11 Setting Up and Generating the CNAO Shared Information XML File

This chapter contains the following topics:

-

Section 11.1, "Understanding the CNAO Shared Information XML File"

-

Section 11.2, "Setting Up UDC Values for the CNAO General Information XML File"

-

Section 11.3, "Setting Up Subsidiary Information for the Shared Info XML File"

-

Section 11.6, "Entering the Short Name for Supplier and Customer Address Book Records"

-

Section 11.7, "Generating the Shared Information XML File for CNAO Audit Files"

11.1 Understanding the CNAO Shared Information XML File

The shared information XML file includes information about the reporting organization, and includes the metadata for several other XML output files. It provides a listing of data that can be used as a reference for data in other output files.

For example, the XML output file for accounts receivable and accounts payable records includes the address book numbers of your customers and suppliers, but does not include the names of the customers and suppliers. To determine the name of a supplier, you can compare the address book number in the XML output file for accounts payable (AP) and accounts receivable (AR) records to the XML output file for the shared information. The shared information XML file includes the address book number and the name of customers and suppliers.

The shared information XML file that you generate for CNAO audit requirements includes information about these factors:

-

Electronic accounting book

The electronic accounting book section includes information about the reporting organization, such as the name, ID, and industry; information about the software that you use to generate the reports; and other information such as the accounting year and currency.

You set up the electronic accounting book information in the Electronic Accounting Book program (P75C002). A description of this existing program is included in this document for your convenience.

-

This section of the XML output includes the accounting year and period; and the start and end dates of the accounting period. The system uses the accounting year and period as set up in the Company Names & Numbers program (P0010), and uses the start and end dates as set up in the Fiscal Date Patterns program (P0008).

-

This section of the XML output includes the codes and descriptions that you set up in Document Type - China (75C/DT) UDC table. You set up a code and description in the 75C/DT UDC table to describe every document type that you use for your transactions. The system prints the document types and descriptions in the Shared Information XML output file as a reference for the document types that are reported in the other output files.

-

This section of the XML output includes the codes and descriptions that you set up in the Exchange Rate (75C/ER) UDC table. You set up a code and description in the 75C/ER UDC table to describe every exchange rate type that you use for your transactions. The system prints the exchange rate types and descriptions in the Shared Information XML output file as a reference for the exchange rate types that are reported in the other output files.

-

Currency

This section of the XML output includes the currency codes that exist in the Currency Code (F0013) table. The system takes the description for the currency codes from the Translation (75C/TR) UDC table. The system prints the currency codes and descriptions in the Shared Information XML output file as a reference for the currency codes that are reported in the other output files.

-

This section of the XML output includes the codes from the Payment Instrument (00/PY) UDC table. The system takes the description for the payment instruments from the alternate UDC description that you set up in the User Defined Codes program (P0004A). The system prints the payment codes and alternate descriptions in the Shared Information XML output file as a reference for the payment instruments that are reported in the other output files.

-

This section of the XML output includes the business units for the company that you specify in the processing options of the Generate Shared Information XML program (R75C008). You set up codes in the Department Type (75C/DE) UDC table that match the business units that you want to include in the Shared Information XML output file. When you run the Generate Shared Information XML program, the system compares the business units that exist for the specified company in the Business Unit Master table (P0006) to the business units that exist in the 75C/DE UDC table. The system includes only the business units that exist in both the P0006 table and 75C/DE UDC table.

-

This section of the XML output includes the data for the employees that you enter in the Employee Record Information program (P75C008).

-

This section of the XML output includes customer address book numbers and addresses as stored in the Customer Master record, and the short name for the customer that you enter in the Address Book Additional Information program (P75C012).

-

This section of the XML output includes supplier address book numbers and addresses as stored in the Supplier Master record, and the short name for the supplier that you enter in the Address Book Additional Information program (P75C012).

-

This section of the XML out includes the output for the subsidiary information that you set up in the Subsidiary Info program (P75C010). You set up subsidiary information to provide additional information for general ledger accounts.

