18 Working with Sales Orders and Notas Fiscais with Withholding for Services Sold (Release 9.1 Update)

|

Important (Release 9.1 Update): Law No. 13,137 / 2015, published on June 22, 2015, amended the regulations for withholding tax calculations and payment on the sale of services. The amended regulations requires the withholding to be paid when the total of the Programa de Integração Social (PIS), Contribuição para Financiamento da Seguridade Social (COFINS), and Contribuição Social sobre o Lucro Líquido (CSLL) amounts exceed the established minimum. In the JD Edwards EnterpriseOne software, the calculation and payment based on the tax amounts per payment is referred to as Withholding Method 1.Prior to the amended legislation, the JD Edwards EnterpriseOne system provided a method of accumulating and paying withholding amounts for the sale of services based on the accumulated amount of the payments in a month for services sold. In the JD Edwards EnterpriseOne system, the calculation and payment based on the accumulated services-sold payments is referred to as Withholding Method 2. If you set up and used the withholding solution for the sale of services prior to the software update that introduced the payments based on the withholding amounts (Method 1), your system is likely set up to use the accumulated monthly payment amounts method (Method 2) to calculate and process withholding on services sold. The system enables you to continue using the accumulated payment amounts method. Oracle does not provide a legal opinion about which organizations must calculate and withhold taxes and contributions using the new regulations that base the withholding on the tax amounts. You must determine which withholding calculation method to use. |

|

Important: If you used the JD Edwards EnterpriseOne software for Brazil prior to the enhancement that enables you to set up the withholding calculation on services sold based on the invoice date or the due date, then you must run the R8976427 table conversion program to move existing records for PIS, COFINS, and CSLL in the Service Nota Fiscal Withholding Amounts by Formula table (F76B427) table to the Service Nota Fiscal Wh by Formula Installment table (F76B429). You run the conversion program once only. See Appendix G, "Table Conversion for Sale of Services Withholding" |

This chapter contains the following topics:

-

Section 18.1, "Understanding Withholding for the Sale of Services."

-

Section 18.2, "Entering Withholding Information in Sales Orders for Services"

-

Section 18.3, "Working with Notas Fiscais for the Sale of Services"

18.1 Understanding Withholding for the Sale of Services

When you sell goods and services, you prepare and send to your customers a nota fiscal for the goods or services. The nota fiscal includes information about the transaction, including the taxes applied to the transaction.

When you sell services to a customer, you must include lines on the nota fiscal for the supplier withholding taxes that are applied to the services that you sell. These withholding amounts are withheld from the payment that the customer makes to you. The system calculates withholding amounts for these withholding types:

-

Imposto de Renda de Pessoa Jurídicais (IRPJ)

-

Instituto Nacional do Seguro Social (INSS)

-

Imposto sobre Serviços (ISS)

-

Programa de Integração Social (PIS)

-

Contribuição para Financiamento da Seguridade Social (COFINS)

-

Contribuição Social sobre o Lucro Líquido (CSLL)

The JD Edwards EnterpriseOne applications that you use to enter sales order and nota fiscal information and to generate notas fiscais enable you to calculate withholding and include the withholding lines on the nota fiscal that you send to your customer. You can provide the withholding amounts on the service notas fiscais that you generate from the sales order process, and when you create a stand-alone nota fiscal.

When you enter a sales order for a service that you sell, the system enables you to enter withholding concepts for the sales order. The system uses the concepts to obtain the information needed to calculate the withholding amounts when you generate the nota fiscal. When you print the nota fiscal, the system retrieves the calculated amounts and includes them on the nota fiscal. If you need to modify the nota fiscal or void it, the system accesses the stored withholding information and updates it to include the changes.

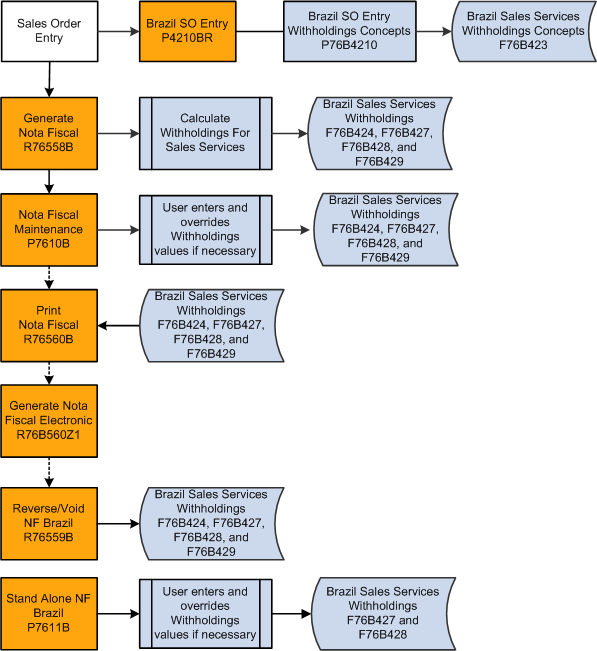

This process flow shows the programs that you use to process notas fiscais and work with withholding for the sale of services:

Figure 18-1 Programs Used for Sales of Services

Description of ''Figure 18-1 Programs Used for Sales of Services''

18.1.1 Understanding Withholding Based on the Withholding Amounts per Payment (Withholding Method 1) (Release 9.1 Update)

When you set up a company to use the withholding amounts per payment as the basis of determining when PIS, COFINS, and CSLL must be paid, the system uses the value in the PCC Minimum Withholding table (F76B410) to determine the minimum amount of withholding that will cause the system to write lines for PIS, COFINS, and CSLL on the nota fiscal. You set up the minium withholding in the PIS-COFINS-CSLL Minimum Withholding Setup program (P76B410).

|

Note: In addition to setting up with withholding minimum by company in the PIS-COFINS-CSLL Minimum Withholding Setup program, you must complete all of the setup to process supplier withholding.See Chapter 3, "Setting Up Localizations for Brazil" Chapter 8, "Setting Up Supplier Withholding for Brazil" Chapter 10, "Setting Up Your System for Withholding for the Sale of Services in Brazil" If you are changing from using Withholding Method 2 to using Withholding Method 1, be sure to review all of your existing setup for processing supplier withholding before using Withholding Method 1. |

When you run the Generate Nota Fiscal program (R76558B), the system reads the set up in the F76B410 table as well as the other tables used for the nota fiscal generation process. The system calculates the withholding amounts for PIS, COFINS, and CSLL, but does not write the amounts to the Sales Order Detail File (F4211) or to the nota fiscal unless the sum of the PIS, COFINS, and CSLL withholdings exceed the minimum amount set up.

