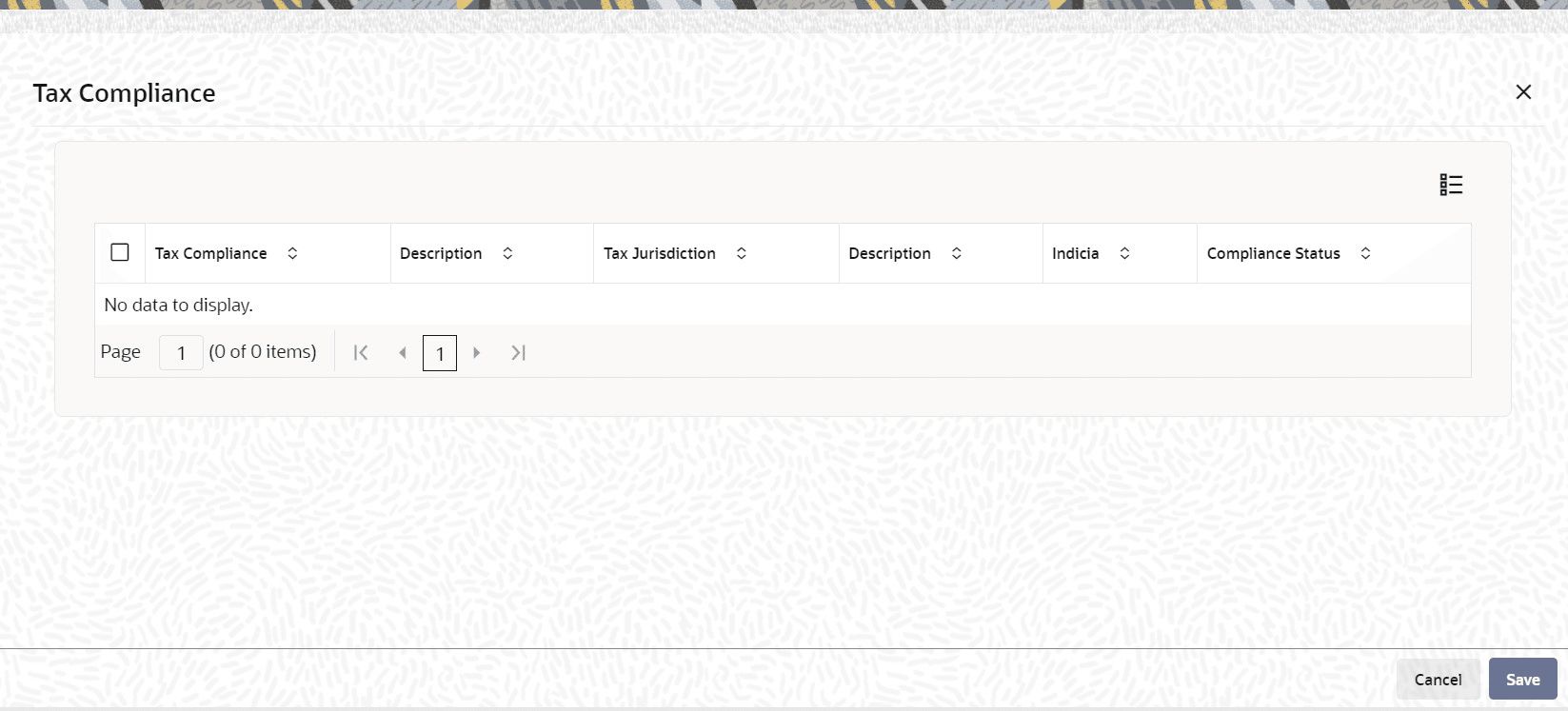

2.2.23 Tax Compliance Button

This topic provides the systematic instructions to enter the tax compliance details.

Once a new unit holder is created in the system, and on saving the

unitholder; indicia checks are triggered. If Indicia are identified for the unit holder,

the details are updated in Tax Compliance screen. If indicia is

not triggered for the unitholder created then this sub screen will be blank.

Parent topic: Process Unit Holder Maintenance Detail