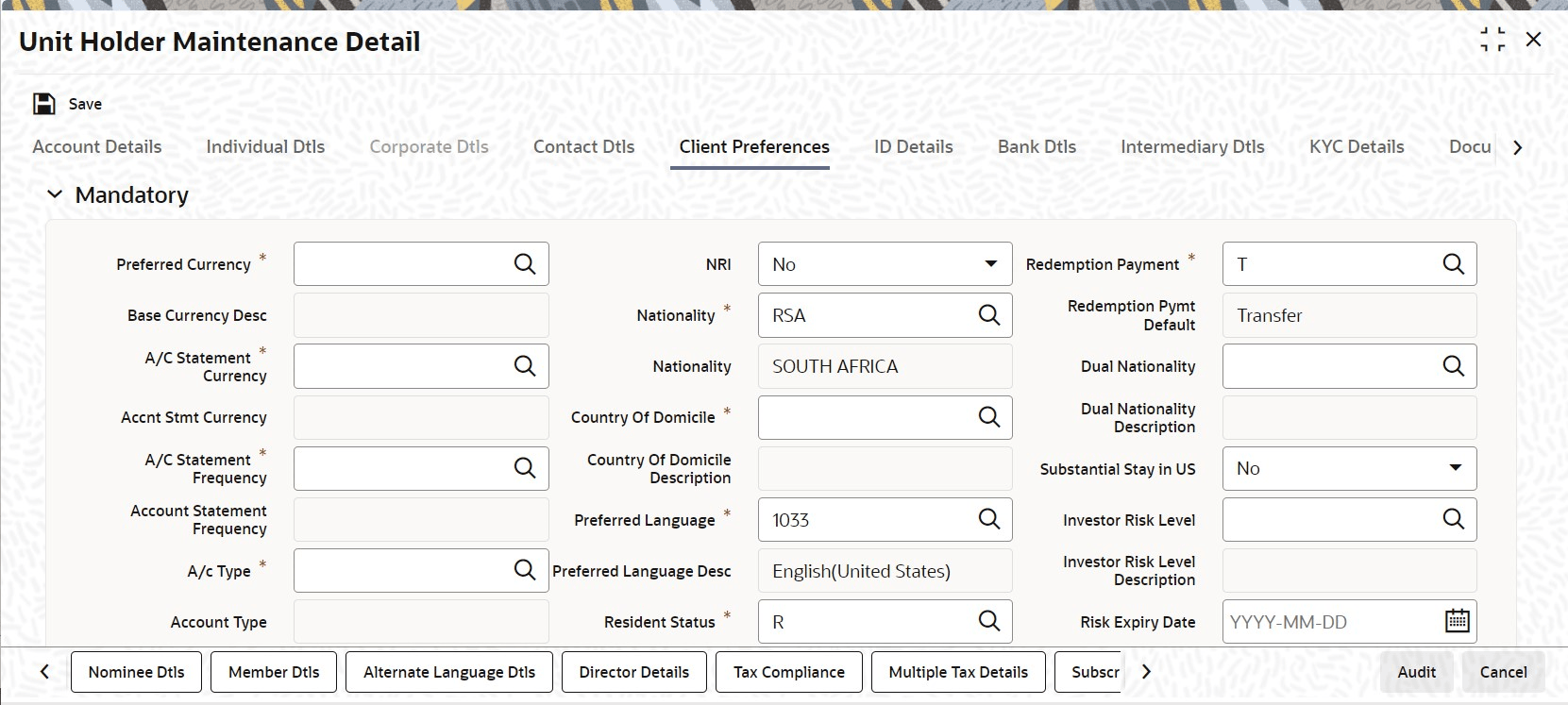

- On Unit Holder Maintenance Detail screen, click

Client Preferences tab.The Client Preferences details are displayed.

Figure 2-6 Unit Holder Maintenance Detail_Client Preferences Tab

- On the Client Preferences tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-8 Client Preferences - Field Description

Field Description Preferred Currency Alphanumeric; 3 Characters; Optional

Select the currency in which the investor prefers to transact with the AMC from the list.

The preferred currency is the currency in which the investor or unit holder prefers to make any payments involving transactions or receive any dividend income payments. The currency you select here will be deemed as the default currency for all payments from or to the investor.

