Tax Exemption Report

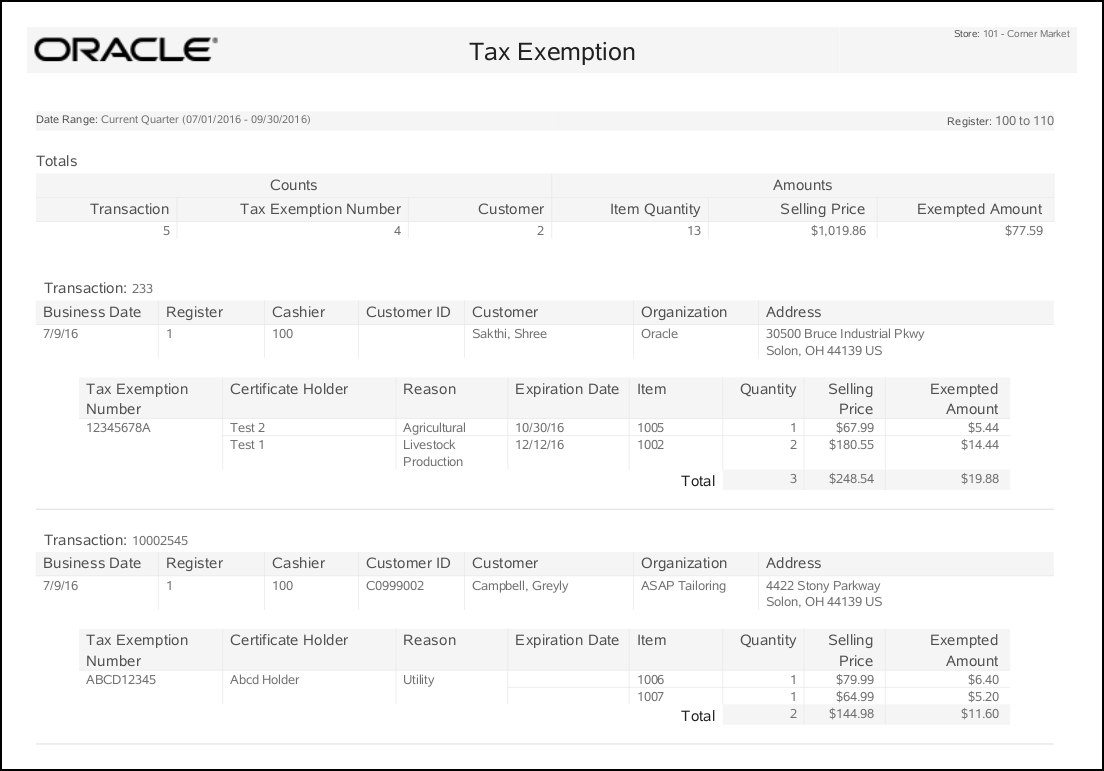

The Tax Exemption Report gives a customer-by-customer breakdown on transactions where a tax exemption was applied to a sale. For each transaction the report shows the date, exemption number, holder name, expiration date, reason code, and customer information. The report summarizes the total number of exemptions applied, total price of all items, and the total exempted amount for all tax exemptions on the report.

The data is grouped by transaction. If there is more than one tax exemption in a transaction, they will be grouped together. The outer table is transaction level, the inner table is exemption level. For the same exemption ID, Xstore allow users to have different certificate holders, reasons and expiration dates. They will be displayed when they are different.

Table 4-6 Tax Exemption Report Parameters

| Parameter | Description |

|---|---|

|

Totals |

|

|

Counts |

Transaction Tax Exemption Number Customer |

|

Amounts |

Item Quantity Selling Price Exempted Amount |

|

Transaction |

Date the transaction took place. |

|

Transaction Date |

Register where the transaction took place. |

|

Register |

Cashier who performed the transaction. |

|

Cashier |

Cashier who performed the transaction. |

|

Customer ID |

ID of the customer. |

|

Customer |

Customer name |

|

Organization |

The customer's organization. |

|

Address |

Customer address. |

|

Each Item Per Transaction |

|

|

Tax Exemption Number |

Customer's tax exemption number. |

|

Certificate Holder |

Owner of the tax exempt certificate |

|

Reason |

Reason code for the tax exemption. |

|

Expiration Date |

Date the tax exemption expires. |

|

Item |

The item identifier. |

|

Quantity |

Item quantity. |

|

Selling Price |

Item's selling price. |

|

Exempted Amount |

The item's exempted amount. |

Criteria Selections for Tax Exemption Report

Select an option or make entries in any of the following fields to determine report output:

-

Date Range: Enter a single fixed date, a date range (begin and end dates) or select a relative date option (Yesterday, Last Week, and so on) from the drop-down list.

-

Start Register: Enter the first register ID you want to include in the report.

-

End Register: Enter the last register ID you want to include for a range of registers or the same ID as the start register ID to restrict the report to a single register.

Figure 4-6 Sample: Tax Exemption Report