17 Working With Sales Order Processing for Brazil

|

Important: (Release 9.1 Update)If you used the JD Edwards EnterpriseOne software for Brazil prior to the enhancement that enables you to set up the withholding calculation on services sold based on the invoice date or the due date, then you must run the R8976427 table conversion program to move existing records for PIS, COFINS, and CSLL in the Service Nota Fiscal Withholding Amounts by Formula table (F76B427) to the Service Nota Fiscal Wh by Formula Installment table (F76B429). You run the conversion program once only. See Appendix G, "Table Conversion for Sale of Services Withholding" |

This chapter contains the following topics:

-

Section 17.1, "Understanding Sales Order Management for Brazil"

-

Section 17.2, "Understanding the Nota Fiscal for Sales Orders for Brazil"

-

Section 17.4, "Setting Up Series Length, Number Length, and Legal Next Numbers for Notas Fiscais"

-

Section 17.5, "Setting Up Next Status Codes for Notas Fiscais"

-

Section 17.6, "Setting Up Authorized Persons to Access NFe Information (Release 9.1 Update)"

-

Section 17.7, "Setting Up Allowed Contingencies (Release 9.1 Update)"

-

Section 17.8, "Working With the NFe XML Statuses and Emission Types"

-

Section 17.9, "Working With Tributary Situation Codes for Nota Fiscais"

-

Section 17.10, "Entering Additional Sales Order Information for Brazil"

-

Section 17.11, "Working with Import Declarations and Electronic Nota Fiscais"

-

Section 17.14, "Processing PIS/PASEP and COFINS Taxes for Brazil"

-

Section 17.15, "Entering Additional Charges for Nota Fiscais"

-

Section 17.16, "Working with Print Messages for Notas Fiscais"

-

Section 17.17, "Entering the Correction Letter (CC-e) for the Nota Fiscais (Release 9.1 Update)"

-

Section 17.20, "Using the NFe Transmission Process (Release 9.1 Update)"

-

Section 17.24, "Manually Processing NFe Responses from Third-Party Software"

-

Section 17.27, "Working With Returns, Reverses, and Cancellations in Brazil"

-

Section 17.28, "Reviewing NFe Information for Ship-to Sales Returns"

-

Section 17.29, "Working With Deleted, Unused, and Cancelled Nota Fiscais"

|

Note: The sales order process is different if you use the São Paulo electronic nota fiscal process to obtain nota fiscal numbers. |

17.1 Understanding Sales Order Management for Brazil

In Brazil, the government requires that businesses maintain detailed information about all merchandise and associated taxes during the delivery process. The information accompanies shipments in the nota fiscal.

When you use the JD Edwards EnterpriseOne Sales Order Management system in Brazil, you associate applicable Brazilian taxes with your sales orders. You then generate and print notas fiscais for the orders. When you generate the notas fiscais, the system assigns a temporary number to the order. You can use this temporary number when you review or revise your orders. When you print notas fiscais, the system assigns the appropriate number from the numbering sequence that is assigned to your company by the Brazilian government. You set up the Nota Fiscal Next Number - Brazil program (P7600B) with the numbering sequence that is assigned to your company.

The system automatically creates journal entries to account for the notas fiscais that are created during the JD Edwards EnterpriseOne Sales Order Management process.

You can use JD Edwards EnterpriseOne for Brazil Localizations to generate the type of Nota Fiscal that better suits the needs of you company:

-

Classical Nota Fiscal: Classical fiscal notes are the fiscal notes that are generated, printed out in paper, and delivered when the transaction takes place.

-

Nota Fiscal Eletrônica (NF-e or Electronic Fiscal Note): It is a digital file issued and stored electronically that documents transactions to report the information to government agencies for tax purposes. Its legal validity is guaranteed by the digital signature of the sender (guarantee of authorship and integrity) and the receipt of the information by the fiscal authorities even before the occurrence of the transaction itself. The electronic file must follow a specific layout that the fiscal authority sets.

-

Saõ Paulo NF-e: The NF-e layout and report process for companies and consumers in the state of Saõ Paulo responds to requirements and objectives that are specific to this state.

-

National NF-e: National electronic notas fiscais are those that are not specific to Saõ Paulo.

-

Nota Fiscal Eletrônica para Consumidor Final (NFC-e or Fiscal Note for End Consumers) (Release 9.1 Update): If your company works with end consumer transactions, the SEFAZ requires that you identify these transactions by using a specific type of NF-e called NFC-e. You can use JD Edwards EnterpriseOne for Brazil Localizations to generate these electronic fiscal notes.

-

-

To process sales orders in the JD Edwards EnterpriseOne Sales Order Management system, complete these tasks:

-

Enter the sales order by using the Sales Order Entry - Header - Brazil (P4210, version ZJDE7002) or the Sales Order Entry - Detail - Brazil (P4210, version ZJDE7001) programs.

-

Confirm the shipment by using the Shipment Confirmation program (P4205).

-

Generate the nota fiscal by running the Generate Nota Fiscal - Brazil program (R76558B).

This program assigns a temporary number to the nota fiscal and calculates Brazil tax amounts.

Ensure the appropriate Nota Fiscal Type is set in the processing options in the Default section (0 for classical and Sao Paulo notas fiscais and 1 for National NFe and NFCe).

-

Add additional charges by using the Nota Fiscal Maintenance - Brazil program (P7610B).

This program lets you add freight, insurance and other expense information to the nota fiscal.

-

According to the type of Nota Fiscal that your company uses:

- Classical Nota Fiscal

-

Print the final nota fiscal by running the Print Nota Fiscal - Ship From program (R76560B).

This program assigns the nota fiscal number according to the next numbering scheme that you set up, and then prints the nota fiscal.

- Sao Paulo Nota Fiscal

-

-

Print the final nota fiscal by running the Print Nota Fiscal – Ship From program (R76560B).

-

Generate the XML NFe file running the Nota Fiscal Elec. - Outbound program (R76B560Z1) from a menu option or use processing options so the system can run it in this stage of the process.

-

Use the XML Transaction Review program (P70XMLZ1) to review the data that you wrote to the tables for the outbound transaction.

-

Use the custom program that you develop or that you obtain from a third-party to format in the legally required layout the XML data generated by the JD Edwards EnterpriseOne programs.

-

Use the custom program that you develop or that you obtain from a third-party to send the formatted XML data to the fiscal authority.

-

Use the custom program that you develop or that you obtain from a third-party to receive the data that the fiscal authority sends back.

-

Run the XML Inbound Process program (R70XMLI1) to update your system with the information that you receive back from the fiscal authority.

Use the XML Transaction Review program to review the data that you receive.

-

Use the Nota Fiscal Elect. Revision program (P76B01TE) to review updated nota fiscal information and release the nota fiscal that was put on hold by the Nota Fiscal Elec. - Outbound program.

-

- National Nota Fiscal and NFC-e

-

-

Generate the NF-e XML file by running the NF-e Info Generation program (R76B561), which runs the NF-e Info Generation by Lot UBE program (R76B561L).

You can run the NF-e Info Generation program from a menu option or from the NF-e Response Process and Contingencies program (P76B12TE).

-

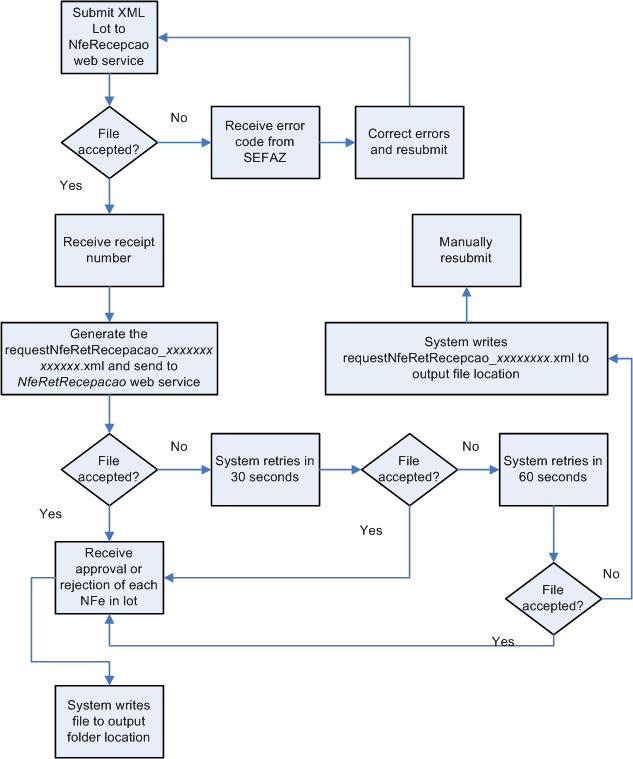

Submit the NFe XML file to SEFAZ.

You can use a custom, a third-party program, or the NF-e Transmission program (P76B0021) to submit the file to SEFAZ.

The NF-e Transmission program enables you to select the file, select the service (submit for processing, cancel, or destroy), and transmit the file to SEFAZ. You can view the status of the submission in the NF-e Transmission program.

-

Receive the response from SEFAZ.

-

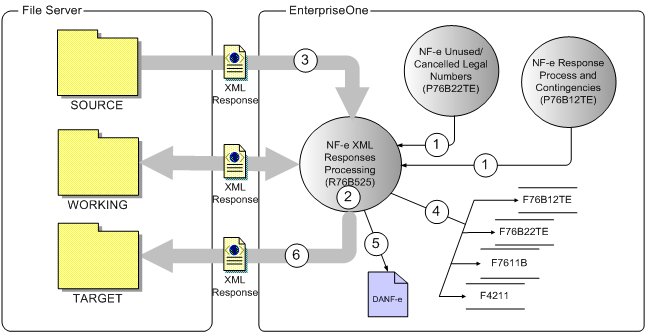

Upload the final response file from the SEFAZ by running the appropriate version of the NFe XML Response Processing program (R76B525). Use the menu entry for the appropriate XML version.

The NFe XML Response Processing program retrieves the response XML file from the source folder and updates the JD Edwards EnterpriseOne tables.

You can also upload the response by using the NF-e Response Process and Contingencies program (P76B12TE), and for unused and cancelled NFes by using the Unused/Cancelled NF-e Numbers program (P76B22TE).

-

Print the DANF-e document from the NF-e Response Process and Contingencies program (P76B12TE).

-

-

Update journal entries for Brazil taxes by running the Update Sales - Brazil program (R76B803).

-

Update other sales files by running the Sales Update program (R42800).

