2.2.18 Joint Holder Dtls Button

This topic provides the systematic instructions to specify the names of any joint unit holders to be considered for joint unitholder accounts, or Either or Survivor accounts.

- On Unit Holder Maintenance Detail screen, click

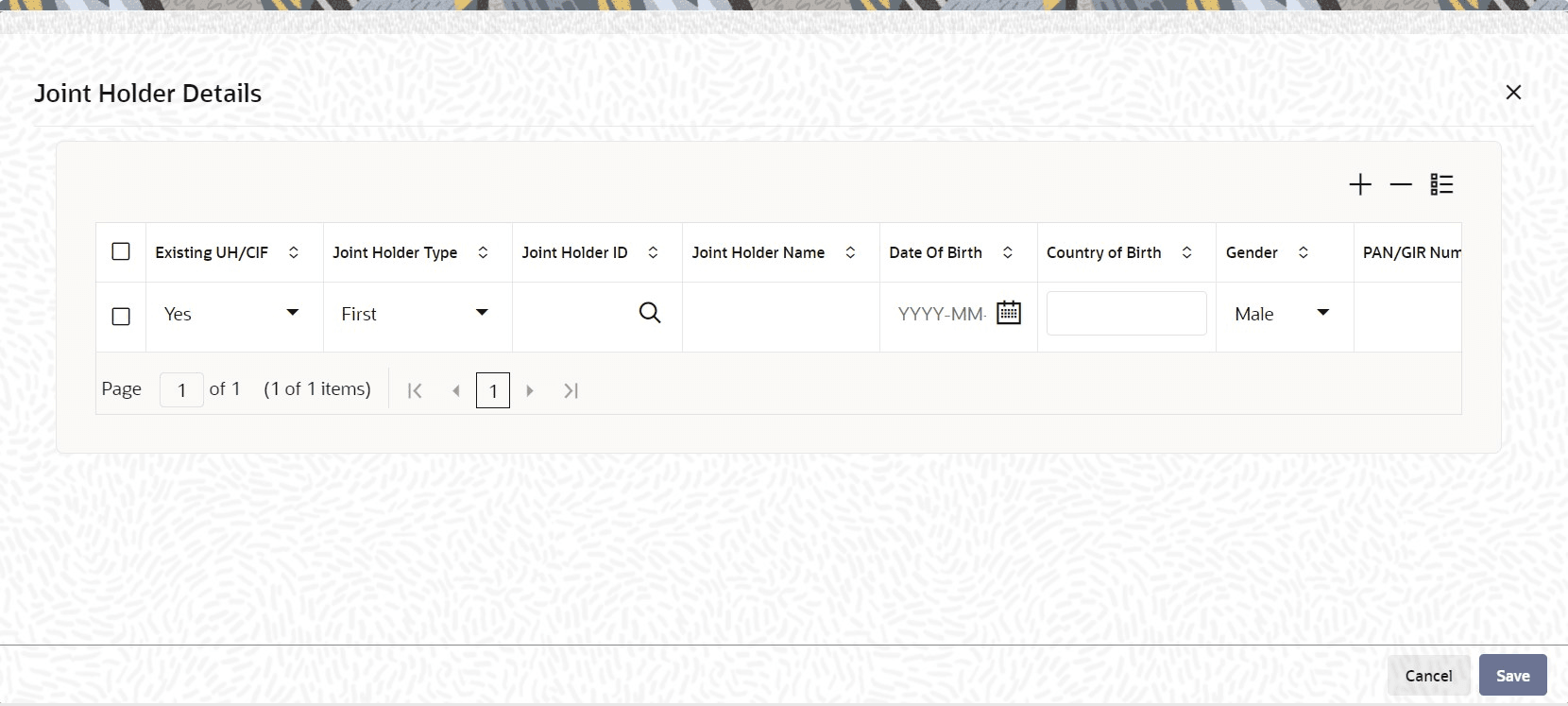

Joint Holder Dtls button.The Joint Holder Details screen is displayed.

Figure 2-21 Unit Holder Maintenance Detail_Joint Holder Details Button

- On Joint Holder Details screen, specify the

fields.For more information on fields, refer to the field description table.

Table 2-22 Joint Holder Details - Field Description

Field Description Existing UH/ CIF Optional

Select if the unit holder or CIF is existing or not from the drop-down list. The list displays the following values:- Yes

- No

Joint Holder Type Mandatory

Select the Type of joint account from the drop-down list. The list displays the following values:- First

- Second

- Third

Joint Holder ID Alphanumeric; 12 Characters; Mandatory

Select the ID of the joint account holder from the list of IDs available.

Joint Holder Name Display

The system displays the name of the Joint Holder.

Date of Birth Date format, Optional

Enter the joint account holder’s date of birth.

Country of Birth Display

The system displays the country of birth mapped for the UH.

Gender Optional

Specify the gender of the joint account holders.

PAN/GIR Number Alphanumeric; 15 Characters; Optional

Specify the Permanent Account Number (PAN) of the joint account holders in the respective text boxes.

Form 60/61 Available? Optional

Indicate whether Form 60/61 is available for the joint holders in case they don’t have a PAN.

MFIN Alphanumeric; 15 Characters; Optional

Specify the MFIN of the joint account holder.

Recover CGT? Optional

Select

Yesoption, if the tax on capital gain has to be deducted from the transaction (Redemption, Transfer and Switch).Country Of Domicile Alphanumeric; 3 Characters; Optional

Select the country of domicile from the option list provided; these details are maintained as part of Country Maintenance.

Address Line 1 and Address Line 2 Alphanumeric; 105 Characters; Optional

Click Address Details link to view the Address text box. Here you can enter the address of the joint account holder.

City Alphanumeric; 105 Characters; Optional

Specify the city name of the joint holder.

State Alphanumeric; 5 Characters; Optional

Specify the state name of the joint holder.

Country Alphanumeric; 3 Characters; Optional

Specify the country name of the joint holder.

Zip Code Alphanumeric; 3 Characters; Optional

Specify the Zip Code.

E-mail Alphanumeric; 255 Characters; Optional

Specify the E-mail details of the joint holder.

Contact Person Alphanumeric; 60 Characters; Optional

Specify the contact person details.

Telephone 1 and 2 Alphanumeric; 60 Characters; Optional

Specify the telephone number.

Cellphone Number Alphanumeric; 60 Characters; Optional

Specify the Cellphone Number.

Fax Alphanumeric; 60 Characters; Optional

Specify the fax number.

US Indicia Display

The system defaults the US Indicia Available as

YesorNobased on the existing UH/CIF maintained.If the existing UH/CIF is

Yes, then the system defaults the US Indicia Available.If the existing UH/CIF is

No, then the system derives the US Indicia Available based on the country, country of domicile and bank branch country.FATCA Classification Display

If the joint selected is an existing entity in the system, then system displays FATCA classification type.

FATCA Status Display

If the joint selected is an existing entity in the system, then system displays FATCA status based on FATCA maintenance.

Note: The fields PAN/GIR Number, MFIN and Form 60/61 will be displayed only if the client country

SHOWPANINFOis set toTruefor your bank.

Parent topic: Process Unit Holder Maintenance Detail