12 Setting Up and Generating Payroll Information for CNAO Audit Files for China

This chapter contains the following topics:

12.1 Understanding Payroll Information for CNAO Audit Files in China

You must report the details of your payroll information according to the requirements for CNAO version 2. Because the JD Edwards EnterpriseOne Payroll system does not include China-specific information, the software provided for reporting CNAO version 2 audit files includes programs that you use to enter the CNAO-specific information that must be reported.

After you complete the payroll setup, you run the Generate Payroll XML program (R75C501) to generate the XML file. The system generates an XML file with this payroll information:

-

Payroll Periods

This section includes information such as the payroll period and dates.

-

Payroll Elements

This section includes information such as the payroll element ID and name.

-

Individual Payroll Records

This section includes information for individuals on the payroll, such as the payroll period and employee category.

-

Individual Payroll Detailed Records

This section includes information for individuals on the payroll, such as the employee ID and amount paid.

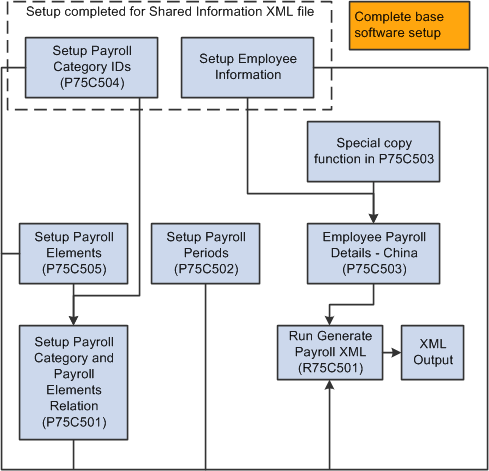

12.1.1 Process Flow for Setting Up and Generating the CNAO Audit File for Payroll

This process flow shows the set up that you need to complete and the relationships between the setup programs:

Figure 12-1 Process Flow for Setup for Payroll File

Description of ''Figure 12-1 Process Flow for Setup for Payroll File''

12.1.2 Checklist for Setting Up and Generating the CNAO Audit File for Payroll

Checklist for Setting Up and Generating the CNAO Audit File for Payroll:

| Complete | Action | Comments |

|---|---|---|

| Verify that alternate descriptions of currency code translations are set up. | You set up the alternate descriptions in the Translation (75C/TR) UDC table. | |

| Verify that an employee record exists in the Address Book Master table (F0101) for each employee. | The address book record number for the employee must be the same as the employee ID that you use in your payroll system. | |

| Verify that data in your payroll system is complete and accurate. | Your payroll information must be up-to-date so that you enter accurate data in the JD Edwards EnterpriseOne system. | |

| Enter employee record information. | You use the Employee Record Information program (P75C008) to enter employee records information.

If you already completed the setup for the Shared Information CNAO XML file, these employee records already exist in your system. |

|

| Set up payroll category IDs to define employee classifications, such as management, regular employees, contact employees, and so on. | You use the Setup Payroll Category program (P75C504) to set up payroll categories.

If you already completed the setup for the Shared Information CNAO XML file, these payroll categories IDs already exist in your system. |

|

| Set up payroll elements to define payroll types, such as regular pay, bonus pay, expense reimbursement, and so on. | You use the Setup Payroll Elements program (P75C505) to set up payroll elements. | |

| Associate payroll categories to payroll elements. | You use the Payroll Category and Payroll Elements Relation program (P75C501) to associate the payroll category IDs with the payroll element IDs. | |

| Enter the payroll periods. | You use the Setup Payroll Periods program (P75C502) to enter information about the payroll periods. | |

| Enter payroll details for each employee, such as payment periods and payment amounts. | You use the Employee Payroll Details - China program (P75C503) to enter payroll details. | |

| Verify that the XML element names are set up for the payroll file. | You use the Dynamic XML Element Names program (P75C013) to set up names for the sections headings and the section fields of the payroll XML file.

For example, instead of having the system print the term Individual Payroll Records for the heading of that section, you can enter a different string, including Chinese characters, that the system will print in the XML output file. |

|

| Generate the Payroll CNAO XML file. | You run the Generate Payroll XML program (R75C501) to generate the XML file. |

12.2 Setting Up Payroll Elements

This section provides an overview of payroll elements and discusses how to:

-

Set up payroll elements.

