5.6.14 Using KYC Risk Score Tab

About KYC Risk Score Tab

This tab displays information on the events, which were a reason for creating the case. It displays all events of this case along with the details of how the risk score was calculated, the relationships the customer holds with other parties (internal customers and non-customers). The accelerated re-review rule, which was a reason for KYC Risk Scoring to be performed. This is available only for KYC Case type. You will have to map this tab manually.

Note:

This tab is not mapped by default out of the box. KYC Customer Dashboard has all the information displayed on this tab. This tab can be enabled by using a case designer only if required.- KYC Event List: details the list of KYC events associated with the selected case.

- KYC Event Details: provides complete information on the selected KYC event.

- View and analyze the list of KYC event details associated with the case

- View and analyze the individual KYC events details

The details of this tab aid the user to decide if there is a need for a manual override of the risk score calculated by the system. For more information, see Editing Case Context Details.

Managing KYC Event List

- Event code: it is the unique identification for KYC event (not event ID)

- Event Score: it is the KYC risk Score calculated by the system for that specific event

- Event Created Date: the date on which the KYC risk assessment is considered as an event

- Event Category: the category of the risk score as calculated by the system.

You can click the check box to view an event risk score detail of how the system has calculated the risk score for this event along with the accelerated re-review rules and interested parties.

Managing KYC Event Details

This section allows you to view and analyze the complete details of the selected KYC Event.

Viewing Rule Based Assessment

This section displays maximum score of all the rules matched for the customer assessed through rule based model.

The Rule Based Assessment displays the following fields as described in the following table.

Table 5-27 Rule Based Assessment

| Field | Description |

|---|---|

| Rule Name | Displays the Rule the customer has met. |

| Rule Score | Displays the risk score of the corresponding rule name. |

| Rule Details | Displays the rule details. For example, the country to which the customer belongs. |

Viewing Algorithm Based Assessment

This section display assessment details assessed through algorithm based approach and includes details such as risk parameter name, risk parameter value, and weighted score.

The Algorithm Based Assessment displays the following fields as described in the following table.

Table 5-28 Algorithm Based Assessment

| Field | Description |

|---|---|

| Risk Parameter Name | Displays the Risk Parameter Name. |

| Weighted Score | Displays the weighted risk score of each risk parameter. |

| Risk Parameter Value(s) | Displays the value corresponding to each risk parameter and the additional values as defined during the Risk Parameter definition. |

Viewing Accelerated Rule Trigger

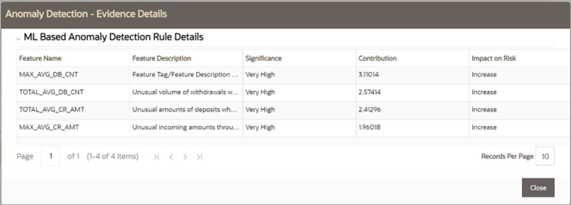

This section displays the accelerated review rule which is associated with the primary customer. For the ML Based Anomaly Detection Rule, the rule details display in a pop-up window.

Figure 5-53 Anomaly Detection - Evidence Details

Viewing Interested Party Details

This section displays interested parties of a primary customer if any. For more information, see KYC Assessment Guide.