6.4.1.2 In canvas Variable Prompts

Figure 6-43 In-canvas Prompt Filters for Org Unit

Figure 6-44 In-canvas Prompt Filters for Product

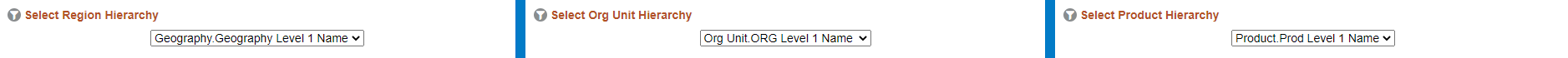

Figure 6-45 In-canvas Prompt Filters for Region

Figure 6-46 In-canvas Prompt Filters for Other Insights

- Select Org Unit Hierarchy: You can use this filter to select the Org Unit Level Name pertaining to the Org Unit Hierarchy level, for rolling up the results on the underlying Org Unit Leaves that are part of the selected hierarchy.

- Select Product Hierarchy: You can use this filter to select the Product Level Name pertaining to the Product Hierarchy level, for rolling up the results on the underlying Product Leaves that are part of the selected hierarchy.

- Select Region Hierarchy: You can use this filter to select the Region Level Name pertaining to the Region Hierarchy level, for rolling up the results on the underlying Region Leaves that are part of the selected hierarchy.

- Select Income Statement Reporting Line: This is a

mandatory filter for the group filtering on the Income Statement reporting line

dimension. The following filter values are available for selection:

- Net Income Before Tax: Net income before tax is the amount of profit made by the financial institution before income tax is paid. This figure is found by subtracting total expenses from total revenue.

- Net Interest Income: Net Interest Income (NII) is the difference between the revenue generated from a bank's interest-bearing assets and expenses incurred while paying its interest-bearing liabilities. A bank's assets consist of personal and commercial loans, mortgages, securities etc. A bank's liabilities typically consist of customer deposits.

- Non Interest Income: The non-interest income is the revenue generated by the banks and financial institutions, usually from the non-core activities (loan processing fee, late payment fees, credit card charges, service charges, penalties, and so on, net off waivers).

- Operating Expenses: Operating Expenses are expenses incurred by the bank or financial institution to carry out normal business operations.

- Provision for Credit Losses: The provision for credit losses is an estimation of potential losses that a bank might experience due to credit risk. The provision for credit losses is treated as a non-operating expense on the company's financial statements.