7 Setting Up the System for Brazilian Taxes

This chapter contains the following topics:

-

Section 7.1, "Understanding Setup for Brazilian Taxes Processing"

-

Section 7.6, "Setting Up IPI Legal Framing Codes for Brazil (Release 9.1 Update)"

-

Section 7.7, "Setting Up for PIS/PASEP and COFINS Tax Credits"

-

Section 7.8, "Understanding ICMS Interstate Tax Calculation Rules (Release 9.1 Update)"

7.1 Understanding Setup for Brazilian Taxes Processing

Before the JD Edwards EnterpriseOne systems can calculate Brazilian taxes, you must set up the tax tables, UDCs, AAIs, and other information that the system needs to perform the calculations. In Brazil, sales and use taxes are calculated on both inbound (procurement) and outbound (sales) transactions.

You can set up the system to perform calculations for these taxes:

-

IPI (Imposto sobre Produtos Industrializados).

-

ICMS (Imposto sobre Circulaço de Mercadorias e Serviços).

-

ICMS Substitution (Imposto sobre Circulaço de Mercadorias e Serviços Substituto).

-

ISS (Imposto sobre Serviços).

-

PIS/PASEP (Programa de Integração Social/Programa de Formação do Patrimônio do Servidor Público).

-

COFINS (Contribuiço do Financiamento para Seguridade Social).

7.2 Setting Up UDCs

You must set up country-specific UDCs to process taxes for Brazil.

7.3 Setting Up AAIs

In addition to the standard AAIs that you set up for the system, you must set up distribution AAIs to account for Brazilian taxes. For example, you must set up AAI 4385 for debits and AAI 4390 for credits for PIS/PASEP and COFINS taxes.

7.4 Setting Up Transaction Nature Codes

This section provides an overview of transaction nature codes and discusses how to set up transaction nature codes.

7.4.1 Understanding Transaction Nature Codes

The transaction nature code is a 3-character code that has a 2-character suffix. You set up transaction nature codes to identify whether a transaction is inbound, outbound, in-state, cross-border, and so on. The Brazilian government specifies the codes that apply for each type of transaction.

After you set up transaction nature codes, you can associate online text, print text, or both.

|

Note: If you need to delete a transaction nature code, you must first delete the online text, the print text, or both. |

7.4.2 Prerequisite

Verify that the UDC tables for IPI Code - Fiscal Value (76/IP), ICMS Code - Fiscal Value (76/II), and ICMS Tax Substitution Markup (76/SM) are set up.

7.4.3 Forms Used to Set Up Transaction Nature Codes

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Transaction Nature | W7615BD | Brazilian Localization Setup (G76B41B), Transaction Nature | Review and select existing transaction nature codes. |

| Transaction Nature | W7615BE | Click Add on the Work With Transaction Nature form. | Add transaction nature codes. |

| Media Object Viewer | W4310J | On the Work With Transaction Nature form, click either Online Text or Print Text, then select Online Text or Print Text from the Row menu. | Associate online or print text with a transaction nature code. |

7.4.4 Adding Transaction Nature Codes

Access the Transaction Nature form.

- Transaction Nature

-

Enter a 3-character code that for tax purposes identifies a type of transaction. To enter values for the transaction nature code, use this convention: X.YY. X defines the origin of the transaction (inbound or outbound). Values for X are:

1: Inbound, inside the state.

2: Inbound, other states.

3: Inbound, import.

5: Outbound, inside state.

6: Outbound, other states.

7: Outbound, export.

YY defines the transaction as a whole, such as a sales transaction.

Examples of transaction nature codes include:

511: In-state sale.

611: Out-of-state sale.

- Transaction Suffix

-

Enter a value to complete this 2-character field in conjunction with the transaction nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax.

Values might include:

01: Bonus

02: Demo

03: Sample

04: Return merchandise

05: Back order

06: Donation

Examples of Transaction Nature codes with suffixes include:

511 01: In-state sale, bonus.

511 05: In-state sale, back order.

- DIPI Classification

-

Enter the DIPI Classification code, which is a 4-character, alphanumeric field that you can use for tax reporting. Use this code to link the product with the Transaction Nature code.

- ICMS Code

-

Enter a code that indicates how ICMS tax is applied. You set up the codes that you need in the ICMS Code - Fiscal Value UDC (76/II). The system uses the code when it calculates ICMS tax, and when printing fiscal books.

- ICMS Substitution

-

Enter a code that specifies whether a client or product is subject to tax substitution. Values are:

Y: Use list price.

Z: Use net price.

N: No.

- IPI Code

-

Enter a code that indicates how IPI tax is assessed. This code determines in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. You must enter a code that exists in the IPI Code Fiscal Value (76/IP) UDC table. Values are:

1: Taxable

2: Exempt or not taxable

3: Other

- Special ICMS TAX FLAG

-

Select to enable the ICMS Tax Situation Code field.

- ICMS Tax Situation Code

-

Enter a value that exists in the Tax Summary (76/ST) UDC table to specify a special tax situation. Examples of the hard-coded values are:

40: Exempt

41: Not taxed

50: Suspended

7.5 Setting Up ICMS and IPI Taxes

This section provides overviews of classification codes, ICMS tax, ICMS substitution tax, IPI tax, and tax codes; lists prerequisites; and discusses how to:

-

Set up fiscal classification types.

-

Set up tax codes.

-

Set up ICMS tax rates.

-

Set up IPI tax rates.

-

Associate ICMS and IPI codes with customers, suppliers, and branch/plants.

-

Set up ICMS and IPI information in the Item Master table.

7.5.1 Understanding Fiscal Classification Types

The Brazilian government tax authorities created a classification system for items and services that assigns them a specific fiscal classification number. According to the nature of the item or service, there are 3 possible codes that identify the tax authority that defines the fiscal classification number:

-

NCM: It stands for Mercosul Common Nomenclature. It is a code used for goods, it has 8 digits, and it identifies items according to a classification list that the government issues.

-

NBS: NBS stands for Brazilian Nomenclature of Service. It is a code that identifies and classifies services and intangibles according to a list that the government issues.

-

LC116: This code stands for Lei Complementar 116. It lists and classifies specific services that meet certain criteria, and that are subject to very specific taxing rules.