See Setting Up Subsidiary Information for the Shared Info XML File

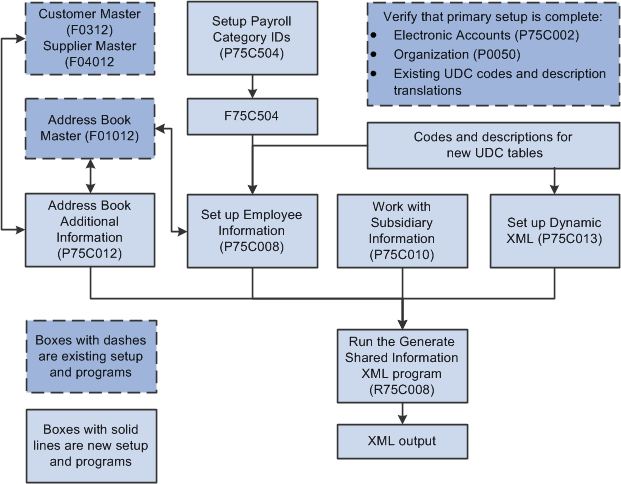

11.1.1 Process Flow for Setting Up and Generating the Shared Information XML File

Because some of the information that you enter to set up your system to generate the general information XML file is dependent on other information, the order in which you set up the system is important.

This process flow shows the recommended order of the steps that you take to set up your system to generate the shared information XML file:

Figure 11-1 Process Flow for Setup for the Shared Information File

Description of ''Figure 11-1 Process Flow for Setup for the Shared Information File''

11.1.2 Checklist for the Shared Information XML File

Use this table to assure that you complete all necessary steps to successfully generate the shared information audit file.

| Complete | Action | Comments |

|---|---|---|

| Verify that electronic accounts are set up for your organization. | You must set up the electronic account information before generating the general information XML file. You use the existing program Electronic Accounting Book (P75C002) to set up electronic accounts.

See Setting Up the Organization Details in the Electronic Accounting Book |

|

| Verify that parent/child relationships are set up for your business units if such relationships exist for your business units. | You set up parent/child relationships in the Organization Structure Inquiry/Revisions program (P0050). This program enables you to specify the relationship between multiple business units. The output report includes the parent business unit (data item MCU1) that exists in the Organization Master File (F0050) for the business units that you report. You Structure specify the business units that you report in the 75C/DE UDC table. | |

| Verify that an employee record exists in the Address Book Master table (F0101) for each employee. | The address book record number for the employee that you enter in the Employee Record Information program (P75C008) must exist in the F0101 table. | |

| Verify that address book and customer master records exist for each of your customers. | You add additional, China-specific information to the customer address book records in the Additional Address Book Information - China program (P75C012).

See Entering the Short Name for Supplier and Customer Address Book Records The Generate Shared Information XML program also reads values from the customer master record. |

|

| Verify that address book and supplier master records exist for each of your suppliers. | You add additional, China-specific information to the supplier address book records in the Additional Address Book Information - China program (P75C012).

See Entering the Short Name for Supplier and Customer Address Book Records The Generate Shared Information XML program also reads values from the supplier master record. |

|

| Verify that appropriate values exist in the UDC tables used by the Generate Shared Information XML (R75C008). | The Generate Shared Information XML program reads these UDC tables:

Setting Up UDC Values for the CNAO General Information XML File |

|

| Verify that alternative UDC description translations are set up for values in the 00/PY and 75C/ER UDC tables. | The Generate Shared Information XML program reads UDC descriptions for the 00/PY and 75C/ER UDC tables from the User Defined Codes - Alternate (F0005D) only. | |

| Verify that the element names are set up for the shared information file. | You use the Dynamic XML Element Names program (P75C013) to set up names for the sections headings and the section fields of the shared information XML file.

For example, instead of having the system print the term Electronic Accounting Book for the heading of that section, you can enter a different string, including Chinese characters, that the system will print in the XML output file. |

|

| Set up payroll category IDs. | You use the Setup Payroll Category program (P75C504) to set up payroll category codes. | |

| Enter employee record information. | You use the Employee Record Information program (P75C008) to enter employee records information. | |

| Enter supplier and customer address book information. | You use the Address Book Additional Information program (P75C012) to enter a short name for suppliers and customers.

See Entering the Short Name for Supplier and Customer Address Book Records |

|

| Enter the subsidiary information that you want to include in the CNAO shared information XML file. | You use the Work With Subsidiary Information program (P75C010) to enter the additional information to include in the CNAO shared information XML file.

See Setting Up Subsidiary Information for the Shared Info XML File |

|

| Generate the shared information XML file for CNAO audit files. | You run the Generate Shared Information XML program (R75C008) to generate the shared information XML file.

See Generating the Shared Information XML File for CNAO Audit Files |

11.2 Setting Up UDC Values for the CNAO General Information XML File

Before you use the programs to enter and generate data for the CNAO general information XML file, set up these UDC tables.

