11 Recognizing Revenue and Cost of Goods Sold (Release 9.1 Update)

This chapter discusses:

-

Section 11.1, "Understanding the Revenue Recognition Program (P03B116)"

-

Section 11.2, "Working with the Revenue Recognition Program (P03B116)"

-

Section 11.3, "Recognizing Revenue and Cost of Goods Sold Automatically"

-

Section 11.4, "Additional Methods for Sending Invoices to Revenue Recognition"

-

Section 11.6, "Auditing Revenue Recognition Invoices (Release 9.1 Update)"

11.1 Understanding the Revenue Recognition Program (P03B116)

The Revenue Recognition program (P03B116) enables you to recognize revenue and cost of goods sold (COGS) for an individual invoice or multiple invoices. You can recognize revenue and COGS on both domestic and foreign invoices, and you can also recognize revenue for credit memos.

When P03B116 is not in summarized mode, you can recognize less, recognize more, or recognize all revenue for invoices that originate from the Accounts Receivable, Sales Order Management, Contract and Service Billing, or Real Estate Management systems. You can recognize less, recognize more, or recognize all of the COGS for a sales order invoice that originates from the Sales Order Management system.

Optionally, you can use the following methods to recognize revenue:

-

Use blind recognition to recognize revenue and COGS for the entire invoice. During blind recognition, you enter a G/L date and reason code for all of the summarized invoices that you select.

-

Use guided recognition to review the invoice prior to revenue recognition. During guided recognition, you enter a G/L date and reason code for each invoice you select.

-

(Release 9.1 Additional Update) Use a schedule to determine when portions of the invoice are eligible for revenue recognition. You can automatically split the amount of a pay item across a number of periods, or you can manually schedule portions of the G/L distribution line for recognition, until the pay item is fully recognized.

The system uses the following tables to store information about each invoice in the revenue recognition process:

-

Customer Ledger Tag table (F03B11T)

When you enter an invoice, the system updates the Revenue Recognition Inclusion column in the F03B11T table with a Y to identify those invoices that are sent to the revenue recognition process. Otherwise, the system displays an N in this column.

-

(Release 9.1 Additional Update) Revenue Recognition Schedule table (F03B115)

The system stores each schedule record when you use a schedule to recognize revenue.

-

Revenue Recognition Invoice table (F03B116)

The system stores all revenue information related to the domestic or foreign revenue recognition amounts and amounts not recognized, the revenue recognition status, the revenue recognition reason code, the revenue recognition date, and the eligible for recognition date.

-

Revenue Recognition G/L Information table (F03B117)

The system stores all revenue and COGS information related to the domestic or foreign revenue recognition amounts and amounts not recognized, the revenue recognition reason code, and the revenue recognition date. The system also stores the G/L distribution information for the invoice.

-

Account Ledger table (F0911)

Based on the values in the F03B117 table, the system creates entries in the Performance Liability Account (PLA), PLA adjustment account, Cost of Goods Sold Performance Liability Account (COGS PLA), and the COGS PLA adjustment account in the F0911 table. The system also updates the F0911 table to indicate whether the record is related to an inventory transaction or revenue recognition transaction.

-

Revenue Recognition Invoice Audit table (F03B118)

When information is updated in the F03B116 table, the system also includes these updates in the F03B118 table to provide an audit trail of the invoice activity.

-

Revenue Recognition G/L Information Audit table (F03B119)

When information is updated in the F03B117 table, the system also includes these updates in the F03B119 table to provide an audit trail of the G/L distribution activity.

11.1.1 Programs and Reports that Integrate with the Revenue Recognition Process

Invoices created in the following programs and reports integrate with the revenue recognition process:

-

Standard Invoice Entry program (P03B11)

If you use the P03B11 program to inquire on an invoice that is in the revenue recognition process, the system displays invoice information from the Customer Ledger table (F03B11). However, if you access the G/L Distribution form in the P03B11 program, the system displays information from the F03B117 table.

Note:

If you select an invoice that is in the revenue recognition process, the system displays the Rev Rec check box as checked in the header of the Standard Invoice Entry form. -

Speed Invoice Entry program (P03B11SI)

-

Sales Update report (R42800)

When you run this report, the system sends sales order invoices with revenue amounts and COGS amounts to the revenue recognition process. The system also creates tax and inventory records directly in the F0911 table.

If you set the Sales Update processing options to summarize inventory and COGS in a G batch type, the system does not perform revenue recognition processing.