If the

Payment Modechosen isTransfer, the system allows you to successfully save the unit holder details only if you maintain a bank account for the preferred currency or multi-currency.You can also choose Fund Base Currency (FBC) as your preferred currency (for unit holders only). In this case, you will be allowed to proceed with saving unit holder details without maintaining an account for FBC.

You can save transactions for unit holders with FBC as preferred currency, but these transactions will be marked incomplete. You can complete such transactions by specifying unit holder Bank details for the unit holder and for the transactions (in the Payments Details section).

The system processes payments on the basis of the currency for each fund for the FBC option. In case an account exists for the FBC, the system picks it up for payments or else it picks up the default multi-currency account for the unit holder. If neither is available, the system displays an error message.

The investor can, if need be, choose to transact in a currency different from the one you specify here, for any transaction.

Note: When you specify the country in which the investor is domiciled, in the Country of Domicile field, the currency associated with the specified country is retrieved from the Country Currency Maintenance record in the system and displayed in this field by default. If you do not select any currency here, then the displayed default currency will be deemed as the preferred currency for the investor.

Base Currency Desc Display

The system displays the description for the selected base currency.

A/C Statement Currency Alphanumeric; 3 Characters; Optional

Select the currency for account statements for the investor, from the drop-down list.

If you do not make any selection, this will be deemed as the account statement currency for the unit holder.

Accnt Stmt Currency Display

The system displays the account statement currency for the selected account statement currency.

A/C Statement Frequency Alphanumeric; 1 Character; Mandatory

Select the frequency at which the investor wishes to receive periodic statement of accounts from the AMC. This could be:- Monthly

- Daily

- Yearly

- Half-Yearly

- Bi-Weekly

- Quarterly

- Weekly

Account Statement Frequency Display

The system displays the account statement frequency.

A/C Type Alphanumeric; 2 Characters; Optional

Specify whether the account is to be a Voluntary account or a Retired account. Once authorized, this field cannot be modified from the list.

Account Type Display

The system displays the type of account for the selected account type.

Preferred Mailing Mode Alphanumeric; 2 Characters; Mandatory

Select the mailing mode in which the investor prefers to receive correspondence from the AMC from the list.

If you wish to suppress the printing of contract notes in respect of the unit holder during execution of End of Day processes, you must select the

Fileoption in this field.Preferred Mailing Mode Description Display

The system displays the description for the selected preferred mailing mode.

NRI Optional

Select if the investor is NRI or not from the drop-down list. The list displays the following values:- Yes

- No

Nationality Alphanumeric; 15 Characters; Mandatory

Select the nationality of the investor for whom you are creating the account from the list.

When you specify the country in which the investor is domiciled, in the Country of Domicile field, the nationality of the specified country is displayed in this field by default. If you do not make any selection in this field, then the displayed default nationality will be deemed as the nationality of the investor.

Nationality Display

The system displays the nationality description.

Country of Domicile Alphanumeric; 3 Characters; Mandatory

Select the country where the investor is domiciled from the list provided.

If you do not make a selection, then this default Country of Domicile is reckoned for the investor account in the database.

Country Of Domicile Description Display

The system displays the description for the selected Country of Domicile.

Preferred Language Alphanumeric; 12 Characters; Mandatory

Select the language preferred by the investor for correspondence and communication from the list.

Preferred Language Desc Display

The system displays the description for the selected preferred language.

Resident Status Alphanumeric; 1 Character; Mandatory

Indicate whether the investor resides in the selected country of domicile or not, by selecting either the Resident or the Non-Resident option.

Resident Status Display

The system displays the description for the selected resident status.

Redemption Payment Alphanumeric; 1 Character; Optional

Select the default mode of payment that is to be used for paying out the proceeds of any redemption transactions for the investor.

The two modes of payment supported in the system are:- Check

- Transfer

Redemption Pymt Default Display

The system displays the description for the selected redemption payment.

Dual Nationality Alphanumeric; 3 Characters; Optional

Select the dual nationality from the adjoining option list.

Dual Nationality Description Display

The system displays the description for the selected dual nationality.