In some cases, the system calculates the withholding differently when you your system is set up to process by payment due date instead of by invoice date.

See Section 18.1.3, "Understanding Withholding by Due Date or Invoice Date (Release 9.1 Update)."

18.1.2 Understanding the Minimum Monthly Basis Amount for PIS, COFINS, and CSLL Withholding (Withholding Method 2)

|

Note (Release 9.1 Update): The system uses the process described in this section when you set up a company to use Withholding Method 2 in the PIS-COFINS-CSLL Minimum Withholding Setup program. |

Before it calculates withholding amounts for PIS, COFINS, and CSLL, the system verifies that the accumulated basis amount for all service notas fiscais for a customer within the month exceed the minimum amount that you set up in the Minimum Monthly Basis Amount to withhold program (P76B422). The system first determines the basis amount for the current nota fiscal, adds that amount to the accumulated amount that exists in the Service Nota Fiscal Accumulated Withholding table (F76B424), and then accesses the Minimum Amount to Withhold table (F76B422) to retrieve the minimum amount on which the withholding applies.

18.1.2.1 Basis Amount

When you save the sales order for the services sold, the system creates a record in the Nota Fiscal Detail - Brazil table (F7611B). The system uses that record to determine the basis amount that it uses to determine if the current nota fiscal plus the accumulated nota fiscal amount for the month exceeds the minimum monthly basis amount that you set up on the Minimum Monthly Basis Amount to withhold program.

To determine the basis amount, the system adds or subtracts from the value of the service sold the values for each of these items in the sales order record in the F7611B table:

-

Adds IPI (Imposto sobre Produtos Industrializados) tax.

-

Adds ICMS substitution (Imposto sobre Circulaço de Mercadorias e Serviços Substituto).

-

Adds nota fiscal freight.

-

Adds nota fiscal insurance.

-

Adds nota fiscal financial expenses.

-

Subtracts nota fiscal discount.

-

Subtracts ICMS repasse discount.

-

Subtracts ICMS free port zone discount.

18.1.2.2 Example of Withholding and Accumulated Amounts

As you process notas fiscais for services sold to a customer within a month, the system saves the accumulated basis amount of the notas fiscais to the Service Nota Fiscal Accumulated Withholding table (F76B424). The system also saves the calculated withholding amounts for each tax type for the month to the F76B424 table. When the accumulated basis amount, including the amount of the current nota fiscal, exceeds the minimum basis amount for the tax type, the system begins calculating withholding amounts for the current and subsequent notas fiscais. The first nota fiscal that causes the minimum basis amount to be exceeded includes the calculated withholding amount for the entire accumulated amount. The system accumulates the amounts by legal company and customer.

|

Note: If you set up the Withholding Taxes on Services - Calculation Method program (P76B220) to calculate withholding amounts based on the payment due date instead of the invoice date, the system adds to the amounts in the F76B424 table by month. For example, if you process a nota fiscal that includes payments due in January, February, and March, then the system accumulates amounts for each month. |

For example, suppose that:

-

You set up the minimum basis amount for PIS at 10,000 Brazilian reais (BRL).

-

The total of the basis amount for the first three notas fiscais that you process does not exceed 10,000 BRL.

-

The fourth nota fiscal that you process for the month brings the total of the accumulated basis amount to 12,000 BRL.

-

(Release 9.1 Update) The company fiscal ID and customer fiscal ID in the Withholding Taxes on Services - Calculation Method program are set up to calculate withholding based on the invoice date, or no setup exists in the Withholding Taxes on Services - Calculation Method program and the system uses the default calculation method, which is invoice date.

In this example, the system would calculate and include on the fourth nota fiscal a withholding amount for the entire 12,000 BRL. Subsequent notas fiscais would include a withholding amount that is calculated based on the basis amount of that single nota fiscal.

If you delete or void a nota fiscal, the system adjusts the tax basis amount in the F76B424 table, nota fiscal withholding amounts for PIS, COFINS, and CSLL in the F76B429 table, and nota fiscal withholding amounts for IR, INSS, and ISS in the F76B427 table.

This table shows how the accumulated basis amount in the F76B424 table and the PIS withholding amounts are maintained in the F76B429 table for a minimum basis amount of 10,000 BRL:

| Nota Fiscal (NF) Number | NF Total Amount | PIS Rate | NF Withholding Amount | NF Total Accumulated Amount | NF Withholding Accumulated Amount |

|---|---|---|---|---|---|

| 1 | 1000 | 10% | 0 | 1000 | 0 |

| 2 | 1000 | 20% | 0 | 2000 | 0 |

| 3 | 2000 | 10% | 0 | 4000 | 0 |

| 4 | 8000 | 10% | 1200 | 12000 | 1200 |

| 5 | 1000 | 10% | 100 | 13000 | 1300 |

| 6 | 1000 | 10% | 100 | 14000 | 1400 |

| 7 | 1000 | 20% | 1600

Note: User mistakenly enters 1600 instead of 200. |

15000 | 3000 |

| 8 | 1000 | 20% | 200 | 16000 | 3200 |

| 9 | 1000 | 10% | -1300

Note: User nets –1400 for NF 7 to correct amount and +100 for NF 9. |

17000 | 1900 |

| Delete NF 4, 5, and 6 | 7000

Note: 10,000 deleted from accumulated amount. Accumulated amount is now below minimum. |