The Brazilian Institute of Tax Planning (IBPT) issues the list and provides a text file with the approximate average tax burden of all products and services, based on the NCM and on the NBS classifications.

You use the IPI - IBPT Tax Revision program (P76B18) to set up the tax rates and tax reductions that the system uses to calculate the taxes that you pay to the customers and suppliers.

You can work with fiscal classifications to set up the applicable tax rates to goods and services. Use this program to add, change or delete fiscal classification records.

|

Note: If you used the JD Edwards EnterpriseOne software for Brazil prior to the implementation of Resolution 13 of 2012, you should note that the name and usage of the P76B18 program is changed. |

7.5.2 Understanding ICMS Tax

ICMS is a state tax that the government levies on purchasing and sales transactions in Brazil. The tax rate varies from state to state, and some products can be taxed at different rates. The price of the product always includes ICMS tax, but the amount of this tax also appears on the nota fiscal.

When you set up ICMS tax rates, you must complete these fields in the ICMS Tax Revision program (P7608B) before the system can calculate the ICMS differential:

-

Item Origin

-

From State

-

To State

-

ICMS State Tax

-

ICMS Interstate Tax

The system applies tax rates by exception. Set up all of the general tax rates first. Then, if a transaction has special or unique settings, use the ICMS Tax Revisions program to set up the ICMS tax on a case-by-case basis. Enter the data of the transaction as a record, and then enter the exceptions.

7.5.2.1 ICMS and Item Origin (Release 9.1 Update)

|

Note: If you do not work with items with imported content, you do not need to set up your system with the item origin information. The system uses the second hierarchy listed below if item origin information is not set up. |

If your company works with items with imported content, your system must be set up with values for the item origin before you can calculate ICMS taxes. Item origin information is set up in the Item Origin (76/IO) UDC table. The Item Origin field appears on the ICMS Tax Revision form in the ICMS Tax Revision program (P7608B).

The system retrieves the ICMS tax rate using this hierarchy:

-

Item Origin, From State, To State, Item, MarkUp Level

-

Item Origin, From State, To State, MarkUp Level

-

Item Origin, From State, Item, MarkUp Level

-

Item Origin, From State, MarkUp

If the system does not locate the ICMS tax rate using the above hierarchy, then the system uses this hierarchy to locate the ICMS tax rate:

-

Item Origin = *, then From State, To State, Item, MarkUp Level

-

Item Origin = *, then From State, To State, MarkUp Level

-

Item Origin = *, then From State, Item, MarkUp Level

-

Item Origin = *, then From State, MarkUp

|

Note: A pre-installation table conversion program populates the Item Origin field with *. If you do not assign an item origin code in the item master or item branch set up, then the value for the item origin remains *. |

See ICMS and Item Setup.

7.5.3 Understanding ICMS Substitution

In Brazil, ICMS Substitution is ICMS tax that is charged on interstate transactions, or on special products and clients. Although this tax appears to be the same as ICMS, it is applied differently.

The rates are the same rates that the system uses for ICMS calculation. A markup is applied to the price of the supplier to forecast the price that will be charged in the next transaction.

You enter ICMS substitution rates on the same forms as you enter ICMS tax rates.

7.5.4 Understanding Deferred ICMS (Release 9.1 Update)

The fiscal authorities grant some industries in Brazil the benefit of deferring the ICMS tax partially or totally. This means that the payment is not required until later in the process of commercializing goods and the responsibility is transferred to the buyer of the product. This causes a reduction in the applicable ICMS tax.

The system only applies deferred ICMS percentages on Outbound Notas Fiscais where the From State and To State are the same; and only when the ICMS Tax situation Code is either 51 (Deferred) or 90 (Others).

See Understanding ICMS Tributary Situation Codes

|

Note: When the system determines the ICMS tributary situation codes, one of the factors considered is the setup in the ICMS Code- Fiscal Value UDC table (76/II). ICMS fiscal value codes for taxable transactions have a 1 in the Special Handling Code field.See ICMS Code - Fiscal Value (76/II) for more information. |

The system calculates the deferred ICMS and displays the information in the Nota Fiscal, the DANFE and also in the XML files that you generate to report information to the fiscal authority. If your XML report includes transactions with partially deferred ICMS, the system adds a required legal legend to the report.

You use the following programs to work with Deferred ICMS:

-

ICMS Tax Setup program (P7608B) to set up the deferred ICMS percentage

-

Stand Alone Nota Fiscal program (P7611B) to enter stand-alone outbound notas fiscais and inbound by company notas fiscais with deferred ICMS

-

Nota Fiscal Maintenance program (P7610B) to review the calculated deferred ICMS in a fiscal note.

7.5.5 Understanding IPI Taxes

You use the IPI - IBPT Tax Revision by Fiscal Classification program (P76B18) to set up the tax rates and tax reductions that the system uses to calculate the IPI tax that you pay to the customers and suppliers. You can set up IPI tax rates by fiscal classification. You can also set up a default IPI tax rate that applies to all customers and suppliers.

7.5.6 Understanding Tax Codes

You use the Tax Code Revision program (P7617B) to set up tax codes to define the taxes that apply to an item. The tax codes that you set up determine the ICMS and IPI taxes that apply to the item. When you enter a purchase or sales order for the item, the system uses the tax code from the Item Branch Regional Information - Brazil table (F76412). If the tax code does not exist in the F76412 table, the system uses the tax code from the Item Master Regional Information - Brazil table (F76411).

7.5.7 Prerequisites

Before you complete the tasks in this section:

-

Verify that the UDC tables for IPI Code - Fiscal Value (76/IP), ICMS Code - Fiscal Value (76/II), and Tax Code (76/CT) are set up.

-

Verify that the UDC table for Item origin (76/IO) is set up

-

Verify that the appropriate keywords are set up in UDC table 76/GL, translating the item GL/class code to the one that will be used by the accounting process.

-

Verify that the appropriate AAIs are set up.

-

Set up the second character in the special handling code to recover or not recover the ICMS in UDC table 76/PU.

-

Verify that codes for ICMS are set up in the Tax Code Revision program (P7617B).

-

Verify that the ICMS code, the IPI code, and the ICMS Substitution fields are completed for the appropriate transaction nature codes.

