22 Setting Up Additional Information for EFD PIS/COFINS (Release 9.1 Update)

This chapter contains the following topics:

-

Section 22.3, "Setting Up Additional Fixed Asset Information for Brazil"

-

Section 22.4, "Setting Up Additional Import Declaration Information for Brazil"

-

Section 22.5, "Setting Up Additional Judicial Process Information"

-

Section 22.6, "Setting Up Additional Administrative Process Information"

-

Section 22.7, "Setting Up Additional Place Execution Information"

-

Section 22.8, "Setting Up Additional Nota Fiscal Legal Model Type Information"

-

Section 22.9, "Setting Up Additional PIS/COFINS Substitution Information"

22.1 Setting Up Item Category Codes

Before you work with EFD PIS/COFINS, you must set up item category codes 01, 02, 03, 04, 05, 06 and 07. The system uses the category codes in block 0. If you do not set up them, the system does not add data to the fields in the registers.

Review the following category codes:

-

UDC 70/C1: Item type (TIPO_ITEM)

-

UDC 70/C2: Mercosur Code (COD_NCM)

-

UDC 70 /C3: EX Code According TIPI (EX_IPI)

-

UDC 70/C4: Generic Item Code (COD_GEN)

-

UDC 70/C5: Service Code (COD_LST)

-

UDC 70/C6: Petrol Code (COD_COMB)

-

UDC 70/C7: Incidence Indicator code (COD_TAB). With category code 7, find position 1 and 2 (Code UDC 07/C7).

-

UDC 70/C7: Group code (COD_GRU). With category code 7, find position 3 and 4 (Code UDC 70/C7).

-

UDC 70/C7: Trade name (MARCA_COM): With category code 7, find description (UDC 70/C7).

For example, in UDC 70/C7 there is a code 0429 with the description Guaraná Antartica. In Block 0, 04 equals COD_TAB, 29 equals COD_GRU and Guaraná Antartica equals MARCA_COM.

22.2 Setting Up UDC Values

Set up legal Brazilian codes by adding a Brazilian code value in the Special Handling Code field for selected values in the UDC table (76B/ST). You set up legal Brazilian codes according to the table 4.1.2 Document Situation at the following SPED Tabelas website: http://www.sped.fazenda.gov.br/spedtabelas/AppConsulta/publico/aspx/ConsultaTabelasExternas.aspx?CodSistema=SpedFiscal

Review the values that you must add in the Special Handling Code field:

-

For value A, enter 00.

-

For value C, enter 02.

-

For value D, enter 00.

-

For value P, enter 00.

-

For value R, enter 04.

-

For value U, enter 05.

Also, you must add a value in the Description 02 field for each value in the UDC table (76B/XP).

Review the values in the Description 02 field:

-

T1: Taxable operations. Subject to payment of the contribution to PIS/COF.

-

N2: Non taxable and exempt operations. Not Subject to payment of the contribution to PIS/COF.

-

D0: Operations with direct credit (Acquisition, costs, expenses or charges). Subject to the incidence of PIS/COF.

-

P0: Operations with presumed credit (Acquisition, costs, expenses or charges). Subject to the incidence of PIS/COF.

-

A: Acquisition operations with PIS/COF.

Review the values that you must add in the Description 02 field:

-

For value 01, enter T1.

-

For value 02, enter T1.

-

For value 03, enter T1.

-

For value 04, enter T2.

-

For value 05, enter T1.

-

For value 06, enter T2.

-

For value 07, enter N2.

-

For value 08, enter N2.

-

For value 09, enter N2.

-

For value 49, enter N2.

-

For value 50, enter D0.

-

For value 51, enter D0.

-

For value 52, enter D0.

-

For value 53, enter D0.

-

For value 54, enter D0.

-

For value 55, enter D0.

-

For value 56, enter D0.

-

For value 60, enter P0.

-

For value 61, enter P0.

-

For value 62, enter P0.

-

For value 63, enter P0.

-

For value 64, enter P0.

-

For value 65, enter P0.

-

For value 66, enter P0.

-

For value 67, enter P.

-

For value 70, enter A.

-

For value 71, enter A.

-

For value 72, enter A.

-

For value 73, enter A.

-

For value 74, enter A.

-

For value 75, enter A.