Substantial Stay in US Optional

Indicate your Substantial Stay in US from the adjoining drop-down list. The options available are:- Yes

- No

Investor Risk Level Numeric; 3 Characters; Optional

Select the Investor Risk Level from the option list. Alternatively, you can select Investor Risk Level from the option list. The system displays all valid Investor Risk Level maintained in the system.

If investor with any risk level (including null) tries to invest in a fund with Restricted fund as

Yes, then the system will display warning message as Fund is restricted for investment from selected transaction type/ref type combination. The error message will be displayed based on Restriction applicable field, based on ref types mapped into Fund Restriction screen.Note: You can configure Fund risk level and investor risk level at PARAMS Maintenance for FUNDRISKPROFILE and INVRISKPROFILE param codes respectively. The system will validate the fund risk for an investor in Investor Fund Risk Rating Mapping screen.

This validation is also applied to electronic deals (bulk upload/SWIFT/gateway), light weight screens and bulk transaction screens. For light weight screen and bulk upload, the warning/ error messages will be logged and cannot be viewed on the screen.

The warning messages will be generated during the Save, Edit and Modify operations for the transactions captured manually.

If the SI ref type is mapped, the system will generate warning message on the RSP transaction while saving.

During authorization, the warning messages will appear for confirmation and the checker will have to accept the warnings to complete the transaction authorization.Note: The above validations are also applicable for transactions that are uploaded through FCIS Bulk Upload, SWIFT and gateway services.(Create/ Modify for IPO Subscription/ Subscription/ Switch/ Transfer).

Investor Risk Level Description Display

The system displays the description for the selected investor risk level.

Risk Expiry Date Date Format; Optional

Select the expiry for the risk rating captured for the UH from the adjoining calendar.

When investor or guardian of minor account reaches 70 years old, the system will automatically update investor risk level to ‘10’ [‘conservative/ low’] and expiry date field will not be updated.

This check and risk profile updating will be handled by a BOD batch job. This job will be sequenced before SI generation job. Age at which the risk profile defaults to

10is configurable in Parameter Maintenance Screen with Param Code as RISKPROFILEEXPIRYAGE. This job for resetting risk profile can be scheduled as part of mini EOD for the required AMC's also.When expiry date is crossed, the system will consider the investor risk level as

10[Low] irrespective of the investor risk level maintained. The system will not update the investor risk level field to10[Low] in this case.Latest Assessment Date Date Format; Optional

Select the date on which investor risk profile was last assessed from the adjoining calendar.

Check Writing Facility Optional

You can use this field to indicate that the investor is allowed to avail check writing facility on any funds of the AMC in which the investor holds unit balances.

Typically, in money market funds, investors could be issued deposit slips for subsequent purchases. They could also write checks to any external entity/ individual, which are reckoned as redemption from the investor account, when produced by the external entity individual, to the AMC.

Telephone Redemption Optional

Select

Yesto indicate that telephonic requests from the investor for redemption transactions must be accepted.Telephone Switch Optional

Select

Yesto indicate that telephonic requests from the investor for switch transactions must be accepted.Note: If you select both Telephone Redemption and Telephone Switch fields as

Yes, then the system will accept redemption and switch transaction requests with telephone as the means of purchase.Registration Type Alphanumeric; 2 Characters; Optional

For investors requesting NSCC or Wire Order transactions, indicate whether the registration of certificates issued, if any, must be in the investor’s name (Individual Name) or registration name specified for the broker dealer (Street Name).

Registration Type Desc Display

The system displays the description for the selected registration type.

Place of Birth Alphanumeric; 80 Characters; Optional

Enter the place of birth of the investor. This is mandatory if you have not specified the Tax ID.

Dispatch Date Date Format; Optional

Enter the dispatch date.

Trail Commission Preference Optional

Select the trail commission preference from the drop-down list. The list displays the following values:- Payout

- Reinvestment

Preferred Fund ID for Redemption Alphanumeric; 6 Characters; Optional

The fund you select in this field will be the one from which management fee will be recovered and into which any incentives will be credited.

When an incentive is being credited, the system will first consider the fund you have selected here, in the field Preferred Fund ID. If you have selected a fund here, the incentive will be credited into this fund. If you have not selected a fund, the incentive will be credited into the fund for which a fund-load mapping has been done.