500

Note: 1400 deleted from accumulated withholding amount. |

|||

| Delete NF 2 | 6000 | 500

Note: No withholding was calculated for NF 2, so the accumulated amount does not change. |

|||

| 10 | 1000 | 10% | 0 | 7000 | 500 |

| 11 | 1000 | 10% | 0 | 8000 | 500 |

| 12 | 20000 | 10% | 2800

Note: 10% of the accumulated amount (28000) is calculated. |

28000 | 3200 |

18.1.3 Understanding Withholding by Due Date or Invoice Date (Release 9.1 Update)

You can use the Withholding Taxes on Services - Calculation Method program (P76B220) to specify whether to have the system use the invoice date or payment due date when it calculates the withholding for PIS, COFINS, and CSLL. You can set up the preference for using the invoice date or payment due date for both Withholding Method 1 and Withholding Method 2. You might use this setup if you invoice a customer on one nota fiscal for multiple payments, such as installment payments. If you do not set up a record for a company fiscal ID and customer fiscal ID combination, then the system uses the invoice date as the date of the calculations.

See Setting Up the Withholding Calculation Date for the Sale of Services (Release 9.1 Update)

The system uses the setup when you run the Generate Nota Fiscal program (R76558B). The Generate Nota Fiscal program writes data for the PIS, COFINS, and CSLL withholding to the Service Nota Fiscal Wh by Formula Installment table (F76B429). The F76B429 table includes by installment the tax type, tax concept, basis amount, tax rate, withholding amount, and calculation date for notas fiscais that have PIS, COFINS, or CSLL withholdings.

After you generate the nota fiscal, you can modify withholding amounts if necessary.

See Working with Notas Fiscais for the Sale of Services.

18.1.3.1 Example of Withholding by Payment Due Date for Withholding Method 1 (Release 9.1 Update)

Suppose that you have set up the following criteria for calculating PIS, COFINS, and CSLL withholdings:

-

The company is set up to calculate the withholding amounts based on the month of the payment in the Withholding Taxes on Services - Calculation Method program (P76B220).

-

The company is set up to use Withholding Method 1 in the PIS-COFINS-CSLL Minimum Withholding Setup program (P76B410), and the minimum amount is 10.00 BRL (Brazilian reais).

-

The rate for PIS withholding is set up as .65%.

-

The rate for COFINS withholding is set up as 3%

-

The rate for CSLL withholding is set up as 1%.

If your company is set up using the criteria listed above, the system writes the withholding lines for PIS, COFINS, and CSLL withholdings when the total of the withholdings per payment exceeds the minimum amount for withholdings that is set up in the PIS-COFINS-CSLL Minimum Withholding Setup program.

For example, suppose that you have different due dates for two lines on an invoice. If each payment is 200 BRL, then neither payment would have withholding amounts written to the nota fiscal because the total of the withholding amounts for PIS (1.3), COFINS (6) and CSLL (2) would equal 9.3, and would be below the minimum of 10 that is set up for the company.

However, if the payment due date for both lines is the same date, then the system would calculate the withholding amounts and write lines to the nota fiscal for each withholding type because the total of the withholding exceeds the minimum amount established in the PIS-COFINS-CSLL Minimum Withholding Setup program.

18.1.3.2 Example of Withholding by Invoice Date for Withholding Method 1 (Release 9.1 Update)

Suppose that you have set up the following criteria for calculating PIS, COFINS, and CSLL withholdings:

-

The company is set up to calculate the withholding amounts based on the month of the invoice in the Withholding Taxes on Services - Calculation Method program (P76B220).

-

The company is set up to use Withholding Method 1 in the PIS-COFINS-CSLL Minimum Withholding Setup program (P76B410) and the minimum amount is 10.00 BRL (Brazilian reais).

-

The rate for PIS withholding is set up as .65%.

-

The rate for COFINS withholding is set up as 3%

-

The rate for CSLL withholding is set up as 1%.

If your system is set up using the criteria listed above, a payment amount of 200 BRL would result in no withholdings because the total of the withholding amounts for PIS (1.3), COFINS (6) and CSLL (2) would equal 9.3, and would be below the minimum of 10 that is set up for the company. If the payment amount is 300, then the system would print lines for the withholding amounts on the nota fiscal because the total of PIS (1.95), COFINS (9), and CSLL (3) is equal to 13.95 and would exceed the minimum amount of 10 BRL.

You might have multiple payments for an invoice. If so, the system will use the total of the withholdings for all payments for the single invoice to determine whether to print lines for the PIS, COFINS, and CSLL withholding. For example, suppose that you have an invoice for 300 BRL, and the amount is split into two payments on different dates; one payment is 100 BRL and the other is 200 BRL. The total of the withholding for PIS, COFINS, and CSLL for the first payment of 100 BRL is 4.65, which is below the minimum, so no withholding lines are printed on the nota fiscal for this payment. The total of the withholding amounts for the second payment of 200 BRL is 9.3, which is also below the minimum amount. However, because the total of the withholding for the invoice exceeds the minimum (4.64 + 9.3 = 13.95), the system prints the withholding lines for the total of the two payments on the nota fiscal for the second payment.

18.1.3.3 Example of Withholding Calculations by Payment Due Date for Withholding Method 2

The Generate Nota Fiscal program calculates the withholding amount only when the accumulated amount of transactions for the month exceed the minimum amount on which withholding calculations are based. For example, suppose that you set up a company fiscal ID and customer fiscal ID to use the payment date as the basis date for calculating the withholding amounts for PIS, COFINS, and CSLL and these factors apply:

-

You generate a nota fiscal on January 5 for payments due January 20, February 20, and March 20.

-

The accumulated sales amount in January meets the minimum basis amount, but the minimum amount is not met for February and March.

-

The accumulated sales amounts in the F76B424 table are:

-

400 for January.

This nota fiscal is the first of the month that causes the accumulated amount to exceed the minimum basis amount for PIS, COFINS, and CSLL, so the withholding amounts calculated for this nota fiscal are based on the total accumulated amount.