-

Associate payroll category IDs to payroll element IDs.

12.2.1 Understanding Payroll Elements

You must report payroll categories (employee classifications) and payroll elements (payment types), and report the link between the payroll categories and payroll elements. The system uses the associations to link types of employee classifications, such as management, to employment payment types, such as salaries or bonuses.

You use the Setup Payroll Category program (P75C504) to set up payroll categories. If you completed the setup for the CNAO Shared Information XML file, the payroll categories exist in your system. If you did not complete the setup for the shared information file, complete that setup before continuing with the setup described in this section.

See Entering Payroll Category IDs

You use the Setup Payroll Elements program (P75C505) to set up payroll elements. Payroll elements are types of payments for payroll, such as salaries and bonuses. You specify a payroll element ID and description. The system saves the values that you enter to the Payroll Elements table (F75C505).

After you set up payroll categories and elements, you use the Payroll Category and Payroll Elements Relation - China (P75C501)Payroll Category and Payroll Elements Relation – China program (P75C501) to associate the payroll category ID with the payroll element IDs. The system saves the data that you enter to the Payroll Category and Elements table (F75C501).

12.2.2 Forms Used to Set Up Payroll Categories and Elements

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Payroll Elements | W75C505A | Payroll (G75C052), Set Up Payroll Elements | Review and select existing payroll element records. |

| Payroll Elements Revision | W75C505B | Click Add on the Work with Payroll Elements form. | Enter payroll element IDs and descriptions. |

| Work with Payroll Category and Payroll Elements | W75C501A | Payroll (G75C052), Setup Payroll Category and Payroll Elements Relation | Review and select existing records. |

| Payroll Category and Payroll Elements Revision | W75C501B | Click Add on the Work with Payroll Category and Payroll Elements form. | Associate payroll category IDs to payroll element IDs. |

12.2.3 Setting Up Payroll Elements

Access the Payroll Elements Revision form.

Figure 12-2 Payroll Elements Revision Form

Description of ''Figure 12-2 Payroll Elements Revision Form''

- Payroll Element ID

-

Enter the payroll element ID. You can enter numbers and letters in this field.

- Payroll Element Name

-

Enter the name of the payroll element. You can enter numbers and letters in

this field.

12.2.4 Associating Payroll Category IDs to Payroll Element IDs

Access the Payroll Category and Payroll Elements Relation form.

Figure 12-3 Payroll Category and Payroll Elements Revision Form

Description of ''Figure 12-3 Payroll Category and Payroll Elements Revision Form''

- Payroll Category ID

-

Enter the payroll category ID for which you set up the association. The value that you enter must exist in the F75C0504 table.

- Payroll Element ID

-

Enter the payroll element ID to associate with the payroll category ID. The value that you enter must exist in the F75C505 table.

12.3 Setting Up Payroll Periods

This section provides an overview of payroll periods and discusses how to set up payroll periods.

12.3.1 Understanding Payroll Periods

You use the Setup Payroll Periods – China program (P75C502) to enter information about the payroll periods, such as starting and ending dates, payroll year and period, and accounting year and period. You set up a record for each payroll period that you report. For example, if you process payroll once a month, set up 12 payroll periods. If you process payroll twice a month, set up 24 payroll periods.

The system saves the data that you enter to the Payroll Period table (F75C502) and uses the data to populate the Payroll Periods section of the CNAO audit files for payroll.

12.3.2 Forms Used to Set Up Payroll Periods

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Payroll Periods | W75C502A | Payroll (G75C052), Setup Payroll Periods | Review and select existing payroll periods. |

| Payroll Period Revision | W75C502B | Click Add on the Work with Payroll Periods form. | Enter payroll and accounting period information. |

12.3.3 Setting Up Payroll Periods

Access the Payroll Period Revision form.

Figure 12-4 Payroll Period Revision Form

Description of ''Figure 12-4 Payroll Period Revision Form''

- Payroll Period Year

-

Enter the year for which you set up the payroll periods. Your payroll year might be different from the calendar year. For example, if your company's fiscal year is July 1, 2010 through June 30, 2011, fiscal year 2011 includes part of calendar year 2010 and part of calendar year 2011.

