6.4.3.7 Term Deposit

Figure 6-22 Term Deposit (TD) Product Type

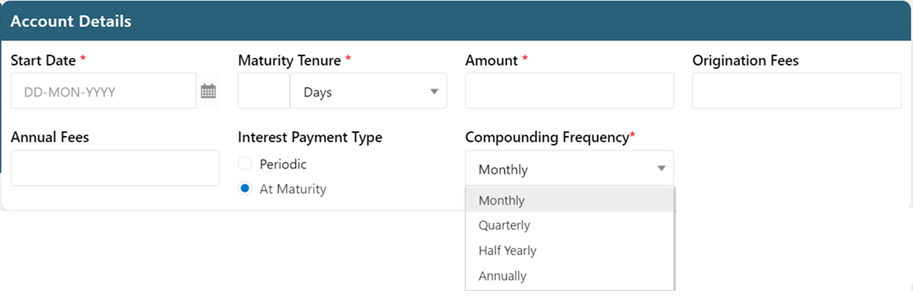

Figure 6-23 Account Details Table

Table 6-25 Account Table Field and Descriptions

| Field | Description |

|---|---|

| Start Date | Select the Start Date of the deal from the calendar. |

| Maturity Tenure | Select the Date of Maturity for the deal either in Days, Months, or Years. |

| Transaction Amount | Enter the deal amount. |

| Origination Fees | Enter the amount of fees or activation fees that have been charged for the deal. |

| Annual Fees | Enter the annual amount of fees applicable for the account. |

| Interest Payment Type |

Select the relevant option for Interest Payment Type:

|

- The Real-Time Transfer Pricing service is optional as an additional service and

can be invoked as has been mentioned in the Mortgage product type.

The Relationship Manager has also the flexibility to input the values directly without the service.

Table 6-26 Profitability Drivers Fields and Descriptions

| Field | Description |

|---|---|

| Miscellaneous Fees |

This is the likely fee income to be generated from the account. This can be captured by three different approaches:

|

| Other Income | This is any other income that is charged against the account. This can be captured by three different approaches as explained in the Miscellaneous Fees field. |

| Expenses | These are any expenses that are charged against the account. This can be captured by three different approaches as explained in the Miscellaneous Fees Field. |

| Utilization Rate % | This is the utilization rate against the account. This can be captured by three different approaches as explained in the Miscellaneous Fees field. |

| Revolve Rate % | This is the Revolve Rate against the account. This can be captured by three different approaches as explained in the Miscellaneous Fees field. |

OFS PCD supports Import and Export of Profitability Drivers. When you are defining the Schedule for the Profitability Drivers, click either Import or Export buttons to select the external file to import/export the Profitability Drivers.