7.5.8 Forms Used to Set Up ICMS and IPI Taxes

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Tax Codes | W7617BA | Brazilian Localization Setup (G76B41B), Tax Code Revision | Review and select tax codes. |

| Tax Code Revisions | W7617BB | Click Add on the On Work With Tax Codes form. | Add and revise tax codes. |

| Work With ICMS Tax Rates | W7608BA | Brazilian Localization Setup (G76B41B), ICMS Tax Revision | Review and select existing records. |

| ICMS Tax Revision | W7608BD | Click Add on the Work With ICMS Tax Rates form. | Set up ICMS tax rates |

| IPI - IBPT Tax Revision by Fiscal Classification - Work With IPI Taxes | W76B18C | Brazilian Localization Setup (G76B41B), IPI - IBPT Tax Revision by Fiscal Classification | Review and select existing records. |

| Load IBP Tax Information | W76B18A | Brazilian Localization Setup (G76B41B), IPI - IBPT Tax Revision by Fiscal Classification, Select a record and then select IBP Tax Revision from the Row menu on the Work With IPI Taxes form. | Define the national and import rates by fiscal classification used to calculate the approximate taxes (Required by Law 12741) |

| Load Massive IBP Tax | W76B18A | Select Load Massive IBP Tax from the Form menu on the Work With IPI Taxes form. | Add multiple records to define the national and import rates by fiscal classification used to calculate the approximate taxes (Required by Law 12741).

See Section 15.2, "Uploading Fiscal Classification Codes from Government Files (Optional)" |

| IPI Tax Revision | W76B18D | Click Add on the IPI - IBPT Tax Revision by Fiscal Classification - Work With IPI Taxes form | Set up IPI tax rates. |

| Address Book Additional Information - Brazil | W01012BRA | Address Book - Brazil (G76B01), Address Book Revisions

On the Work With Addresses form, select a record and then select Regional Info from the Row menu. Select the Fiscal Information tab. |

Associate ICMS codes and IPI codes with customers, suppliers, and branch/plants. |

| Item Master Regional Information - Brazil | W4101BRA | Inventory Master - Brazil (G76B4111), Item Master - Brazil

On the Work With Item Master Regional Information - Brazil form, select an item and click Select. |

Add ICMS and IPI tax information to items. |

| Item Branch Regional Information - Brazil | W76412BA | Inventory Master - Brazil (G76B4111), Item Branch/Plant - Brazil

On the Work With Item Branch Regional Information - Brazil form, select an item and click Select. |

If the values are different at the Item Branch, Item Branch/Location, or Item Branch/Location/Lot level, use this form to enter ICMS and IPI information instead of the Item Master Regional Information - Brazil form. |

7.5.9 Setting Up Tax Codes

Access the Tax Code Revisions form.

- Tax Code

-

Enter an auxiliary code that you use to combine ICMS and IPI tax characteristics. The code that you specify must exist in the Tax Code UDC table (76/CT). Values might include:

01: Taxed domestic goods (IPI and ICMS)

02: Taxed domestic goods (ICMS taxed, IPI tax rate Zero)

03: Exempt products

04: Export

05: ICMS deferred, IPI suspended

06: ICMS exempt, IPI taxed

- ICMS Code

-

Enter a code that indicates how ICMS tax is applied. You set up the codes that you need in the ICMS Code - Fiscal Value UDC (76/II). The system uses the code when it calculates ICMS tax, and when printing fiscal books.

- IPI Code

-

Enter a code that indicates how IPI tax is assessed. This code determines in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. You must enter a code that exists in the IPI Code Fiscal Value (76/IP) UDC table. Values are:

1: Taxable

2: Exempt or not taxable

3: Other

7.5.10 Setting Up ICMS Tax Rates

Access the ICMS Tax Revision form.

- Item Origin

-

Enter a code that specifies the origin of a product. You must select a value from the Item Origin UDC (76/IO) or use "*".

- From State

-

Enter a value that exists in the States (00/S) UDC table to specify the originating state for which you set up the tax.

- To State

-

Enter a value that exists in the States (00/S) UDC table to specify the destination state for which you set up the tax.

- Mark-up Level

-

Enter a value that exists in the A/B Selection Code 30 (01/30) UDC table to specify a code that is used in conjunction with an Address Book Category code to create different ICMS Substitution markup tables depending on the customer markup level. This field cannot be left blank. To make this field a blank space, enter an asterisk (*).

- Item Number

-

Enter the item number if you want to set up the ICMS tax by item.

This field is optional for ICMS tax. Complete this field only to set up ICMS tax rates for specific items.

- ICMS State Tax and ICMS Interstate Tax

-

Enter a number that identifies the percentage of tax that should be assessed or paid to the corresponding tax authority, based on the tax area.

Enter the percentage as a whole number and not as the decimal equivalent. For example, to specify 7 percent, enter 7, not .07.

- ICMS Reduction

-

Enter a factor that the system uses to reduce the amount of the taxable base of a product.

- Substitution Mark-up

-

Enter a percentage of markup applied to the ICMS taxable amount.

- Substitution Reduction

-

Enter a factor that reduces the ICMS substitution tax amount.

- ICMS Deferred Percentage (Release 9.1 Update)

-

Enter a number that identifies the percentage of ICMS tax that the system defers.

Enter the percentage as a whole number and not as the decimal equivalent. For example, to specify 7 percent, enter 7, not .07

Despite the value you enter in this field, the system only calculates deferred ICMS on Outbound Notas Fiscais where the From State and To State are the same; and only when the ICMS Tributary Situation Code is either 51 (Deferred) o 90 (Others).

If the conditions for the deferred ICMS calculation are met and you leave this field blank, the system defers 100 percent of the ICMS due for the transaction.

7.5.11 Setting Up IPI Tax Rates

Access the IPI Tax Revision form.

- Fiscal Classification

-

Enter a code that specifies groups of products, as defined by the local tax authorities. The product groups are based on taxing conventions and other national statistics. The system uses this code to determine the applicable tax rate for a product.

- Print Message

-

Enter a code from UDC 40/PM that you assign to each fiscal print message that appears on the nota fiscal.

- Item Number

-

Enter a number that the system assigns to an item. It can be in short, long, or third-item number format.