-

Batch Invoice Processor report (R03B11Z1A)

-

Generate Delinquency Fees report (R03B525)

-

Late Payment Delinquency Fees report (R03B221)

-

Recycle Recurring Invoice report (R03B8101)

-

AR Invoice Manager (JP03B000)

-

Create A/R Entries (R48199)

-

(Release 9.1 Additional Update) Post RE Invoices and Vouchers (R15199)

-

(Release 9.1 Additional Update) Revenue Fee Generation (R15105)

Note:

Invoices that the system creates through the A/R – A/P netting process are not eligible for revenue recognition because these invoices do not represent performance obligations. Instead, the invoice is for the net amount between vouchers and invoices that is available for the customer/supplier.11.2 Working with the Revenue Recognition Program (P03B116)

This section discusses:

-

Section 11.2.1, "Understanding the Revenue Recognition Program"

-

Section 11.2.3, "Setting Processing Options for the Revenue Recognition Program (P03B116)"

-

Section 11.2.6, "Using Blind Recognition to Recognize Revenue and COGS"

-

Section 11.2.7, "Using Guided Recognition to Recognize Revenue and COGS"

-

Section 11.2.8, "Using a Schedule to Recognize Revenue (Release 9.1 Additional Update)"

-

Section 11.2.9, "Modifying the Eligible for Recognition Date"

11.2.1 Understanding the Revenue Recognition Program

You use the Revenue Recognition program to:

-

Review invoices and pay items that are included in the revenue recognition process.

-

Revise invoices and pay items.

-

Remove invoices from the revenue recognition process.

-

Create revenue recognition schedules for pay items.

-

Recognize revenue.

When you select an invoice or invoice pay item in the grid, you can use the selections on the Row menu to:

-

Review the invoice batch in the Batches program (P0011).

-

Review receipts for the invoice in the Standard Invoice Entry program (P03B11).

-

Review the invoice in the Customer Ledger Inquiry program (P03B2002).

You can also select G/L Distribution on the Row menu to review Account Ledger information. The system displays the PLA and revenue entries that are created in Account Ledger table (F0911).

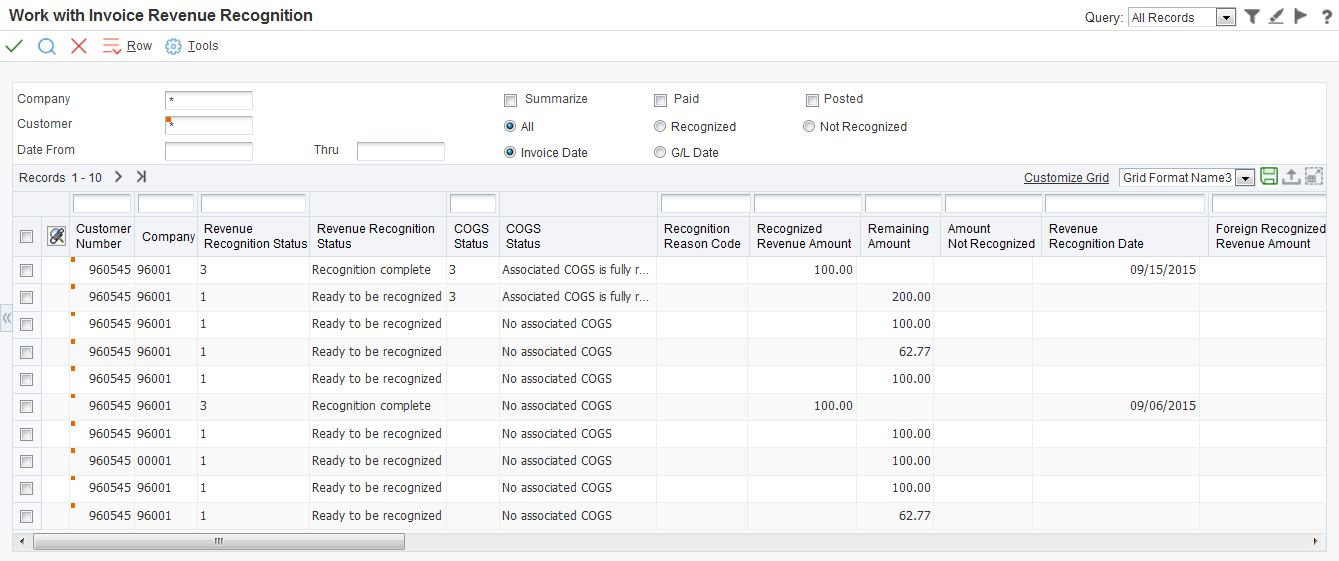

Figure 11-1 Work with Invoice Revenue Recognition form

Description of ''Figure 11-1 Work with Invoice Revenue Recognition form''

You can use the options in the header of the field to determine how the invoices and pay items are displayed.

- Summarize

-

Use this check box to specify whether the system displays summary invoice information for an invoice in the grid.

