Transaction Summary Report

Report that shows transaction information.

Description

The Transactions Summary report shows details including transaction totals, account details, card details, and fee details. You can only view transactions associated with locations you are permitted to see. If you do not have access to all locations in a transaction, then the information in the report is limited. Payment Administrators only see data related to accounts they own.

For details about required privileges to view the report, see Predefined Payment Groups and Privileges.

Report Navigation

-

You can view the report by navigating to Payment Cloud Service and then click Transactions at the bottom of the dashboard.

-

Click Help in the Actions drop-down menu to open a pop-up window, providing detailed help documentation to assist you in navigating and customizing your report.

-

The Transaction Summary Metrics Banner appears at the top of the Transactions page.

-

The Transaction Summary Table appears below the Transaction Summary Metrics banner. This is a high-level overview of the report helping you manage and analyze your transaction data more effectively. Click Actions at the top of this table to filter the information or complete other actions like creating a chart or downloading the information. The table provides a clear and concise breakdown of your transactions, allowing you to quickly assess the following key data points:

-

Payment Method: view the distribution of transactions by the method of payment (for example, credit card merchant).

-

Transaction Count: view the total number of transactions for each payment method.

-

Transaction Amount: check the aggregate value of transactions by payment method.

-

Processing Fee: review the fees associated with each payment method, helping you better understand the cost structure.

-

Deposit to Bank: track the amount deposited to your bank after processing fees, giving you full visibility on your net transactions.

-

-

See Quick Views for details about filtering by date.

-

The Transactions Summary Report appears below the predefined view drop-down field. To view the other report details, click the Payment Reference number.

Transaction Summary Metrics Banner

Table 10-1 Transaction Summary Metrics Banner

| Metric | Description |

|---|---|

|

Total Transaction Count |

Total number of transactions. |

|

Total Sales Amount |

Total monetary amount of transactions in the time period. |

|

Total Refund Amount |

Total monetary amount of refunds. |

|

Total Chargeback Amount |

Total monetary amount of chargebacks. |

|

Total Fee |

Total monetary amount of the fee. |

|

Total Net Proceeds |

Total transaction amount minus total payment processing fees. |

Transactions Summary Report

Table 10-2 Transactions Summary Report

| Metric | Description |

|---|---|

|

Payment Reference |

Original reference for payment. |

|

POS Transaction Reference |

Reference for the transaction. |

|

Tender Reference |

Unique transaction identifier generated by the POS. |

|

Transaction Date and Time |

Date and time transaction received. |

|

Business Day |

Business day of the chargeback. |

|

Transaction Amount |

The original transaction amount. |

|

Transaction Currency |

Currency for processing the payment. An ISO three character code. |

|

Payment Processing Fee |

Monetary amount to process the transaction. Not shown until paid out. |

|

Payment Processing Fixed Fee |

Fixed amount deducted for the transaction by Oracle. |

|

Payment Processing Variable Fee |

Variable amount deducted for the transaction by Oracle. |

|

Net Proceeds |

Transaction amount minus the payment processing fee. |

|

Transaction Status |

Latest status of the transaction. |

|

Transaction Type |

Either Sale, Refund, Void, or Chargeback. |

|

Payout Reference |

Reference for the payout that the transaction was part of. |

|

Payout Date |

Date and time when the payout was made. |

|

Payout Status |

Status when the transaction was paid out or if it was withdrawn in the case of a refund or chargeback. |

|

Settlement Currency |

Currency for the settlement. An ISO three character code. |

|

Exchange Rate |

Exchange rate for the settlement. It is 1 if processed and settled with the same currency. |

|

Payment Method |

Payment method used for the transaction. |

|

Location Name |

Name for the location. |

|

Payment Location Identifier |

Payment reference for the location. |

|

Payment Terminal Identifier |

Unique identifier for the terminal. |

|

Shopper Interaction |

The method the guest used to make the payment. For example, in-store, e-commerce, or MOTO. |

|

Card Present |

Indicates if a card was present or not at time of transaction. |

|

Offline |

States Yes if an offline transaction was performed. |

|

Card Bin |

BIN number used in the transaction |

|

Card Last 4 Digits |

Last 4 digits of the card used in the transaction. |

|

Account Holder Name |

Legal business name of the account holder. |

|

Account Holder Code |

Code created for the account holder. |

|

Account Name |

Name of the account. |

|

Account Code |

Code created for the account. |

Transaction Details

Table 10-3 Transaction Details

| Metric | Description |

|---|---|

|

Transaction Status |

Latest status of the transaction. |

|

Transaction Type |

Either Sale, Refund, Void, or Chargeback. |

|

Transaction Amount |

The original transaction amount. |

|

Payment Reference |

Original payment service provider reference. |

|

Tender Reference |

Unique transaction identifier generated by the POS. |

|

Entry Mode |

Method used to enter the card. |

|

CVM Performed |

Possible values are:

|

Payout Details

Table 10-4 Payout Details

| Metric | Description |

|---|---|

|

Payout Date |

Date of the payout. |

|

Payout Reference |

Unique reference for the payout. |

|

Transaction Accounting Type |

For example, credited or debited. |

|

Payout Amount |

Amount paid out. |

|

Payout Currency |

Currency of the payout. For example, USD. |

|

Reason |

Shows the amount of money debited or credited as part of a funds transfer. |

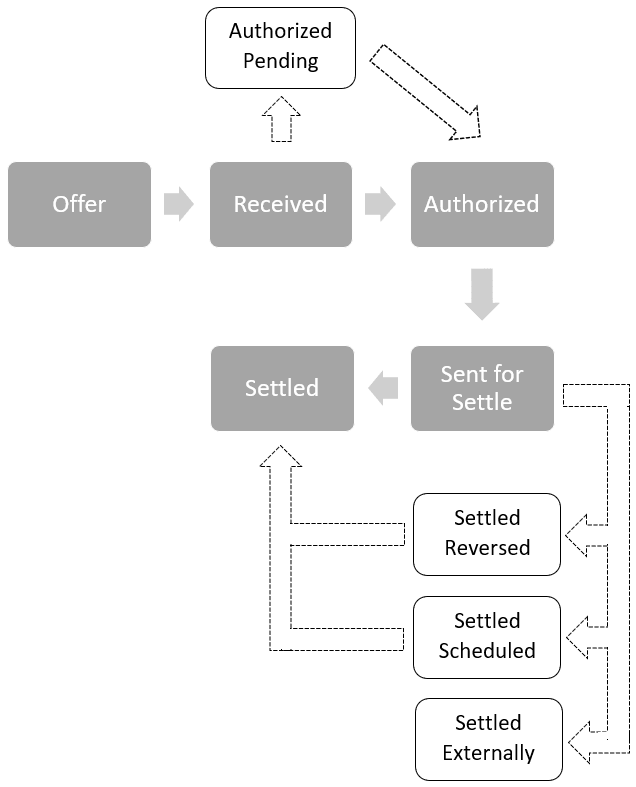

Transaction Event Log

Table 10-5 Transaction Event Log

| Metric | Description |

|---|---|

|

Status type |

Row for each status the transaction has gone through. |

|

Date and Time |

When the status occurred. |

|

Authorized |

Date and time of when transaction was authorized. |

|

Sent for Settle |

Date and time of when transaction was sent for settlement. |

|

Settled |

Date and time of when transaction was settled. |

The payment cycle is illustrated in the following image.

Fee Details

Table 10-6 Fee Details

| Metric | Description |

|---|---|

|

Transaction Amount |

The original transaction amount. |

|

Transaction Type |

Transaction type for each fee charged. |

|

Fixed Fee |

Monetary amount to process transaction. |

|

Variable Fee |

Monetary amount to process transaction based on a variable rate. |

|

Total Fee |

Sum of the fixed fee and variable fee. |

Card Details

Table 10-7 Card Details

| Metric | Description |

|---|---|

|

Payment Method |

Payment method used for the transaction. |

|

Card Type |

Sub-brand of the payment method. For example, Visa Classic or Visa Debit. |

|

Card Number |

Last four digits of the card used in the transaction. |

|

Expiry Date |

Expiration date. |

|

Issuing Country |

Name of the country where card was issued. |

Store Details

Table 10-8 Store Details

| Metric | Description |

|---|---|

|

Location Name |

Name of the location. |

|

Payment Location Identifier |

Payment provider’s reference for the location. |

|

Location Address |

Address of the location. |

Terminal Details

Table 10-9 Terminal Details

| Metric | Description |

|---|---|

|

Payment Terminal Identifier |

Terminal’s unique identifier. [Device model]-[Serial number] |

|

Terminal Version |

POS terminal version. |

|

Payment Device |

Model name of the terminal. |

Account Details

Table 10-10 Account Details

| Metric | Description |

|---|---|

|

Account Holder Name |

Legal business name of the account holder. |

|

Account Holder Code |

Code created for the account holder. |

|

Account Name |

Name of the account. |

|

Account Code |

Code created for the account. |

|

Bank Account Name |

Name for the bank account. |

Parent topic: Reports