- IPI Tax and IPI Reduction

-

Enter a number that identifies the percentage of tax that should be assessed or paid to the corresponding tax authority, based on the tax area.

Enter the percentage as a whole number and not as the decimal equivalent. For example, to specify 7 percent, enter 7, not .07.

For IPI tax, complete this field to identify a tax rate for a tax authority that has jurisdiction in a geographic area.

- ICMS Code

-

Enter a code that indicates how ICMS tax is applied. You set up the codes that you need in the ICMS Code - Fiscal Value UDC (76/II). The system uses the code when it calculates ICMS tax, and when printing fiscal books.

Complete this field to associate tax information with the fiscal classification.

- IPI Code

-

Enter a code that indicates how IPI tax is assessed. This code determines in which column of the Inbound/Outbound Fiscal Book the system prints the IPI tax amount. You must enter a code that already exists in the IPI Code Fiscal Value (76/IP) UDC table. Values are:

1: Taxable

2: Exempt or not taxable

3: Other

Complete this field to associate tax information with the fiscal classification.

7.5.12 Setting Up IBPT Taxes (Release 9.1 Update)

Access the IBP Tax Revisions form.

- Ex TIPI

-

Select the applicable Ex TIPI value for the fiscal classification from UDC table 76B/EX.

- Effective Date

-

Specify the date from when the rate must be considered as valid

- ST

-

Enter the two-digit UDC code for the state or province from the State & Province Codes UDC table (00/S).

- Fiscal Type

-

Select the code from UDC table 76B/TL that identifies the tax authority that defines the fiscal classification number according to the nature of the item. Values are:

-

0: NCM

-

1: NBS

-

2: LC116

-

- Description IBP Tax

-

This field describes the rate.

- National Rate

-

Enter the average rate to calculate taxes for domestic goods or services. The system determines if this rate is applicable according to the item origin and the information set in the Special Handling Code SH) field.

- Imported Rate

-

Enter the average rate to calculate taxes for imported goods or services. The system determines if this rate is applicable according to the item origin and the information set in the Special Handling Code SH) field.

- Source

-

Enter the information source for average rates. This information prints on fiscal documents.

- Version

-

Enter the version number of the file issued by the government with the applicable rates. File version numbers are sequential and you can use this field to verify your system is using the version file that is up to date.

7.5.13 Associating ICMS and IPI Codes with Address Book Records

Access the Address Book Additional Information - Brazil form.

Complete the ICMS Code field on the Fiscal Information tab with the appropriate ICMS tax code, and complete the IPI Code field with the appropriate IPI tax code.

7.5.14 Setting Up ICMS and IPI Information in the Item Master Table

Access the Item Branch Regional Information - Brazil form.

Complete these fields with the appropriate values for the item master:

-

Fiscal Classification

-

Tax Code

-

Purchase Use

7.6 Setting Up IPI Legal Framing Codes for Brazil (Release 9.1 Update)

This section provides an overview of IPI Legal Framing Codes and discusses how to set up IPI Legal Framing Codes for Brazil.

7.6.1 Understanding IPI Legal Framing Codes

|

Important: Amendment 87 mandates the use of SEFAZ-defined IPI Framing Code values in the NF-e.Prior to the amended legislation, the JD Edwards EnterpriseOne system provided the default value 999 in the invoice to indicate a framing code. SEFAZ has now provided a set of framing code values based on the IPI Tax Situation Code (CST) value. Brazilian law requires that these framing code values are included in the XML of the NF-e. |

IPI Legal Framing Codes are three-character SEFAZ-defined codes that identify the category of goods that are IPI taxed. The Brazilian government specifies the codes that apply for each IPI CST.

You set up IPI Legal Framing Codes and associate them with the Transaction Nature, Transaction Suffix, and the IPI Tax Situation Code (CST). The JD Edwards EnterpriseOne system retrieves the IPI Legal Framing Code based on the Transaction Nature/Transaction Suffix/IPI Tax Situation Code setup and saves it in the Nota Fiscal Details - Tributary Situations table (F76B012) during PO Receipt generation (P4312BR), NF generation (R76558B), and Standalone NF generation (P7611B).

7.6.2 Forms Used to Set Up IPI Legal Framing Codes

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With IPI Legal Framing | W7613BC | In the Fast Path field, enter P7613B. | Access the form to set up IPI Legal Framing Codes. |

| IPI Legal Framing | W7613BG | Click Add in the Work With IPI Legal Framing form. | Associate IPI Legal Framing Codes with Transaction Nature, Transaction Suffix, and IPI Tax Situation Code. |

| Nota Fiscal Detail Additional Information | W7610BJ | Select a record, and select Detail Addl Info (Additional Information) from the Row menu on the Nota Fiscal Detail Revision form. | Review IPI Legal Framing Codes in the nota fiscal record. |

| Outbound Nota Fiscal Detail Revision | W7611BF | Select Detail Revision from the Row menu on the Outbound Nota Fiscal Header Revision form. | Add and revise the IPI Legal Framing Code for standalone outbound nota fiscal records. |

7.6.3 Prerequisites

Verify that the UDC table for IPI Legal Framing Codes (76B/LF) is set up with the required IPI Legal Framing Codes.

7.6.4 Setting Up IPI Legal Framing Codes

Access the IPI Legal Framing form.

- Transaction Nature

-

Enter a three-character code that identifies a type of transaction for tax purposes. Enter values for the transaction nature code using the X.YY convention. X defines the origin of the transaction (inbound or outbound). Values for X are:

1: Inbound, inside the state

2: Inbound, other states

3: Inbound, import

5: Outbound, inside state

6: Outbound, other states

7: Outbound, export

YY defines the transaction as a whole, such as a sales transaction.

Examples of transaction nature codes include:

511: In-state sale

611: Out-of-state sale

- Transaction Suffix

-

Enter a value to complete this two-character field in conjunction with the transaction nature code to identify the complementary implications of a type of transaction. For example, the suffix might indicate that a certain type of transaction represents an inventory change, or that a transaction is eligible for a certain type of tax.