-

200 for February.

The accumulated amount for February does not exceed the minimum basis amount for any of the withholding types, so no calculations are done for February for this nota fiscal.

-

200 for March.

The accumulated amount for March does not exceed the minimum basis amount for any of the withholding types, so no calculations are done for March for this nota fiscal.

-

This table shows selected fields for the F76B429 table for the January 5 nota fiscal:

| Tax Type | Tax Rate | Basis Amount | Minimum Achieved | Tax Amount | Calculation Date |

|---|---|---|---|---|---|

| 05 | .03 | 100 | Y | 12 | January 20 |

| 06 | .10 | 250 | Y | 40 | January 20 |

| 07 | .20 | 250 | Y | 80 | January 20 |

| 05 | .03 | 100 | N | 0 | February 20 |

| 06 | .10 | 250 | N | 0 | February 20 |

| 07 | .20 | 250 | N | 0 | February 20 |

| 05 | .03 | 100 | N | 0 | March 20 |

| 06 | .10 | 250 | N | 0 | March 20 |

| 07 | .20 | 250 | N | 0 | March 20 |

The next sales order for the customer for which you generate a nota fiscal includes payments for January, February and March, and the amounts due for each month are 200 for each month. The payment due dates are the last day of each month. The system will calculate the withholding amount for each withholding type because each withholding type has met the minimum basis amount. This table shows selected fields for the F76B429 table for the second nota fiscal generated in January:

| Tax Type | TAx Rate | Basis Amount | Minimum Achieved | Tax Amount | Calculation Date |

|---|---|---|---|---|---|

| 05 | .03 | 100 | Y | 6 | January 31 |

| 06 | .10 | 250 | Y | 20 | January 31 |

| 07 | .20 | 250 | Y | 40 | January 31 |

| 05 | .03 | 100 | Y | 6 | February 28 |

| 06 | .10 | 250 | Y | 20 | February 28 |

| 07 | .20 | 250 | Y | 40 | February 28 |

| 05 | .03 | 100 | Y | 6 | March 31 |

| 06 | .10 | 250 | Y | 20 | March 31 |

| 07 | .20 | 250 | Y | 40 | March 31 |

|

Note: For an example of withholding based on the invoice date for Withholding Method 2, see Section 18.1.2.2, "Example of Withholding and Accumulated Amounts." |

18.1.4 Understanding Validations and Calculations for Withholding for Services Sold

When you run the Generate Nota Fiscal program (R76558B) to calculate withholding amounts for services sold, the system validates that certain conditions apply and then calculates the withholding amount.

18.1.4.1 Validations

Before the system calculates withholding amounts, it must validate whether certain conditions are met. This table describes the conditions validated:

| Validated Condition | Description |

|---|---|

| The sales order is for a service and includes withholding information. | The system compares the transaction nature code of the lines on the sales order to the values in UDC 76B/TT. If the transaction nature code does not exist in UDC 76B/TT, then the system processes the sales order as a service sales order.

The system accesses the Sales Order Withholding Concept Tag File (F76B423) to determine if withholding information exists for the sales order. If no withholding information exists, the system does not process withholding for the sales order. If withholding information for the sales order exists in the F76B423 table, the system retrieves the withholding concepts from the table and uses the concepts to retrieve the withholding percentage from the tax percentages that you set up for the company in the Review A/P Tax Code program (P76B0401) and the Taxes Setup by City & Service program (P76B409). |

| (Release 9.1 Update)

(Withholding Method 1) The minimum amounts for PIS, COFINS, and CSLL withholding are met. |

If the service sold is subject to withholding for PIS, COFINS, or CSLL, the system:

|

| (Withholding Method 2) The minimum amounts for PIS, COFINS, and CSLL withholding are met. | If the service sold is subject to withholding for PIS, COFINS, or CSLL, the system:

If the total of the accumulated amount for the month and the total from the new transactions is not greater than the minimum amount stored in the F76B422 table, then the system does not calculate the withholding amounts. If the total of the accumulated amount and the new transaction amount is greater than the minimum amount, then the system calculates the withholding. Whether or not the total exceeds the minimum amount, the system saves the new accumulated amount to the F76B424 table. |

| What percentage of the ISS withholding amount is exempt, as set up in the Services ISS Exempt program (P76B106). | The system retrieves the ISS rate, city, service, and current date, and then calculates the ISS withholding amount. The system then applies the exempt percentage to the calculated amount to determine the actual ISS withholding amount. |

18.1.4.2 Calculations

After validating whether withholding amounts should be calculated, the system calculates the withholding and saves the calculated amount for ISS to the Service Nota Fiscal Withholding Amount by Service table (F76B428), the calculated amounts for IRRF and INSS to the Service Nota Fiscal Withholding Amounts by Formula table (F76B427), and the calculated amounts for PIS, COFINS, and CSLL to the Service Nota Fiscal Wh by Formula Installment table (F76B429). The system reads the values in the F76B427, F76B428, and F76B429 tables when you modify calculated amounts using the Nota Fiscal Withholdings program (P76B4220) and when you print the nota fiscal.