-

For value 98, enter A.

-

For value 99, enter N2.

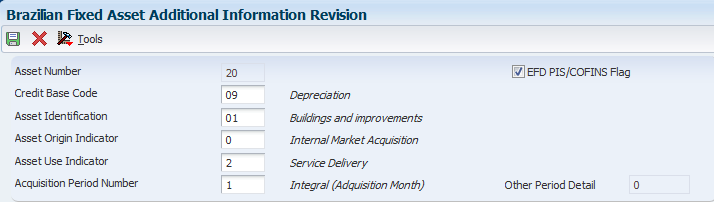

22.3 Setting Up Additional Fixed Asset Information for Brazil

This section discusses how to set up additional fixed asset information for Brazil.

Use the Brazilian Fixed Assets program (P76B1204) to enter fixed asset information that is required for block F, registers F120 and F130. The system stores this information in the Brazilian Fixed Asset Additional Information table (F76B1201).

22.3.1 Form Used to Enter Fixed Assets Information

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Assets | W1204C | Fixed Asset Master Information (G1211), Master Information | Locate existing fixed asset records. |

| Brazilian Fixed Asset Additional Information Revision | W76B1204A | Select a row in the grid, and then select Regional Info from the Row menu. | Select or clear the check box to include the record in the EFD PIS/Cofins report file |

22.3.2 Setting Up Additional Fixed Asset Information

Access the Brazilian Fixed Asset Additional Information Revision form:

Figure 22-1 Brazilian Fixed Asset Additional Information Revision form

Description of ''Figure 22-1 Brazilian Fixed Asset Additional Information Revision form''

- Include in EFD PIS/COFINS

-

If you select this check box, the system includes the asset in the EFD PIS/Cofins report file.

If you do not select this check box, the system does not include the asset in the EFD PIS/Cofins report file.

22.4 Setting Up Additional Import Declaration Information for Brazil

Use the Import Declaration program (P76B016) to enter additional information that is required in block C of the EFD PIS/Cofins report file. The system stores this information in the Import Declaration table (F76B033).

22.4.1 Setting Up Additional Import Declaration Information

Access the Import Declarations Revisions form.

Figure 22-2 Import Declaration Revisions

Description of ''Figure 22-2 Import Declaration Revisions ''

- Nbr of Concession Reg Drawback

-

Enter a number that identifies the concession of regime drawback.

22.5 Setting Up Additional Judicial Process Information

Use the Brazilian Judicial Processes program (P76B035) to enter judicial information required for block 1. The system stores this information in the Judicial Processes table (F76B035).

22.5.1 Forms Used to Set Up Judicial Processes and Relationships

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Judicial Processes | W76B035A | On the Brazilian Localization Setup menu (G76B41B) or on the Stand Alone Nota Fiscal - Brazil menu (G76B4321), select Judicial Processes. | Review or select judicial process ID numbers. |

| Judicial Processes Revision | W76B035B | Click Add on the Work With Judicial Processes form. | Set up judicial information. |

| Work With Judicial Process Relationships | W76B035C | In the Nota Fiscal Maintenance program (P7610B), access the Work With Nota Fiscal Headers form (W7610BG). Select a record and select Judicial Processes from the Row menu.

In the Stand Alone Nota Fiscal program (P7611B), navigate to the Work With Stand Alone NF Header form (W7611BA). Select a record and select Judicial Processes from the Row menu. |

Review or select judicial process relationships. |

| Judicial Process Relationship Revisions | W76B035D | On the Work With Judicial Process Relationship form, click Add. | Create relationships between nota fiscais and judicial processes. |

22.5.2 Setting Up Judicial Processes

Access the Judicial Processes Revision form.

Figure 22-3 Judicial Processes Revisions

Description of ''Figure 22-3 Judicial Processes Revisions ''

- Judicial Process ID Number

-

Enter a value that identifies a judicial process. A judicial process may authorize the adoption of tax treatment, the calculation basis, or different rate from that provided in legislation. The system uses this field in conjunction with Judicial Section ID and Vara ID fields to complete the information about a Judicial Process.

- Judicial Section ID

-

Enter a value that identifies the judicial section where the judicial process is filed.

- Vara ID

-

Enter a value that identifies the district court of a judicial section where the judicial process is filed.