Values might include:

01: Bonus

02: Demo

03: Sample

04: Return merchandise

05: Back order

06: Donation

Examples of transaction nature codes with suffixes include:

511 01: In-state sale, bonus

511 05: In-state sale, back order

- IPI Tax Situation Code

-

Enter a value from the Tax Summary UDC table 76B/XI that specifies a special tax situation. Hard-coded values are:

00: Inbound with credit recoverable (entrada com recuperação de crédito)

01: Inbound taxable with zero rate (entrada tributada com alíquota zero)

02: Inbound exempt (entrada isenta)

03: Inbound not taxable (entrada não-tributada)

04: Inbound immune (entrada imune)

05: Inbound suspended (entrada com suspensão)

49: Other inbounds (outras entradas)

50: Outbound with credit recoverable (saída com recuperação de crédito)

51: Outbound taxable with zero rate (saída tributada com alíquota zero)

52: Outbound exempt (saída isenta)

53: Outbound not taxable (saída não-tributada)

54: Outbound immune (saída imune)

55: Outbound suspended (saída com suspensão)

99: Other outbounds (outras saídas)

- IPI Legal Framing

-

Select the code from the UDC table 76B/LF that identifies the tax situation that defines the IPI tax, according to the nature of the item. These values are defined by SEFAZ.

If you select a framing code that does not belong to the range of values applicable to the selected CST, the system shows an error message.

7.6.5 Updating IPI Legal Framing Codes in the Nota Fiscais

After you generate outbound notas fiscais (using NF Generation - R76558B), you can review the legal framing codes using the Nota Fiscal Detail Additional Information form (P7610B).

When you generate the notas fiscais, the system calculates the IPI Tax Situation Code and based on the IPI Tax Situation Code, Transaction nature, and Transaction Suffix values, the system retrieves the corresponding IPI Framing Code from the IPI Legal Framing table (F7613B). The system then updates the Nota Fiscal Detail - Tributary Situations table (F76B012) with the IPI Legal Framing Code.

If the required Legal Framing Code is not available in the IPI Legal Framing table (F7613B), the JD Edwards EnterpriseOne system displays a warning in the NF Generation report (R76558B). See the Work Center for more details and the resolution for the missing Legal Framing Code.

You should set up the required IPI Legal Framing Code using the P7613B program and then proceed with PO Receipt/NF/Standalone NF generation. Then, run the NF-e Info Generation report (R76B561) to include the IPI Legal Framing Code in the NF-e XML.

7.6.6 Updating IPI Legal Framing Code in the Standalone Nota Fiscais

When you generate a standalone notas fiscais, you can update the IPI Legal Framing Code using the Outbound Nota Fiscal Detail Revision form (P7611B). The system validates the IPI Legal Framing Code to ensure that the value is within the range of IPI Framing Codes for the specified IPI Tax Situation Code/Transaction Nature/Transaction Suffix setup.

7.7 Setting Up for PIS/PASEP and COFINS Tax Credits

This section provides overviews of the 76/GL UDC table, GL Class codes, tax codes, how to associate purchase use codes with tax codes, and tax line types for PIS/PASEP and COFINS tax credits; lists a prerequisite; and discusses how to:

-

Set up tax codes for PIS/PASEP and COFINS tax credits.

-

Associate purchase use code with tax codes.

7.7.1 Understanding the 76/GL UDC Table for PIS/PASEP and COFINS Tax Credits

For PIS/PASEP and COFINS tax credits, you set up codes in the GL/Class Code Cross-Reference (76/GL) UDC table to create cross-references between GL offset accounts and GL classes for suppliers, fiscal companies, and tax codes instead of setting up a cross-reference between the GL offset account and the GL class for an item or service.

When you set up the GL/Class Code Cross-Reference UDC for PIS/PASEP and COFINS tax credits:

-

Complete the Codes field by entering the first three characters of the tax name followed by 4 characters that represent the GL category code that is associated with the company/transaction type/account combination for the AAI.

Note:

For PIS/PASEP tax credits, you must enter PIS for the first 3 characters for PIS tax credits and COF for the first 3 characters for COFINS tax credits.The first three characters of the codes must be completed as:

Tax, Cost, or Discount Code COFINS COF ICMS Differential DIF Expenses EXP Freight FRT ICMS ICM ICMS Recoverable ICR IPI IPI IPI Recoverable IPR PIS/PASEP PIS ICMS Repasse Discount REP ICMS Substitution Recoverable SBR Insurance SEG ICMS Substitution Tax SUB Trade Discount TDC -

Create codes for default AAIs that point to a specific default account. The system first searches for a code with a specific GL class in the last four characters (for example, COFGL30, where GL30 is the supplier's GL class). If a specific code that includes the item's GL class does not exist, then the system locates the default code (for example, COF****).

-

Complete the Description 01 field with the GL category code that is associated with the GL offset account for the JD Edwards EnterpriseOne Distribution system AAI to which the system posts the transaction.

7.7.2 Understanding GL Class Codes for PIS/PASEP and COFINS Tax Credits

You must set up GL Class codes for PIS/PASEP and COFINS tax credits for the suppliers. Additionally, because you are the supplier when you sell goods or services, you must set up a supplier master for the fiscal companies and GL Class codes for the fiscal companies. Before the system can calculate PIS/PASEP and COFINS tax credits for purchase and sales transactions, the supplier master records for the suppliers and for the fiscal companies must contain a GL Class code for PIS/PASEP and for COFINS tax credits. You assign a GL Class code on the GL Distribution tab of the Supplier Master Revisions form.

The source of the GL Class code that the system uses when calculating PIS/PASEP and COFINS tax credits depends on the type of transaction that the system processes. Inbound transactions include transactions that have Transaction Nature codes that are less than 500. Inbound transactions include those in which you generate notas fiscais from purchase orders, ship-to sales returns, and ship-from sales returns. Outbound transactions include transactions that have Transaction Nature codes that are greater than 500. Outbound transactions include those in which you generate notas fiscais from sales orders and purchase returns.