Consider the following cases during the redemption of a fee:

Case 1 – Periodic Fee maintained at the product level

If the periodic load is maintained at the product level, redemption will happen from the fund indicated here, only if the fund has sufficient balance. If the fund does not have sufficient balance, the system will consider the funds that you have selected through the Management Fee Applicability screen.

For further information on the Management Fee Applicability screen, refer topic Management Fee in the LEP User Manual.

Case 2 – Period Fee maintained at the fund level

If the periodic load is maintained at the fund level, the redemption will happen in the following manner:

The system will first consider the fund you have selected here, in the field Preferred Fund ID. If there is sufficient balance, the redemption will happen from this fund. If the balance is not sufficient, or you have not selected a fund (this field being optional), the system will consider the fund for which a fund-load mapping has been done. If there is sufficient balance in this fund, the redemption will be carried out from this fund. If, in this fund, the balance is not sufficient, the system will carry out the redemption from any other fund that the Unit Holder has invested into, in the appropriate ratio.

The funds, from which the fee amount is redeemed, may not be in the same currency. If the funds have different base currencies, the mid rate will be used as the exchange rate to arrive at the amount to be redeemed, in the fee currency.

Note: If the fee needs to be accrued in a certain currency, the transaction will need to be generated in the same currency. Hence, if the base currency of a certain fund is not that particular currency and it does not allow any transaction in that currency, the fund will not be considered for redemption of the fee amount.

This can be illustrated with the following example:

Example

The base currency of the fund where the fee is accrued is RAND. After apportioning, the system will generate a redemption transaction in three funds with base currency and the restrictions as follows:

F1: Base Currency – RAND; Allowed Currencies: RAND, USD and GBP

F2: Base Currency – USD; Allowed Currencies: USD, INR and GBP

F3: Base Currency – GBP; Allowed Currencies: USD and GBP

In this case since the fee is accrued in RAND, the redemption transactions need to be generated in RAND. In the above case, F2 does not allow a RAND transaction. The system in such a case will raise an error.

Transaction Delivery Preferences Alphanumeric; 1 Character; Optional

Select the transaction delivery preferences from the option list.

Cert Delivery Preference Display

The system displays the certificate delivery details for the selected transaction delivery preferences.

Registration Name Alphanumeric; 50 Characters; Optional

For street name registrations, specify the registration name to be displayed on the certificates. Typically, this is the dealer name of the corresponding broker dealer.

Pay by FEDWIRE / ACH Optional

Select

Yesto indicate that payment by FEDWIRE or ACH is to be accepted for the investor.Apply Indexation on CGT? Optional

You can use this field to indicate whether indexation is to be applied on capital gains tax computation, for the investor. Select this option to indicate application of indexation. Leave it unchecked to indicate that indexation is not applicable.

To indicate application of indexation, you must also specify it as applicable for the capital gains load, when you associate the load with a fund in the Fund Load Setup. Indexation is applied only if it is specified both in this Unit Holder New Account screen (for the investor’s profile) as well as in the Fund Load Setup, for the fund.

Country of Birth Alphanumeric; 3 Characters; Optional

Select the country of birth of the investor. This is mandatory if you have not specified the Tax ID from the list.

Country of Birth Description Display

The system displays the description for the selected country code.

Returned Date Date Format; Optional

Enter the returned date.

All Signatories Sign Required Mandatory if check writing is allowed

For joint accounts in which the unit holder is availing the check-writing facility, use this field to indicate whether the signatures of all joint unit holders must be required on issued checks.

ROA Investor Optional

Select

Yesto indicate that the investor prefers to avail of the Rights of Accumulation (ROA) facility.Country Type Alphanumeric; 1 Character; Optional

Specify the country type. The adjoining option list displays all valid county codes maintained in the system. You can choose the appropriate one.

Country Type Description Display

The system displays the description for the selected country type code.

Campaign Code Alphanumeric; 6 Characters; Optional

You can link the campaign to the unit holder. Specify the campaign to be mapped. You can also select the campaign code from the option list. The campaign codes with the start and the end date in between the unit holder account opening date is displayed in the option list. You can modify the campaign even after the authorisation.

Stop Account The section displays the following fields.

IRS Notification on A/C Alphanumeric; 10 Characters; Mandatory

Specify IRS notification details on account. The adjoining option list displays all valid IRS Notification ID maintained in the system. You can choose the appropriate one.