- Payroll Period Number

-

Enter the payroll period number that corresponds to the dates that you enter in the Start Date and End Date fields.

- Start Date

-

Enter the first day of the payroll period that you entered in the Payroll Period Number field.

- End Date

-

Enter the last day of the payroll period that you entered in the Payroll Period Number field.

- Accounting Year

-

Enter the accounting year for which the payroll period exists. The accounting year might be different from the payroll period year.

- Accounting Period

-

Enter the accounting period for which the payroll period exists. The accounting period might be different from the payroll period.

12.4 Entering Employee Payroll Details

This section provides an overview of employee payroll details, lists prerequisites, and discusses how to:

-

Enter employee payroll period details.

-

Enter employee payment information for a single period.

-

Copy employee payment information.

|

Note: Instead of manually entering or copying employee details as described in this section, you can also import the data from a spreadsheet. |

12.4.1 Understanding Employee Payroll Details

You use the Employee Payroll Details program (P75C503) to enter employee payroll details, such as the payroll category and payroll periods for which you processed payroll for an employee. You enter a record for each employee that you paid during the CNAO reporting period. The system validates whether the record for which you add payroll details is for an active employee. The system considers an employee to be active if you enter Y (Yes) in the Employee Status field of the Employee Record Information program (P75C008).

The system saves the data that you enter to the Employee Payroll table (F75C503), and writes the data to the payroll XML file when you run the Generate Payroll XML program (R75C501).

12.4.1.1 Copying Payroll Details

If you have employees for which the payroll details are the same from period to period, you can copy the details from one period to another. After you enter the payroll details for one period, access the copy function from the Form menu on the Work with Employee Payroll Details form. You can then specify the period from which to copy an existing set of details and the period to which to copy the details.

You can specify what to copy by completing different fields in the top grouping of fields on the Copy Payroll Detail form:

-

To copy records for only a specific active employee, complete the Company, Payroll Category ID, and Employee ID fields.

-

To copy records for all active employees in a company with the same payroll category ID, complete the Company and Payroll Category ID fields.

-

To copy all records for all active employees in a company, complete the Company field.

|

Note: For all copy functions, you must complete the required fields in the Copy From Payroll Period and Copy To Payroll Period sections. |

12.4.2 Prerequisites

Before you perform the tasks in this section, complete the setup in these programs:

-

Employee Record Information (P75C008).

-

Setup Payroll Category - China (P75C504).

-

Setup Payroll Periods – China (P75C502).

-

Setup Payroll Elements (P75C505).

-

Setup Payroll Category and Payroll Elements Relation (P75C501).

12.4.3 Forms Used to Enter Employee Payroll Periods and Payment Information

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Employee Payroll Details | W75C503A | Payroll (G75C052), Employee Payroll Details | Review and select existing employee payroll detail records. |

| Employee Payroll Details Revision | W75C503E | Click Add on the Work with Employee Payroll Details form. | Enter payroll period and company details for each employee that you paid. |

| Employee Payroll Details Revision | W75C503H | Click OK on the Employee Payroll Details Revision form (W75C0503B). | Enter the payment information for each employee payroll record.

The system populates many fields on this form with the values from the Employee Payroll Details Revision (W75C503B) form. |

| Copy Payroll Details | W75C503B | Select Copy Emp Payroll from the Form menu on the Work with Employee Payroll Details form. | Copy the payment information for an employee from one period to another. |

12.4.4 Entering Employee Payroll Period Details

Access the Employee Payroll Details Revision (W75C503E) form.

Figure 12-5 Employee Payroll Details Revision Form

Description of ''Figure 12-5 Employee Payroll Details Revision Form''

- Employee ID

-

Enter the employee ID. The value that you enter must exist in the Address Book Master table (F0101).

- Employee Name

-

The system populates this field with the name that is associated with the Employee ID in the F75C008 table.

- Employee Category

-

The system populates this field with the employee category that is associated with the Employee ID in the F75C008 table.

- Department ID

-

The system populates this field with the department ID that is associated with the Employee ID in the F75C008 table.

- Legal Entity

-

The system populates this field with the legal entity that is associated with the Employee ID in the F75C504 table.

