10 Setting Up Your System for Withholding for the Sale of Services in Brazil

|

Important: (Release 9.1 Update) Law No. 13,137 / 2015, published on June 22, 2015, amended the regulations for withholding calculations and amounts on the sale of services. Oracle does not provide a legal opinion about which organizations must calculate and withhold taxes and contributions using the new regulations. You must determine whether to use the newer withholding calculation method. |

This chapter contains the following topics:

-

Section 10.1, "Setting Up UDCs for Withholding for the Sale of Services"

-

Section 10.2, "Specifying the PIS, COFINS, and CSLL Minimum Withholding Method (Release 9.1 Update)"

-

Section 10.3, "Setting Up Withholding Concepts and ISS Exemptions for the Sale of Services"

-

Section 10.4, "Setting Up Minimum Amounts for Withholding for the Sale of Services"

10.1 Setting Up UDCs for Withholding for the Sale of Services

Before you set up and process withholding for the sale of services, set up the UDC tables described in this section, and the UDC tables described in Section 3.2.1, "Setting Up UDCs for Supplier Withholding for Brazil".

10.1.1 Date for PIS/COFINS/CSLL WH (76B/DW) (Release 9.1 Update)

The JD Edwards EnterpriseOne system provides hard-coded values for this UDC table. You use the values in this UDC in the Withholding Taxes on Services - Calculation Method program (P76B220) to specify which date to use for PIS, COFINS, and CSLL tax calculations for the sale of services. Values are:

-

DD: Due date.

-

ID: Invoice date.

See Setting Up the Withholding Calculation Date for the Sale of Services (Release 9.1 Update)

10.1.2 Government Entities (76B/GE)

The system uses the values in this UDC table to determine whether a company is a government entity. Withholding for the sale of services does not apply to government entities. Set up this UDC table with the code that you use to identify government entities in the Person/Corporation Code field in the Address Book Revision program.

10.1.3 Method (76B/MH) (Release 9.1 Update)

The system provides hard-coded values for this UDC table. You select a value from this UDC table when you specify the method to use in the P76B410 program. Values are:

1: By payment /Fiscal Note

2: By monthly accumulation

10.1.4 Withholding Transaction Source (76B/TS) (Release 9.1 Update)

The system provides hard-coded values for this UDC table. You select a value from this UDC table when you specify the transaction type in the PIS-COFINS-CSLL Minimum Withholding Setup (P76B410) program. Values are:

1: Sale

2: Purchase

10.1.5 Transaction Nature Items (76B/TT)

The system uses the values in this UDC table to determine whether a transaction nature code applies to goods or services. You set up values in this UDC table for goods. When you run the Generate Nota Fiscal - Brazil program (R76558B), the system uses the values in UDC 76B/TT to determine if a line on a sales order is for goods or services. If the transaction nature code is set up in the 76B/TT UDC table, the system processes the line as the sale of a good, and does not apply ISS withholding. If the transaction nature code does not appear in the 76B/TT UDC table, the system processes the line as the sale of a service and applies ISS withholding.

10.1.6 Doc. Types Unaffected Withhold (76B/UW) (Release 9.1 Update)

Set up this UDC table with the document types for transaction for which withholding does not apply. For example, if you use document type GO for sales to the federal government, and those sales transactions are not subject to withholding, enter GO as a code in this UDC.

10.2 Specifying the PIS, COFINS, and CSLL Minimum Withholding Method (Release 9.1 Update)

This section provides an overview of the PIS-COFINS-CSLL Minimum Withholding Setup program (P76B410) and discusses how to specify the withholding method for PIS, COFINS, and CSLL minimum withholdings.

10.2.1 Understanding the PIS-COFINS-CSLL Minimum Withholding Setup Program

You use the PIS-COFINS-CSLL Minimum Withholding Setup program to specify which withholding method to use as the basis for including lines for PIS, COFINS, and CSLL withholding on the nota fiscal.

When you process notas fiscais, the system uses the transaction nature code in the nota fiscal to determine if the transaction is for the sale or purchase of a service, and then uses the withholding method set up in the PIS-COFINS-CSLL Minimum Withholding Setup program to determine how to calculate the withholding amounts and when to write the withholding amounts to the nota fiscal. The system uses the setup in the PIS-COFINS-CSLL Minimum Withholding Setup program for only the transactions nature codes that you set up in the program. If a record is not set up in the PIS-COFINS-CSLL Minimum Withholding Setup program for a transaction nature code, then the system uses the withholding process described in this guide as Withholding Method 2.

