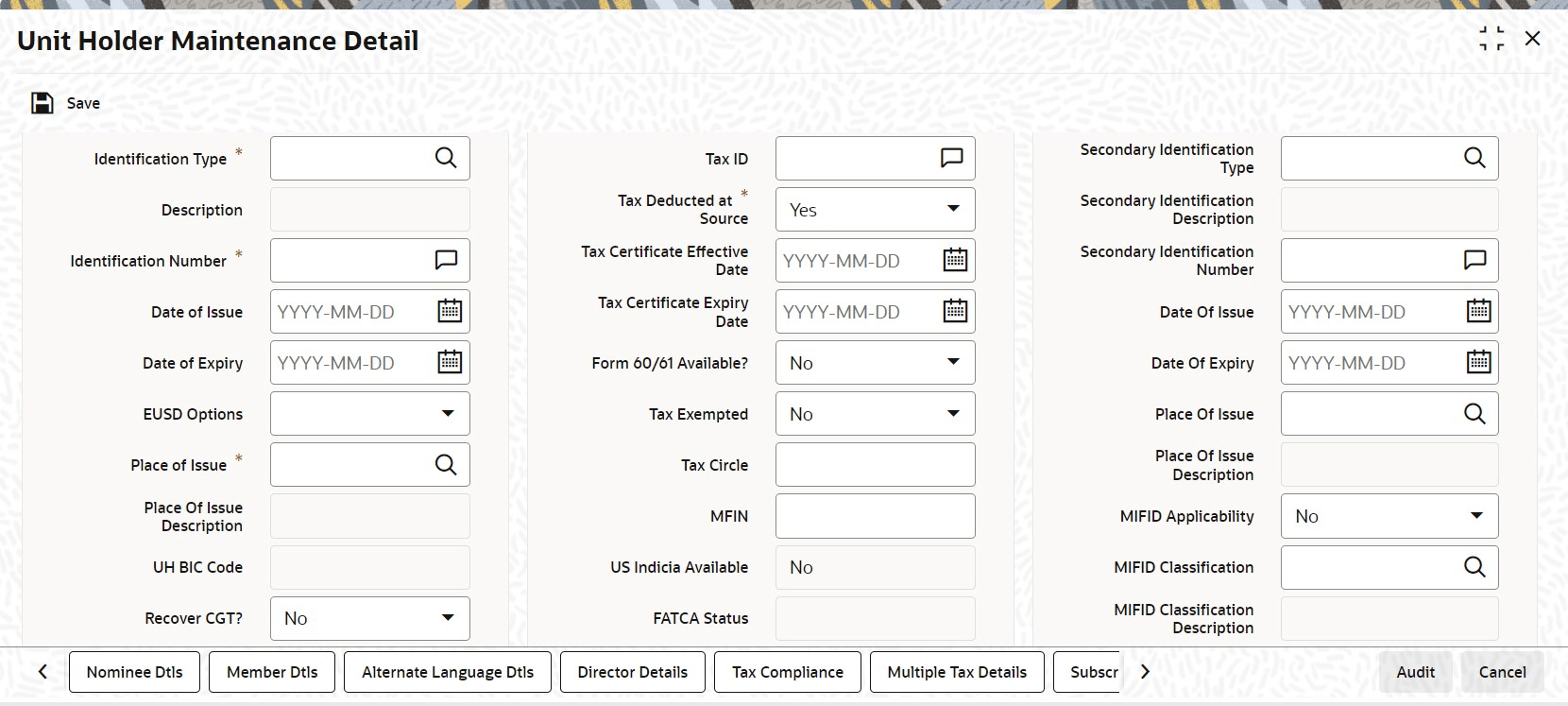

2.2.6 ID Details Tab

This topic provides the systematic instructions to specify the ID details for corporate investors in the Unit Holder Maintenance Detail screen.

- On Unit Holder Maintenance Detail screen, click

ID Details tab.The ID Details are displayed.

Figure 2-7 Unit Holder Maintenance Detail_ID Details Tab

- On the ID Details tab, specify the fields.For more information on fields, refer to the field description table.

Table 2-9 ID Details - Field Description

Field Description Identification Type Alphanumeric; 20 Characters; Mandatory

Select the type of identification that is being provided by the investor from the list. The identification type is the mode in which the unit holder will furnish an identification document or proof, and could be a Personnel ID, License, Birth Certificate, etc. This is used for identifying the unit holder during all subsequent transactions.

You can capture NRIC Number as the identification type for a unit holder account. If you have selected NRIC Number as the Identification Type for the account, you can specify the applicable NRIC Number as the Identification Number. Once authorized, this field cannot be modified.

Description Display

The system displays the description for the selected identification type.

Identification Number Alphanumeric; 50 Character; Mandatory

Specify the number or ID of the identification document or proof that is furnished by the unit holder. Once authorized, this field cannot be modified.

Date of Issue Date Format, Optional

Specify the date of issue of the identification document or proof that is furnished by the unit holder.