17.2 Understanding the Nota Fiscal for Sales Orders for Brazil

In Brazil, the government requires companies to maintain additional sales order information for tax calculation purposes. This information includes:

-

Transaction nature.

-

Tax code.

-

Fiscal classification.

-

Whether the item is subject to ICMS Substitution.

-

Origin of the item.

-

Type of purchase (from a client's perspective).

-

Fiscal message.

-

And, if the item has imported content:

-

Imported Content percentage (CI)

-

Imported Content Form (FCI)

-

EX-TIPI

-

When you use the JD Edwards EnterpriseOne Sales Order Management system, you include this additional information in the header and detail portions of your sales order.

After you enter sales orders, generate the nota fiscal to have the system run validations and tax calculations, then you print notas fiscais by fiscal company and series. When you print notas fiscais, the system creates the notas fiscais that you ultimately send to your customers with each shipment. Notas fiscais include the following detailed information:

-

Merchandise price.

-

Applicable tax amounts.

-

How the merchandise will be used.

-

Origin and destination of the shipment.

-

Any other expense that is associated with the transaction.

At times, you might need to create a nota fiscal that it is not directly attached to a purchase or sales order. In such cases, you can generate the stand-alone nota fiscal.

17.3 Understanding NFe and DANFe Generation

This section provides overviews of NFe generation, DANFe generation, contingency processes, transmission types, and emission types and status values.

17.3.1 Understanding NFe Generation

The Encontro Nacional de Coordenadores e Administradores Tributários Estaduais (ENCAT) is the national meeting of coordinators and tax auditors. The ENCAT, with the supervising of the Brazilian Fiscal Authority (Receita Federal Do Brazil), known as the SEFAZ (Secretaria do Estado da Fazenda do Brasil, the State Revenue Department), created the Electronic Fiscal Note (NFe) and established that the system must generate the NFe for all the company transactions (sales, purchase, sales return, purchase return and importation). The NFe was created to substitute the current paper nota fiscal (models 1 and 1A).

Companies must send an XML file containing nota fiscal information to SEFAZ in order to obtain their approval. SEFAZ may reject the transmission for formal issues, such as incorrect tags, or for customer issues, such as an irregular tax situation. The company sends the XML file to SEFAZ through an preestablished Web service. If there are any problems during the transmission, companies may generate their documentation through different circuits called contingencies.

If your company works with end consumer transactions, the SEFAZ requires that you identify these transactions by using a specific type of NF-e called NFC-e (Nota Fiscal Eletrônica para Consumidor Final or Fiscal Note for End Consumers). You can use JD Edwards EnterpriseOne for Brazil Localizations to generate these electronic fiscal notes.

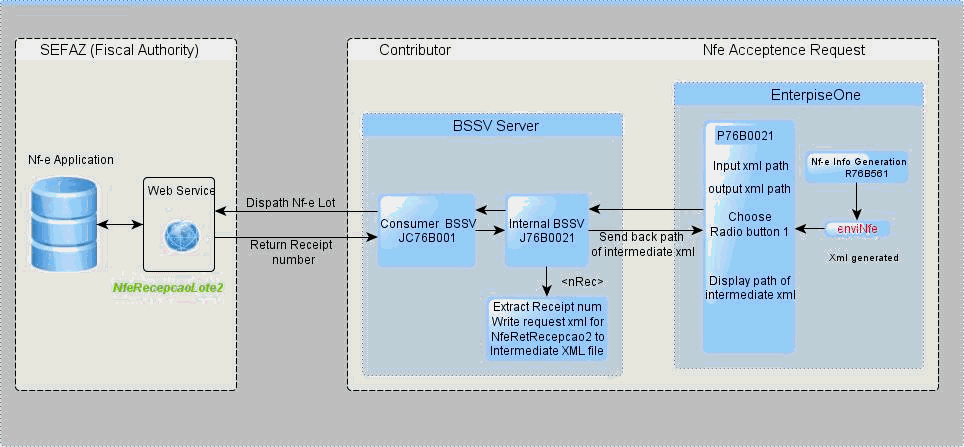

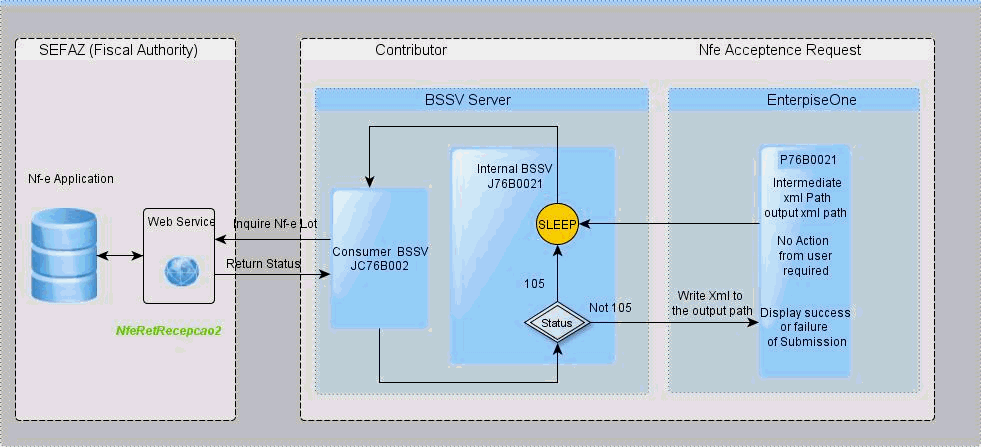

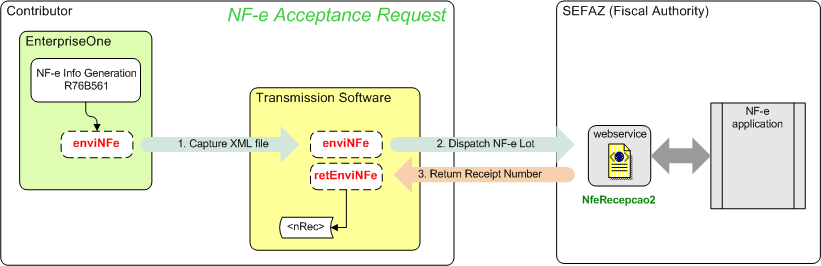

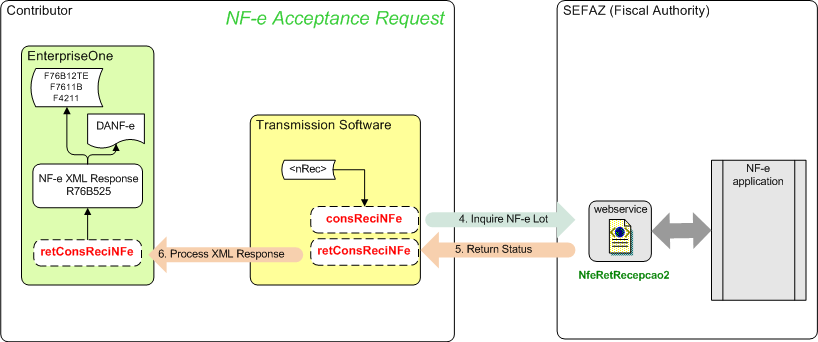

Review the following process flow for NFe and DANFe transmission:

Figure 17-1 NFe and DANfe Transmission Process Flow

Description of ''Figure 17-1 NFe and DANfe Transmission Process Flow''

17.3.2 Understanding DANFe Generation

After receiving NFe approval from SEFAZ, the company prints a document to escort the merchandise called the Electronic Fiscal Note Auxiliary Document, or DANFe (Documento Auxiliar da Nota Fiscal Electronica).

A DANFe report is a shipment note that contains summary NFe information. The DANFe report originates from NFe, therefore it contains NFe information such as the legal access key and dimensional bar code. The company includes the DANFe with the shipment of goods. The DANFe has a bar code so that trucks can present it for scanning, and the government employee can review the NFe via the Internet.

The system provides different DANFe reports:

-

DANFe for Nota Fiscal

-

DANFe for end-consumer transactions

Review the following DANFe example:

Figure 17-2 Example of DANFe document (Release 9.1 Update)

Description of ''Figure 17-2 Example of DANFe document (Release 9.1 Update)''

17.3.3 Understanding Contingency Processes

An emission type is the procedure that the system uses to generate an NFe. Under normal circumstances, you follow a standard procedure to transmit an NFe to SEFAZ. You would generate and transmit the NFe, obtain approval from SEFAZ, print the DANFe on standard paper, and ship the merchandise.

However, if SEFAZ web site is not operating or you are not able to generate the NFe, you can use a contingency process to generate a contingency NFe. The system provides the following contingency processes to transmit an NFe:

-

SVC Contingency (Release 9.1 Update)

Use the SVC contingency method when the normal emission type is unavailable. There are two different environments and emission types for the SVC contingency process: SVC-AN (SEFAZ Virtual de Contingência - Ambiente Nacional) and SVC-RS (SEFAZ Virtual de Contingência - Rio Grande do Sul).

In the SVC contingency process, you follow these steps:

-

Change the NFe emission type value to 6 for SVC-AN contingencies or to 7 for SVC-RS contingencies.

-

Generate the NFe.

If you are regenerating the NFe after a failed attempt of sending a normal NFe, the system renumbers the access key changing the digit that indicates the emission type and the check digit, in order to avoid processing duplicated documents.

-

Transmit the SVC NFe.

If a normal XML file was sent out before sending the SVC XML file, the system marks the old NFe as unused. You do not need to do this manually.

The system transmits a new XML containing the NFe information to SVC-AN or SVC-RS. You do not need to transmit an XML to the normal SEFAZ site.

-

Process response from SEFAZ.

Use the automatic or manual methods available to process the response from SEFAZ.

-

Print DANFe.

The system prints the DANFe on common stock paper.

-

Ship merchandise.

-

-

FS and FS-DA Contingencies

Use the FS (Formulario de Securanza or Security Form) or FS-DA (Formulario de Securanza - Documento Auxiliar or Auxiliary Document Security Form) contingency method if there are errors when you transfer the NFe or NFC-e XML file to SEFAZ. In the FS and FS-DA contingency processes, you follow these steps:

-

Change NFe emission type to 2 for FS contingencies and 5 for FS-DA contingencies.

-

Regenerate NFe on the FS or FS-DA form, with legend "DANFe em Contingência - impresso emdecorrência de problemas técnicos.". This status allows companies to release the sales order and send the goods to the customer.

-

Print two copies.

-

Transmit NFe.