- Judicial Nature Indicator

-

Enter a value from UDC 76B/JN that identifies the nature of a judicial action filed in Federal Court. Examples of values are:

01: Final court decision in favor

02: Not final judicial decision.

- Process Origin Indicator

-

Enter a value from UDC 76B/OI that identifies the origin of a administrative or judicial process. Values are:

1: Federal Court

3: Revenue Division

9: Others

- Tax Effects Description

-

Enter a brief description of tax effects generated by the judicial decision.

- Judgement Date

-

Enter the judgement date of the judicial decision.

22.6 Setting Up Additional Administrative Process Information

This section provides an overview of additional administrative process information and discusses how to:

-

Set up additional administrative process information.

Set up administrative process relationships.

22.6.1 Understanding Additional Administrative Process Information

Use the Brazilian Administrative Processes program (P76B037) to enter administrative information that is required in record 1020 of block 1. The system stores this information in the Administrative Processes table (F76B037).

You can also establish a relationship between a nota fiscal and its administrative processes. You can associate an administrative process with several nota fiscais. The system stores this information in the Fiscal Notes and Administrative Process Related Brazilian table (F76B038).

22.6.2 Forms Used to Set Up Administrative Processes

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work With Administrative Processes | W76B037A | On the Brazilian Localization Setup menu (G76B41B) or on the Stand Alone Nota Fiscal - Brazil menu (G76B4321), select Administrative Processes. | Review and select administrative process IDs. |

| Administrative Process Revision | W76B037B | Click Add on the Work With Administrative Processes form. | Set up administrative information. |

| Work With Administrative Process Relationships | W76B037E | In the Nota Fiscal Maintenance program (P7610B), access the Work With Nota Fiscal Headers form (W7610BG). Select a record and select Admin. Processes from the Row menu.

In the Stand Alone Nota Fiscal program (P7611B), navigate to the Work With Stand Alone NF Header form (W7611BA). Select a record and select Admin. Processes from the Row menu. |

Review or select judicial process relationships. |

| Administrative Process Relationship Revisions | W76B037D | On the Work With Administrative Process Relationship form, click Add. | Create relationships between nota fiscais and administrative processes. |

22.6.3 Setting Up Additional Administrative Process Information

Access the Administrative Process Revision form.

Figure 22-4 Administrative Process Revision

Description of ''Figure 22-4 Administrative Process Revision''

- Administrative Process ID

-

Enter a value that identifies an administrative process. An administrative process may authorize the adoption of tax treatment, the calculation basis, or different rate from that provided in legislation.

- Administrative Process Nature

-

Enter a value from UDC 76B/PN that indicates the nature of action, due to administrative proceedings in the Federal Revenue Secretary of Brazil. Examples of values are:

01: Administrative Inquiry Procedures

02: Decision-Making Order

- Process Origin Indicator

-

Enter a value from UDC 76B/OI that indicates the origin of an administrative process. Values are:

1: Federal Court

3: Revenue Division

9: Others

- Administrative Decision Date

-

Enter the date of order of the administrative decision.

22.6.4 Adding Administrative Process Relationships

Access the Administrative Processes Relationships Revisions form.

Figure 22-5 Administrative Process Relationship Revisions

Description of ''Figure 22-5 Administrative Process Relationship Revisions''

22.7 Setting Up Additional Place Execution Information

Use the Place Execution program (P76B031) to specify whether a import nota fiscal is executed in the country or outside. The system requires this information for block A, register A120.

22.7.1 Form Used to Set Up Place Execution Information

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Place Execution | W76B031A | In the Nota Fiscal Maintenance program (P7610B), navigate to the Nota Fiscal Detail Revision (W7610BE) form. Select a record and select Place Execution from the Row menu.

In the Stand Alone Nota Fiscal program (P7611B), navigate to the Nota Fiscal Detail Revision (W7611BF) form. Select a record and select Place Execution from the Row menu. |

Specify whether a nota fiscal is executed abroad. |

22.8 Setting Up Additional Nota Fiscal Legal Model Type Information

This section provides an overview of nota fiscal legal model type information and discusses how to set processing options for Nota Fiscal Model Type Classification (R76B047).

