11.4.1.3 Adjustment - Formula Based Rate

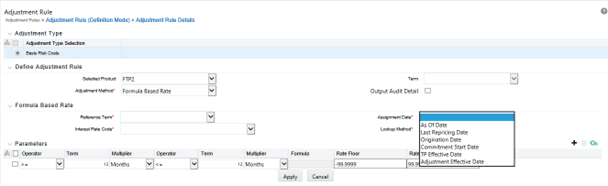

Figure 11-22 Adjustment Rule Details - Formula Based Rate

The Formula Based Rate Adjustment method allows the user to determine the add-on rate based on a lookup from the selected yield curve, plus a spread amount, and then the resulting rate can be associated with specific terms or term ranges. Reference term selections include:

- Repricing Frequency: The calculation retrieves the rate for the term point equaling the reprice frequency of the instrument. If the instrument is a fixed rate and, therefore, does not have a reprice frequency, the calculation retrieves the rate associated with the term point equaling the original term on the instrument.

- Original Term: The calculation retrieves the rate for the term point equaling the original term on the instrument.

- Remaining Term: The calculation retrieves the rate for the

term point corresponding to the remaining term of the instrument. The remaining term

value represents the remaining term of the contract and is expressed in

days.

Remaining Term = Maturity Date – As-of-Date

- Duration (read from the TP_DURATION column): The calculation retrieves the rate for the term point corresponding to the Duration of the instrument, specified in the TP_DURATION column.

- Average Life (read from the TP_AVERAGE_LIFE column): The calculation retrieves the rate for the term point corresponding to the Average Life of the instrument, specified in the TP_AVG_LIFE column.

You can create your reference term ranges and assign a particular formula based adjustment rate to all instruments with a reference term falling within the specified range.

With this method, you also specify the Interest Rate Code and define an Assignment Date for the Rate Lookup. The Interest Rate Code can be any IRC defined within Rate Management, but will commonly be a Hybrid IRC defined as a Spread Curve (for example, Curve A – Curve B).

Assignment Date selections include:

- As-of-Date

- Last Repricing Date

- Origination Date

- TP Effective Date

- Adjustment Effective Date

- Commitment Start Date

Note:

Term range considers one month equal to 30.416667 days and 1 year = 365 days, therefore, 12 Months would marginally be more than one year by 0.000004 days.The formula definition is comprised of the following components.

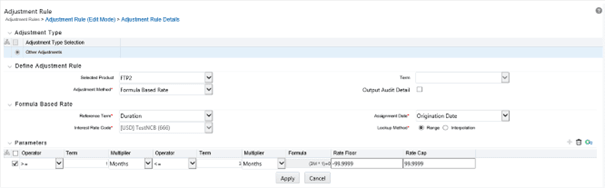

Figure 11-23 Adjustment Rate Details - Formula Based Rates

- Term Point: This allows you to associate a specific term point from the IRC to each Term Range.

- Coefficient: This allows you to define a multiplier that is applied to the selected rate.

- Rate Spread: This allows you to define an incremental rate spread to be included on top of the IRC rate.

The resulting formula for the adjustment rate: (Term Point Rate * Coefficient) + Spread For example:

Figure 11-24 Formula Rate Parameters

Note:

For increased precision, you can reduce the Term Ranges to smaller term increments allowing you to associate specific IRC rate tenors with specific terms.- Holiday Calendar: Select if a holiday calendar is applicable for calculating the charges/credits.

- Rolling Convention: Select the appropriate business day rolling convention if a Holiday Calendar is selected.

- Interest Calculation logic: Select the appropriate option to indicate how the interest payment should be adjusted when a holiday date is encountered.