-

Enter the form NFe number, date, hour and remark "DANFe in contingency" in the NFe Response Process and Contingencies program (P76B12TE) so that NFe number matches the pre-printed form.

-

Print FS or FS-DA DANFe.

-

Store a copy of the FS or FS-DA DANFe.

-

Ship merchandise.

-

Send the XML file to SEFAZ when the web site becomes available.

-

-

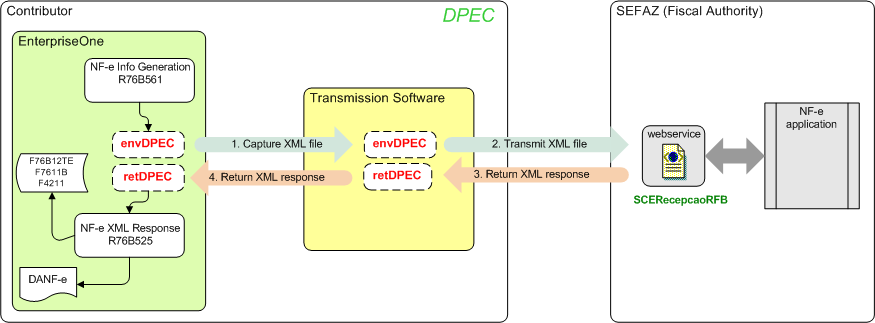

EPEC/DPEC Contingency

In the EPEC (Evento Previo de Emissao em Contingencia) or DPEC (Declaracao Previa de Emissao em Contingencia) contingency process, you follow these steps:

-

Change NFe emission type to 4 for EPEC/DPEC contingencies.

-

Regenerate NFe with a reduced set of tags, data, and digital signature. The system generates two XML files: the usual XML file (with type equal to 4) and a summary version of the XML.

-

Generate the EPEC/DPEC file.

-

Transmit the NFe and EPEC/DPEC file.

The system sends the XML file to the fiscal authority Electronic Contingency System using Web services or uploads it to the Portal Nacional da NF.

-

Process the response for the summarized XML.

-

Print the DANFe after the SEFAZ accepts the NFe.

The system prints the DANFe on common stock paper with the legend "DANFe impresso em contingência - DPEC regularmente recebida pela Receita Federal do Brasil."for national NFe DANFE. The print message for end-consumer transaction DANFE states "DANFe impresso em contingência - DPEC regularmente recebida pela SEFAZ autorizadora."

The system prints the DANFe on common stock paper with the legend "DANFe impresso em contingência - DPEC regularmente recebida pela Receita Federal do Brasil.".

-

Store a copy of the DANFe.

-

Ship merchandise.

-

Transmit the NF-e once technical issues are fixed. When you receive the approval for the EPEC/DPEC complete XML file (type equal to 4), change the NF-e to the final status A.

-

-

Offline NFC-e Contingency (Release 9.1 Update)

In the offline NFC-e contingency process, you follow these steps:

-

Change the NFe emission type to 9 for Offline NFC-e Contingency.

-

Regenerate the NFC-e with the contingency reason and the date and time.

-

Generate the offline NFC-e contingency XML file.

-

Print DANFe for the end consumer.

The system prints the DANFe on common stock paper with legend "EMITIDA EM CONTINGÊNCIA"

-

After the technical issues are fixed, transmit the NFC-e within 24 hours following from the emission time.

-

When you receive the approval from the fiscal authority, complete the XML file (type equal to 9), and change the NFC-e to the final status A.

-

17.3.4 Understanding Transmission Types

Review the following transmission types:

-

The NFe is a digital document that records an operation of merchandise transit or a service delivery. The legal legitimacy of an NFe is guaranteed by the digital signature of the emitter and the user authorization of the legal authority of the taxpayer state.

You send the NFe's to SEFAZ in a lot of fifty NFe's.

The XML schema file for NFe transmissions is located at the following Web site:

http://www.nfe.fazenda.gov.brin the Esquemas XML section. Open the appropriate .zip file and select the .xsd file with the filename that starts with "nfe". -

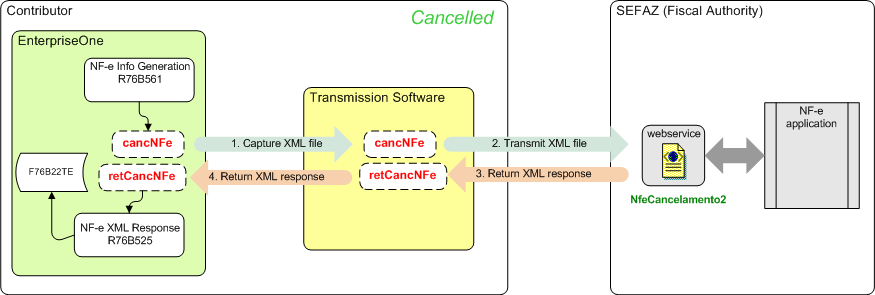

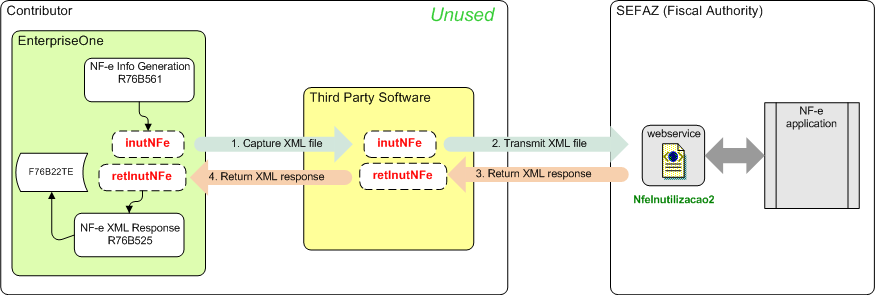

Voided NFe Legal Numbers Transmissions

If the NFe was rejected for any reason, you can send the voided NFe legal numbers in an XML file to SEFAZ via Web service.

The XML schema file for voided NFe legal numbers transmissions is located at the following Web site:

http://www.nfe.fazenda.gov.brin the Esquemas XML section. Open the appropriate .zip file and select the .xsd file with the filename that starts with "cancNFe". -

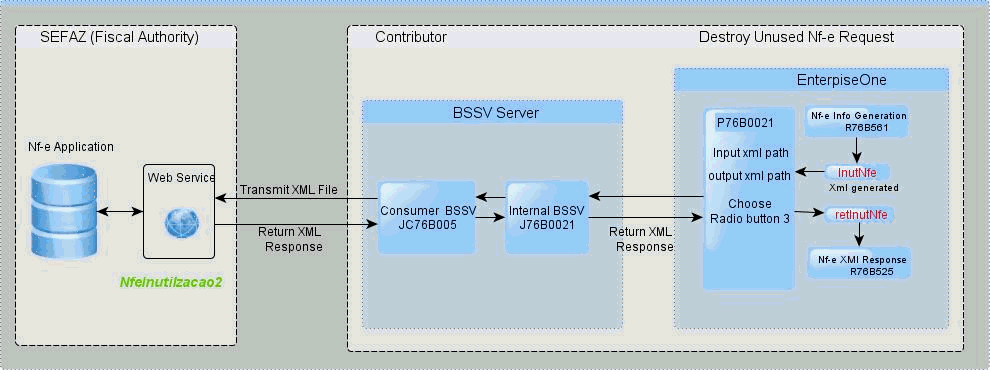

Unused NFe Legal Numbers Transmissions

Use the unused NFe legal numbers transmissions procedure when XML has been rejected by SEFAZ or the XML is a FS, FS-DA or Offline NFC-e contingency. You can cancel the original NFe XML if SEFAZ received the first XML with the original nota fiscal when there is an FS or FS-DA contingency. The system generates an XML with the unused NFe and sends it to SEFAZ. If nota fiscal will not be used, you can reverse the nota fiscal and notify SEFAZ that the nota fiscal number will not be used.

The XML schema file for unused NFe legal numbers transmissions is located at the following Web site:

http://www.nfe.fazenda.gov.brin the Esquemas XML section. Open the appropriate .zip file and select the .xsd file with the filename that starts with "inutNFe" -

EPEC/DPEC Contingency Transmissions

If the complete NFe file cannot be transmitted to SEFAZ, you can use the EPEC/DPEC contingency process to send a small XML file.

The XML schema file for EPEC and DPEC contingency transmissions is located at the following Web site:

http://www.nfe.fazenda.gov.brin the Esquemas XML section. Open the appropriate .zip file and select the .xsd file with the filename that starts with "env".

17.3.5 Understanding Emission Types and NFe Status Values

You have to complete different actions depending on the emission type and status values of an NFe. For example, if the emission type is normal and the status is generated, you can move the status to Accepted when company receives the answer from SEFAZ.

The following table lists the relationships between emission type and NFe statuses and their corresponding actions:

| From Emission Type | From NFe Status | To Emission Type | To NFe Status | Next NFe Status | Program | Actions |

|---|---|---|---|---|---|---|

| 1: Normal | 1: Initial | 1: Normal | G: Generated | 564 | NFe Info Generation program (R76B561) |

|

| 1: Normal | G: Generated | 1: Normal | A: Accepted | 577 | NF-e Response Process and Contingencies program |

|

| 1: Normal | G: Generated | 1: Normal | R: Rejected | 998 | NF-e Response Process and Contingencies program | Change status |

| 1: Normal | G: Generated | 1: Normal | C: Cancelled | 998 | NF-e Response Process and Contingencies program | Change status |

| 1: Normal | G: Generated | 1: Normal | E: Error | 579 | NF-e Response Process and Contingencies program | Change status |

| 1: Normal | E: Error | 1: Normal | I: Initial | 562 | NF-e Response Process and Contingencies program |

|

| 1: Normal | E: Error | 2: FS Contingency | I: Initial | 566 | NF-e Response Process and Contingencies program |

|

| 1: Normal | E: Error | 4:EPEC/DPEC Contingency | I: Initial | 565 | NF-e Response Process and Contingencies program |

|

| 1: Normal | E: Error | 5:FS-DA Contingency | I: Initial | 569 | NF-e Response Process and Contingencies program |

|

| 1: Normal | E: Error | 6: SVC-AN Contingency | I: Initial | 564 | NF-e Response Process and Contingencies program |

|

| 1: Normal | E: Error | 7: SVC-RS Contingency | I: Initial | 564 | NF-e Response Process and Contingencies program |

|

| 2: FS Contingency | I: Initial | 2: FS Contingency | G: Generated | 570 | NFe Info Generation program (R76B561) |

