35 H and 35 I

In addition to the preceding report, the reconciliation feature also caters to the quantitative disclosure requirements of the 35 H and 35 I report as per IFRS 7, but with more details or granularity.

The report shows the roll forward of Expected Credit Loss and Carrying amount values, from the beginning period balance, through the various parameters or values affecting the ECL and carrying amounts to the ending balances of the current period. The report is designed in a manner that allows you to view it in either a simple format or a detailed one. The reporting lines are created with hierarchies that allow you to expand a reporting line to view the subsections, in a rolldown or rollup format. The rolldown format shows the roll forwards for every factor affecting the ECL or carrying amount, while the rollup view clubs many of these factors under major headers such as Model or Risk Parameters, Remeasurement, and so on.

The following table explains the list of reporting lines that are part of this report and the corresponding factors associated with it.

Table 13-1 The list of reporting lines

| List of Major Factors | Description |

|---|---|

| Beginning Balance | Displays the balance of ECL and Carrying amount, stage-wise, based on Date 1 Run (Run 1). |

| To 12 Month ECL (Stage 1) | Displays the ECL and Carrying amount of accounts migrating from Stages 2 or 3 to Stage 1. |

| To Lifetime ECL - Not Credit Impaired (Stage 2) | Displays the ECL and Carrying amount of accounts migrating from Stages 1 or 3 to Stage 2. |

| To Lifetime ECL - Credit Impaired or Defaulted (Stage 3) | Displays the ECL and Carrying amount of accounts migrating from Stages 1 or 2 to Stage 3. |

| Accounts that have been Derecognized | Displays the ECL and Carries amount of accounts that are closed or derecognized. |

| Accounts that have been Originated or Purchased | Displays the ECL and Carrying amount of accounts that are newly recognized. |

| Change in allowance due to change in stage assignment | Displays the change in ECL due to change in Stage. This will not result in a change in the carrying amount. |

| Change in Carrying Amount | Displays the change in ECL due to changes in the carrying amount (not including write-off), undrawn line, and change in cash flows. |

| Write-offs | Reduction in ECL and Carrying amount due to write-offs faced in the current period. |

| Recovery | Increase in ECL due to recoveries made in the current period (Carrying amount does not get affected). |

| Changes in Exchange Rate | Displays the change in ECL and outstanding due to changes in the Exchange rate. |

| Remeasurement of Loss Allowance | Displays the change in ECL due to a change in methodology or changes in approach in the collective assessment. This will not result in a change in the carrying amount. |

| Changes in Model or Risk Parameters | Displays the change in ECL due to CCF, PD, LGD, Provision Rate, Loss Rate, Roll Rate, EIR, and time factors (depending on the method used). This will not result in a change in the carrying amount. |

| Other Changes or Multiplier Effect | Displays the changes in ECL due to the multiplier effect and due to additional impairment losses faced due to write-offs. No changes in the carrying amount. |

| Ending Balance post Cumulative changes (as in the preceding row) | Displays the balance of ECL and Carrying amount, stage-wise, based on Date 2 Run (Run 2). |

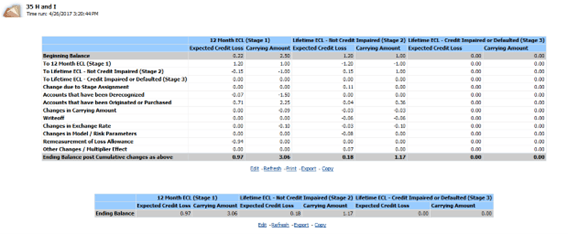

Figure 13-4 The detailed view of the 35 H and I Reports

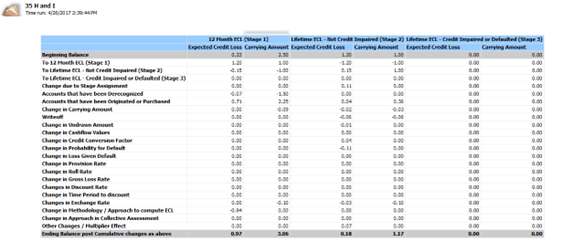

Figure 13-5 The simple view of the 35 H and I Reports