10.2.2 Equivalence of the Static Spread and Margin

Static spread calculations are deterministic, therefore they are a special case of the equations in the previous section where, roughly speaking, all processes are equal to their expected value, and the margin p is substituted to the risk-adjusted margin m. The equivalent of �Equation 8–29 is then:

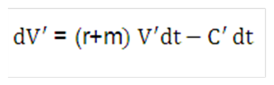

Equation 36

Figure 10-37 Equation 36

Description of the Transfer Pricing Option Cost Equation 36 follows:

Where f is the instantaneous forward rate. The equivalent of Equation 8–31 and Equation 8–33 is then:

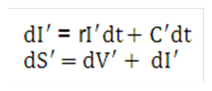

Equation 37

Figure 10-38 Equation 37

Description of the Transfer Pricing Option Cost Equation 37 follows:

Equation 38

Figure 10-39 Equation 38

Description of the Transfer Pricing Option Cost Equation 38 follows:

Equation 39

Figure 10-40 Equation 39

Description of the Transfer Pricing Option Cost Equation 39 follows:

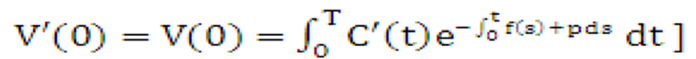

The solution of Equation 37 and Equation 39 is:

Equation 40

Figure 10-41 Equation 40

Description of the Transfer Pricing Option Cost Equation 40 follows:

Comparing Equation 40 and Equation 8:

Equation 41

Figure 10-42 Equation 41

Description of the Transfer Pricing Option Cost Equation 41 follows:

For example, the static spread is equal to the margin.