|

| 2: FS Contingency | G: Generated | 2: FS Contingency | A: Accepted | 619 | NF-e Response Process and Contingencies program | Change status |

| 2: FS Contingency | G: Generated | 2: FS Contingency | E: Error | 579 | NF-e Response Process and Contingencies program | Change status |

| 2: FS Contingency | E: Error | 2: FS Contingency | I: Initial | 566 | NF-e Response Process and Contingencies program |

|

| 4: EPEC/DPEC Contingency | 1: Initial | 4: EPEC/DPEC Contingency | G: Generated | 569 | NFe Info Generation program (R76B561) |

|

| 4: EPEC/DPEC Contingency | G: Generated | 4: EPEC/DPEC Contingency | D: DPEC Summary Accepted | 575 | NF-e Response Process and Contingencies program |

|

| 4: EPEC/DPEC Contingency | D: EPEC/DPEC Summary Accepted | 4: EPEC/DPEC Contingency | A: Summary | 581 | NF-e Response Process and Contingencies program | Change status |

| 4: EPEC/DPEC Contingency | G: Generated | 4: EPEC/DPEC Contingency | E: Error | 579 | NF-e Response Process and Contingencies program | Change status |

| 4: EPEC/DPEC Contingency | E: Error | 4: EPEC/DPEC Contingency | I: Initial | 565 | NF-e Response Process and Contingencies program |

|

| 4: EPEC/DPEC Contingency | E: Error | 2: FS Contingency | I: Initial | 566 | NF-e Response Process and Contingencies program |

|

| 4: EPEC/DPEC Contingency | E: Error | 5: FS-DA Contingency | I: Initial | 569 | NF-e Response Process and Contingencies program |

|

| 5: FS-DA Contingency | I: Initial | 5: FS-DA Contingency | G: Generated | 572 | NFe Info Generation program (R76B561) |

|

| 5: FS-DA Contingency | G: Generated | 5: FS-DA Contingency | A: Accepted | 619 | NF-e Response Process and Contingencies program | Change status |

| 5: FS-DA Contingency | G: Generated | 5: FS-DA Contingency | E: Error | 579 | NF-e Response Process and Contingencies program | Change status |

| 5: FS-DA Contingency | E: Error | 5: FS-DA Contingency | I: Initial | 569 | NF-e Response Process and Contingencies program |

|

| 6: SVC-AN Contingency | I: Initial | 6: SVC-AN Contingency | G: Generated | 584 | NFe Info Generation program (R76B561) |

|

| 6: SVC-AN Contingency | G: Generated | 6: SVC-AN Contingency | A: Accepted | 586 | NF-e Response Process and Contingencies program |

|

| 6: SVC-AN Contingency | G: Generated | 6: SVC-AN Contingency | R: Rejected | 997 | NF-e Response Process and Contingencies program | Change status |

| 6: SVC-AN Contingency | G: Generated | 6: SVC-AN Contingency | E: Error | 583 | NF-e Response Process and Contingencies program | Change status |

| 6: SVC-AN Contingency | E: Error | 6: SVC-AN Contingency | I: Initial | 564 | NF-e Response Process and Contingencies program |

|

| 6: SVC-AN Contingency | G: Generated | 6: SVC-AN Contingency | C: Cancelled | 998 | NF-e Response Process and Contingencies program | Change status |

| 7: SVC-RS Contingency | 1: Initial | 7: SVC-RS Contingency | G: Generated | 585 | NFe Info Generation program (R76B561) |

|

| 7: SVC-RS Contingency | G: Generated | 7: SVC-RS Contingency | A: Accepted | 587 | NF-e Response Process and Contingencies program |

|

| 7: SVC-RS Contingency | G: Generated | 7: SVC-RS Contingency | R: Rejected | 997 | NF-e Response Process and Contingencies program | Change status |

| 7: SVC-RS Contingency | G: Generated | 7: SVC-RS Contingency | E: Error | 583 | NF-e Response Process and Contingencies program | Change status |

| 7: SVC-RS Contingency | E: Error | 7: SVC-RS Contingency | I: Initial | 564 | NF-e Response Process and Contingencies program |

|

| 7: SVC-RS Contingency | G: Generated | 7: SVC-RS Contingency | C: Cancelled | 998 | NF-e Response Process and Contingencies program | Change status |

| 9: Offline Contingency | I: Initial | 9: Offline Contingency | G: Generated | 570 | NFe Info Generation program (R76B561) |

|

| 9: Offline Contingency | G: Generated | 9: Offline Contingency | A: Accepted | 619 | NF-e Response Process and Contingencies program | Change status |

| 9: Offline Contingency | G: Generated | 9: Offline Contingency | E: Error | 579 | NF-e Response Process and Contingencies program | Change status |

| 9: Offline Contingency | E: Error | 9: Offline Contingency | I: Initial | 566 | NF-e Response Process and Contingencies program |

|

17.3.6 Understanding the NFe Process

When you sell goods or services, you must generate a nota fiscal for the transaction. For most transactions, you must send an XML file containing nota fiscal information to the SEFAZ for their approval. The SEFAZ may reject the transmission for formal issues, such as incorrect tags, or for customer issues, such as an irregular tax situation. You send the XML file to SEFAZ through a pre-established Web service.

|

Note: The SEFAZ defines the layout of the XML file that you use to report your transactions. There are currently two available versions that you can use: Version 2.0 and 3.1. When generating the XML file and the DANFe, use the correct program version.For your convenience, JD Edwards EnterpriseOne Localizations for Brazil includes separate menu entries in the Electronic NFe Processes (G76BNFE) menu that associate different program versions to the legal layout versions. Ensure that you choose the version that complies with current fiscal regulations applicable to your company. |

When you process sales orders, generate NF-e files, and use the business services provided by the JD Edwards EnterpriseOne software or use third party software to transmit the NFe XML files, you:

-

Enter the sales order by using the Sales Order Entry - Header - Brazil (P4210, version ZJDE7002) or the Sales Order Entry - Detail - Brazil (P4210, version ZJDE7001) programs.

-

Add charges by using the Nota Fiscal Maintenance - Brazil program (P7610B).

This program lets you add freight, insurance and other expense information to the nota fiscal.

-

Generate the nota fiscal by running the Generate Nota Fiscal - Brazil program (R76558B).

This program assigns a temporary number to the nota fiscal and calculates Brazil tax amounts. You must set the Nota Fiscal Type processing option to generate the appropriate Nota Fiscal (National, End Consumer and so on). The program generates an initial record in the NFe Header table (F76B01TE) and NF-e Status Log table (F76B12TE).

-

Generate the NF-e XML file by running the NF-e Info Generation program (R76B561), which runs the NF-e Info Generation by Lot UBE program (R76B561L).

You can run the NF-e Info Generation program from a menu option or from the NF-e Response Process and Contingencies program (P76B12TE).

-

Submit the NFe XML file to SEFAZ.

You can use a custom, a third-party program, or the NF-e Transmission program (P76B0021) to submit the file to SEFAZ.

The NF-e Transmission program enables you to select the file, select the service (submit for processing, cancel, or destroy), and transmit the file to SEFAZ. You can view the status of the submission in the NF-e Transmission program.

-

Receive the response from SEFAZ.

-

Upload the final response file from the SEFAZ by running the appropriate version of the NFe XML Response Processing program (R76B525). Use the menu entry for the appropriate XML version.

The NFe XML Response Processing program retrieves the response XML file from the source folder and updates the JD Edwards EnterpriseOne tables.

You can also upload the response using the NF-e Response Process and Contingencies program (P76B12TE), and for unused and cancelled NFes, using the Unused/Cancelled NF-e Numbers program (P76B22TE).

-

Print the DANF-e document from the NF-e Response Process and Contingencies program (P76B12TE) if you did not set the processing option to automatically print it.

-

Update journal entries for Brazil taxes by running the Update Sales - Brazil program (R76B803).

-

Update the base-software sales tables by running the Sales Update program (R42800) if you did not set the processing option in the Update Sales - Brazil program to update the base-software tables.

Verify that the corresponding version R42800BR is set up in your system.

17.4 Setting Up Series Length, Number Length, and Legal Next Numbers for Notas Fiscais

This section provides overviews of series length and numbers length and legal next numbers and discusses how to:

-

Set up nota fiscal serie length and number length.

-

Set up nota fiscal legal next numbers.

17.4.1 Understanding Series Length and Numbers Length

Use the Nota Fiscal Series and Numbers Length program (P76B008) to set up the character length of the nota fiscal serie and number for each type of nota fiscal; paper and electronic. Because the NFe legal number and legal serie length depends on the nota fiscal type, the fields are defined longer than what is needed. For example, the paper nota fiscal serie length is a two character number and the legal number is a six character number. The electronic nota fiscal serie length is a three character number and the legal number is a nine character number.

Use the Next Numbers - Nota Fiscal program (P7600B) to set up next numbers for the classic, Sao Paolo, and national notas fiscais and the Nota Fiscal Next Numbers program (P76B007) to set up next numbers for the electronic notas fiscais. The system validates that the different nota fiscal next numbers do not exceed the determined lengths. The system stores this information in the Nota Fiscal Legal Next Number Length table (F76B008).

For some companies, the NFe series is not required, so you have to set up a legal next number using the series 000. The system retrieves and advances the next number automatically based on the fiscal company and the serie. If the legal next number is greater than 999.999.999 for a outbound NFe, the system resets the next number to 1.

17.4.2 Understanding Legal Next Numbers

The system has two types of next numbers:

-

Classic and Sao Paolo notas fiscais next numbers

-

National NFe and End Consumer NFCe next numbers

You set up temporary next numbers for national NFe and NFCe in the Next Numbers program (P0002). Also, you have to set up a next number from the block of nota fiscal numbers that are assigned to a company by SEFAZ in the Next Numbers - Nota Fiscal program (P7600B). The system uses the temporary next number from the Next Numbers program and NFe next number from the Next Numbers - Nota Fiscal program when you run the Generate Nota Fiscal program (R76558B). The Generate Nota Fiscal program generates the legal nota fiscal number from the Nota Fiscal Next Number program (P76B007).

The system stores the NFe next number information in the Nota Fiscal Legal Next Number table (F76B007).