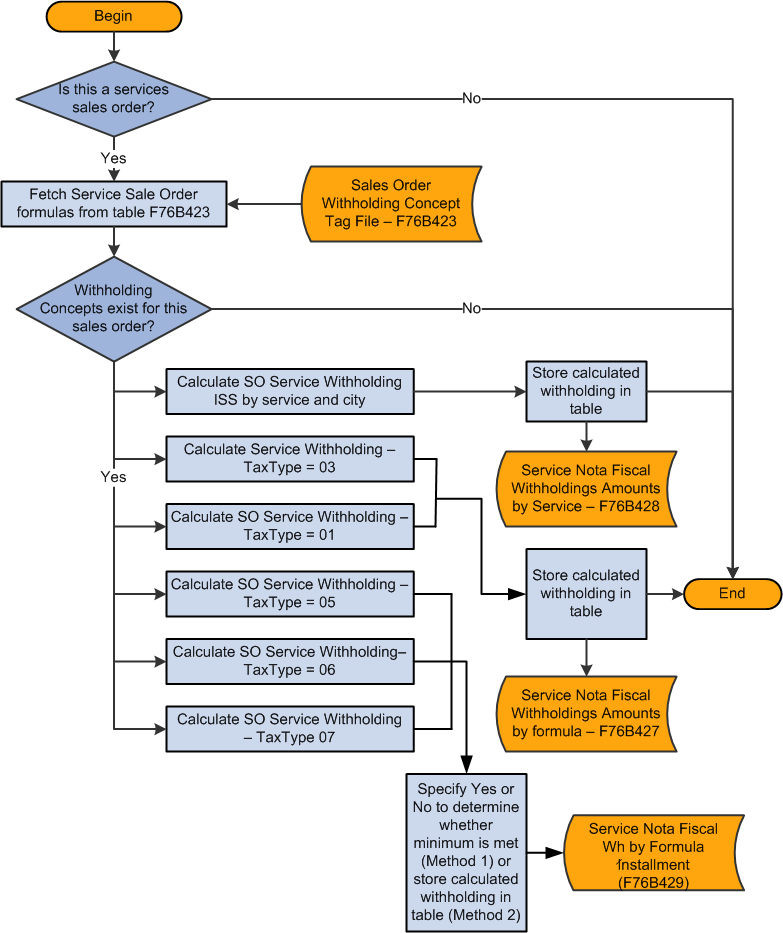

The following process flow shows how the system determines whether to calculate withholding and the tables to which it saves the withholding information. If the company and transaction is set up to use Withholding Method 1, then the system writes a value of Y (yes) or N (no) to the Service Nota Fiscal Wh by Formula Installment table (F76B429). If the company and transaction is set up to use Withholding Method 2, then the system writes the withholding amounts to the F76B429 table.

Figure 18-2 Process Flow for Calculations

Description of ''Figure 18-2 Process Flow for Calculations''

18.2 Entering Withholding Information in Sales Orders for Services

This section provides an overview of withholding information in sales orders for services, lists prerequisites, and discusses how to enter withholding information for sales orders for services.

18.2.1 Understanding Withholding Information in Sales Orders for Services

When you sell services to your customers, you can enter withholding information for the sales order lines for the services. The system uses the withholding concept, service code, and city code that you enter in the sales order when you generate the nota fiscal and calculate the withholding amounts.

You use the SO Brazil Withholding Additional Info program (P76B4210) to enter or modify the withholding information associated with a sales order. If certain conditions exist when you enter a sales order or add lines to an existing sales order, the system launches the forms for the SO Brazil Withholding Additional Info program after you click OK on the S.O. Brazilian Information Detail form. You can also access the forms of the SO Brazil Withholding Additional Info program when you use the Regional Info menu options in the sales order entry process. The system populates the forms in the SO Brazil Withholding Additional Info program with default values that you set up for the withholding concept, service codes, and city code. You can change the values if needed.

This table shows the conditions that must exist to enable you to work with withholding for sales orders for services sold:

| Condition | Description |

|---|---|

| The sales order line is for a service. | The system compares the transaction nature code of the sales order line to the Transaction Nature Items (76B/TT) UDC table. |

| The transaction is between two companies. | The system runs a validation routine to determine if the selling company and the buying company are legal entities that are not government agencies. The system uses the values in the 76B/GE UDC table to determine if a company is a government agency. |

| The sales order line is at a status that allows modification. | The sales order line cannot be at status 999 (closed). Additionally the processing options on the Edit tab in the Nota Fiscal Maintenance - Brazil program (P7610B) must be set to enable modifications. |

When you complete the final save function for the sales order, the system saves the withholding information to the Sales Order Withholding Concept Tag File (F76B423).

18.2.1.1 Default Values

The system displays the forms on which you enter or modify withholding information when certain conditions exist for the transaction. If withholding information was set up in the Withholding Concept Setup program (P76B421), the forms include the default information stored in the Withholding Concept Setup table (F76B421). The system uses this hierarchy to retrieve information from the F76B421 table:

-

Retrieves the short item number (data item ITM) of the sales order line along with the address number of the legal company.

If the system does not find default values for the item number and address number combination, then it goes to the next step of the hierarchy.

-

Retrieves the short item number of the sales order without using the address number of the legal company.

If the system does not find default values for the short item number, then it goes to the next step of the hierarchy.

-

Retrieves the address book number of the legal company.

If the system does not find default values for the legal company, it displays a warning message. You can accept the warning and continue processing the transaction.

The F76B421 table does not store default values for the city code, sales service fiscal code, and service national code. The system retrieves default values from these tables:

-

The system retrieves the city code from the address book supplemental data set up in the Supplemental Data table (F00092).

-

The system retrieves the sales service fiscal code from the Service Fiscal Code table (F76B405).

-

The system retrieves the service national code from the Service Type Code table (F76B408).

18.2.1.2 Validations

Default and user-entered values in the forms of the SO Brazil Withholding Additional Info program are valid when:

-

Each withholding concept is set up with a valid value from the Tax Code table (F76B0401).

Valid values are those that are set up with the correct tax type code from UDC table 76B/TR and are set up as tax codes for retention. For example, a withholding concept for PIS (Programa de Integração Social) must use a value from the F76B0401 table that has 05 (PIS) in the Tax Type field (data item BRTXTP) and R (retention) in the Retention/Aggregation/Credit field (data item BRRTA).

-

Each withholding concept for which withholding applies includes a valid value.

For example, if INSS (Instituto Nacional do Seguro Social) withholding applies, the option to apply INSS must be enabled and a withholding concept for INSS must be entered.

-

If ISS (Imposto sobre Serviços) withholding applies:

-

The value for the city code must be completed with a valid value from UDC table 76B/FC.

-

The Service Type field must be completed with a valid value from the F76B408 table.