If you select this check box, the system summarizes all pay items for an invoice into a single line in the grid. The invoice amount is the total of the all pay items for the invoice. If you do not select this check box, the system displays each pay item for an invoice on an individual line in the grid.

- All, Recognized, and Not Recognized Options

-

Use these option to specify whether the system displays all, recognized, or not recognized invoice pay items.

If you select All, the system displays records with a status of 0 (Not to be recognized), 1 (Ready to be recognized), 2 (Partially recognized), or 3 (Recognition Complete) in the Revenue Recognition Status field.

If you select Recognized, the system displays records with a status of 3. If you select Not recognized, the system displays records with a status of 0, 1, or 2.

11.2.1.1 Revising Invoices in the Revenue Recognition System

Before you recognize revenue, you might want to review the invoices that are included in the revenue recognition process. Use the following guidelines for revising G/L lines on invoices in the revenue recognition process:

-

If the VAT Capture by pay item constant is on, you cannot modify G/L lines on unposted or posted invoices.

-

If the VAT Capture by pay item constant is off, you cannot modify G/L lines if the invoice is posted, but you can modify G/L lines if the invoice is unposted.

Review how the system updates tables when you revise an unposted invoice in the revenue recognition process:

-

If you change an unposted invoice by modifying, adding, or deleting invoice pay items without changing the invoice total or altering the G/L distribution lines, the system updates only the pay item records in the F03B116 table.

-

If you add or delete pay items that change the total amount of the unposted invoice and you also alter the G/L lines, the system adds or deletes records in the F03B116 and F03B117 tables and also updates the associated performance liability G/L entries in the F0911 table.

Review how the system updates tables when you revise a posted invoice in which no revenue has been recognized:

-

If you change a posted invoice by modifying, adding, or deleting invoice pay items without changing the invoice total or altering the G/L lines, the system updates only the pay item records in the F03B116 table.

-

If you change a posted invoice by modifying, adding, or deleting invoice pay items in a way that changes the invoice total, the system adds records or clears amounts in the F03B116 table. If this case, you have to create a new G/L distribution line that system stores in the F03B117 table. The system also updates the associated PLA entries in the F0911 table.

-

If you void a posted invoice pay items and the associated G/L lines, the system voids records in the F03B116 and the F03B11 table and creates reversal records in the F0911 table. The system also clears the amount and sets the reason code to V (voided) for records in the F03B117 table.

Review how the system updates tables when you revise a posted invoice in which revenue has been recognized:

-

If you add pay items and G/L lines to a partially or fully recognized invoice, the system adds records to the F03B116, F03B117, and the F0911 tables.

-

If you try to modify or void posted invoice pay items or modify G/L lines on a partially or fully recognized invoice, the system displays an error.

-

If you void an entire posted invoice which is partially or fully recognized, the system does the following:

-

For G/L lines with revenue recognized, the system clears the amount and sets the reason code to V (voided) for records in the F03B117 table.

-

For G/L lines with no revenue recognized, the system creates offset performance liability G/L entries in the F0911 table for the remaining amount.

-

11.2.1.2 Removing Invoices From the Revenue Recognition Process

In some cases, you might find that an invoice was incorrectly included in the revenue recognition process. You can use the Revenue Recognition program (P03B116) to remove an invoice from the revenue recognition process.

To remove an invoice from the revenue recognition system, select the Summarize check box in the header of the Work with Invoice Revenue Recognition form, select the invoice in the grid, and select Remove from Rec from the Row menu. This row selection is only available if you select the Summarize check box.

Use the following guidelines to determine if you can remove an invoice in the revenue recognition process:

-

You can remove an invoice from the revenue recognition process if revenue or COGS has not been recognized.

-

If you remove an invoice from the revenue recognition process, the system updates the Revenue Recognition Inclusion column in the Customer Ledger Tag table (F03B11T) with a N to specify that the invoice is not in the revenue recognition process. If the invoice is not posted, the system deletes the existing records in the F0911 table, moves the F03B117 records to the F0911 table, and deletes records in the F03B116, F03B117, F03B118, and F03B119 tables. If the invoice is posted, the system creates reversal entries for the existing records in the F0911 table, moves the F03B117 records to the F0911 table, deletes records in F03B116 and F03B117, and retains records in the F03B118 and F03B119.

-

-

You cannot remove an invoice from the revenue recognition process if any revenue or COGS amount has been recognized. This includes partial recognition of revenue on an invoice.

If you do remove an invoice from the review recognition process, you have the option to send it to the revenue recognition process again, either manually or by using the batch process.

Additional Methods for Sending Invoices to Revenue Recognition

11.2.2 Prerequisites

Before you complete the tasks in this section, you must:

-

Complete the revenue recognition setup tasks.