17.4.3 Forms Used to Set Up Nota Fiscal Series Length, Numbers Length, and Legal Next Numbers

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| WorkWith Nota Fiscal Serie and Number Length | W76B008A | NF-e Setup (G76BNFE2), NF Serie and Number Length Setup | Review and select notas fiscais. |

| Nota Fiscal Serie and Number Length Revision | W76B008B | Click Add on the Work With Nota Fiscal Serie and Number Length form. | Set up nota fiscal serie length and number length. |

| WorkWith Nota Fiscal Next Numbers | W76B007A | NF-e Setup (G76BNFE2), NF Legal Next Number Setup | Review and select notas fiscais. |

| Nota Fiscal Next Numbers Revision | W76B007B | Click Add on the Work With Nota Fiscal Next Numbers form. | Set up nota fiscal legal next numbers. |

17.4.4 Setting Up Nota Fiscal Serie Length and Number Length

Access the Nota Fiscal Serie and Number Length Revision form.

Figure 17-3 Nota Fiscal Serie and Number Length Revision

Description of ''Figure 17-3 Nota Fiscal Serie and Number Length Revision''

- Nota Fiscal Type

-

Enter a value that exists in the Transaction Type (70/TY) UDC table to specify the type of nota fiscal. The system enables or disables fields on forms, and performs validations based on the value that you enter.

- NF Legal Model Type

-

Enter a value that exists in the Nota Fiscal Model Type (76B/MT) UDC table to specify the nota fiscal model type.

- Legal Nota Fiscal Serie Length

-

Enter a value that identifies the character length of the nota fiscal legal series number. The maximum character length is 10. This is a required field.

- Legal Nota Fiscal Number Length

-

Enter a value that identifies the character length of the legal nota fiscal number. The maximum character length is 20.

- Electronic NF - Apply (Release 9.1 Update)

-

Select the option to indicate that the nota fiscal type is electronic. This option is required when you work with national fiscal notes and end-consumer fiscal notes (NFC-e).

17.4.5 Setting Up Nota Fiscal Legal Next Numbers

Access the Nota Fiscal Next Numbers Revision form.

Figure 17-4 Nota Fiscal Next Numbers Revision form

Description of ''Figure 17-4 Nota Fiscal Next Numbers Revision form''

- Fiscal Company

-

Enter the company in which to set up next numbers for the nota fiscal.

- Nota Fiscal Type

-

Enter a valid value from UDC table 70/TY to specify the nota fiscal type.

- Nota Fiscal Legal Serie

-

Enter a value that identifies the nota fiscal legal series number. This is a required field.

- Nota Fiscal Legal Next Number

-

Enter the legal number assigned to the nota fiscal. This is a required field.

17.5 Setting Up Next Status Codes for Notas Fiscais

This section provides an overview of activity rules and discusses how to set up next status codes.

17.5.1 Understanding Activity Rules

Use the NF-e Next Status Setup program (P76B090) to configure all the valid next status codes related to a specific emission type and NFe status combinations. Each combination of emission type and XML status correspond to a next status value. You must use activity rules to set up the valid next status combinations. Therefore, the system validates the activity rules and only changes the status of the sales order and nota fiscal to valid and permitted next statuses. The system stores activity rule information in the NF-e Next Status Setup table (F76B090).

This table provides a recommendation as to how you can configure activity rules:

| Last | Description | Next | Other | Allowed | Allowed | Allowed | Allowed | Ledger |

|---|---|---|---|---|---|---|---|---|

| 520 | Enter sales order | 540 | 560 | 562 | N | |||

| 540 | Print pick | 560 | N | |||||

| 560 | Ship confirmation | 562 | N | |||||

| 562 | Generate nota fiscal | 564 | 563 | 580 | Y | |||

| 563 | Additional charges | 564 | N | |||||

| 564 | Normal (Generate XML) | 577 (accepted) | 998 (rejected /canceled) | 579 (error) | 565 (contingencies) | N | ||

| 565 | Contingencies | 566 (FS and Offline) | 598 (EPEC/DPEC) | 569 (FSDA) | 581 (SVC-AN) | 582 (SVC-RS) | N | |

| 566 | FS CONT (Print DANFE) | 570 | Y | |||||

| 568 | EPEC/DPEC CONT (Generate XML) | 577 (accepted) | 998 (rejected/canceled) | 579 (error) | 566 (FS and offline) | 569 (FSDA) | 564 (normal) | N |

| 569 | FS – DA CONT (Print DANFE) | 572 | Y | |||||

| 570 | FS CONT and Offline (Generate XML) | 619 (accepted) | 579 (error) | N | ||||

| 572 | FS – DA CONT (Generate XML) | 619 (accepted) | 579 (error) | N | ||||

| 575 | EPEC/DPEC CONT (Print DANFE) | 619 | Y | |||||

| 577 | Normal (Print DANFE) | 619 | Y | |||||

| 579 | XML Error | 564 (normal) | 566 (FS and Offline) | 568 (EPEC/DPEC) | 569 (FSDA) | N | ||

| 580 | Print nota fiscal | 617 | 620 | 998 | Y | |||

| 581 | SVC-AN (Generate XML) and EPEC/DPEC Accepted | 584 | N | |||||

| 582 | SVC-RS (Generate XML) | 585 | N | |||||

| 583 | Error | 584

SVC-AN |

585

SVC-RS |

564 Contingency | N | |||

| 584 | SVC-AN (Accepted) | 586 | 997 Rejected | 998 Cancelled | 583 Error | N | ||

| 585 | SVC-RS (Accepted) | 587 Print DANFE | 997 Rejected | 998 Cancelled | 583 Error | N | ||

| 586 | SVC-AN (Print DANFE) | 619 | 998 | Y | ||||

| 587 | SVC-RS (Print DANFE) | 619 | 998 | Y | ||||

| 617 | NFE generation (Sao Paolo) | 618 | N | |||||

| 618 | NFE reception (Sao Paolo) | 619 | N | |||||

| 619 | Generate Brazil tax lines | 620 | N | |||||

| 620 | Sales update | 999 | N | |||||

| 998 | Reverse | N | ||||||

| 999 | Complete (ready to purge) | N |

|

Note: It is not required that you set up activity rules according to this table. |

17.5.1.1 Status Change Examples for Emission Types

Review the following examples of the status changes for different emission types.

This table shows the steps from Normal status to Accepted status:

| Emission Type and NFe Status-From | Next Status -From | Program | Emission Type and NFe Status -To | Next Status - To |

|---|---|---|---|---|

| Generate Nota Fiscal report (R76558B) | 0 – I | 562 | ||

| 0 – I | 562 | NFe Info Generation report (R76B561) | 1 –G | 564 |

| 1 –G | 564 | NF-e Response Process and Contingencies program (P76B12TE) | 1 –A | 577 |

| 1 –A | 577 | Print DANFE report (R76B561) | 1 –A | 619 |

17.5.2 Forms Used to Set Up Next Status Codes

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with NF-e Next Status Setup | W76B090A | NF-e Setup (G76BNFE2), NF-e Next Status Setup | Review or select next statuses codes. |

| NF-e Next Status Setup Revisions | W76B090B | Select a record on the Work with NF-e Next Status Setup form. | Set up next statuses codes. |

17.5.3 Setting Up Next Status Codes

Access the NF-e Next Status Setup Revisions form.

Figure 17-5 NF-e Next Status Setup Revisions form

Description of ''Figure 17-5 NF-e Next Status Setup Revisions form''

- Document Type

-

Enter a value from UDC table 00/DT that identifies the type of document.

- NF-e Em Type (nota fiscal emission type)

-

Enter a valid value from the NF-e Emission Type UDC (76B/ET) table to identify the XML transmission method.

- NF-e St (nota fiscal status)

-

Enter a valid value from the NF-e Status UDC (76B/ST) table that identifies the status of the NFe XML file.

- Next Status

-

Enter a value from UDC table 40/AT that identifies the next step in the order flow of the line type.

17.6 Setting Up Authorized Persons to Access NFe Information (Release 9.1 Update)

This section provides an overview of the NFe Access Authorized Person program and the Authorized Persons by Nota Fiscal program, and discusses how to add authorized persons to access the NFe information.

17.6.1 Understanding NFe Access Authorization

Beginning with the layout version 3.10 of the NFe XML file, companies can include an additional optional section in the XML file to specify additional people to be able to access the information provided to the government authorities in the NFe XML file that they transmit to the SEFAZ. This list can include accountants, carriers, or any other person the company deems appropriate. The only requirement is to inform the authorized persons to the SEFAZ in a list included in the XML file that the system generates. Authorized persons can access the XML file from the SEFAZ Web site after the company sends the XML file.

The system provides two different methods to include authorized persons in the NFe XML file:

-

Use the NFe Access Authorized Person program (P76B0112) to add authorized persons associated to the address book records that you use when entering fiscal notes (for company, carrier, Ship To, and Ship From entities). Whenever you enter a nota fiscal using any of these records, the associated authorized persons are listed automatically as the authorized persons for that nota fiscal.

This program creates the records for authorized persons in the NFe Access Authorized Person for Brazil (F76B0112).

-

Use the Authorized Persons by Nota Fiscal program (P76B1020) to add, modify, or delete records of authorized persons to access a nota fiscal XML file in particular, that the system stores in the Authorized Person by Nota Fiscal (F76B1020) table.

For example, you can use the NFe Access Authorized Persons program (P76B0112) to set up two authorized persons for the company 0001, one for Carrier A, two for the Ship To address book record B, and one for the Ship From address book record C. If you enter a fiscal note that involves the company 0001 and the Carrier A, the Authorized Persons by Nota Fiscal program (P76B1020) lists the three authorized persons entered (one for Carrier A and two for the company 0001), and allows you to add additional authorized persons specifically for that fiscal note.

17.6.2 Prerequisites

Before you complete the tasks in this section:

-

Verify that the legal company records are set up in the Legal Company Constants program (P76B010).

-

Verify that Business Units are set up.

-

Verify that there is an Address Book record for every person you are authorizing to access to NFe information.

17.6.3 Forms Used to Set Up NFe Access Authorized Person

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with NF-e Access Authorized Person | W76B0112A | NF-e Setup (G76BNFE2), NF-e Access Authorized Person Setup | Review or select records in the authorized person list. |

| NF-e Access Authorized Person Revisions | W76B0112B | - Select a record on the Work with NF-e Access Authorized Person form.

- In the Nota Fiscal Maintenance program (P7610B), access the Work With Nota Fiscal Headers form (W7610BG). Select a record and select Authorized Persons from the Row menu. |

Add or modify records. |

| Authorized Person by Nota Fiscal | W76B1020B | Sales Order Processing - Brazil (G76B4211), Nota Fiscal Inquiry - Header Browse and select the Row Menu Authorized Persons | Create, review, or modify records of authorized persons by Nota Fiscal before generating the XML file. |

17.6.4 Setting Processing Options for the NFe Access Authorized Person Program (P76B0112)

Processing options enable you to specify the default processing for programs and reports.

