4.1.7.3.3 Define Split Payment Patterns

You can use a Split payment pattern for financial instruments that make principal payments along with two concurrent amortization schedules. Split patterns may be a combination of Absolute and Relative Payment Patterns for example, and contain multiple sets of payment phases under a single amortization code. These patterns could further use a combination of Conventional, Level Principal, and Non-Amortizing Payment Types.

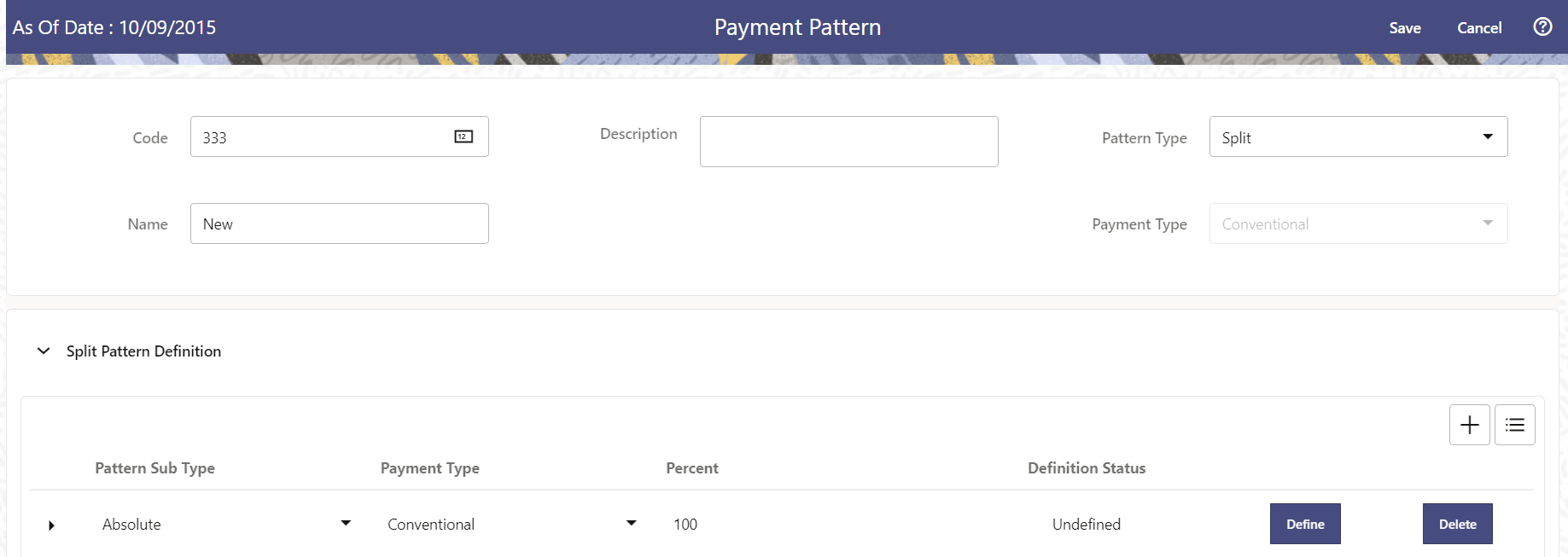

Figure 4-16 Split Payment Patterns

To define a split payment pattern, follow these steps:

- In the Payment Patterns page, select Pattern Type as Split.

- Define Split Pattern definition.

- Select the required Pattern Sub Type for each leg.

- Absolute

- Relative

- Select the Payment Type for each Payment Phase or Split.

- Enter the Percent value to indicate the percentage weight of the timeline being defined for the individual payment phases (each row). The sum of the percentage weights must total 100%.

Note:

The payment pattern term specifications for different payment phases or splits vary depending on whether you select the Absolute or Relative Pattern Type. You can define the term specifications for the splits following the steps described previously for defining payment phases for these patterns. See:

- Select the required Pattern Sub Type for each leg.

- Select one of the legs and then select Define button to enter pattern details for the leg.

- Select one of the legs and then select Delete button to delete pattern details for the leg.

- Click the Add icon to add additional Payment Phases to the Pattern.

- Click Add Multiple Row icon to enter the number of rows you want to add and click Go.

- Click Apply and Save.

The Split payment pattern is saved and the Payment Pattern summary page is displayed.