-

Post all invoices that you want to recognize as revenue.

-

Set processing options for the Revenue Recognition Program (P03B116). Be aware of the following:

-

The Recognize Revenue and COGS option on the Process tab is for sales order invoices only.

When this processing option is set to blank or 0 and the Summary check box is not selected, you can select Recg Rev and COGS from the Row menu on the Work with Revenue Recognition form and the system automatically displays the Recognize COGS form after you exit the Revenue Recognition form.

-

11.2.3 Setting Processing Options for the Revenue Recognition Program (P03B116)

Processing options enable you to specify the default processing for programs and reports.

11.2.3.1 Selections

- 1. Paid Pay Items

-

Use this processing option to specify the default value of the Paid check box on the Work with Revenue Recognition form. Values are:

Blank or 0: The Paid check box is not selected. The system displays all pay items.

1: The Paid check box is selected. The system displays only fully received pay items.

- 2. Posted Invoices

-

Use this processing option to specify the default value of the Posted check box on the Work with Revenue Recognition form. Values are:

Blank or 0: The Posted check box is not selected. The system displays all invoices.

1: The Posted check box is selected. The system displays only posted invoices.

- 3. Recognized Pay Items

-

Use this processing option to specify the default value of Recognition Status option on the Work with Revenue Recognition form. Values are:

Blank or 0: The All radio button is selected. The system displays all pay items.

1: The Recognized radio button is selected. The system displays only recognized pay items.

2: The Not Recognized radio button is selected. The system displays the pay items that are not recognized.

11.2.3.2 Defaults

Use these processing options to specify the default revenue recognition reason code for the following actions:

- 1. Recognize All

-

Use this processing option to specify a value from UDC table (03B/RR) that indicates the default revenue recognition reason code of an invoice pay item when you recognize all revenue on the Recognize Revenue form.

- 2. Recognize Less

-

Use this processing option to specify a value from UDC table (03B/RR) that indicates the default revenue recognition reason code of an invoice pay item when you recognize less revenue on the Recognize Revenue form.

- 3. Recognize More

-

Use this processing option to specify a value from UDC table (03B/RR) that indicates the default revenue recognition reason code of an invoice pay item when you recognize more revenue on the Recognize Revenue form.

11.2.3.3 Process

- Recognize Revenue and COGS

-

Use this processing option to specify whether the system automatically displays the Recognize COGS form after you exit the Recognize Revenue form. This processing option is applicable only for sales order invoices.

Values are:

Blank or 0: The system does not automatically display the Recognize COGS form when you exit the Recognize Revenue form.

1: The system automatically displays the Recognize COGS form when you exit the Recognize Revenue form

Note:

When this processing option is set to blank or 0 and the Summary check box is not selected, you can select Recg Rev and COGS from the Row menu on the Work with Revenue Recognition form and the system automatically displays the Recognize COGS form after you exit the Revenue Recognition form.

11.2.4 Recognizing Revenue

When recognizing revenue, you can recognize less and leave the remainder open, recognize less and close the remainder, recognize more, or recognize all revenue.

Note:

You cannot recognize revenue for a voided invoice, or remove a voided invoice from the revenue recognition process.-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

On the Work with Invoice Revenue Recognition form, select a record and click Select, or select Recognize Revenue from the Row menu.

The system displays the G/L Distribution information for the invoice pay item in the grid. If Tax Capture by Pay Item is on, the system displays the G/L distribution lines for only the selected invoice pay item in the grid.

If the invoice is a foreign invoice, both the domestic and foreign amounts will be displayed. If the invoice is a domestic invoice, only the domestic amount will be displayed. If the invoice is a foreign invoice, you enter the foreign amount.

Note that if the selected line has a schedule, you cannot manually recognize revenue for that line.

-

Review, and if necessary, select the Summarize option.

- Recognized Revenue Amount

-

When the Summarize check box is not selected, enter the amount of the invoice that will be recognized as revenue.

When the Summarize check box is selected (guided recognition), the system displays the amount of the invoice that will be recognized as revenue.

- Remaining Amount

-

This field displays the remaining amount of an invoice that can be recognized as revenue.

- Amount Not Recognized

-

When the Summarize check box is not selected, enter the amount of the invoice that will not be recognized as revenue.

When the Summarize check box is selected (guided recognition), the system displays the amount of the invoice that will not be recognized as revenue.

- Foreign Recognized Revenue Amount

-

When the Summarize check box is not selected, enter the foreign amount of the invoice that will be recognized as revenue.

When the Summarize check box is selected (guided recognition), the system displays the foreign amount of the invoice that will be recognized as revenue.