17.6.4.1 Select

- 1. Authorized Persons per Address Book record

-

Enter a value that specifies the maximum number of authorized persons allowed to access the information in the XML file.

Ensure the value entered does not exceed the maximum number of authorized persons that the fiscal authority sets.

If you do not complete this field, the system uses a value of 2.

17.6.5 Adding NFe Access Authorized Person Records

Access the NF-e Access Authorized Person Revisions form.

Figure 17-6 NFe Access Authorized Person Revisions

Description of ''Figure 17-6 NFe Access Authorized Person Revisions''

- Authorizing Person

-

Enter the address book record number that identifies who can create records of authorized persons to access the Nota Fiscal XML file.

- Authorized Person

-

Enter the address book record number that identifies who can access the Nota Fiscal XML file.

17.6.6 Setting Processing Options for the Authorized Persons by Nota Fiscal Program (P76B1020)

Processing options enable you to specify the default processing for programs and reports.

17.6.6.1 Default

- 1. Authorized Persons per Nota Fiscal

-

Enter a value that specifies the maximum number of authorized persons allowed to access the information in the XML file.

Ensure that the value entered does not exceed the maximum number of authorized persons that the fiscal authority sets.

If you do not complete this field, the system uses a value of 10.

17.6.7 Adding Records of Authorized Persons by Nota Fiscal

Access the Authorized Persons by Nota Fiscal form.

Figure 17-7 Authorized Persons by Nota Fiscal Form

Description of ''Figure 17-7 Authorized Persons by Nota Fiscal Form''

- Authorized Person to Access

-

Enter the address book record number that identifies who can access the Nota Fiscal XML file. The system populates the details for the record entered.

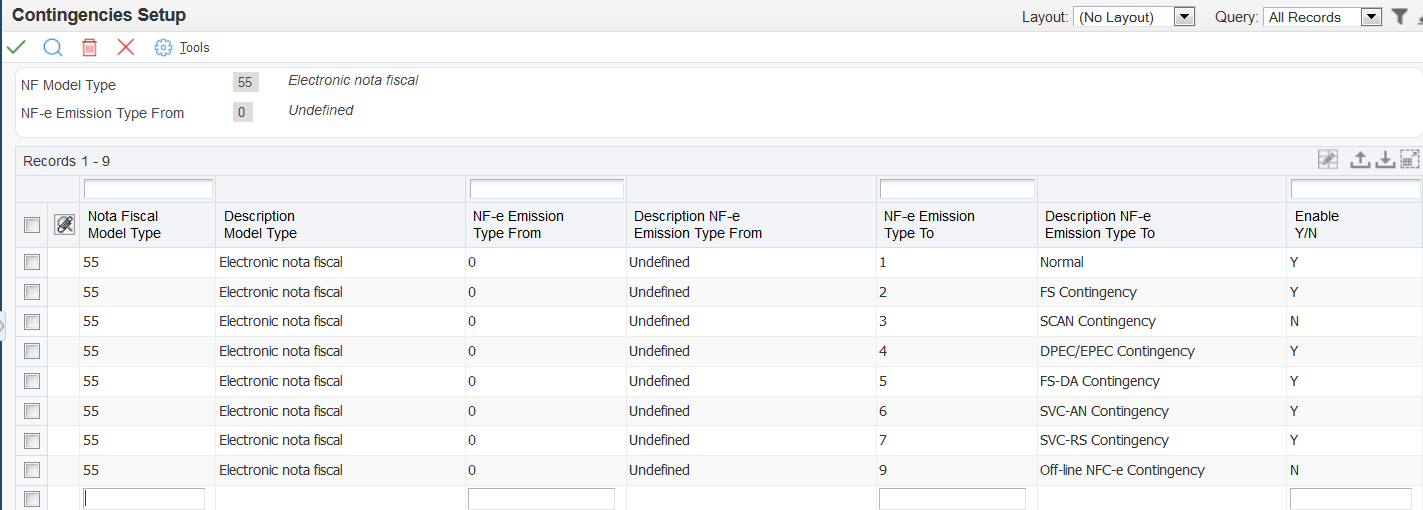

17.7 Setting Up Allowed Contingencies (Release 9.1 Update)

This section provides an overview of the Contingencies Setup program (P76B209) and discusses how to set up contingencies.

17.7.1 Understanding Allowed Contingency Setup

The contingencies that you can use for notas fiscais are determined by the nota fiscal model type. Model types are defined by the government, and are described in UDC 76B/MT in the JD Edwards EnterpriseOne system. The model types for which the JD Edwards EnterpriseOne system supports contingency processing are:

-

55: Electronic nota fiscal

-

65: End consumer

|

Note: The Brazilian government can change the allowed contingencies, or add new ones, at any time. You must verify that you have the most current information before you set up and use the Contingency Setup program. |

Each model type allows for certain types of contingencies, and each contingency allows certain changes from one transmission type to another. The following table lists the allowed progression of changes to the emission type in effect as of October, 2015:

| NF Model Type | Model Type Description | NFe Emission Type From | Description | NFe Emission Type To | Description | Enable Y/N |

|---|---|---|---|---|---|---|

| 55 | Fiscal Note | 0 | Initial | 2 | FS | Y |

| 55 | Fiscal Note | 0 | Initial | 4 | EPEC | Y |

| 65 | Consumer Sales Fiscal Note | 0 | Initial | 4 | EPEC | Y |

| 55 | Fiscal Note | 0 | Initial | 5 | FSDA | Y |

| 55 | Fiscal Note | 0 | Initial | 6 | SVCAN | Y |

| 55 | Fiscal Note | 0 | Initial | 7 | SVCRS | Y |

| 65 | Consumer Sales Fiscal Note | 0 | Initial | 9 | Offline | Y |

| 55 | Fiscal Note | 1 | Normal | 2 | FS | Y |

| 55 | Fiscal Note | 1 | Normal | 4 | EPEC | Y |

| 65 | Consumer Sales Fiscal Note | 1 | Normal | 4 | EPEC | Y |

| 55 | Fiscal Note | 1 | Normal | 5 | FSDA | Y |

| 55 | Fiscal Note | 1 | Normal | 6 | SVCAN | Y |

| 55 | Fiscal Note | 1 | Normal | 7 | SVCRS | Y |

| 65 | Consumer Sales Fiscal Note | 1 | Normal | 9 | Offline | Y |

| 55 | Fiscal Note | 4 | EPEC | 2 | FS | Y |

| 55 | Fiscal Note | 4 | EPEC | 5 | FSDA | Y |

Nota fiscal model types exist in the Model Type UDC (76B/MT). The NFe emission types exist in the Emission Type UDC (76B/ET).

You use the Contingency Setup program (P76B209) to enter or modify the various contingencies for each model type supported in the JD Edward EnterpriseOne system. After you set up the contingencies, you can use the Enable Y/N field to specify whether the change in the emission type is valid for the type of notal fiscal. The system stores the records in the Setup Contingencies (F76B209) table.

|

Note: Instead of manually entering each record, you can create a spreadsheet with the values that you need and then import the values into the Contingency Setup program. You must set up records for all of the allowed changes in the emission type. Setting up records for disallowed changes is optional. |

After you run the Generate Fiscal Note program (R76558B) for national (model 55) or end-consumer (model 65) transactions, you can use the NF-e Response Process and Contingencies program (P76B12TE) to change the status of the nota fiscal from one type of emission to another. The NF-e Response Process and Contingencies program uses the values that are set up in the Contingency Setup program to validate whether the change in emission type is allowed. The system considers any status that is not set up to be invalid.

17.7.2 Forms Used to Set Up Allowed Contingencies

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Contingency Setup | W76B209B | NF-e Setup (G76BNFE2), Contingency Setup

Select a record on the Work with Contingencies form, and then click Select. |

Add new contingencies for nota fiscal types and modify existing contingency records. |

17.7.3 Setting Up an Allowed Contingency

Access the Contingency Setup form.

- Nota Fiscal Model Type

-

Specify a model type from the Model Type (76B/MT) UDC table.

- NF-e Emission Type From

-

Specify an emission type from the Emission Type (76B/ET) UDC table to identify the existing emission type.

- NF-e Emission Type To

-

Specify an emission type from the Emission Type (76B/ET) UDC table to identify the new emission type.

- Enable Y/N (Enable yes or no)

-

Enter Y (yes) to specify that the relationship between the original and new emission type is allowed. Enter N (no) if the relationship is not allowed.

17.8 Working With the NFe XML Statuses and Emission Types

This section provides overviews of XML statuses and the NF-e Response Process and Contingencies program (P76B12TE) and discusses how to:

-

Set processing options for the NF-e Response Process and Contingencies program (P76B12TE).

-

Update NFe statuses.

-

Work with NFe contingency statuses.

-

Enter NFe response information.

-

Review additional NFe information.

-

Review NFe status history.

17.8.1 Understanding XML Statuses

After the system generates the NFe (nota fiscal electronica), it creates the XML file to be sent to SEFAZ. Use the JD Edwards EnterpriseOne localizations transmission process or third-party software to retrieve information and send the XML file to SEFAZ. When the transmission software receives an answer from SEFAZ, you must evaluate the answer and the determine how to change the emission type and XML status for the NFe.

The system provides two methods to update the answer received from SEFAZ:

-

The system enables you to manually enter the resulting status of the NFe in the NF-e Response Process and Contingencies program (P76B12TE).

-

The system enables the transmission software to insert a new record for each response in the NF-e Status Log Z File (F76B12TZ). When you run the NF-e Response Process Batch Input report (R76B12TZ), the system accesses the F76B12TZ table, retrieves each non-processed record, inserts it in the NF-e Status Log table (F76B12TE), and executes the corresponding actions related to that status code. You can review and revise batch input transactions in the NF-e Response Process Batch Input Revisions program (P76B12TZ).