-

-

The Sales Service Fiscal Code and Service National Code must be populated with valid values.

The system automatically populates the Sales Service Fiscal Code and Service National Code fields. You cannot edit these fields; the system retrieves them from the setup for ISS withholding. If the values for these fields are not set up in the Service Fiscal Code program (P76B405) and Service National Codes program (P76B407), the system displays a warning message.

18.2.1.3 Withholding Taxes on Services - Calculation Method Program (P76B220) (Release 9.1 Update)

The system uses the setup from the Withholding Taxes on Services - Calculation Method program (P76B220) when it calculates PIS, COFINS, and CSLL withholdings. In the Withholding Taxes on Services - Calculation Method program, you can specify whether to have the system calculate the withholding based on the invoice date or on the payment due date. The setup in this program is based on the first 9 digits in the company and customer fiscal IDs. Changes that you make to the PIS, COFINS, and CSLL concepts on the SO Brazil Withholding Additional Information form do not affect whether the system calculates the withholding by invoice date or payment due date. The system does not perform the calculations until you run the Generate Nota Fiscal program (R76558B).

18.2.2 Prerequisites

Before you perform the task in this section:

-

Set up the processing options for the Sales Order Brazilian Additional Information - Brazil program (P4210BR).

-

Verify that withholding concepts are set up appropriately.

-

Verify that ISS withholding setup is complete.

-

Set up the withholding calculation by date to have the system calculate withholding based on the due date instead of the invoice date, which is the default date for the calculation.

Note:

The system does not perform withholding calculations when you enter the sales order. It performs the calculations when you run the Generate Nota Fiscal program (R76558B). -

Specify which minimum withholding method to use.

18.2.3 Forms Used to Enter Withholding Information for Sales Orders for Services

18.2.4 Entering Withholding Information for Sales Orders for Services

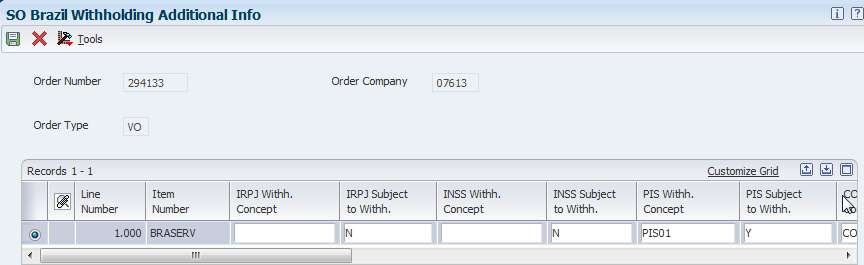

Access the SO Brazil Withholding Additional Information form.

Figure 18-3 SO Brazil Withholding Additional Info form

Description of ''Figure 18-3 SO Brazil Withholding Additional Info form''

The system populates the values on the form based on the values for the item number and legal company address book number. You can modify the withholding concepts and whether to apply the withholding to each line for a service on a sales order.

|

Note: The forms that appear when you use the Regional Info menu options to modify withholding information are slightly different from the form that appears when you add a sales order. |

- IRPJ Withh. Concept ([Imposto de Renda de Pessoa Jurídicais] withholding concept)

-

Enter a tax type code for IRPJ from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the IRPJ Withholding Flag option before you can enter a value in this field.

- IRPJ Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the IRPJ Withholding Concept field.

- INSS Withh. Concept

-

Enter a tax type code for INSS that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the INSS Withholding Flag option before you can enter a value in this field.

- INSS Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the INSS Withholding Concept field.

- PIS Withh. Concept

-

Enter a tax type code for PIS that exists in the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the PIS Withholding Flag option before you can enter a value in this field.

- PIS Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the PIS Withholding Concept field.

- COFINS Withh. Concept ([Contribuição para Financiamento da Seguridade Social] withholding concept)

-

Enter a tax type code for COFINS from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the COFINS Withholding Flag option before you can enter a value in this field.

- COFINS Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the COFINS Withholding Concept field.

- CSLL Withh. Concept ([Contribuição Social sobre o Lucro Líquido] withholding concept)

-

Enter a tax type code for CSLL from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the CSLL Withholding Flag. option before you can enter a value in this field.

- CSLL Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the CSLL Withholding Concept field.

- City Code

-

Enter a value from the Fiscal City Code (76B/FC) UDC table to specify the city in which the service was sold.

- Service Type Code

-

Enter a tax type code for ISS from the F76B0401 table. You set up tax code types in the Review A/P Tax Code program. You must select the ISS Withholding Flag option before you can enter a value in this field.

- ISS Subject to Withh.

-

Select to cause the system to calculate withholding for this tax type when you run the Generate Nota Fiscal program. You must select this option before you can enter a value in the Service Type Code field.

- Sales Service Fiscal Code

-

The system retrieves the sales service fiscal code from the Service Fiscal Code table (F76B405). You cannot change the default value on this form.

- Service National Code

-

The system retrieves the service national code from the Service Type Code table (F76B408). You cannot change the default value on this form.

18.3 Working with Notas Fiscais for the Sale of Services

This section provides an overview of notas fiscais for the sale of services and discusses how to:

-

Enter or modify IRPJ, INSS, and ISS withholding information.

-

Enter or modify PIS, COFINS, and CSLL withholding information.

18.3.1 Understanding Notas Fiscais for the Sale of Services (Release 9.1 Update)

After you enter a sales order, you can run the Generate Nota Fiscal program (R76558B) to have the system generate the nota fiscal. You can also manually enter a stand-alone nota fiscal. When you work with notas fiscais for the sale of services, you can:

-

Enter and modify withholding information for generated notas fiscais.

-

Enter and modify withholding information for stand-alone notas fiscais.

-

Reverse the nota fiscal.

-

Review withholding information on the printed the nota fiscal.

18.3.1.1 Enter and Modify Withholding Information for Generated Notas Fiscais

You can modify withholding information for generated notas fiscais if necessary. You use the Nota Fiscal Maintenance program (P7610B) to modify nota fiscal information generated by the Generate Nota Fiscal program.