22.8.1 Understanding Nota Fiscal Legal Model Type Information

When creating nota fiscais, you can specify the legal model type, which allows the system to determine the block in which a document must be included in the EFD PIS/COFINS report file. The system stores the nota fiscal legal model type information in the NF Header PIS/COFINS Tag File - BRA - 76B table (F76B030).

This list describes the programs that use the nota fiscal legal model type information:

-

Nota Fiscal Receipts - Brazil program (P4312BR).

You use this program to enter a nota fiscal legal model type. See Section 39.10, "Entering and Reviewing Receipts for Procurement for Brazil"

-

Nota Fiscal Series and Number Length program (P76B008).

Use the Nota Fiscal Series and Number Length program to create a relationship between the nota fiscal type and the nota fiscal legal model type. The system stores the details of this relationship in the NF Type / Legal Model Type table (F76B032). See Section 17.4, "Setting Up Series Length, Number Length, and Legal Next Numbers for Notas Fiscais"

-

Generate Nota Fiscal program (R76558B).

When you use the Generate Nota Fiscal program to generate a nota fiscal, the system includes the information about the nota fiscal legal model type. You set processing options to specify legal model type information.

See Section 17.19.6, "Setting Processing Options for Generate Nota Fiscal (R76558B)"

-

Nota Fiscal Maintenance program (P7610B).

Use the Nota Fiscal Maintenance program to enter a value in the NF Legal Model Type field if the Nota Fiscal Type field is editable. See Section 20.5, "Maintaining Inbound and Outbound Notas Fiscais Records for Fiscal Books"

-

Stand Alone Nota Fiscal program (P7611B).

Use the Stand Alone Nota Fiscal program to enter a value in the NF Legal Model Type field if the Nota Fiscal Type field is editable.

SeeSection 17.26.5, "Entering a Stand-Alone Nota Fiscal (Release 9.1 Update)"

-

Sales Return Ship To program (P76B805).

Use the Sales Return Ship To program to enter a value in the NF Legal Model Type field if the Nota Fiscal Type field is editable.

See Section 17.27.8, "Entering Nota Fiscal Information for Ship-To Sales Returns"

-

Nota Fiscal Ship To - Fiscal Notes Numbers program (P76B425).

Use the Nota Fiscal Ship To - Fiscal Notes Numbers program to review. a value in the NF Legal Model Type field. You can use this program to view records; you cannot edit them.

See Section 17.28, "Reviewing NFe Information for Ship-to Sales Returns"

-

Nota Fiscal Model Type Classification program (R76B047).

When you run the Nota Fiscal Model Type Classification program, the system updates the legal model type on existing notas fiscais in the NF Header PIS/COFINS Tag File - BRA - 76B table (F76B030). When all of the existing notas fiscais are updated, you do not need to run this program again.

The report lists the individual records that were updated and the total number of records updated. Also, the reports display an error message if there is no available information to determine the NF legal model type.

See Section 22.8.2, "Setting Processing Options for Nota Fiscal Model Type Classification (R76B047)"

-

Nota Fiscal Legal Model Type Classification Control program (R76B048).

Use the Nota Fiscal Legal Model Type Classification Control program to verify if the system assigned the legal model type to the current nota fiscais.

The reports displays the nota fiscais that are pending classification.

22.8.2 Setting Processing Options for Nota Fiscal Model Type Classification (R76B047)

Processing options enable you to set default processing values.

22.8.2.1 General

- Legal Model Type:

-

Specify a value from UDC 76B/MT that indicates the model type that the system assigns to the nota fiscais. If you leave this processing option blank, the system retrieves the nota fiscal type from the nota fiscal record in the F76B01TE table. If there is no nota fiscal type, the system uses the value BRNFI-CL Then the system uses the nota fiscal type to access the F76B032 table and retrieve the legal model type.

- Retrieve Legal Model Type from P76B008 Program

-

If the Legal Model Type processing option is blank, use this processing option to specify if the system retrieves the legal model type from the Nota Fiscal Series and Number Length program (P76B008). Values are:

Y: Retrieve the legal model type from the Nota Fiscal Series and Number Length program.

N: Do not retrieve the legal model type from the Nota Fiscal Series and Number Length program.

If you leave this processing option blank, the system uses the default value N.