The system uses the following fields to define each NFe status:

-

Emission Type: Enter a value that identifies the transmission type that the system uses for the XML file. Values are:

-

0: Undefined

-

1: Normal

-

2: FS Contingency

-

3: SCAN Contingency

-

4: DPEC/EPEC Contingency

-

5: FS-DA Contingency

-

6: SVC-AN Contingency

-

7: SVC-RS Contingency

-

9: Offline NFC-e Contingency

-

-

XML Status: Enter a value that specifies the status code of the NFe XML. For each status change, the system adds a new record in NF-e Status Log table (F76B12TE) and the corresponding next status in the Nota Fiscal Details table (F7611B) and the Sales Order Detail table (F4211). Values are:

-

I: Initial

In the initial status, the system generates an initial record in the NF-e Status Log table (F76B12TE) when you run the Generate Nota Fiscal program (R76558B) for records with 0 in the Emission Type field. The system changes the emission type from 0 to 1, 2, 3, 4, 5, 6, 7, or 9 depending on user selection and the NFe type. If you are working with National NFes, you can use the emission types 1, 2, 4, 5, 6, and 7; and if you are working with an XML for NFC-e, you can use the emission types 2 and 9. You also have the option of generating a normal XML and then changing the emission type to normal or to a contingency. When you run the NFe Info Generation program (R76B561), the system generates a second record in the F76B12TE table.

-

G: Generated

-

D: DPEC Summary Accepted

-

A: Accepted

If you receive this status code from SEFAZ, the system updates the corresponding next status of the sales order and nota fiscal and submits the DANFe using the NFe Info Generation program (R76B561). You can also submit the DANFe by manually selecting notas fiscais to print.

-

E: Error

This status is a temporary status until the error is fixed. You must correct the error and then generate the XML file again to continue the process.

-

C: Cancelled

You can cancel an existing NFe in the NF-e Response Process and Contingencies program (P76B12TE). If you receive an approval from SEFAZ, the system has to generate an XML file with the cancelled NFe number. Otherwise, the system marks this NFe number as unused so the system can generate the corresponding XML file with that unused NFe number.

-

R: Rejected

If you receive this status code from SEFAZ, the system inserts a new record in NF-e Status Log table (F76B12TE) and the corresponding next status value in the Nota Fiscal Details table (F7611B) and the Sales Order Detail table (F4211). This is a final status and you will not be able to continue the transaction.

-

17.8.2 Understanding the NF-e Response Process and Contingencies Program (P76B12TE)

Use the NF-e Response Process and Contingencies program (P76B12TE) to change the NFe status or emission type. The system uses the next status code from the NF-e Next Status Setup table (F76B090) and validates the next status using the activity rules functionality. If no errors occur, the system updates the nota fiscal status in the Nota Fiscal Details table (F7611B) and the sales order in the Sales Order Detail table (F4211).

Use the NF-e Response Process and Contingencies program to manually cancel an NFe. If the NFe was accepted and DANFe was printed, the system does not allow you to cancel the NFe. You have to void or reverse the NFe, accordingly. If NFe was accepted but not printed, you can cancel NFe. If the XML was not approved yet, the system marks this number as unused by inserting a new record in the NF-e Legal Numbers Unused/Cancelled - BRA table (F76B22TE) with the NFe legal number.

For example, review how the system works with cancelled NFe numbers. If you change the emission type from Normal to SVC-AN Contingency and receive SVC-AN Contingency XML approval from SEFAZ, the system marks the NFe legal number generated in the Normal emission type as Unused by inserting a new record in the NF-e Legal Numbers Unused/Cancelled - BRA table (F76B22TE) with the NFe legal number. However, if you receive the Normal XML approval and the NFe was already changed to SVC-AN Contingency, the system cancels the NFe legal number generated by Normal emission type and waits for SVC-AN XML response.

You can also use the use the NF-e Response Process and Contingencies program to generate the XML and DANFe files.

17.8.3 Forms Used to Work With the NFe XML Statuses and Emission Types

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with NF-e Status Log | W76B12TEA | Electronic NFe Processes, (G76BNFE), NF-e Response Processes and Contingencies | Update NFe statuses. |

| NF-e Contingency Status Revision | W76B12TEB | On the Work with NF-e Status Log form.

|

Work with NFe contingency statuses. |

| NF-e Response Information Revision | W76B12TEC | On the Work with NF-e Status Log form.

|

Enter NFe response information. |

| NFe Additional Information | W76B12TED | Select Inquires, Additional Information from the Row menu on the Work with NF-e Status Log form. | Review additional NFe information. |

| Work with NF-e Status History Log | W76B12TEE | Select Inquires, History Log from the Row menu on the Work with NF-e Status Log form. | Review NFe status history. |

17.8.4 Setting Processing Options for the NF-e Response Process and Contingencies Program (P76B12TE)

Processing options enable you to specify the default processing for programs and reports.

17.8.4.1 Display

- 1. Electronic Nota Fiscal Type Display (Release 9.1 Update)

-

Select a code from the Transaction Type UDC table (70/TY) that identifies the type of Nota Fiscal for which the system shows records.

If you leave this processing option blank, the system uses BRNFI-NA (National NFe).

17.8.4.2 Defaults

- 1. Enter the Print Message code (40/PM) associated to the contingency methods in order to complete the Contingency Reason Field:

- FS Contingency Reason Code

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the FS contingency method. The system requires this value when you change the emission type to any contingency method.

- SCAN Contingency Reason Code

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the SCAN contingency method. The system requires this value when you change the emission type to any contingency method.

- EPEC/DPEC Contingency Reason Code

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the EPEC/DPEC contingency method. The system requires this value when you change the emission type to any contingency method.

- FS-DA Contingency Reason Code

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the FS-DA contingency method. The system requires this value when you change the emission type to any contingency method.

- SVC-AN Contingency Reason Code (Release 9.1 Update)

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the SVC-AN contingency method. The system requires this value when you change the emission type to any contingency method.

- SVC-RS Contingency Reason Code (Release 9.1 Update)

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the SVC-RS contingency method. The system requires this value when you change the emission type to any contingency method.

- Offline NFC-e Contingency Reason Code (Release 9.1 Update)

-

Enter a value from UDC table 40/PM to specify the standard print message code associated with the offline NFC-e contingency method. The system requires this value when you change the emission type to any contingency method.

- 2. Enter the Print Message codes (40/PM) associated to the Unused or Cancelled NF-e legal number in order to complete the Reason Field:

- Reason Code for Unused

-

Enter a value from UDC table 40/PM to specify the standard print message code associated to the unused NFe legal number.

- Reason Code for Cancelled

-

Enter a value from UDC table 40/PM to specify the standard print message code associated to the cancelled NFe legal number.

- 3. Enter the NF-e Emission Type to be used as default

-

Enter a valid value from the NF-e Emission Type UDC (76B/ET) table to identify the XML transmission method.

- 4. Enter the NF-e Status to be used as default

-

Enter a value from the NF-e Status UDC (76B/ST) table that identifies the default status of the NFe XML file.

If you leave this processing option blank, the system selects all NFe statuses (default).

I: Initial. The status previous to the XML generation.

G: Generated. The status when the company generates the XML file and sends it to SEFAZ (or third party software).

A: Accepted. The status when SEFAZ accepts or approves the NF-e.

E: Error. The status when SEFAZ finds errors in the XML validation.

R: Rejected. The status when SEFAZ denies or rejects the NF-e.

C: Cancelled. The status when the company cancels the operation.

D: DPEC Summary. The status when SEFAZ accepts the summary XML file for DPEC Contingency method.

17.8.4.3 Process

- 1. Contingency NF-e Legal Number

-

Specify the NFe legal number that the system uses. The system uses this field for contingency flows only. Values are:

Blank: The system uses the normal NFe legal number.

1: The system uses a new legal number to replace the one you are processing.

- 2. Protocol Number validation

-

Specify whether the system validates the protocol number. Values are:

Blank: The system validates the NFe protocol number.

1:The system does not validate the NFe protocol number.

- 3. Time limit to cancel Fiscal Notes after governments acceptance (in hours). (Release 9.1 Update)

-

Specify the number of hours after which you can cancel NFes. The government specifies a length of time, and you must enter that time period (in hours) here. If you do not complete the processing option, the process uses 24 hours from the time that you receive the NFe number from the government.

17.8.4.4 Versions

- NORMAL XML Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal XML generation. The default value is ZJDE0001.

- NORMAL DANF-e Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal DANFe generation. The default value is ZJDE0002.

- SCAN Contingency XML Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal SCAN XML generation. The default value is ZJDE0003.

- SCAN Contingency DANF-e Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal SCAN DANFe generation. The default value is ZJDE0004.

- FS Contingency XML Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS XML generation. The default value is ZJDE0005.

- FS Contingency DANF-e Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS DANFe generation. The default value is ZJDE0006.

- DPEC/EPEC Contingency XML Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal DPEC/EPEC XML generation. The default value is ZJDE0007, associated to the XML Layout Version 2.00. If you work with version 3.1, you can set version ZJDE0029 as default value.

- DPEC/EPEC Contingency DANF-e Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal DPEC/EPEC DANFe generation. The default value is ZJDE0008, associated to the XML Layout Version 2.00. If you work with version 3.1, you can set version ZJDE0030 as default value.

- FS-DA Contingency XML Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS-DA XML generation. The default value is ZJDE0009.

- FS-DA Contingency DANF-e Generation

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS-DA DANFe generation. The default value is ZJDE0010.

- SVC-AN Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal SVC-AN XML generation. The default value is ZJDE0011.

- SVC-AN Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal SVC-AN DANFe generation. The default value is ZJDE0012.

- SVC-RS Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal SVC-RS XML generation. The default value is ZJDE0013.

- SVC-RS Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal SVC-RS DANFe generation. The default value is ZJDE0014.

- NFC-e (Release 9.1 Update)

- NFC-e Normal XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal NFC-e XML generation. The default value is ZJDE0015.

- Normal NFC-e DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal NFC-e DANFe generation. The default value is ZJDE0016.

- FS NFC-e Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS NFC-e XML generation. The default value is ZJDE0017.

- FS NFC-e Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS NFC-e DANFe generation. The default value is ZJDE0018.

- FS-DA NFC-e Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS-DA NFC-e XML generation. The default value is ZJDE0019.

- FS-DA NFC-e Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal FS-DA NFC-e DANFe generation. The default value is ZJDE0020.

- Offline NFC-e Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal offline NFC-e contingency XML generation. The default value is ZJDE0021.

- Offline NFC-e Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal offline NFC-e contingency DANFe generation. The default value is ZJDE0022.

- EPEC NFC-e Contingency XML Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal EPEC NFC-e contingency XML generation. The default value is ZJDE0037.

- EPEC NFC-e Contingency DANF-e Generation (Release 9.1 Update)

-

Specify the version of the NF-e Info Generation program that the system uses for normal EPEC NFC-e contingency DANFe generation. The default value is ZJDE0038.

