2.3 Business Process Flow

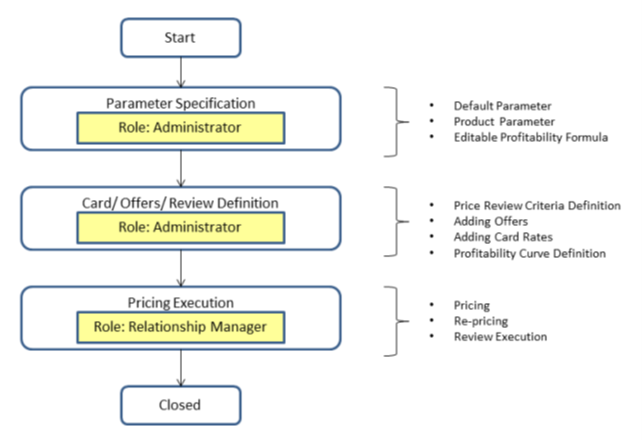

The Business Process Flow for the process is shown below:

Figure 2-1 Business Process Flow

The process flow is described below:

- You need to specify the parameters before starting the process. This product

supports three key methodologies:

- Carded: In this method, the Interest Rate is pre-set

and fixed by the banks.

A Carded process involves finding a suitable price for the customer based on a pre-determined (set of) options available for that product and other dimensional combinations.

- Negotiated: In this method, the Interest Rate is

negotiated with the customer.

A Negotiated Process allows the banker to determine a suitable price point within a set of thresholds determined by the bank/banker to solve for a target profitability parameter.

- User Input: In this method, the banks can input their Rate of Interest based on certain parameters.

- Carded: In this method, the Interest Rate is pre-set

and fixed by the banks.

- The next stage is the Pricing Definition Section where you need to define the offers and the Carded Rates for the customer.

- Finally, in the Pricing Execution, you can price new customers as well as consider the existing customers based on the available details of the customer and account.

- Based on the available details of the customer and account, the application generates the best rate possible for the desired profitability.

- In addition to this, reviews can be conducted to identify the accounts that need to be re-priced. The identification is based on certain pre-defined conditions.