IRS Notification Display

The system displays the description for the selected IRS Notification ID.

Stop Code Alphanumeric; 25 Characters; Optional

Specify the Stop Code. The adjoining option list displays all valid stop code maintained in the system. You can choose the appropriate one.

If multiple stop codes are mapped to the unit holder, the highest stop account restriction will be considered for the unit holder status and the system will display the warning message as Unit Holder is mapped with the stop account code at transaction level.

Stop Code Description Display

The system displays the description for the selected stop code.

Stop Account Reason Alphanumeric; 255 Characters; Optional

Specify the reason for stopping an account.

Stop Account Effective Date Date Format; Optional

Specify the effective date to stop an account.

The stop code effective date can be a future dated. However, the system will validate only those stop codes which has the effective date less than or equal to the application date and lesser than release date for current transactions. The system will not validate the stop codes which has effective date greater than the application date.

For backdated transactions,- In case of single stop code for the UH, the system will pick up the stop account restriction applicable for that period of time. However, in case of multiple stop codes, based on the transaction type (whether IPO, Subscription, Redemption etc), the system will check each bit for the respective stop codes available for that time and will take the highest preference stop account restriction.

- For both single and multiple stop codes, the system will pick up the stop account restriction if the transaction date is greater than or equal to the stop account effective date but less than the stop account release date.

The system will not allow you to add any stop code effective date for the backdated and display an error message as Stop Code effective date cannot be a backdated.

Stop Account Release Date Date Format; Optional

Specify the stop account release date.

Note: Stop code will remain available in the system and will not be made to null.

Stop Account Optional

Select stop account status from the adjoining drop-down list. Following are the options available:- Yes

- No

Stop Account Restrictions Display

The stop account restrictions box gets populated with according to the stop code mapped to UH.

Client Communication Restrictions The section displays the following fields.

Contract Notes Optional

Select if contract notes are applicable or not from the adjoining drop-down list. Following are the options available:- Applicable

- Not Applicable

Account Statement Optional

Select if account statement is applicable or not from the adjoining drop-down list. Following are the options available:- Applicable

- Not Applicable

Communication Mode Restrictions The section displays the following fields.

Communication Mode Alphanumeric; 2 Characters; Optional

Specify the communication mode. The adjoining option list displays all valid communication mode maintained in the system. You can choose the appropriate one.

For communication mode, the system will restrict the param value to the length of 2 characters.

The system will validate the applicable communication mode in UH screen against the communication mode in the transaction screen.

Communication Mode Description Display

The system displays the description for the selected communication mode.

Restriction Optional

Select if restriction is applicable or not from the adjoining drop-down list. Following are the options available:- Applicable

- Not Applicable

Once the communication mode is restricted, the system will not allow you to enter the trades using the specific communication mode including uploads and will display an error message as The communication mode is restricted for the UH.

If you try to map the restricted communication mode again to the UH then the system will display an error message as Communication mode is already restricted for the UH.

If you try to capture the transaction for the UH where the defined communication mode is restricted, then the system will display an error message as Communication mode is restricted for the UH.

Beneficiary Payout You can direct redemption and dividend proceeds to beneficiaries by specifying the following preferences

Redemption Payout Optional

Check this option to indicate that the proceeds of a redemption transaction should be transferred to the beneficiaries mentioned. If you select this option, you need to maintain a minimum of one beneficiary along with the percentage to be awarded for the beneficiary in the Beneficiary Dtls screen. It is also essential that the beneficiary be an existing Unit Holder and not a third party beneficiary.

Dividend Payout Optional

Check this option to indicate that dividends should be transferred to the beneficiaries specified. If you select this option, you need to maintain a minimum of one beneficiary along with the percentage to be awarded for the beneficiary in the Beneficiary Dtls screen. It is also essential that the beneficiary be an existing unitholder and not a third party beneficiary.

When you have multiple beneficiaries for a payout (dividend or redemption), you can amend the percentage to be given to each, as and when required. If the total percentage awarded to the beneficiaries does not add up to 100%, the remaining payout will be done to the primary unitholder. The amount paid out to the beneficiary will be net of withholding tax, which will be derived on the basis of the tax for the unitholder – Beneficiary Country combination.

Parent topic: Process Unit Holder Maintenance Detail