Sample Computation Logic

The following is an example of a Loan account spread over two time periods with changes in various parameters. Assuming a PD or LGD approach for ECL computation, the following table shows various parameters related to the said account, including the ECL, computed against both dates.

Table 13-2 Values in the related to the loan account

| Date | 31-Dec-15 | 31-Dec-16 |

| Account ID | HOMELOAN123 | HOMELOAN123 |

| Balance Outstanding | $ 1,000.00 | $ 700.00 |

| IFRS Stage Identified | 1 | 3 |

| 12 Month PD | 5% | 20% |

| Lifetime PD | 10% | 45% |

| LGD | 70% | 70% |

| Write-off | $ - | $ 200.00 |

| 12 Month ECL | $ 35.00 | $ 98.00 |

| Lifetime ECL | $ 70.00 | $ 220.50 |

| Reporting ECL | $ 35.00 | $ 220.50 |

Note that in the second period, the account faced a $200 Write-off in addition to a repayment of $100.

Based on the computations, the Expected Credit Loss (which needs to be provisioned for, in the Balance sheet) in period 1 is $35.00 which increases to $220.50 in period 2.

The reconciliation process parses through the given information for both dates and identifies the change in ECL due to each parameter.

In this case, the actual change in ECL between the two dates is $185.50

The changes due to the various parameters are arrived at by computing the ECL with the date 1 values except for the given parameter, which is replaced with the Date 2 value.

Taking PD as an example:

With an account in Stage 2, ECL computed on Date 1 would have been $70.00

Now, replacing only the PD with Date 2 value, compute the ECL as follows:

- Outstanding of Date 1 = $1000.00

- LGD of Date 1 = 70%

- PD of Date 2 = 45%

- ECL computed = $315.00

- Change in ECL due to PD = $315 - $70 = $245.00

The same process is repeated for other parameters.

Table 13-3 Values in the parameters related to the loan account

| Date 1 ECL at Stage 2 | Change due to PD | Change due to LGD | Change due to Outstanding | |

| Balance Outstanding | $ 1,000.00 | $ 1,000.00 | $ 1,000.00 | $ 700.00 |

| PD | 10% | 45% | 10% | 10% |

| LGD | 70% | 70% | 70% | 70% |

| ECL | $ 70.00 | $ 315.00 | $ 70.00 | $ 49.00 |

| Change in ECL due to given parameter | NA | $ 245.00 | $ - | $ (21.00) |

Summing up the changes in ECL attributed to each of these factors, you can notice that the cumulative change is different from that of the actual change. This difference is due to the multiplier effect of individual changes and is thereby posted under the header Cumulative or Multiplier Effect.

Table 13-4 Values in the difference due to the multiplier effect of individual changes report

| Cumulative Attributed Change by each parameter | $ 224.00 |

| Actual Change | $ 150.50 |

| Multiplier Effect | $ (73.50) |

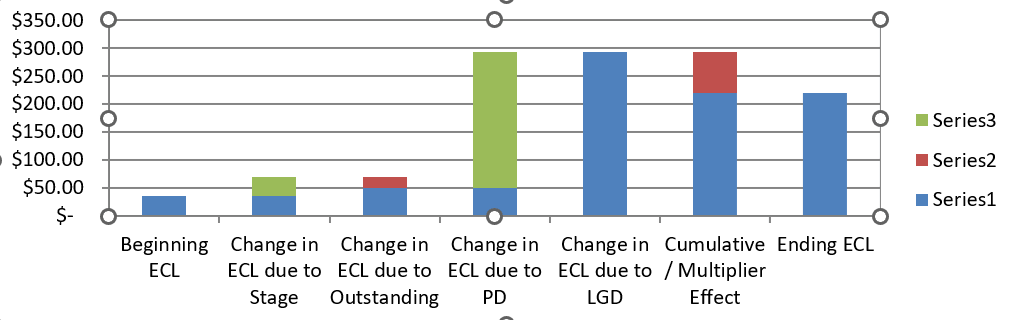

The waterfall report based on the given example is as follows.

Table 13-5 Values in the waterfall report example

| Beginning ECL | $ 35.00 |

| Change in ECL due to Stage | $ 35.00 |

| Change in ECL due to Outstanding | $ (21.00) |

| Change in ECL due to PD | $ 245.00 |

| Change in ECL due to LGD | $ - |

| Cumulative or Multiplier Effect | $ (73.50) |

| Ending ECL | $ 220.50 |

From the disclosure’s perspective, the 35 H and 35 I report values are as follows.:

Table 13-6 Values in the 35 H and I report

| Expected Credit Loss | Carrying Amount | |||||

| 12 Month ECL (Stage 1) | Lifetime ECL - Not Credit Impaired (Stage 2) | Lifetime ECL - Credit Impaired or Defaulted (Stage 3) | 12 Month ECL (Stage 1) | Lifetime ECL - Not Credit Impaired (Stage 2) | Lifetime ECL - Credit Impaired or Defaulted (Stage 3) | |

| Beginning Balance | $35.00 | $0.00 | $0.00 | $1,000.00 | $0.00 | $0.00 |

| To 12 Month ECL (Stage 1) | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| To Lifetime ECL - Not Credit Impaired (Stage 2) | -$35.00 | $35.00 | $0.00 | -$1,000.00 | $1,000.00 | $0.00 |

| To Lifetime ECL - Credit Impaired or Defaulted (Stage 3) | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change due to Stage Assignment | $0.00 | $35.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Accounts that have been Derecognized | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Accounts that have been Originated or Purchased | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Carrying Amount | $0.00 | -$21.00 | $0.00 | $0.00 | -$100.00 | $0.00 |

| Write-off | $0.00 | -$200.00 | $0.00 | $0.00 | -$200.00 | $0.00 |

| Change in Undrawn Amount | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Cash flow Values | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Credit Conversion Factor | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Probability for Default | $0.00 | $245.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Loss Given Default | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Provision Rate | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Roll Rate | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Gross Loss Rate | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Changes in Discount Rate | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Time Period to Discount | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Changes in Exchange Rate | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Methodology or Approach to compute ECL | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Change in Approach in Collective Assessment | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

| Other Changes or Multiplier Effect | $0.00 | $126.50 | $0.00 | $0.00 | $0.00 | $0.00 |

| Ending Balance | $0.00 | $220.50 | $0.00 | $0.00 | $700.00 | $0.00 |

Note that Other Changes include changes due to factors not selected in the reconciliation run and the multiplier effect. In this example, Other Changes includes the Multiplier Effect of - $73.50 and an additional impairment loss of $200 that equals the write-off amount.