This table displays the source of the GL Class code that the system uses when debiting or crediting accounts for inbound and outbound transactions:

| Account | Distribution AAI | Source of GL Class Code |

|---|---|---|

| Inbound debit account | 4385 | The GL Class code that exists in the F0401 table for the supplier. |

| Inbound credit account | 4390 | The GL Class code that exists in the F76B0401 table for the PIS/PASEP or COFINS tax. |

| Outbound debit account | 4220 | The GL Class code that exists in the F76B0401 table for the PIS/PASEP or COFINS tax. |

| Outbound credit account | 4240 | The GL Class code that exists in the F0401 table for the fiscal company. |

7.7.3 Understanding Tax Codes for PIS/PASEP and COFINS Tax Credits

The Review AP Tax Code program (P76B0401) enables you to set up tax codes that the system uses to calculate tax credits on notas fiscais. After you set up tax codes in the Review AP Tax Code program, you associate the tax codes with the suppliers on the Tax Information tab of the Address Book Additional Info - Brazil program (P01012BR). You use the Purchase Use Tax Setup - Brazil program (P76B003) to associate purchase use codes with the tax codes. The system uses the associations between the tax codes, purchase use codes, and suppliers to determine how to apply PIS/PASEP and COFINS tax credits.

|

Note: You must enter a C in the Retention/Aggregation/Credit field (data item BRRTA) for tax codes that you set up for PIS/PASEP and COFINS tax credits. Tax codes that have an R or an A in the Retention/Aggregation/Credit field are not valid tax codes for PIS/PASEP or COFINS credits. |

7.7.4 Understanding How to Associate Purchase Use Codes with Tax Codes

You use the Purchase Use Tax Setup - Brazil program (P76B003) to set up associations between purchase use codes and tax codes for PIS/PASEP and COFINS tax credits. When you run the Nota Fiscal Check & Close program (P76B900) or the Generate Nota Fiscal - Brazil program (R76558B), the system accesses the associations between the purchase use codes and tax codes to determine whether to calculate the taxes. If an association exists in the Purchase Use Tax Setup - Brazil table (F76B003) between a tax code and the purchase use code on a line item, the system calculates the tax as specified by the tax code. When you set up the associations, select the appropriate Apply option to instruct the system to calculate the tax.

|

Note: The Purchase Use Tax Setup Revisions form in the Purchase Use Tax Setup - Brazil program has a section for setting up tax credits and a section for setting up withholding. Use the fields in the Taxes Information section to associate purchase use codes with tax codes for tax credits. |

7.7.5 Understanding Tax Line Types for PIS/PASEP and COFINS Tax Credits

Before the system can process PIS/PASEP and COFINS tax credits, you must set up line types for the taxes in the Line Type Constants program (P40205). When you set up line types for PIS/PASEP and COFINS, set the options on the Line Type Constants Revisions form as:

| Option | Setting |

|---|---|

| GL Interface | On |

| AR Interface | Off |

| AP Interface | Off |

| CSMS Interface | Off |

| Inv. Interface | N |

| GL Offset | Select the appropriate GL Posting Code from the GL Posting Category UDC (41/9). |

7.7.6 Prerequisite

Verify that the tax codes for withholding taxes are set up in the Tax Code AP UDC table (76B/TR).

7.7.7 Forms Used to Set Up Tax Codes for PIS/PASEP and COFINS Tax Credits

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Tax Information | W76B0401B | AP Tax Processing - Brazil (G76B0414), Review AP Tax Code | Review and select existing tax code records. |

| Tax Information Revisions | W76B0401A | Click Add on the Work with Tax Information form.

Select the tab for PIS or COFINS. |

Set up tax codes for PIS/PASEP and COFINS tax credits. |

| Work With Purchase Use Tax Setup | W76B003A | Brazil Localization Setup (G76B41B), Purchase Use Tax Setup | Review and select existing records. |

| Purchase Use Tax Setup Revisions | W76B003B | Click Add on the Work With Purchase Use Tax Setup form. | Associate purchase use codes with tax codes for PIS/PASEP and COFINS credits. |

7.7.8 Setting Up Tax Codes for PIS/PASEP and COFINS Tax Credits

Access the Tax Information Revisions form.

Select the PIS tab to set up tax codes for PIS/PASEP tax credits. Select the COFINS tab to set up COFINS tax credits.

Figure 7-6 Tax Information Revisions form

Description of ''Figure 7-6 Tax Information Revisions form''

- Brazil Tax Information

-

Enter a UDC that describes the tax. The code can be up to 8 characters long.

- Tax Type

-

Enter the type of Brazilian tax. You enter a code that exists in the Tax Code AP UDC table (76B/TR). You must enter 05 for PIS/PASEP or 06 for COFINS. The system activates the tax tab based on the value that you enter.

- Tax Rate

-

Enter the retention or aggregation tax rate that is applied to the service transaction.

- GL Offset (general ledger offset)

-

Enter a code that determines the trade account that the system uses as the offset when you post invoices or vouchers. The system concatenates the value that you enter to the AAI item RC (for JD Edwards EnterpriseOne Accounts Receivable) or PC (for JD Edwards EnterpriseOne Accounts Payable) to locate the trade account. For example, if you enter TRAD, the system searches for the AAI item RCTRAD (for receivables) or PCTRAD (for payables).

You can assign up to four alphanumeric characters to represent the GL offset or you can assign the 3-character currency code (if you enter transactions in a multicurrency environment). You must, however, set up the corresponding AAI item for the system to use; otherwise, the system ignores the GL offset and uses the account that is set up for PC or RC for the company specified.

If you set up a default value in the GL Offset field of the customer or supplier record, the system uses the value during transaction entry unless you override it.

Note:

Do not use code 9999. It is reserved for the post program and indicates that offsets should not be created. - Retention/Aggregation/ Credit

-

Enter a value that specifies whether retention or aggregation applies. You must enter a C in the Retention/Aggregation/Credit field (data item BRRTA) for tax codes that you set up for PIS/PASEP or COFINS credits. Tax codes that have an R or an A in the Retention/Aggregation/Credit field are not valid tax codes for PIS/PASEP or COFINS credits.

- Alternate Payee Address Number

-

Enter an alternate address to which JD Edwards EnterpriseOne Accounts Payable can send payments due.

- Receita Code

-

Enter a code that identifies the type of IR tax. You must set up valid codes in the Receita Code UDC (76B/IR) table.