- Payroll Category Name

-

The system populates this field with the payroll category name that is associated with the Employee ID in the F75C504 table.

- Payroll Period Year

-

Enter the payroll period year to associate with the Employee ID. The value that you enter must exist in the F75C502 table.

- Payroll Period Number

-

Enter the payroll period number to associate with the Employee ID. The value that you enter must exist in the F75C502 table.

- Accounting Year

-

Enter the accounting year to associate with the Employee ID. The value that you enter must exist in the F75C502 table.

- Accounting Period

-

Enter the accounting period to associate with the Employee ID. The value that you enter must exist in the F75C502 table.

- Start Date

-

Enter the start date of the payroll period. The value that you enter must exist in the F75C502 table.

- End Date

-

Enter the end date of the payroll period. The value that you enter must exist in the F75C502 table.

12.4.5 Entering Employee Payment Information for a Single Period

Access the Employee Payroll Details Revision (W75C503H) form.

|

Note: The system populates many of the fields on this form from the values that you enter on the Employee Payroll Details Revision form. Only the fields that were not populated on the Employee Payroll Details Revision form are listed here. |

- Payroll Element

-

Enter the payroll element. Payroll elements are payment types that you set up in the Setup Payroll Elements program (P75C505).

- Currency Code

-

The system populates this field with the currency code that is associated with the payroll category name in the F75C504 table. The system uses this value to access the 75C/TR UDC table to obtain the currency description to print in the CNAO payroll file. If the 75C/TR UDC table does not have a value for the currency code, then no description is printed in the XML file.

- Amount

-

Enter the amount paid to the employee during the payroll period.

12.4.6 Copying Employee Payment Information

Access the Copy Payroll Details form.

You can specify what to copy by completing different fields in the top grouping of fields on the Copy Payroll Detail form:

-

To copy records for only a specific active employee, complete the Company, Payroll Category ID, and Employee ID fields.

-

To copy records for all active employees in a company with the same payroll category ID, complete the Company and Payroll Category ID fields.

-

To copy all records for all active employees in a company, complete the Company field.

|

Note: For all copy functions, you must complete the required fields in the Copy From Payroll Period and Copy To Payroll Period sections. |

- Company

-

Enter the company of the employee record to copy.

- Payroll Category ID

-

Enter a value from the Payroll Category table (F75C504) to specify the type of payment.

- Employee ID

-

Enter the employee ID of the record to copy.

12.4.6.1 Copy From Payroll Period

- Payroll Period Year

-

Enter the year of the payroll record to copy.

- Payroll Period Number

-

Enter the period number of the payroll record to copy.

12.4.6.2 Copy To Payroll Period

Use the fields in this section to specify the range of payroll periods to copy to. You enter a year and period to specify the beginning of the period to copy to, and enter a year and period to specify the end of the period to copy to.

- Payroll Period Year (Periods From column)

-

Enter the year for the beginning of the payroll period to copy to.

- Payroll Period Number (Periods From column)

-

Enter the period number for the beginning of the payroll periods to copy to.

- Payroll Period Year (Periods To column)

-

Enter the year for the end of the range of the payroll periods to copy to.

- Payroll Period Number (Periods To column)

-

Enter the period number for the end of the range of the payroll periods to copy to.

12.5 Importing Payroll and Employee Data

This section provides an overview of data import, lists prerequisites, and discusses how to import data for CNAO audit files.

12.5.1 Understanding Data Import

Instead of manually entering data, you can import data from a spreadsheet to populate the values for these programs:

-

Setup Payroll Category (P75C504)

The Setup Payroll Category program is discussed in the Setting Up and Generating the CNAO Shared Information XML File chapter. The process to import data for this program is discussed in this section.

-

Payroll Category and Payroll Elements Relation (P75C501)

-

Setup Payroll Periods (P75C502)

-

Employee Payroll Details - China (P75C503)

When you import data, the system populates the tables in which the values are stored for the program. The system stores the values in these tables:

-

Payroll Category (F75C504) for data imported using the Setup Payroll Category program.

-

Payroll Category and Elements (F75C501) for data imported using the Payroll Category and Payroll Elements Relation program.

-

Payroll Periods (F75C502) for data imported using the Setup Payroll Periods program.