- Foreign Remaining Amount

-

This field displays the remaining foreign amount of an invoice that can be recognized as revenue.

- Foreign Amount Not Recognized

-

When the Summarize check box is not selected, enter the foreign amount of the invoice that will not be recognized as revenue.

When the Summarize check box is selected (guided recognition), the system displays the foreign amount of the invoice that will not be recognized as revenue.

-

Enter the G/L date for the revenue recognition transaction. The system uses this value as the G/L date of the invoice.

When recognizing less, recognizing more, or recognizing all revenue, you may enter values in multiple G/L lines in the grid.

If you select the G/L date in the Exchange Rate Date processing option, the system does not use the G/L date to determine the exchange rate during revenue recognition. During revenue recognition, the system uses the exchange rate that was valid when the invoice is created. Therefore, exchange rate fluctuation does not affect how you recognize revenue.

-

To recognize less revenue and leave the remainder open:

-

In the header, enter a value in the Revenue Amount field that is less than the value in the Remaining Amount field.

-

In the grid, enter the same value in the Recognized Revenue Amount field.

-

Click OK to save the invoice.

-

-

To recognize less revenue and close the remainder:

-

In the header, enter a value in the Revenue Amount field that is less than the value in the Remaining Amount field.

-

In the header, enter the value in the Amount Not Recognized field that the system displays in the Remaining Amount field.

-

In the grid, enter the same values in Recognized Revenue Amount and Amount Not Recognized fields.

-

Click OK to save the invoice.

-

-

To recognize more revenue:

-

In the header, enter a value in the Revenue Amount field that is more than the value in the Remaining Amount field.

-

In the grid, enter the same value in the Recognized Revenue Amount field.

-

Click OK to save the invoice.

-

-

To recognize all revenue:

-

In the header, enter a value in the Revenue Amount field that is equal to the value in the Remaining Amount field.

-

In the grid, enter the same value in the Recognized Revenue Amount field.

-

Click OK to save the invoice.

Note:

The system displays a value in the Revenue Rec Status field that indicates the current COGS status of an invoice pay item. Values are:0: Not to be recognized

1: Ready to be recognized

When you enter and post an invoice, the system displays 1 in this field.

2: Partially recognized

If you recognize part of the invoice amount, the system changes the value in this field to 2.

3: Recognition complete

If you recognize the full invoice amount, the system changes the value in this field to 3.

-

11.2.5 Recognizing Cost of Goods Sold (COGS)

You can recognize more, less, or all of the cost of goods sold (COGS) for a sales order invoice. Review these steps to recognize less and leave the remainder open, recognize less and close the remainder, recognize more, or recognize all COGS:

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

On the Work with Invoice Revenue Recognition form, select a record and select Recognize COGS from the Row menu.

The system displays the COGS account information for the invoice pay items in the grid. If the invoice is a foreign invoice, the system displays both the domestic and foreign amounts. If the invoice is a domestic invoice, the system displays only the domestic amount.

-

Enter the G/L date for the COGS transaction. The system uses this value as the G/L date of the invoice.

-

To recognize less COGS and leave the remainder open:

-

In the grid, enter a value in the Recognized COGS Amount field that is less than the value in the Remaining Amount field.

-

Click OK to save the sales order invoice.

-

-

To recognize less COGS and close the remainder:

-

In the grid, enter a value in the Recognized COGS Amount field that is less than the value in the Remaining Amount field.

-

In the grid, enter a value in the Amount Not Recognized field that is equal to the value in the Remaining Amount field.

-

Click OK to save the sales order invoice.

-

-

To recognize more COGS:

-

In the grid, enter a value in the Recognized COGS Amount field that is more than the value in the Remaining Amount field.

-

Click OK to save the sales order invoice.

-

-

To recognize all COGS:

-

In the grid, enter the same value in the Recognized COGS Amount field as the system displays in the Remaining Amount field.

-

Click OK to save the sales order invoice.

-

Note:

The system displays a value in the Revenue Rec Status field that indicates the current COGS status of an invoice pay item. Values are:0: Not to be recognized

1: Ready to be recognized

When you enter and post an invoice, the system displays 1 in this field.

2: Partially recognized

If you recognize part of the invoice amount, the system changes the value in this field to 2.

3: Recognition complete

If you recognize the full invoice amount, the system changes the value in this field to 3.

11.2.6 Using Blind Recognition to Recognize Revenue and COGS

You can use blind recognition to recognize all of the revenue and COGS for one or more invoices without reviewing the pay item or G/L account information. You cannot use blind recognition for an invoice if a line on that invoice has a schedule attached.

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

When you select the Summarize check box on the Work with Invoice Revenue Recognition form, you can select invoices with a combination of single and multiple pay items, and single and multiple G/L distribution lines.

