33.2.1 Defining an Off-Balance Sheet Transaction

After selecting an Off-Balance Sheet product in the product and currency selection pane, define the characteristics of the transaction. To define the attributes of the transaction, follow these steps.

- Select the check box next to the product and click Define.

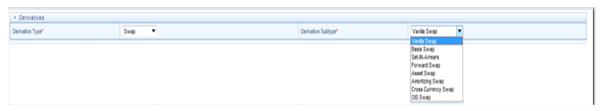

Figure 33-1 List of Derivatives for defining an Off-Balance Sheet transaction

- In the Derivatives pane, select the Derivative Type and Derivative

Subtype.

The following derivative types are available in Derivative Types drop-down list:

- Swap

- Option

- FX Contracts

The following derivative subtypes are available in Derivative Subtype drop-down list:

- If the Derivative Type is a Swap, select one of the seven swap types: Vanilla, Basis, Set in Arrears, Forward, Asset, Amortizing, or Cross Currency.

- If the Derivative Type is an Option, select one of the three types: Interest Rate Cap, Interest Rate Floor, and Interest Rate Collar.

- If the Derivative Type is FX Contracts, select subtype Spot or Forward.

- Enter details in the Core Products Attributes tab and click

Save.

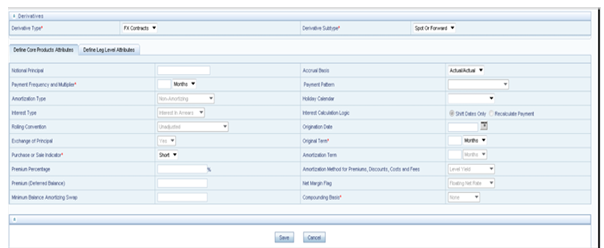

Figure 33-2 Core Products Attributes tab for defining an Off-Balance Sheet transaction

- Depending on the relationship triggers on the type and subtype products, relevant fields are editable. For more information, see Table 1.

- Enter additional if required and click Save.

- Enter details in the Leg Attributes tab and click

Save.

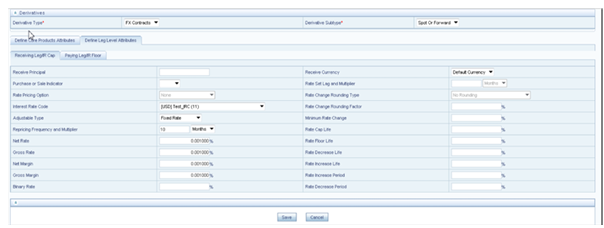

Figure 33-3 Leg Attributes tab for defining an Off-Balance Sheet transaction

- Receiving Leg / IR Cap tab: Use this tab to define the Receiving Leg or the Cap Characteristics. The fields are editable based on the relationship triggers of the Derivative Type and Derivative Subtype. For FX Contracts Derivative type, Receive Principal, pay Principal, Receive Currency, and Pay Currency are mandatory fields.

- Paying Leg / IR Floor tab: Use this tab to define the pay side, or the interest rate floor. The fields are editable based on the relationship triggers of the Derivative Type and Derivative Subtype.

- After saving the attributes, if the definition is successful, then defined status turns to green.

- A message is displayed to ask if you want to define another product/currency combination, click Yes to continue. Else, click No to go back to the Transaction Strategies Summary page.