-

Employee Payroll (F75C503) for data imported using the Employee Payroll Details - China program.

12.5.1.1 Order of Setup

Many of the programs use data in tables that are populated by other programs. To most efficiently use the setup programs and the import function, Oracle recommends that you manually enter or import data in this order:

-

Set up address book records for your employees if they do not already exist.

-

Manually enter or import values for the Setup Payroll Category program.

The codes that you enter in this program are used by the Employee Record Information program and the Payroll Category and Payroll Elements Relation program.

Note:

The Setup Payroll Category program is discussed in the Setting Up and Generating the CNAO Shared Information XML File chapter. The Payroll Category and Payroll Elements Relation program is discussed in this chapter. -

Manually enter the data required in the Employee Record Information program (P75C008).

The data that you enter in this program are used by the Employee Payroll Details - China program. The import functionality is not enabled for the Employee Record Information program.

-

Manually enter the data required in the Setup Payroll Elements program (P75C505).

The data that you enter is used by the Setup Payroll Category and Payroll Elements Relation program and the Employee Payroll Details - China program. The import functionality is not enabled for the Setup Payroll Elements program.

-

Enter or import data required for the Payroll Category and Payroll Elements Relation program.

This program uses data that was entered in the Setup Payroll Category program and the Setup Payroll Elements program, so you should enter data for those programs before attempting to enter data for the Payroll Category and Payroll Elements Relation program.

-

Enter or import data required for the Setup Payroll Periods program.

The data that you enter or import is used by the Employee Payroll Details - China program.

-

Enter or import data required for the Employee Payroll Details - China program.

Note:

This program also enables you to use a special copy function. You should compare the copy function and the data import function to determine which method of entering or replicating data is most efficient for your organization.

12.5.1.2 Steps to Import Data

To import data:

-

Prepare a spreadsheet with the values that you want to import.

-

Access the import function for the program whose data you want to import.

-

Complete the range of cells to import.

-

Import the data.

12.5.1.3 Considerations for Spreadsheet Preparation

The import function in the JD Edwards EnterpriseOne software is designed to work with Microsoft Excel© spreadsheets, comma-separated values, or values from a clipboard.

When you prepare the spreadsheet, consider these factors:

-

The system uses the same validations for data that you import that it uses for data that you enter manually. Therefore, verify that the values you want to import are valid values for the program. For all the system validates that the new records are not duplicates of existing records. The system performs programs, these additional validations:

Program Validations Setup Payroll Category The system performs these validations: -

The value entered or imported for the Company field must exist in the Company Constants table (P0010).

-

The value entered or imported for the Currency field must exist in the Currency Codes table (F0013).

Payroll Category and Payroll Elements Relation The system performs these validations: -

The value entered or imported for the Payroll Category ID field must exist in the F75C504 table.

-

The value entered or imported for the Payroll Element ID field must exist in the F75C505 table.

Setup Payroll Periods The system validates that dates are entered in a valid format. Employee Payroll Details - China The system performs these validations: -

The value entered in the Employee ID filed must exist in the Address Book Master table (F01012).

-

The values entered in the Employee Name and Department ID fields must exist in the Employee Records Information table (F75C008).

You use the Employee Record Information program (P75C008) to add information about each employee, including the department for the employee.

See Setting Up and Generating the CNAO Shared Information XML File

-

The value for the Employee Category field must exist in the Employee Category (75C/EC) UDC table.

-

The values that you enter in the Legal Entity and Payroll Category Name fields must exist in the F75C504 table.

-

Values for these fields must exist in the F75C502 table:

-

Payroll Period Year

-

Payroll Period Number

-

-

-

The columns in the spreadsheet must be in the same order as the fields on the form in which you would manually enter data. For example, when you manually enter data in the Payroll Category and Payroll Elements Relation program, you enter data in the fields on the Payroll Category and Payroll Elements Relation form. You must list the values for the Payroll Category ID field in a column that precedes the column for the Payroll Element ID field.

If you choose to leave an optional field blank, insert a blank column in the appropriate place in the spreadsheet.

-

Consider preparing a spreadsheet with the values for only a few records before preparing a spreadsheet with all of the records that you need to import. Importing a few records initially enables you to verify that you have the data in the correct format and in the correct order in the spreadsheet.