-

After you select the records, select the Row menu and select Blind Recognition.

-

The system displays the Blind form. Use the Override G/L Date field to specify the G/L date the system uses when recognizing revenue and COGS for the invoice. If you leave this field blank, the system uses the original G/L date on the invoice. Use the Reason Code field to specify the reason code of a pay item. The system automatically populates the Reason Code field with the value in the Recognize All processing option, but you can change it.

-

After you complete these fields and click OK, the system recognizes revenue and COGS by using the remaining amount for each G/L Distribution line for the selected invoices.

-

The system updates the records in the F03B116 and the F03B117 tables with the appropriate amounts and the reason code. On the Work with Invoice Recognition form, the system updates the Revenue Recognition Status field to Recognition Complete. The system also sets the batch to pending or approved status.

11.2.7 Using Guided Recognition to Recognize Revenue and COGS

You can use guided recognition to recognize all revenue and COGS for one or more invoices by reviewing summarized pay item information. You cannot use guided recognition for an invoice if that invoice includes a line with a schedule attached.

-

When you select the Summarize check box on the Work with Invoice Revenue Recognition form, you can select invoices with a combination of single and multiple pay items, and single and multiple G/L distribution lines.

-

After you select the records, click the Row menu and select Guided Recognition.

-

The system displays the Recognize Revenue form populated with information for the first selected invoice. The system displays an asterisk (*) in the Pay Item field to indicate that the grid is displaying a summary of all pay items. The amount fields are populated with the sum of all of the pay items. All amount fields are disabled. You can enter values in the G/L Date field and the Reason Code fields. To review all the invoice pay item information for a selected invoice, select the Form menu and select Pay Item Details.

-

After you click OK, the system displays the information for the next invoice on the Recognize Revenue form, if you selected multiple invoices; or returns to the Work with Invoice Revenue Recognition form, if you have reviewed all of the selected invoices. The system recognizes revenue and COGS by using the remaining amount for each G/L Distribution line for the selected invoices. During the guided recognition, you can select Cancel to quit the revenue recognition.

-

The system updates the records in the F03B116 and the F03B117 tables with the appropriate amounts and the reason code. On the Work with Invoice Recognition form, the system updates the Revenue Recognition Status field to Recognition Complete. The system also sets the batch to pending or approved status.

11.2.8 Using a Schedule to Recognize Revenue (Release 9.1 Additional Update)

You can use a schedule to recognize specified portions of revenue on a pay item on different dates. When you create a schedule on a G/L distribution line on an invoice, you can:

-

Automatically split the remaining amount across a specified number of periods.

-

Manually enter schedule records.

-

Use a combination of these methods.

For example, you can automatically split the remaining amounts across a specified number of periods, and then manually update those records to reflect the distribution schedule you want to use. Alternatively, you can manually enter a record in the grid, and then split the remaining amount across a specified number of periods.

To create a schedule, you must select the Summarize option on the Work With Invoice Revenue Recognition form. Additionally, the invoice must have a remaining amount.

You cannot create a schedule if:

-

The invoice has been voided.

-

The invoice is not posted.

-

The Revenue Recognition Status code is complete.

After you have created a schedule for the invoice, you can recognize revenue by running the Revenue Recognition for Schedule program (R03B1151). After schedule records have been processed by the R03B1151 program, they no longer appear on the schedule.

To create a schedule for revenue recognition:

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

On the Work with Invoice Revenue Recognition form, select the Summarize option, and click Search.

-

Select an invoice, and then select Schedule Recognition from the Row menu.

-

On the Schedule Revenue Recognition form, select a row, and then select Add/Update Schedule from the Row menu.

-

To manually enter schedule records for the invoice, on the Revise Scheduled Revenue Recognition form, complete these fields until the Remaining Amount field in the header is blank, and then click OK:

-

Eligible for Recognition Date

The date you enter in this field must be greater than the date in the G/L Date field in the header of the form. This date is used by the R03B1151 program to determine whether the record is eligible to be included in the revenue recognition process. The date is also used as the G/L date if the G/L Date processing option in the R03B1151 is blank.

-

Scheduled Amount to Recognize

-

Recognition Reason Code (Optional)

-

-

To automatically split the remaining amount across a specified number of periods, complete these fields in the header of the Revise Scheduled Revenue Recognition form, and then click the Distribute by Period button:

-

From Date

-

Number of Periods

-

Period Begin Date or Period End Date

Select one of these options to specify whether the system uses the period begin date or the period end date as the Eligible for Recognition Date in the grid.

-

-

Verify that the Schedule Active option is selected to activate the schedule.

-

Review, delete, add, or revise the records in the grid as necessary, and then click OK to save the schedule.