When the generated nota fiscal is for the sale of services, the program and form that you use to modify withholding information differs based on the withholding type and the setup in the Withholding Taxes on Services - Calculation Method program (P76B220).

INPJ, INSS, and ISS withholdings are always calculated based on the invoice date. PIS, COFINS, and CSLL withholdings are calculated based on the invoice date if you set up a company/customer combination in the Withholding Taxes on Services - Calculation Method program (P76B220) to use the invoice date, or if no setup exists for the company/customer combination. PIS, COFINS, and CSLL withholdings are calculated based on the payment due date if you set up a company/customer combination in the Withholding Taxes on Services - Calculation Method program to use the payment due date.

If the withholding calculations are based on the invoice date, then you modify withholding information on the Withholding Additional Info form in the Nota Fiscal Withholdings program.

See Entering and Modifying Withholding Information for IRPJ, INSS, and ISS

If the withholding calculations for PIS, COFINS, and CSLL are based on the payment due date, you modify the withholding information on the Withholding Additional Info Revisions form in the SO Withholding Additional Info program (P76B420). You use a different program and form to modify PIS, COFINS, and CSLL withholdings calculated based on the payment due dates because multiple withholding lines can exist for a single detail line on the nota fiscal. The Withholding Additional Info Revisions form enables you to work with each individual withholding line.

See Entering and Modifying Withholding Information for PIS, COFINS, and CSLL

You can access the Withholding Additional Info form in the Nota Fiscal Withholdings program only when the nota fiscal is for the sale of services. You can access the Withholding Additional Info Revisions form only when withholding calculations for PIS, COFINS, or CSLL are based on the payment due date. If PIS, COFINS, or CSLL withholding was not enabled when you generated the nota fiscal, you can select the option for the withholding on the Withholding Additional Info form and then access the Withholding Additional Info Revisions form to enter the withholding information.

When you access the Nota Fiscal Withholdings program, the system populates the fields for each withholding type with the data that was saved to the Service Nota Fiscal Withholding by Formula (F76B427), Service Nota Fiscal Withholdings by Service (F76B428), or Service Nota Fiscal Wh by Formula Installment table (F76B429) tables. The F76B427, F76B428, and F76B429 tables include the withholding information for the different withholding types. If the withholding calculations for PIS, COFINS, and CSLL are based on the payment due date, then the system displays the data for PIS, COFINS, and CSLL withholding that was saved to the F76B429 table, but does not enable you to modify it on the Withholding Additional Info form. Instead, you use a Form menu option to access the withholding lines for PIS, COFINS, or CSLL.

The system saves the modified data to the F76B427, F76B428, and F76B429 tables when you click save your changes, and also saves modifications to ISS amounts to the Service Nota Fiscal Accumulated table (F76B424).

18.3.1.2 Enter and Modify Withholding Amounts for Stand-Alone Notas Fiscais

You use the Stand-Alone Nota Fiscal program (P7611B) to enter and modify stand-alone notas fiscais. Because a standalone nota fiscal does not obtain the withholding information from a sales order, you must manually enter the rate, amount, basis, and concept for each withholding type that applies to the nota fiscal on the Withholding Additional Info form.

When you add lines to a stand-alone nota fiscal, the system uses values from the Withholding Concepts Setup table (F76B421) as the default values for the withholding concepts. If you modify an existing record, the system retrieves the existing records from the F76B427, F76B428, and F76B429 tables. When you save new or existing withholding lines, the system saves the modified values to the F76B427, F76B428, and F76B429 tables. The system also saves new or modified amounts for PIS, COFINS, and CSLL to the F76B424 table if the company and transaction is set up to use Withholding Method 2.

You enter a stand-alone nota fiscal for the sale of services using the same steps as you use when you enter a stand-alone nota fiscal for other types of sales. If the transaction nature code that you enter is associated with a sale of a service, then you can access the Withholding Add. Information option using the Row menu of the Nota Fiscal Detail Revision form.

See Entering Stand-Alone Notas Fiscais.

|

Note: For stand-alone notas fiscais, you use the Withholding Additional Info form to work with all withholding types. The system does not enable the Withholding Additional Info Revisions form in the SO Withholding Additional Info program (P76B420) when you work in the Stand-Alone Nota Fiscal program. |

18.3.1.3 Reverse Transactions with Withholding for the Sale of Services

You use the Reverse/Void Nota Fiscal program to reverse a nota fiscal before or after printing the nota fiscal, and before you run the Sales Update - Brazil program (R76B803).

When you run the Reverse/Void Nota Fiscal program for service notas fiscais that include withholding and are not printed, the system deletes the withholding records for the nota fiscal from the Service Nota Fiscal Withholding Amount by Service (F76B428), the Service Nota Fiscal Withholding Amounts by Formula (F76B427) table if the withholding is for IR or INSS, and from the Service Nota Fiscal Wh by Formula Installment table (F76B429) if the withholding is for PIS, COFINS, or CSLL. The system also updates the accumulated amounts in the Service Nota Fiscal Accumulated Withholding table (F76B424) if the company and transaction type is set up to use Withholding Method 2.

If the nota fiscal was printed, the system updates the accumulated amounts in the F76B424 table if Withholding Method 2 is used, but does not delete the withholding records from the F76B427, F76B428, and F76B429 tables because the nota fiscal records must be reported in the fiscal books.

|

Note: You use a different process to void a nota fiscal after you run the Sales Update - Brazil program.See Working With Returns, Reverses, and Cancellations in Brazil |

18.3.1.4 Withholding Amounts on Printed Notas Fiscais

You run the Print Nota Fiscal program (R76560B) to print a document that includes the details of the goods or service sold, including the tax amounts, and withholding amounts for sales transactions that include withholding amounts.

