Hedge Instruments

- Click the Add button from the Hedged Instrumentspane.

You have to select an instrument type that you want to search for. Depending on the selection, the search parameters are disabled if they are not relevant for the selected Instrument Type. To use the Time to Maturity search option, you need to specify the band from the drop-down list and the date as to which the application has to bucket records into the selected maturity band.

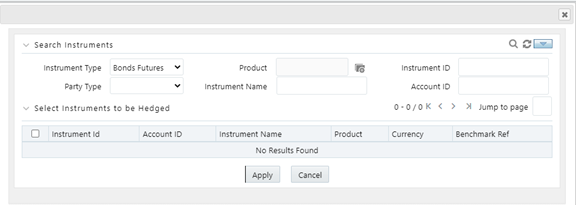

The Search Instruments window is displayed with the list of existing Instruments available for Hedging.Figure 7-4 The Search Instruments window

You can search for Instruments using Instrument Type, Product, Instrument ID, Party Type, Instrument Name, and Account ID.

You can also use the Advanced Search feature by clicking the Advanced Search button and entering the details such as Issuer Type, Issuer, Party, Country, Instrument Rating, Counterparty Rating, Restructured, Currency, Benchmark Ref, Time to Maturity, Folder, and Filter Type.

The results are displayed in Select Instruments to be Hedged pane with the details such as Instrument Id, Account ID, Instrument Name, Product, Currency, and Benchmark Ref.

- Select the checkbox adjacent to the Instrument ID of the Hedge Instrument

you want to select and click the Apply button.

The selected Instruments are displayed with the details such as Account ID or No, Product, Party, Instrument Name, and Currency.

Note:

If you switch between the Hedge Segments and Hedge Instruments tab, then contents in the pane will be reset. - Click the Hedging Instruments process from the Hedge Creation Processgrid.

- Click the Add button from the Hedging Instrumentsgrid.

The Hedge Instruments window is displayed with the list of existing Hedge Instruments.

You can search for Instruments using Instrument Type, Product, Instrument ID, Party Type, Instrument Name, and Account ID, Issuer Type, Issuer, Party, Country, Instrument Rating, Counterparty Rating, Restructured, Currency, Benchmark Ref, Time to Maturity, Folder, and Filter Type.

The results are displayed in the Select Instruments to be Hedged pane with the details such as Instrument Id, Account ID, Instrument Name, Product, Currency, and Benchmark Ref.

The available Instrument Types are Bonds Futures, Bonds Options, Commodity Futures, Commodity options, Cross Currency Swap, Currency Forwards, Currency Futures, Currency Options, Equity Futures, Equity Option, and Interest Rate Swap.

- Select the checkbox adjacent to the Account ID/No of the Hedge Instrument

that you want to select and click the Apply button.

The selected Instrument is displayed with the details such as Account ID/No, Instrument Name, Maturity, Underlying Quantity, Currency, Benchmark Ref, and an option to select the Risk Type.

Note:

- Hedge Risk Type selection is used only for reporting purposes.

- You cannot select multiple Risk Types for an Instrument Type. The only exception is Cross Currency Swap Instrument Type, where multiple Risk Types can be added in a single definition.

- On a subsequent date, it is advisable not to include a Hedging Instrument that is already part of another Hedge definition designated on an earlier date unless you want to terminate the former Hedge definition.

- Click the drop-down list in the Risk Type column and select the type of

risk that is being covered in the hedge relationship. Available options are the

following:

- Currency Risk

- Interest Rate Risk

- Credit Risk

- Liquidity Risk

- Price Risk

- Volatility Risk

Note:

- Some instruments may appear in the Search grids of both Hedged Items and Instrument Types windows, to be potentially picked up for inclusion in the definitions. This is due to Segments that the application does not read into individual instruments for the mutual exclusive logic to work. However, if such a scenario exists, Effectiveness Testing logic will enforce mutual exclusivity by excluding such common instruments/accounts from the Hedged Items, during processing.

- Hedge Risk Type is a new Dimension type. You can define new Members to this Dimension type through Dimension Management > Members module.

- Select the checkbox adjacent to a Hedging Instrument and

click the Hedge Recommendation icon to select the

recommended hedge.

The Hedge Recommendation window is displayed. This window displays HedgedInstruments and Hedging Instruments.

- Click the drop-down list adjacent to the Risk Type field and select the type of

risk. Available options are:

- Currency Risk

- Interest Rate Risk

- Price Risk

- Click the Search button to view the Hedged Instruments and

corresponding Hedging Instruments.