The Remaining Amount field in the header must be blank, and all rows in the grid must have an Eligible for Recognition Date that is greater than the G/L Date in the header.

The system returns you to the Schedule Revenue Recognition form.

Note that you can delete all schedules attached to a line by selecting the line and then selecting Delete Schedule from the Row menu.

11.2.9 Modifying the Eligible for Recognition Date

To modify the eligible for recognition date:

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

On the Work with Invoice Revenue Recognition form, select an invoice and select Elgble for Recg Date from the Row menu.

-

Update the Eligible for Recognition Date field, and then click OK.

Edit the date that the system uses to determine if the invoice is eligible for revenue recognition. The system determines this date by adding the number of days specified in the Days From Configured Date field to the date specified in the Calculation From Date field.

This date is for informational purposes only. You can use it during the recognition process to select invoices for recognition.

11.2.10 Modifying the Effective Price

To modify the effective price:

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

On the Work with Invoice Revenue Recognition form, select an invoice and select Effective Price from the Row menu.

-

Update the Effective Price field, and then click OK.

11.3 Recognizing Revenue and Cost of Goods Sold Automatically

To automatically recognize revenue and cost of goods sold (COGS) for invoices, you can use the Revenue Recognition - Blind report (R03B116). You can use this report to recognize all of the revenue and COGS for one or more invoices.

(Release 9.1 Additional Update) To recognize revenue for invoices that have a schedule attached to them, you run the Revenue Recognition for Schedule program (R03B1151). This program processes all records that are eligible for recognition during the period specified in the processing options. After the record is processed, it no longer appears in the schedule for that invoice. After all schedule records for an invoice have been processed, the schedule is no longer attached to the invoice.

Note that you cannot create schedules for invoices generated through the Sales Order Management system, as the schedule process does not include COGS.

To select invoices for which you want the system to automatically recognize revenue, you must use data selection. When the system uses data selection to select a pay item on an invoice, the system recognizes revenue for the entire invoice.

11.3.1 Running the Revenue Recognition - Blind Report (R03B116)

Before you begin, set the processing options for this program.

From the Revenue Recognition Processing menu (G03B18), select Automatic Revenue Recognition.

11.3.2 Setting Processing Options for the Revenue Recognition - Blind Report (R03B116)

Processing options enable you to specify the default processing for programs and reports.

11.3.2.1 Default

- Override G/L Date

-

Use this processing option to specify the G/L date the system uses when recognizing revenue for the invoice. If you leave this processing option blank, the system uses the original G/L date on the invoice when recognizing revenue.

- Revenue Recognition Reason Code

-

Use this processing option to enter a value from UDC table (03B/RR) that indicates the revenue recognition reason code of an invoice pay item. Examples include:

R: Fully recognized

P: Effective price difference

N: Non revenue invoice

V: Voided invoice

11.3.3 Running the Revenue Recognition for Schedule Program (R03B1151) (Release 9.1 Additional Update)

When you run the R03B1151 program, set the Eligible for Recognition Thru Date processing option to determine which records will be processed. The system includes all records from the F03B115 table that have an Eligible for Recognition Date less than or equal to the date that you enter in this processing option.

You can run this report in proof mode to process validations and review the records that will be processed before running in final mode. After the records are processed in final mode, they no longer appear on the schedule.

Note:

If you have multiple pay items associated with a single G/L distribution line, when you run the R03B1151 program, the system will apply the amount of revenue to recognize starting with the first pay item that has an remaining amount, and will continue through the pay items in order until the specified amount of revenue is recognized.For example, you might have 3 pay items, each with a remaining amount of $500 USD. If you attempt to recognize $800 USD, the system will apply $500 USD to the first pay item, and then apply $300 USD to the second pay item when you run the R03B1151 program.

Before you begin, set the processing options for this program.

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition for Schedule.

11.4 Additional Methods for Sending Invoices to Revenue Recognition

In addition to using trigger setup to enable the system to send invoices to the revenue recognition process, you have the option to send invoices to the revenue recognition process either manually or by using a batch process.

This section discusses:

-

Manually Sending an Invoice to the Revenue Recognition Process

-

Running the Include Invoice to Revenue Recognition Report (R03B11ME)

11.4.1 Manually Sending an Invoice to the Revenue Recognition Process

You can send an invoice to the revenue recognition process using the Customer Ledger Inquiry program (P03B2002).

Note:

You can only select A/R invoices for this process; not Sales Order, Contract Billing, or Service Billing invoices.-

From the Customer Invoice Entry menu (G03B11), select Standard Invoice Entry or Customer Ledger Inquiry.

-

On the Work With Customer Ledger Inquiry form, Select an invoice and then select Rev Rec Manual Entry from the Row menu.