Withholding Method 1 causes the system to use the sum of the PIS, COFINS, and CSLL withholding for a nota fiscal or payment as the basis for determining whether to write lines for the withholding on the nota fiscal. If you select this method, you must provide a minimum amount.

Withholding Method 2 causes the system to use the accumulated nota fiscal amounts for a month as a basis for determining whether to write lines for the withholding on the nota fiscal. If you select this method, you do not provide a minimum amount in the PIS-COFINS-CSLL Minimum Withholding Setup program. Instead, the system uses as a basis the accumulated amounts for each company/supplier combination from the Minimum Amount to Withhold table (F76B422).

Most of the transactions for which you generate a nota fiscal are sales transactions. However, you might occasionally need to generate a nota fiscal for a purchase, such as when a foreign supplier is not set up to generate the nota fiscal for the services that they sell to you.

10.2.2 Forms Used to Specify the Withholding Method for PIS, COFINS, and CSLL Withholding

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| PIS-COFINS-CSLL Minimum Withholding Setup Revision | W76B410B | SO Withholding Setup (G76B4231), PIS-COFINS-CSLL Minimum Withholding Setup

Click Add on the Work with PIS-COFINS-CSLL Minimum Withholding Setup form. |

Add or modify records for the withholding method. |

| Tax ID by Address Number | W76B410C | Click the Visual Assist icon in the Company ID or Third Party ID field on the PIS-COFINS-CSLL Minimum Withholding Setup Revision form. | Search for a company or supplier tax ID number by the address book number. |

10.2.3 Specifying the Withholding Method for PIS, COFINS, and CSLL Withholding

Access the PIS-COFINS-CSLL Minimum Withholding Setup Revision form.

- Withholding Transaction Source

-

A value from UDC 76B/TS (Transaction Source) that specifies if the setup is for sales or purchase transactions. Valid values are:

1: Sale

2: Purchase

- Company ID

-

The first 9 digits of the company's tax ID. The PIS-COFINS-CSLL Minimum Withholding Setup program provides the Tax ID by Address Number form to use to look up the tax ID using the company's address book number. You access the Tax ID by Address Number form by clicking the Visual Assist icon for the Company ID field.

If you do not complete this field, the system applies the setup to all companies.

- Third Party ID

-

The first 9 digits of the seller's tax ID. The PIS-COFINS-CSLL Minimum Withholding Setup program provides the Tax ID by Address Number form to use to look up the tax ID using the company's address book number. You access the Tax ID by Address Number form by clicking the Visual Assist icon for the Third Party ID field.

You complete this field only when the value in the Withholding Transaction Field is 1 (Purchase).

- Method

-

A value from UDC 76B/MH (Method) that indicates the withholding method to use. Values are:

1: By payment/Fiscal Note.

2: By monthly accumulation.

Withholding Method 1 causes the system to use the sum of the PIS, COFINS, and CSLL withholding for a nota fiscal or payment as the basis for determining whether to write lines for the withholding on the nota fiscal. If you select this method, you must provide a value in the Minimum Amount field.

Withholding Method 2 causes the system to use the accumulated nota fiscal amounts for the month as a basis for determining whether to write lines for the withholding on the nota fiscal. If you select this method, you do not provide a minimum amount in the PIS-COFINS-CSLL Minimum Withholding Setup program. Instead, you set up the minimum in the Minimum Monthly Basis Amount to withhold program (P76B422). The system uses the accumulated amounts for each company/supplier combination from the Minimum Amount to Withhold table (F76B422) as the basis for the withholding calculations.

- Minimum Amount

-

Specify the combined amount of PIS, COFINS, and CSLL withholding to use as the minimum amount for which the system generates withholding lines on the nota fiscal for PIS, COFINS, and CSLL.

For example, if you specify 10.00 in this field, and the calculated total of the PIS, COFINS, and CSLL for the nota fiscal or payment is 9.3, then the system does not write lines on the nota fiscal for the PIS, COFINS, and CSLL withholding. If you specify 10.00 and the total of the PIS, COFINS, and CSLL withholding is 10.5, then the system writes line on the nota fiscal for each of the withholding types.

