6.2.2 Key Facts Tab

The Key Fact tab includes Key Performance Indicator Reports for lines of businesses at the group level. The filters for this tab allow the report results to be focused on selected combinations for comparison and targeted analysis.

The filters include:

- Time

- Company

- Lines of Business

- Region

The various reports available under this tab are detailed in the following sections.

Key Policy Performance Indicators

Figure 6-79 Key Policy Performance Indicators

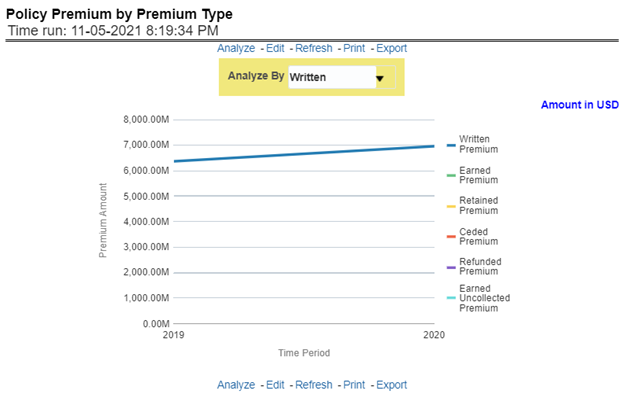

Policy Premium by Premium Type

Figure 6-80 Policy Premium by Premium Type

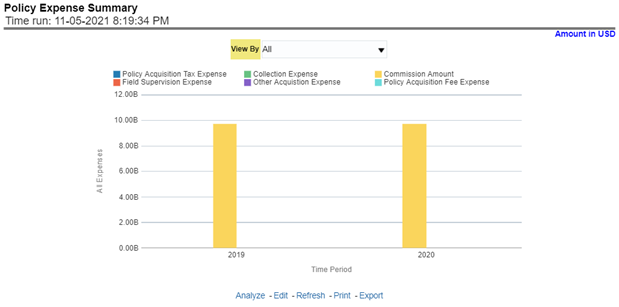

Policy Expense Summary

Figure 6-81 Policy Expense Summary

Policy Count by Policy Type

Figure 6-82 Policy Count by Policy Type

Policy Acquisition by Distribution Channel

Figure 6-83 Policy Acquisition by Distribution Channel

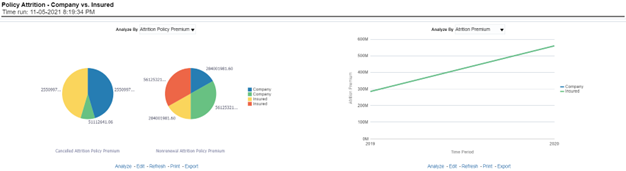

Policy Attrition - Company vs. Insured

Figure 6-84 Policy Attrition - Company vs. Insured

Policy Attrition by Reason

Figure 6-85 Policy Attrition by Reason

Policy Attrition By Distribution Channel

Figure 6-86 Policy Attrition By Distribution Channel

Policy Attrition By Billing Plan

Figure 6-87 Policy Attrition By Billing Plan

Attrition by Cancellation Timing

Figure 6-88 Attrition by Cancellation Timing