When you print a nota fiscal for a sales order that includes lines for withholding, the system accesses the F76B427, F76B428, and F76B429 tables to obtain this information to print in a withholding section on the nota fiscal:

-

Withholding calculation base amount

-

Withholding calculation percentage

-

Withholding amount

-

Service detail

The system groups the withholding by withholding type and percentage and prints the withholding type, basis amount, rate, withholding amount, and due date on the nota fiscal. If no withholding applies to the services sold, the system prints the withholding section with no amounts for the tax types. You can enter text in a processing option to print on the nota fiscal if no withholding applies to the services on the nota fiscal.

18.3.2 Forms Used to Modify Withholding Information for the Sale of Services

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Nota Fiscal Headers | W7610BG | Sales Order Processing - Brazil (G76B4211), Nota Fiscal Inquiry - Header Browse | Review and select existing records. |

| Nota Fiscal Detail Revision | W7610BF | On the Work with Nota Fiscal Headers form, select a nota fiscal for the sale of services and then select Detail Revisions.

Alternatively, select Sales Order Processing - Brazil (G76B4211), select Nota Fiscal Inquiry - Detail Browse. |

Review and select detail lines for a nota fiscal. |

| Withholding Additional Info | W76B4220A | On the Nota Fiscal Detail Revision form, select a line and then select Withholding Additional Info from the Row menu. | Review existing information for all withholding types, and enter or modify withholding information for stand-alone notas fiscais, and for IRPJ, INSS, and ISS withholding. |

| Withholding Additional Info Revision | W76B420A | On the Withholding Additional Info form, select one of these options from the Form menu:

PIS Add. Info COFINS Add. Info CSLL Add. Info |

Enter or modify withholding information for the selected withholding type (PIS, COFINS, and CSLL). |

18.3.3 Entering and Modifying Withholding Information for IRPJ, INSS, and ISS

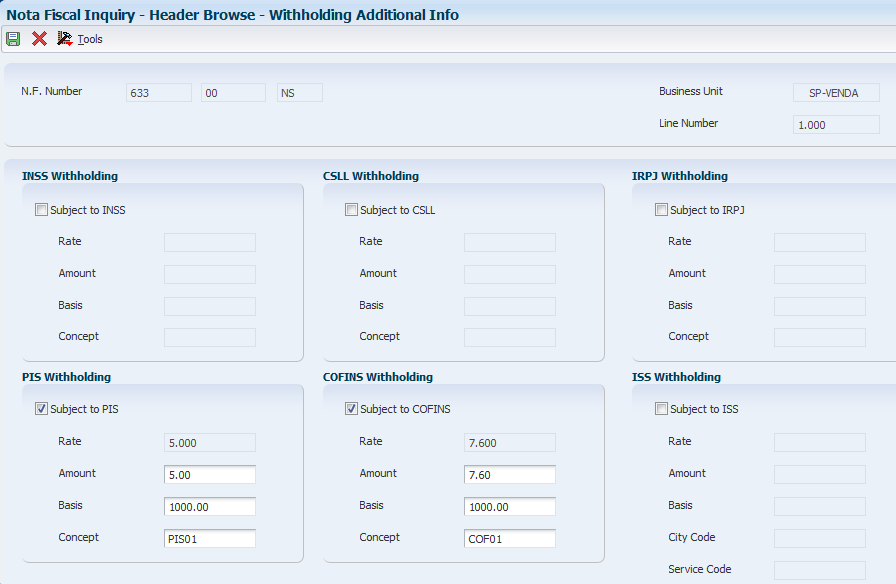

Access the Withholding Additional Info form.

Figure 18-4 Withholding Additional Info form

Description of ''Figure 18-4 Withholding Additional Info form''

-

Select the check box for the withholding type that you want to modify. Options are:

-

INSS

-

IRPJ

-

ISS

-

PIS

You can select this option only when PIS withholding was not applied to the sales order. If one or more records exist for PIS withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

-

COFINS

You can select this option only when COFINS withholding was not applied to the sales order. If one or more records exist for COFINS withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

-

CSLL

You can select this option only when CSLL withholding was not applied to the sales order. If one or more records exist for CSLL withholding, you use the Withholding Additional Info Revisions form to access the records and make changes.

-

-

Complete the following fields, as necessary, for the withholding types that you selected:

-

Amount

-

Basis

-

Concept

-

-

For ISS withholding, complete these fields as applicable:

-

City Code

-

Service Code

-

Sales Code

-

-

Click OK.

18.3.4 Entering and Modifying Withholding Information for PIS, COFINS, and CSLL

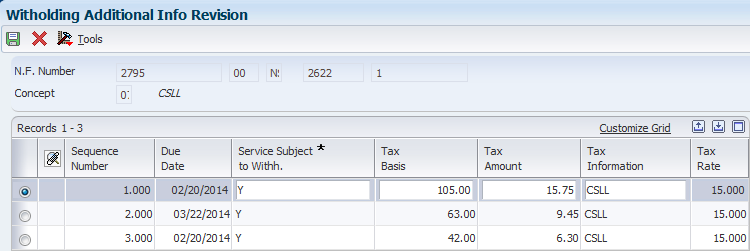

Access the Withholding Additional Info Revisions form.

You use the Withholding Additional Info Revisions form to work with PIS, COFINS, and CSLL withholding only. If no withholding was calculated, you must select the Subject To check box for the withholding type on the Withholding Additional Info form before you can access the Withholding Additional Info Revisions form from the Form menu options on the Withholding Additional Info form.

|

Note: You cannot add withholding lines. You can only modify existing lines. |

Figure 18-5 Withholding Additional Info Revisions form

Description of ''Figure 18-5 Withholding Additional Info Revisions form''

- Service Subject to Withh. (service subject to withholding)

-

Enter Y (yes) if withholding applies for the line.

If you change the value from Y to N (no), and then exit the field, the system deletes the withholding information from the line.When you exit the form, the system saves your changes to the F76B424 and F76B429 tables.

- Tax Basis

-

Enter the amount that is taxed.

- Tax Amount

-

Enter the tax amount, which is the tax basis multiplied by the tax rate.

- Tax Information

-

Enter a value from the Tax Code table (F76B0401).