Zero (0) is a valid value for this field. However, if you enter 0, the system issues a warning message. You can clear the message and leave the value as 0 if you choose to use 0 as the value.

- Effective Date

-

The date on which the system begins to use the record.

10.3 Setting Up Withholding Concepts and ISS Exemptions for the Sale of Services

This section provides an overview of withholding concepts and ISS exemptions for the sale of services and discusses how to:

-

Set up withholding concepts for the sale of services.

-

Specify exemptions to ISS withholding.

10.3.1 Understanding Withholding Concepts and ISS Exemptions for the Sale of Services

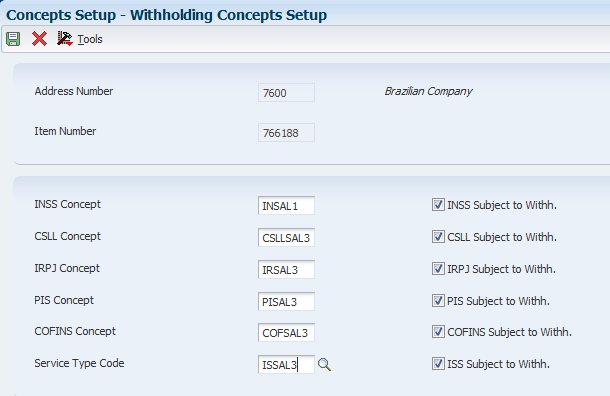

You use the Withholding Concepts Setup - BR program (P76B421) to associate tax type codes with an address book record or item, and to specify whether to calculate withholding for the withholding type. The association with the tax type and the flag to indicate whether to calculate withholding is stored as the withholding concept in the Withholding Concepts Setup table (F76B421).

You can set up records for concepts by address book number or by item number; or by both the address book number and item number. At minimum, you must specify either the address book number or the item number. When you enter sales orders, the system uses the values that you set up in the Withholding Concepts Setup - BR program as default values for the withholding concepts to associate with the sales order. The system compares the company address book number and the item number from the sales order to the values in the F76B421 table. If a value exists for the combination of the address book number and item number, the system uses that value as a default value for the withholding information to associate with the sales order record. If the system does not find the combination of company address book number and item number in the F76B421 table, it looks for the item number. If it does not find the item number, it looks for the company address book record. If none of these values exist in the F76B421 table, the system does not provide a default value.

You must select the option to indicate that a withholding type applies to the record that you set up before the system enables the field in which you enter the tax type code. For example, the INSS Concept field is not enabled unless you first select the INSS Subject to Withh. field.

When you run the Generate Nota Fiscal program (R76558B) to calculate the withholding amounts, the system uses the withholding concept that you set up in the Withholding Concepts Setup - BR program to access the tax type information that you set up in the Review A/P Tax Code, Address Book Additional Information - Brazil, and Services ISS Exempt programs. The records include the percentages that the system uses to calculate withholding amounts.

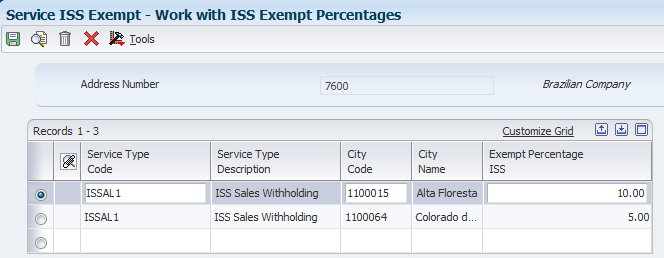

10.3.1.1 ISS Exemptions

Some companies might be exempt from paying ISS contributions for specific services in specific cities. You can set up an exempt percentage for a specified city/service combination in the Services ISS Exempt program (P76B106). The system saves the exemption information to the Services ISS Exempt table (F76B106) and uses the information when you calculate ISS for notas fiscais that you send to customers for the services that you sell. The system applies the exemption to each sales order line that has the same city/service combination.

10.3.2 Forms Used to Set Up Withholding Concepts and ISS Exemptions for the Sale of Services

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Withholding Concepts Setup | W76B421A | SO Withholding Setup (G76B4231), Concepts Setup | Review and select existing records. |

| Withholding Concepts Setup | W76B421B | Click Add on the Work With Withholding Concepts Setup form. | Specify which withholding taxes apply to a company or item and associate a tax type from the F76B0401 or F76B101 table to the address book record or item number. |

| Work with ISS Exempt Percentages | W76B106A | ISS Withholding Setup (G76B41A), Service ISS Exempt | Specify the exempt percentage for each city and service combination. |

10.3.3 Setting Up Withholding Concepts for the Sale of Services

Access the Withholding Concepts Setup form.