- Payment Terms

-

Enter a code that specifies the terms of payment, including the percentage of discount available if the invoice is paid by the discount due date. Use a blank code to indicate the most frequently used payment term. You define each type of payment term on the Payment Terms Revisions form. Examples of payment terms include:

Blank: Net 15

001: 1/10 net 30

002: 2/10 net 30

003: Due on the 10th day of every month

006: Due upon receipt. This code prints on customer invoices.

7.7.9 Associating Purchase Use Code with Tax Codes

Access the Purchase Use Tax Setup Revisions form.

|

Note: The fields in the Withholdings Information section are described in the section Setting Up Purchase Use Codes for PIS/PASEP, COFINS, and CSLL Contributions. |

Figure 7-7 Purchase Use Tax Setup Revisions form

Description of ''Figure 7-7 Purchase Use Tax Setup Revisions form''

- Purchase Use Code

-

Enter a value that exists in the Purchase Use (76/PU) UDC table to specify the purchase use code with which you want to associate tax codes.

- PIS

-

Complete this field in the Taxes Information section.

Enter a tax code that contains 05 in the Tax Type field (data item BRTXTP) and C in the Retention/Aggregation/Credit field (data item BRRTA) in the F76B0401 table. Only tax codes that contain 05 in the Tax Type field and C in the Retention/Aggregation/Credit field are valid for PIS/PASEP tax credits. If the tax code that you enter does not contain 05 and C, the system displays an error message.

- Apply PIS

-

Complete this field in the Taxes Information section.

The system enables the Apply PIS field only when you complete the corresponding PIS field. You must select this option to have the system calculate PIS/PASEP credits based on the code that you entered in the PIS field.

- COFINS

-

Complete this field in the Taxes Information section.

Enter a tax code that contains 06 in the Tax Type field (data item BRTXTP) and C in the Retention/Aggregation/Credit field (data item BRRTA) in the F76B0401 table. Only tax codes that contain 06 in the Tax Type field and C in the Retention/Aggregation/Credit field are valid for COFINS tax credits. If the tax code that you enter does not contain 06 and C, the system displays an error message.

- Apply COFINS

-

Complete this field in the Taxes Information section.

The system enables the Apply COFINS field only when you complete the corresponding COFINS field. You must select this option before the system will calculate COFINS credits that are based on the code that you enter in the COFINS field.

7.8 Understanding ICMS Interstate Tax Calculation Rules (Release 9.1 Update)

Constitutional Amendment 87 resolves the issue on the sharing of Brazilian State VAT revenue (ICMS) between the selling and buying states. Earlier, in an interstate transaction, if the buyer is a non-ICMS taxpayer, the ICMS amount was fully collected by the origin/selling state according to the internal tax rate.

Amendment 87 establishes a new ICMS tax calculation and validation rules that apply in the following ways to an interstate transaction:

-

The ICMS interstate tax rate is applied and paid to the origin/selling state.

-

ICMS differential (difference between the destination internal tax rate and interstate tax rate) is gradually transitioned from the origin/selling state to the destination/buying state.

Amendment 87 in Article 99 stipulates that on a transitional basis the ICMS differential amount will be shared between the origin and destination states as follows:

| Year | Destination State | Origin State |

|---|---|---|

| 2016 | 40% | 60% |

| 2017 | 60% | 40% |

| 2018 | 80% | 20% |

| 2019 onwards | 100% | 0% |

Amendment 87 also mandates that the Brazilian Fund for Combating and Eradicating Poverty (FECOP) that was earlier incorporated in the ICMS amount should now be separated from the ICMS amount and shown in the NF-e XML.

7.8.1 Understanding ICMS Differential Calculation

In an interstate transaction between a seller and a non-ICMS taxpayer, the ICMS differential amount is based on:

-

ICMS internal tax rate in the origin and destination states

-

Interstate tax rate between the origin and destination states

-

Poverty fund percentage, if the state has adopted the fund for combating and eradicating poverty

7.8.1.1 Example of ICMS Differential Calculation

For instance, in an interstate transaction between two states, São Paulo (SP) and Pernambuco (PE), the ICMS differential calculation is based on the following tax rates:

-

ICMS Internal Tax Rate in SP = 18%

-

ICMS Internal Tax Rate in PE = 17%

-

Interstate Tax Rate between SP and PE = 7%

-

ICMS Diff amount = ICMS Internal Tax Rate in PE - Interstate Tax Rate (17% - 7%)

When the transaction is for a line amount of R$1000, then:

ICMS Interstate Tax Rate paid to Selling State = 7% of R$1000 = R$70.00

ICMS Differential amount = 10% of R$1000 = R$100

This ICMS Differential amount (R$100) will be shared between SP and PE and transitioned gradually to PE (destination state) as follows:

| Year | PE (Destination State) | SE (Origin State) |

|---|---|---|

| 2016 | R$40 | R$60 |

| 2017 | R$60 | R$40 |

| 2018 | R$80 | R$20 |

| 2019 onwards | R$100 | R$0 |

7.8.2 Understanding Poverty Fund Calculation

The Fund for Combating and Eradicating Poverty (FECOP) was instituted and regulated to provide a basic standard of living for all Brazilians. Previously, a percentage of ICMS amount allocated for the poverty fund was included in the ICMS amount due to the state.

As the poverty fund is not prorated between two states, Amendment 87 necessitates that the ICMS percentage for the poverty fund should be separated from the ICMS Interstate Rate before the ICMS differential calculation. Amendment 87 also stipulates that both these values be shown separately in the NF-e XML.

7.8.2.1 Example of Poverty Fund Calculation with ICMS Differential Calculation

For example, if the state Rio de Janeiro (RJ), which has an Internal Tax Rate of 19%, has adopted the poverty fund and allocated 1% of the ICMS Internal Rate towards the poverty fund, then the Internal Tax Rate of the state for ICMS Differential calculation would be 18% instead of 19%.

When an interstate transaction between São Paulo (SP) and Rio de Janeiro (RJ) is for a line amount of R$12,000, then:

ICMS Internal Tax Rate of SP = 18%

ICMS Internal Tax Rate of RJ = 19% - 1% (Poverty Fund) = 18%

The ICMS poverty rate is applied on the ICMS tax base of the destination state.