-

Complete these fields and click OK:

- G/L Date

-

The system displays the G/L date of the invoice you selected on the Work with Customer Invoice Inquiry form. You can optionally edit this date before you send the invoice to the revenue recognition process. This is the date the system uses as the G/L date for the invoice when you recognize revenue.

- Eligible for Recognition Date

-

Enter the date that the system uses to determine if an invoice is eligible for revenue recognition. The system determines this date by adding the number of days specified in the Days From Configured Date field to the date specified in the Calculation From Date field.

You must enter a value in this field to manually send an invoice to the revenue recognition process.

11.4.2 Running the Include Invoice to Revenue Recognition Report (R03B11ME)

Use the Include Invoice to Revenue Recognition batch process (R03B11ME) to send batches of invoices to the revenue recognition process, regardless of the trigger configuration setup. The system creates a report that lists all invoices that were successfully processed and those that contain errors.

Before you begin, set the processing options for this program.

Note:

You can only select A/R invoices for this process; not Sales Order, Contract Billing, or Service Billing invoices.From the Customer Invoice Entry menu (G03B11), select Manual Revenue Recognition.

11.4.3 Setting Processing Options for Include Invoice to Revenue Recognition Report (R03B11ME)

Processing options enable you to specify the default processing for programs and reports.

11.4.3.1 Default

Use these processing options to specify default values.

- Eligible for Recognition Date

-

Use this processing option to specify an eligible for revenue recognition date. If you do not specify a date, the system uses the invoice date.

- G/L Date for Revenue Recognition Lines

-

Use this processing option to specify the date that the system uses as G/L date when recognizing revenue for an invoice.

If you leave this field blank, the system uses the G/L date from the invoice as the G/L date on the revenue recognition lines.

11.5 Reversing Revenue Recognition

Use the Revenue Recognition program (P03B116) to reverse the revenue recognition on an invoice in the revenue recognition process. You can reverse recognition on all types of recognition; recognize less and leave remainder open, recognize less and close the remainder, recognize more, and recognize all.

Review how the system updates tables when you reverse recognition for an invoice:

-

In the F03B116 table, the system resets the values in the following fields of the relevant records: domestic or foreign revenue recognition amounts, remaining amounts, and amounts not recognized, and revenue recognition status.

-

If the invoice recognition is not posted, the system deletes the revenue and COGS G/L entries that were generated by the original recognition process from the F0911 table. The system also deletes the F0911 entries that cleared the PLA, PLA Adjustment, COGS PLA, and COGS PLA Adjustment G/L entries created during the recognition process.

-

If the invoice recognition is posted, the system voids the revenue and COGS G/L entries that were generated by the original recognition process from the F0911 table. The system also voids the F0911 entries that cleared the PLA, PLA Adjustment, COGS PLA, and COGS PLA Adjustment G/L entries created during the recognition process.

-

The system removes relevant records from the F03B117 table.

-

If any lines on the invoice included a schedule, the system removes records from the F03B115 table.

11.5.1 Reversing Revenue Recognition

To reverse revenue recognition:

-

From the Revenue Recognition Processing menu (G03B18), select Revenue Recognition.

-

Select the Summarize check box on the Work with Invoice Revenue Recognition form, select a record, and then select Reverse Recognition from the Row menu.

The system displays the document number, type, and company.

-

Update the Void G/L Date field, and then click OK.

Enter a date that specifies the financial period to which the voided transaction is to be posted.

11.6 Auditing Revenue Recognition Invoices (Release 9.1 Update)

During the revenue recognition process, you may have to review audit information for invoices, including actions such as updates, deletes, revenue recognition on the invoices.

Use the Revenue Recognition Invoice Audit program (P03B118) to review audit records from the Revenue Recognition Invoice Audit table (F03B118) and the Customer Ledger table (F03B11) for invoices in the revenue recognition process. Use the Revenue Recognition G/L Audit program (P03B119) to review G/L audit records in the Revenue Recognition G/L Information Audit table (F03B119) and the Account Ledger table (F0911) for invoices in the revenue recognition process.

From both the P03B118 and P03B119 programs, you can use the Row exit to navigate to the Revenue Recognition program (P03B116).

11.6.1 Forms Used to Audit Revenue Recognition Invoices

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Invoice Revenue Recognition Audit | W03B118A | Revenue Recognition Processing (G03B18), Revenue Recognition Invoice Audit | Review invoice information for invoices in the revenue recognition process. |

| Work with Revenue Recognition G/L Audit | W03B119A | Revenue Recognition Processing (G03B18), Revenue Recognition G/L Audit | Review G/L information for invoices in the revenue recognition process. |