- Address Number

-

Enter the company address book number to which the tax types apply. Leave this field blank to associate only an item number to the withholding type.

Note:

You can set up the withholding concepts by only the company, by only the item number, or by both the company and item number. Enter values in both the Address Number and Item Number fields to associate the withholding to the combination of the address book and item number. Either the Address Number or Item Number field must be completed. At a minimum, you must complete either the Address Number or Item Number field. - Item Number

-

Enter the short item number of the service for which the withholding tax applies. Leave this field blank to associate only a company address book record to the withholding type.

Note:

You can set up the withholding concepts by only the company, by only the item number, or by both the company and item number. Enter values in both the Address Number and Item Number fields to associate the withholding to the combination of the address book and item number. At a minimum, you must complete either the Address Number or Item Number field. - INSS Concept

-

Enter a tax type code that exists in the F76B0401 table for INSS retention. You set up tax code types in the Review A/P Tax Code program. You must select the INSS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- INSS Subject to Withh. (INSS subject to withholding)

-

Select this option to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the INSS Concept field.

- CSLL Concept

-

Enter a tax type code that exists in the F76B0401 for CSLL retention. You set up tax code types in the Review A/P Tax Code program. You must select the CSLL Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- CSLL Subject to Withh. (CSLL subject to withholding)

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the CSLL Concept field.

- IRPJ Concept

-

Enter a tax type code that exists in the F76B0401 for IRPJ retention. You set up tax code types in the Review A/P Tax Code program. You must select the IRPJ Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- IRPJ Subject to Withh. (IRPJ subject to withholding)

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the IRPJ Concept field.

- PIS Concept

-

Enter a tax type code that exists in the F76B0401 for PIS retention. You set up tax code types in the Review A/P Tax Code program. You must select the PIS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- PIS Subject to Withh. (PIS subject to withholding)

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the PIS Concept field.

- COFINS Concept

-

Enter a tax type code that exists in the F76B0401 for COFINS retention that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the COFINS Subject to Withh. option before you can enter a value in this field. The system uses the value that you set up as a default value when you enter sales orders for services.

- COFINS Subject to Withh. (COFINS subject to withholding)

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the COFINS Concept field.

- Service Type Code

-

Enter a tax type code for ISS that exists in the Taxes Setup by City and Service table (F76B409). You set up service type codes in the Taxes Setup by City & Service program (P76B409). You must select the ISS Subject to Withh. option before you can enter a value in this field.

- ISS Subject to Withh. (ISS subject to withholding)

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the Service Type Code field.

10.3.4 Specifying Exemptions to ISS Withholding

Access the Work with ISS Exempt Percentages form.

Figure 10-2 Work with ISS Exempt Percentages

Description of ''Figure 10-2 Work with ISS Exempt Percentages''

- Service Type Code

-

Enter a value from the Service Type Code table (F76B408) to specify the type of service that is fully or partially exempt from ISS withholding.

- City Code

-

Enter a value that exists in the Fiscal City Code (76B/FC) UDC table to specify the city for which ISS withholding is exempt.

- Exempt Percentage ISS

-

Enter the percentage of the amount of the sales order line that is exempt from ISS withholding. The system applies this percentage to each sales order line that has the service type code and city code specified on this form.

10.4 Setting Up Minimum Amounts for Withholding for the Sale of Services

This section provides an overview of minimum amounts for withholding for the sale of services and discusses how to set up minimum amounts for withholding.

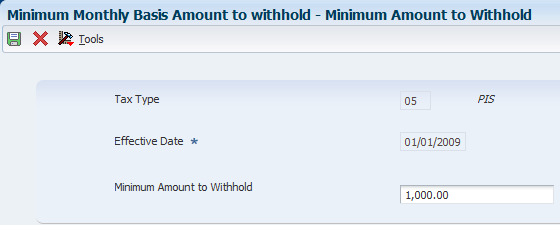

10.4.1 Understanding Minimum Amounts for Withholding for the Sale of Services

|

Note: You complete the setup in the Minimum Monthly Basis Amount to withhold program (P76B422) for only Withholding Method 2 (by monthly payment). (Release 9.1 Update) |

You do not need to calculate withholding for PIS, COFINS, or CSLL until the total of services sold to a customer within a month exceeds a specified amount. You use the Minimum Monthly Basis Amount to withhold program (P76B422) to set up the minimum amounts on which withholding is calculated for each withholding type. The system saves the values that you enter to the Minimum Amount to Withhold table (F76B422) and uses the values when you use the Generate Nota Fiscal program (R76558B) to calculate withholding amounts.