Interstate Tax Rate between SP and RJ = 12%

ICMS Poverty Amount = 1% of R$12,000 = R$120

ICMS Diff amount = ICMS Internal Tax Rate in RJ - Interstate Tax Rate (18% - 12% = 6%)

In this example, the ICMS Interstate Tax Rate paid to Selling State = 12% of R$12,000 = R$1440.00

ICMS Differential amount = 6% of R$12,000 = R$720

This ICMS Differential amount (R$720) will be shared between SP and RJ and transitioned gradually to RJ (destination state) as explained in the above section.

7.8.3 Reviewing ICMS Differential and Poverty Fund Calculations

The system calculates the ICMS Differential and Poverty Fund and displays the information in the XML file.

7.8.3.1 Forms Used to Review ICMS Differential and Poverty Fund Calculations

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Address Book Additional Information - Brazil | W01012BRA | Select Regional Info from the Form menu on the Address Book Revision form. | Review the Taxpayer Class field in the Fiscal information tab to determine if the buyer is an ICMS tax payer or a non-ICMS tax payer (Consumer ). |

| ICMS Tax Revision | W7608BD | Select a record in the Work With ICMS Tax Rates form. | Review and set the poverty flag and poverty rate for the state. |

| Nota Fiscal Detail Additional Information | W7610BJ | Select a record, and select Detail Addl Info (Additional Information) from the Row menu on the Nota Fiscal Detail Revision form. | Review ICMS differential and poverty fund calculation in the nota fiscal record. |

| Outbound Nota Fiscal Detail Revision | W7611BF | Select Detail Revision from the Row menu on the Outbound Nota Fiscal Header Revision form. | Create the NF record and review ICMS differential and poverty fund calculation in the nota fiscal record. |

You use the following programs to review ICMS Differential and Poverty Fund calculations:

-

Work with ICMS Tax Rates (P7608B) to review, flag, and set the destination state's Poverty Rate percentage. The poverty fund amount is reduced from the destination state's internal tax rate before the ICMS differential calculation.

-

Stand-Alone Nota Fiscal program (P7611B) to create the Nota Fiscal with ICMS differential calculation. The ICMS differential calculation is updated in the F7611B table.

-

Nota Fiscal Maintenance program (P7610B)-> (Nota Fiscal Detail Additional Information form) to review the calculated ICMS differential and poverty fund calculation in an outbound nota fiscais and to review the "Amount of ICMS to be Paid" value in an inbound nota fiscais.

7.8.3.2 Reviewing ICMS Differential Calculation in the XML File

The system applies the ICMS differential and Poverty Fund calculation on sales order transactions and displays the information in the XML file that you generate to report the transaction to the fiscal authority.

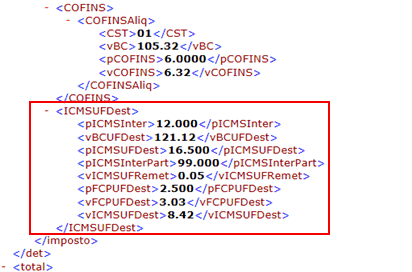

The sample XML report shows the ICMS differential calculation details in the new <ICMSUFDest> parent tag within the <imposto> tag:

7.8.4 Setting Up AAIs for General Ledger (GL) Entries

After a sales order transaction is followed by Nota Fiscal generation (R76558B) and XML generation (R76B561), update the Brazil taxes by running the Update Sales - Brazil program (R76B803). The system updates the Sales Order Detail File table (F4211) with the ICMS differential and poverty amount tax lines.

Then, run the Sales Update program (R42800) to generate reports that include summary or detail information of general ledger (GL) entries. The system updates the Customer Ledger (F03B11) and Account Ledger (F0911) tables. The GL entries in the R42800 report provide details of ICMS differential sharing and poverty fund calculations.

When you update the general ledger for sales transactions, the system uses AAI 4220 to generate a debit to the posting account and AAI 4240 to generate a credit to the posting account.

Set up distribution AAIs 4220, 4240, and 4230 for ICMS differential and poverty fund calculation. Ensure that you set the Branch Plant field to blank for these accounts in the Account Revision form.

7.9 Setting Up Tax Substitution or Identification Code (CEST) Values for Brazil (Release 9.1 Update)

In the Federative Republic of Brazil, the CEST (Specifier code of Tax Substitution or Identification Code of Tax Replacement) values help to identify the goods subjected to the tax substitution regime.

The JD Edwards EnterpriseOne system now allows you to display the CEST value of an item (subjected to tax substitution), in the Nota Fiscal along with the related NCM value.

7.9.1 Understanding Tax Substitution Code (CEST)

The CEST values help in the standardization and identification of goods and assets that may be subject to the tax substitution regime. The CEST value should be shown in the Nota Fiscal regardless of whether the operation, goods, or property is subject to the tax substitution rule.

The agreement between the states of the Federative Republic of Brazil currently comprises of 28 segments of goods and commodities.

The CEST values are provided by the tax authority and are composed of seven digits. For instance, in the CEST value 01.001.00:

-

the first and second digits (01) correspond to the commodity or good segment.

-

the third, fourth, and fifth digits (001) correspond to the item of a commodity or good segment.

-

the sixth and seventh digits (00) correspond to the item specification.

|

Note: You can refer to the government portalhttps://www.confaz.fazenda.gov.br/legislacao/convenios/2015/CV092_15 for the updated list of CEST codes and the related NCM codes. |

7.9.2 Uploading CEST Value Codes from Text Files

You should upload the CEST values to the F76B023 (Tax Substitution Code and NCM - BRA - 76B) table in order to display them in the XML File that you generate to report the transaction to the fiscal authority.

To add the CEST values to the F76B023 table:

-

Enter all the CEST and NCM values in a text file using a delimiter character to separate each field in the file.

-

Run the Text File Processor program (P007101) to import the text file into the Text Processor Detail table (F007111). The system populates values in the Text Processor Header table (F007101) and the Text Processor Detail table (F007111).

-

Now run the R76B023 UBE to update the F76B023 table. The system separates the CEST and NCM values in the F007111 table and updates them in the F76B023 table.

Note:

Ensure that you use the same delimiter that you used in the text file before importing to the Text Processor Detail table (F007111).The CEST value for the item will be populated with the related NCM value when you generate the XML file.