The date of issue that you specify here must not be later than the date of opening the account.

Date of Expiry Date Format; Optional

Specify the date of expiry of the identification document or proof. It must be later than the date of issue and the application date.

EUSD Option Optional

Select the European Union Savings Directive (EUSD) option from the drop-down list. The list displays the following values:- With Holding Tax

- Exchange of Information

- Tax Exemption Certificate

Note: If EUSD option is not applicable at the segment level, then you will not be allowed to specify any option here.

Place of Issue Alphanumeric; 3 Characters; Mandatory

Select the place of issue of the identification type from the option list. Once authorized, this field cannot be modified.

Place of Issue Description Display

The system displays the description for the selected place of issue.

UH BIC Code Display

The system displays the Bank Identification Code (BIC) of the unit holder, in case of financial institutional unit holders.

Recover CGT? Optional

Select

Yesoption, if the tax on capital gain has to be deducted from the transaction (Redemption, Transfer and Switch).FATCA Classification Display

If the ID selected is an existing entity in the system then system displays FATCA Classification type.

Description Display

The system displays the description of FATCA classification.

Tax ID Alphanumeric; 50 Characters; Optional (Mandatory if tax is specified to be deducted at source)

Specify the tax identification number or tax ID for the investor.

You can use this field to capture the PAN number of the unit holder. For any transactions entered into by the unit holder in any fund, which involve volumes that exceed the minimum amount for Tax ID specified in the fund rules, the system validates the availability of the PAN number.

Tax Deducted at Source Mandatory

Select

Yesto indicate that tax must be deducted at source for the investor.If you selectYesat source, then you must specify the following mandatory information:- The tax ID of the investor, in the Tax ID field.

- The tax circle that corresponds to the investor, in the Tax Circle field.

- The tax category that corresponds to the investor, in the Category field.

Tax Certificate Effective Date Date Format; Optional

Specify the date from when the tax certificate is effective.

Tax Certificate Expiry Date Date Format; Optional

Specify the date on which the tax certificate expires. It is mandatory for you to specify the expiry date if you chosen Tax Exemption Certificate as the EUSD option.

Form 60/ 61 Available? Optional

If form 60/ 61 is available, select

Yes. Else selectNo.Tax Exempted Optional

You can use this field to indicate that the investor is the recipient of a special exemption from tax. Check this box to indicate such an exemption. If you have maintained any tax details for such an investor, they will be disabled, and not used.

Tax Circle Alphanumeric; 15 Characters; Optional (Mandatory if tax is specified to be deducted at source)

Specify the tax circle to which the unit holder belongs.

MFIN Alphanumeric; 15 Characters; Optional

Specify the MFIN details of the unit holder, provided the client country parameter is set to SHOWPANINFO for your bank. You will however not be allowed to enter the MFIN details if the unit holder is a minor.

US Indicia Available Display

The system defaults US Indicia Available asYesorNodepending on the following:- The nationality is US

- The dual nationality is US

- The country of birth is US

- The country of domicile is US

- The country of incorporation is US

- The substantial stay in US is true

- The country of correspondence or alternate address is US

- The country code of the telephone number is 01

- The country code of the bank branch address is US

FATCA Status Display

The system displays the FATCA status based on the FATCA maintenance.

On authorization, the system will validate all FATCA related validations and update the FATCA status accordingly, provided, the FATCA client country is

Yes.FATCA DiMinimus Check Display

The system checks this field for investors having US Indicia but whose investments are below a certain maintainable threshold amount.

This field will b unchecked for investors having US Indicia but whose investments are above a certain maintainable threshold amount.

FATCA DiMinimus batch will check and uncheck this field.

Secondary Identification Type Alphanumeric; 12 Characters; Optional

Specify the secondary identification type. you can also select the valid secondary identification details from the adjoining option list.

Secondary Identification Description Display

The system displays the description for the selected secondary identification type.

Secondary Identification Number Alphanumeric; 50 Characters; Optional

Specify the secondary identification number.

Date of Issue Date Format; Optional

Specify the date of issue of the second identification document or proof that is furnished by the unit holder.

The date of issue that you specify here must not be later than the date of opening the account.

Date of Expiry Date Format; Optional

Specify the date of expiry of the second identification document or proof. It must be later than the date of issue and the application date.

Place of Issue Alphanumeric; 3 Characters; Optional

Specify the place of issue of the second identification type. You can also select the valid place of issue of the identification type from the adjoining option list, Once authorized, this field cannot be modified.

Place of Issue Description Display

The system displays the place of issue description for the selected place of issue.

MIFID Applicability Optional

Select the MIFID applicability status from the drop-down list. The list displays the following values:- Yes

- No

MIFID Classification Alphanumeric; 2 Characters; Optional

Specify the MIFID classification details.

MIFID Classification Description Display

The system displays the description for the selected MIFID classification.

Parent topic: Process Unit Holder Maintenance Detail