- NF-e XML Response Processing batch application (R76B525)

-

Specify the version of the NF-e XML Response Processing program that the system uses when you automatically process NFe response messages. The default value is ZJDE0001.

17.8.5 Updating NFe Statuses

Access the Work with NF-e Status Log form.

You can select multiple records in the grid and update those records with a single Row selection. When you make a selection from the Row menu, the system displays a dialog box that informs you of the changes you are about to make to the record.

Use selections on the Row menu to complete the following actions:

-

Select Processes, Generate XML to generate the XML file.

-

Select Processes, Generate DANF-e to generate the DANFe report.

-

Select Processes, Cancel NF-e to change the NF-e status to cancelled.

This selection implies a change in the next status code, depending on the activity rules. The system inserts a new record in NF-e Legal Numbers Unused/Cancelled - Brazil table (F76B22TE).

-

Select Response, Accept, Error, or Reject to access the NF-e Response Information Revision form.

These selections imply a change in the next status code, depending on the activity rules.

-

Select Contingencies, FS Cont., DPEC/EPEC Cont., FS-DA Cont., SVC-AN Cont., SVC-RS Cont., or Offline NFC-e Contingency to access the NF-e Contingency Status Revision form. There is one row exit for each emission type, except for Normal emission type, because Normal is the usual starting emission type.

These selections imply a change in the next status code, depending on the activity rules.

17.8.6 Working with NFe Contingency Statuses

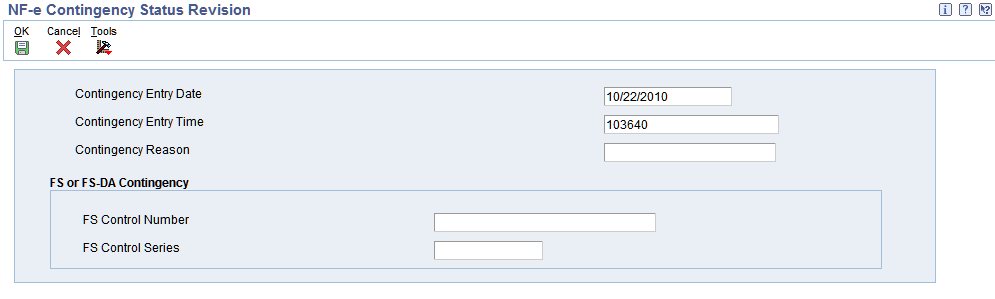

Access the NF-e Contingency Status Revision form.

Figure 17-9 NF-e Contingency Status Revision form

Description of ''Figure 17-9 NF-e Contingency Status Revision form''

The system displays this form only once, regardless the number of records selected in the grid. Therefore, the system populates the values of the Contingency Date and Contingency Time fields to all of the records selected in the grid. Depending on the contingency method, the system displays the value specified in the processing options in the Contingency Reason field.

- Contingency Entry Date

-

The system displays the date of the transmission. You can edit the default value.

This field is required for all contingency methods and is included in the XML.

- Contingency Entry Time

-

The system displays the time of the transmission. You can edit the default value.

This field is required for all contingency methods and is included in the XML.

- Contingency Reason

-

Enter a value from UDC table 40/PM to specify the standard print message code for the contingency. This field is required when you change the emission type to any contingency method.

- FS Control Number

-

Enter a value that identifies the control number that exists in the FS application form. Every FS contingency has a control number of the application form with sequential number from 000.000.001 to 999.999.999, which is printed in the Fiscal Authority reserved frame.

This field is optional. The system enables this field for the FS and FS-DA contingency methods only.

- FS Control Series

-

Enter a value that identifies the control series that exists in the FS application form. Every FS contingency has a series code from AA to ZZ, which is printed in SEFAZ reserved frame.

This field is optional. The system enables this field for the FS and FS-DA contingency methods only.

17.8.7 Entering NFe Response Information

Access the NF-e Response Information Revision form.

Figure 17-10 NFe Response Information Revision

Description of ''Figure 17-10 NFe Response Information Revision''

|

Note: The system displays this form only once, regardless of the number of records selected in the grid. |

- Response Code

-

Enter a value from UDC table 76B/RS that identifies the answer that the system receives from SEFAZ through the third party software. Examples include:

100: NF-e Usage Authorization

110: Denied Usage

202: Reject. Audit Acknowledge Fail

230: Reject. Emissor IE Unregistered

Note:

The value in the Special Handling field specifies the status of the nota fiscal associated to the UDC value. For example, values in the Special Handling field are:

A: Accepted

E: Error

- Protocol Number

-

Enter a value that identifies the transmission identifier that the system receives from SEFAZ through the third party software. This value uniquely identifies the XML transmission and the system prints it on DANFe report.

- DPEC Register Nr

-

Enter a value that identifies the register number received by SEFAZ for a DPEC contingency.

The system enables this field for the DPEC contingency method only.

- DPEC/EPEC Register Date

-

The system displays the register date received by SEFAZ for a DPEC/EPEC contingency. You can edit the default value.

The system enables the EPEC Register Date field for the DPEC/EPEC contingency method only.

- DPEC/EPEC Register Time

-

The system displays the register time received by SEFAZ for a DPEC/EPEC contingency. You can edit the default value.

The system enables the EPEC Register Time field for the EPEC/DPEC contingency method only.

17.8.8 Reviewing Additional NFe Information

Access the NF-e Additional Information form.

Figure 17-11 NF-e Additional Information form

Description of ''Figure 17-11 NF-e Additional Information form''

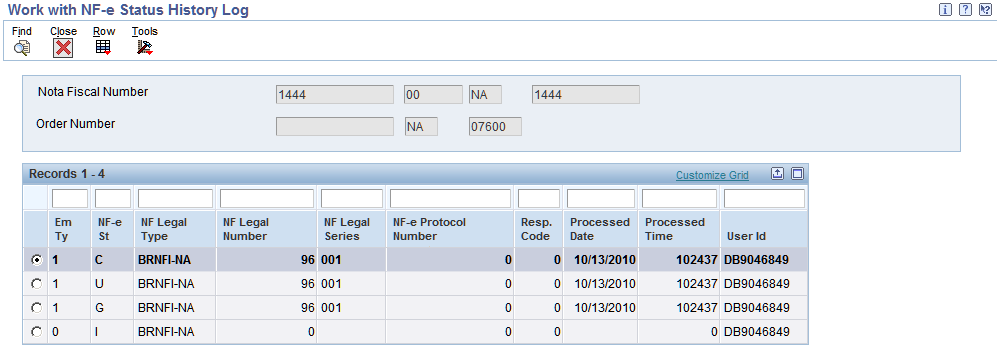

17.8.9 Reviewing NFe Status History

Access the Work with NF-e Status History Log form.

Figure 17-12 Work with NF-e Status History Log form

Description of ''Figure 17-12 Work with NF-e Status History Log form''

Use this form to review all the emission types and statuses of an NFe record. The system displays information from the F76B12TE table.

17.9 Working With Tributary Situation Codes for Nota Fiscais

This section provides overviews of tributary situation codes, ICMS tributary situation codes, IPI tributary situation codes, and PIS and COFINS tributary situation codes and discusses how to specify IPI transaction situation codes manually and specify PIS and COFINS transaction situation codes manually.

17.9.1 Understanding Tributary Situation Codes

The system allows you to maintain tributary situation codes (códigos de situação tributária), which represent different tax situation codes. The system uses four tributary situation codes:

The IPI, PIS, and COFINS tributary situation codes are calculated automatically by the Generate Outbound Nota Fiscal program (R76558B) or the Nota Fiscal Receipts program (P4312BR). Although not standard practice, you can modify these values manually.

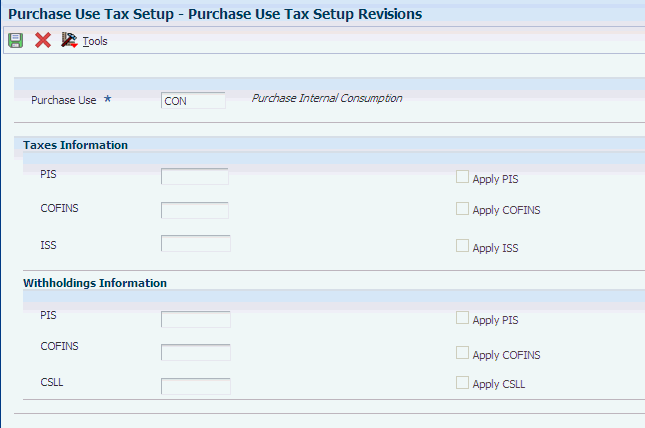

You can manually specify an IPI tributary situation code in the Transaction Nature - Brazil program (P7615B). If you enter an IPI tributary situation code in the Transaction Nature - Brazil program, the system uses this value instead of the automatically calculated value from the Generate Outbound Nota Fiscal program or the Nota Fiscal Receipts program. You can review and change an IPI tributary situation code for a NFe in the Nota Fiscal Maintenance program (P7610B) and the Stand Alone Nota Fiscal program (P7611B).

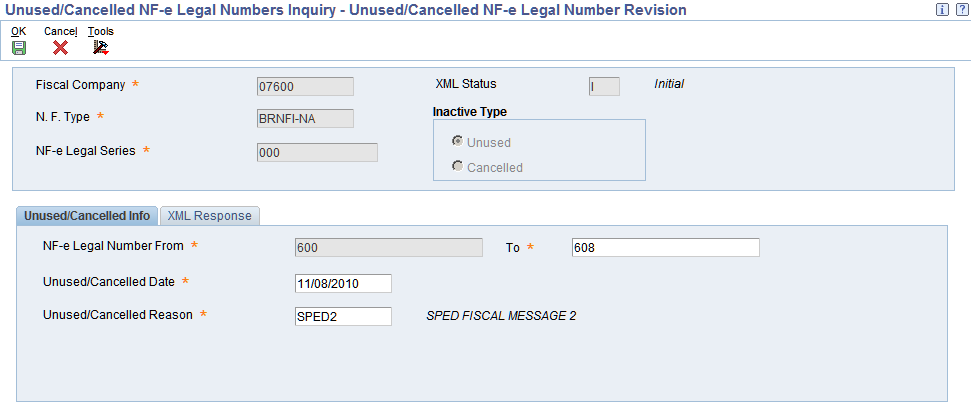

You can manually specify PIS, COFINS, and CSLL tributary situation codes in the Purchase Use Tax Setup program (P76B003). You can review and change the PIS, COFINS, and CSLL tributary situation codes in the Nota Fiscal Maintenance program and the Stand Alone Nota Fiscal program.