22.9 Setting Up Additional PIS/COFINS Substitution Information

This section provides overviews of additional PIS/COFINS substitution information and G/L setup.

22.9.1 Understanding Additional PIS/COFINS Substitution Information

You can add PIS and COFINS substitution tax information to the notas fiscais in purchase and sales scenarios. The system stores the PIS and COFINS substitution basis, rate, and tax for each detail line of the nota fiscais in the NF Detail PIS/COFINS table - BRA - 76B (F76B031).

|

Note: PIS/COFINS substitution functionality is the same as ICMS substitution functionality, with one exception. ICMS Substitution functionality has setup that the system uses to calculate values automatically, but PIS/ COFINS substitution functionality does not have set up. You must enter the values for the PIS and COFINS substitution on the Nota Fiscal Detail Revision form in the Nota Fiscal Maintenance program (P7610B) or the Stand Alone Nota Fiscal program (P7611B). |

The system uses additional PIS/COFINS substitution information in the following programs:

-

Print Nota Fiscal - Sales (R76560B).

When you run the Print Nota Fiscal - Sales program, the system calculates and displays the PIS substitution basis, COFINS substitution basis, PIS substitution tax and COFINS substitution tax totals on the report.

-

Update Sales - Brazil program (R76B803)

When you run the Update Sales - Brazil program, the system calculates and displays the tax lines the PIS Substitute and COFINS Substitute to the Sale Order Detail form and updates the sales order total amount.

-

Nfe Info Generation by Lot program (R76B561L).

When you run the Nfe Info Generation by Lot program, the system extracts PIS and COFINS Substitution information from the NF Header PIS/COFINS table - BRA - 76B (F76B030) and NF Detail PIS/COFINS table - BRA - 76B (F76B031) tables.

After you run the program, the system passes this information to the NFe XML Template and includes the information in NFe XML file.

See Section 17.19.4, "Understanding the NF-e Info Generation by Lot UBE (R76B561L)"

-

Print Nota Fiscal - Purchasing program (R76500B).

When you run Print Nota Fiscal - Purchasing program, the system prints the PIS Substitution Basis, COFINS Substitution Basis, PIS Substitution Tax, and COFINS Substitution Tax values on the report.

See Section 39.18, "Printing the Nota Fiscal for Purchase Returns"

-

Nota Fiscal Check & Close program (P76B900).

When you close the fiscal note, the system displays the PIS and COFINS substitution on Cardex and the G/L.

See Section 39.13.1, "Understanding the Nota Fiscal Check & Close Program (P76B900)"

-

Reverse / Void Nota Fiscal - Brazil program (R76559B).

When you use the Reverse / Void Nota Fiscal - Brazil (R76559B) to delete a nota fiscal, the system deletes the PIS/COFINS substitution information from the following tables:

-

Fiscal Notes and Judicial Process Relationship - BRA - 76B (F76B036)

-

Administrative Process Relationship (F76B038)

-

NF Detail PIS/COFINS - BRA - 76B (F76B031)

-

NF Header PIS/COFINS - BRA - 76B (F76B030)

-

Import Declaration (F76B033)

See Section 17.27.1, "Understanding Sales Order Returns, Reverses, and Cancellations"

-

-

Purchase Receipt Inquiry program (P43214).

When you use the Purchase Receipt Inquiry program (P43214) to void or reverse a nota fiscal, the system deletes the PIS/COFINS substitution information from the following tables:

-

Fiscal Notes and Judicial Process Relationship - BRA - 76B (F76B036)

-

Administrative Process Relationship (F76B038)

-

NF Detail PIS/COFINS table - BRA - 76B (F76B031)

-

NF Header PIS/COFINS - BRA - 76B (F76B030)

-

Import Declaration (F76B033)

See Section 39.11.1, "Understanding Receipt Reversals for Brazilian Procurement"

-

22.9.2 Setting Up UDC 76/GL

Set up the GL/Class code cross reference UDC (76/GL) with values for PIS Substitution and COFINS Substitution. The system uses values in the UDC 76/GL to identify the GL/Class code cross reference. This table lists examples of codes:

| Codes | Description 01 | Description 02 |

|---|---|---|

| SUC*** | user-defined | Cofins Sub. Amount Default |

| SUP*** | user-defined | PIS Sub. Amount Default |