You can use the Next and Previous buttons to move back and forth between Hedged Instruments.

- Select the required Hedged Instruments and Hedging Instruments before clicking the Apply button.

- Click the Questionnaire process from the Hedge Creation Process

grid.

The Generic Questions are displayed under the Credit Risk Dominance Assessment grid.

- Select the answers as either Yes or No by clicking appropriate radio buttons.

- Click the Apply button.

The Questionnaire is saved.

- Click the Save button to save the definition and close the window.

- Click the Effectiveness Testing process from the Hedge Creation Process grid.

- Populate the form under Choose Effectiveness Testing Parameters grid, as

tabulated:

Table 7-1 The Hedge Definition DetailsTable

Field Description Fair Value Determination Run Definition Folder Click the drop-down list and select the required folder from the list of folders. Fair Value Determination Run Definition This field displays the definitions, depending on the folder you have selected in the Fair Value Determination Run Definition Folder field.

Click the drop-down list and select the required definition from the list of definitions.

Qualitative Parameters Credit Risk Dominance Assessment Select the checkbox adjacent to this field if you want to perform a Credit Risk Dominance Assessment. Critical Terms Match Select the checkbox adjacent to this field if you want to perform Critical Terms Match. Quantitative Parameters Measurement Methodology Select the checkbox adjacent to the required measurement methodology. Available values are the following:

- Prospective Cash Flow Based

- Retrospective

- Scenario-Based

Base value to be used for Options Select the radio button adjacent to Intrinsic Value or Fair Value.

Note: This option is available only for instrument type Options.

The Intrinsic Value is the difference between the price of the underlying (for example, the underlying stock or commodity) and the strike price of the Option. Any premium that is more than the option's intrinsic value is referred to as its time value.

Base value to be used for Currency Forwards Select the radio button adjacent to Spot Element Value or Fair Value.

Note: This option is available only for instrument type Currency Forwards.

Hedge Ratios The following needs to be selected to calculate Hedge Ratio.

Hedge Ratios are mandatory.

Computation Type Click the drop-down list and select the required computation type from the list. Available values are the following:

- Cumulative

- Net

Prospective Hedge Ratio Methodology This field is enabled only if you have selected Prospective as the measurement methodology.

Click the drop-down list and select the required Prospective Hedge Ratio Methodology from the list. Available values are the following:

- Dollar Offset

- Regression

If you select Regression as the Hedge Ratio Methodology, you have the option to select the checkbox adjacent to the Make intercept zero fields to compute the Hedge Ratio from the line of best fit (slope) by forcing the intercept to be Zero.

Also, select the Confidence Level from the drop-down list. Confidence Levels are required to perform the F-Test. Available values are the following:

- 1 %

- 2.5 %

- 5 %

- 10 %

To include more confidence levels, reach out to Oracle support.

- Variability Reduction

Retrospective Hedge Ratio Methodology This field is enabled only if you have selected Retrospective as the measurement methodology.

Click the drop-down list and select the required Retrospective Hedge Ratio Methodology from the list. Available values are the following:

- Dollar Offset

- Regression

If you select Regression as the Hedge Ratio Methodology, you have the option to select the checkbox adjacent to the Make intercept zero fields to compute the Hedge Ratio from the line of best fit (slope) by forcing the intercept to be Zero.

Also, select the Confidence Level from the drop-down list. Confidence Levels are required to perform the F-Test. Available values are the following:

- 1 %

- 2.5 %

- 5 %

- 10 %

To include more confidence levels, reach out to Oracle support.

- Variability Reduction

Scenario Hedge Ratio Methodology This field is enabled only if you have selected Scenario Based as the measurement methodology.

Click the drop-down list and select the required Scenario Hedge Ratio Methodology from the list. Available values are the following:

- Correlation

- R Square

Economic Relationship Select the checkbox adjacent to the Economic Relationship field, if you want to calculate the economic relationship using Prospective, Retrospective, Scenario-Based, or all three methods. - Click the Apply button to apply the changes. The Apply function saves the data and retains the window open for further operations.

- Click the Save button to save the changes. Once saved, the definition is

displayed in the Hedge Definitions grid of the Hedge Definitions Summary

window.

The Audit Trail section at the bottom of the Hedge Definition window displays the metadata related to the definition such as Created By, Creation Date, Last Modified By, and Last Modification Date with a System ID. The User Comments section facilitates you to add or update additional information as comments.

For more information on Segmentation Run, see the Segmentation Run chapter.