12.5.1.4 Considerations for Import Function Access

You access the import function in the China-specific programs differently from the way that you access it in the JD Edwards EnterpriseOne base software. For each of the China-specific programs, access the find and browse form for the program, and then select the import option from the Form menu. The detail form that appears includes a Tools menu. You select the Import Grid Data option on the Tools menu to access the Import Assistant form that you use to import data.

|

Note: You can use the detail form to determine the order in which to set up the columns on your spreadsheet. The Import Assistant form also lists the order in which you must set up the columns on your spreadsheet. |

12.5.2 Prerequisites

Before you begin the task in this section, prepare a spreadsheet of the values that you want to import.

12.5.3 Forms Used to Import Data for CNAO Audit Files

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Import Assistant | n/a |

|

Define the import file, cell range, and the import location of the grid for data hat you want to import. |

12.5.4 Importing Data for CNAO Audit Files

-

Access the Import Assistant form.

-

In the Define Import File area, select how to import the data.

-

In the Define Cell Range area, specify the starting and ending cells.

-

In the Define Import Location in Grid area, select an option:

-

Insert

Select Insert to place your data at the beginning of the JD Edwards EnterpriseOne table to which you write the data. If you select this option, the system overwrites any existing data up to the number of rows in the spreadsheet. For example, if you select this option and you import 10 rows, the data in your spreadsheet replaces the first 10 rows of the data in the JD Edwards EnterpriseOne table.

-

Paste

When you select this option, the Import Assistant form displays additional fields in which you specify where to write the data. Select Paste if you want to specify where in the JD Edwards EnterpriseOne table to place the data. Use this option to append data to existing data.

-

-

Click Apply.

If all validations pass, the system displays the data that you imported in the detail form for the program. You can verify and modify the data before saving the data to the JD Edwards EnterpriseOne table.

12.6 Generating the CNAO Audit File for Payroll

This section provides an overview of the CNAO audit file for payroll and discusses how to:

-

Run the Generate Payroll XML program.

-

Set processing options for Generate Payroll XML (R75C501).

12.6.1 Understanding the CNAO Audit File for Payroll

You run the Generate Payroll XML program to generate the XML file to report payroll information. You set processing options to specify data selection, such as the payroll period and company. You also use the processing options to specify the location to which the program writes the XML output and the Chinese characters that the system prints in the file name of the report.

The system reads these tables to obtain the data for the XML file:

-

Employee Record Information (F75C008)

-

Employee Record Information (F75C008)

-

Payroll Periods (F75C502)

-

Employee Payroll (F75C503)

-

Payroll Category (F75C504)

-

Payroll Elements (F75C505)

The default sort for the data output is:

-

Employee ID

-

Payroll Period Number

-

Payroll Period Year

-

Payroll Category

-

Payroll Element

12.6.3 Setting Processing Options for Generate Payroll XML (R75C501)

Processing options enable you to specify default values for programs and reports.

12.6.3.1 General

- Company

-

Specify the company for which you generate the report. If you leave this processing option blank, the system generates the report for all companies.

- Department ID

-

Enter a value from the Business Unit Master table (F0006) to specify the department for which you generate the report. If you leave this processing option blank, the system generates the report for all departments.

- Accounting Year

-

Specify the accounting year of the report. You must enter a value in the format YYYY. The system uses this value to select the employee records that have the specified accounting year in the employee payroll record in the F75C503 table.

- Payroll Period Number From

-

Specify the first payroll period for which you run the report. If you leave this processing option blank, the system selects employee records beginning with the first payroll period of the year specified in the Accounting Year processing option.

- Payroll Period Number To

-

Specify the last payroll period for which you run the report. If you leave this processing option blank, the system selects employee records beginning with the last payroll period of the year specified in the Accounting Year processing option.

12.6.3.2 XML File Name

- XML File Path

-

Specify the location to which the system writes the XML file. You must have write permissions for the location that you specify.

write permissions for the location that you specify.

- Chinese Character — Beginning part of XML name

-

Specify the Chinese characters to precede the year for which you generate the XML file. For example, if you generate the file for the year 2010, the system prints the values that you enter before the numerals 2010.