10.4.2 Forms Used to Set Up Minimum Amounts for Withholding

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Minimum Amount to Withhold | W76B422A | SO Withholding Setup (G76B4231), Minimum Monthly Basis Amount to withhold | Review and select existing records. |

| Minimum Amount to Withhold | W76B422B | Click Add on the Work With Minimum Amount to Withhold form. | Specify the minimum amount and effective date for PIS, COFINS, and CSLL withholding types. |

10.4.3 Setting Up Minimum Amounts for Withholding

Access the Minimum Amount to Withhold form.

- Tax Type

-

Enter a value from the Tax Code A/P (76B/TR) UDC table to specify the tax type of the withholding amount.

- Effective Date

-

Enter the date on which the withholding minimum amount is effective.

- Minimum Amount

-

Enter the minimum accumulated amount on which the system calculates withholding. The system does not calculate the withholding unless the withholding concept is set up to require withholding and the accumulated amount of sales orders for the services sold to a specific customer in a month exceeds the amount in this field.

10.5 Setting Up the Withholding Calculation Date for the Sale of Services (Release 9.1 Update)

This section provides an overview of withholding calculation date for the sale of services and discusses how to set up withholding calculation dates for the sale of services.

10.5.1 Understanding the Withholding Calculation Date for the Sale of Services

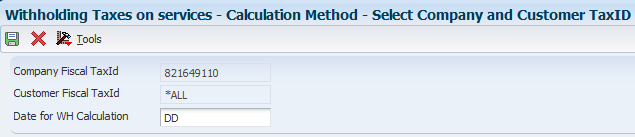

When you have the JD Edwards EnterpriseOne software for Brazil calculate withholdings on the sale of services for PIS, COFINS, and CSLL, you might need to calculate the withholding based on different payment dates. For example, if you set up the sale of a service to be paid in installments, your customer might need to pay you a portion of a payment in several different months.

You use the Withholding Taxes on Services - Calculation Method program (P76B220) to specify whether the system calculates the withholding amounts based on the month of the invoice or the month of the payment due date. The system uses the due date setup when it calculates PIS, COFINS, and CSLL withholding. If you do not set up a record for a company/customer combination, then the system bases the withholding calculation on the invoice date.

You can use the value *ALL in the Company Fiscal TaxId field, in the Customer Fiscal TaxId field, or both the Company Fiscal TaxId and Customer Fiscal TaxId fields to have the system use the invoice date or due date for all companies, customers, or for all company/customer combinations. The system saves the records that you set up to the WH Calculation Method by CO, C table (F76B220).

10.5.2 Forms Used to Set Up Withholding Calculation Dates for the Sales of Services

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Calculation Method – PIS/COFINS/CSLL | W76B220A | SO Withholding Setup (G76B4231), Withholding Taxes on Services - Calculation Method | Review existing records. |

| Select Company and Customer Tax ID | W76B220B | Click Add on the Work with Calculation Method – PIS/COFINS/CSLL form. | Specify the date code for a combination of company and customer. |

10.5.3 Setting Up Withholding Calculation Dates for the Sale of Services

Access the Select Company and Customer Tax ID form.

Figure 10-4 Select Company and Customer Tax ID form

Description of ''Figure 10-4 Select Company and Customer Tax ID form''

- Company Fiscal Tax Id

-

Enter the first 9 digits of the fiscal ID of the company. You can use the visual assist for this field to look up the fiscal ID by the company address book number and the system will retrieve the first 9 digits.

- Customer Fiscal Tax Id

-

Enter the first 9 digits of the fiscal ID of the customer. You can use the visual assist for this field to look up the fiscal ID by the customer address book number and the system will retrieve the first 9 digits.

- Date for WH Calculation

-

Enter a value from UDC 76B/DW to specify whether to calculate withholding amounts based on the invoice date or the due date. Values are:

DD: Due date

ID: Invoice date