11.2.1 Payment Instrument (00/PY)

Verify that appropriate values exist in this UDC table.

After you set up the UDC codes, you must enter an alternate description of the code in the Description field on the UDC Value Alternate Descriptions form. The system does not use the description in the Description 01 or Description 02 fields on the User Defined Codes form. Instead, the system writes the description from the UDC Value Alternate Descriptions form. Select a record on the Work With User Defined Codes form and then select Language from the Row menu to enter the alternate description.

The system writes the codes from the 00/PY UDC table and the alternate descriptions to the Settlement Method section of the CNAO Shared Information XML file.

11.2.2 Search Type (01/ST)

Verify that appropriate values exist in this UDC table. You use the values in this UDC table when you enter subsidiary records for address book records.

11.2.3 Department Type (75C/DE)

Set up codes in this UDC table to identify the business units for which you report transactions. Enter the business units that you want to include in the report in the Codes field of the UDC table. The system compares the values in this UDC table to the business units that exist in the F0006 table for the reporting organization and includes only the business units that exist in this UDC table in the reports.

The system writes the codes to the Shared Information XML file.

11.2.4 Document Type - China (75C/DT)

Set up this UDC table with the document types that you use for your reportable transactions. The system writes the codes, Description 01, and Description 02 values to the Journal Category Type section of the CNAO Shared Information XML file.

11.2.5 Employee Category (75C/EC)

Set up this UDC table with the codes that you use to categorize types of employment.

After you set up the UDC codes, you must enter an alternate description of the code in the Description field on the UDC Value Alternate Descriptions form. The system does not use the description in the Description 01 or Description 02 fields on the User Defined Codes form. Instead, the system writes the description from the UDC Value Alternate Descriptions form. Select a record on the Work With User Defined Codes form and then select Language from the Row menu to enter the alternate description.

11.2.6 Employee Document Type (75C/ED)

Set up this UDC table with codes to represent employee document types.

11.2.7 Exchange Rate (75C/ER)

Set up this UDC table with codes that represent every exchange rate type that you use for your transactions.

After you set up the UDC codes, you must enter an alternate description of the code in the Description field on the UDC Value Alternate Descriptions form. The system does not use the description in the Description 01 or Description 02 fields on the User Defined Codes form. Instead, the system writes the description from the UDC Value Alternate Descriptions form. Select a record on the Work With User Defined Codes form and then select Language from the Row menu to enter the alternate description.

The system prints the exchange rate types and descriptions in the Shared Information XML output file as a reference for the exchange rate types that are reported in the other output files.

11.2.8 Gender (75C/GD)

Set up codes in this UDC table for genders. You can enter either alpha or numeric characters in the Code field. You assign a value from this UDC table to employee records. You use the values that you set up in this UDC table when you set up employee records in the Employee Record Information program (P75C008). The system prints the code in the Gender field in the Employee Records section of the CNAO Shared Information XML file.

After you set up the UDC codes, you must enter an alternate description of the code in the Description field on the UDC Value Alternate Descriptions form. The system does not use the description in the Description 01 or Description 02 fields on the User Defined Codes form. Instead, the system writes the description from the UDC Value Alternate Descriptions form. Select a record on the Work With User Defined Codes form and then select Language from the Row menu to enter the alternate description.

Examples of codes are:

| Codes | Description |

|---|---|

| 1 | Male |

| 2 | Female |

| M | Male |

| F | Female |

11.2.9 Translation (75C/TR)

Set up this UDC table with the currency codes for the currencies that you use, and enter an alternative description for the currency in the UDC Value Alternate Descriptions form. The currency codes that you enter in the Codes field of the User Defined Codes form must exist in the Currency Codes table (F0013). You set up the currency codes in the 75C/TR UDC table so that the Generate Shared Information XML program (R75C008) can obtain the alternative description of the currency code to print in the XML file.

The Generate Shared Information XML program obtains the currency codes from the F0013 table, and then prints the description for the currency code from the values in the Description field that you enter in the UDC Value Alternate Descriptions from.

11.3 Setting Up Subsidiary Information for the Shared Info XML File

This section provides an overview of the subsidiary information for the shared information XML file and discusses how to set up subsidiary information.

11.3.1 Understanding Subsidiary Information

The Shared Information XML file includes subsidiary (additional) information for the general ledger accounts that you report in the CNAO GL XML files. The subsidiary information is not the subsidiary portion of the GL account. Instead, it is additional information that helps to define how the GL account is used.

You use the Work with Subsidiary Information program (P75C010) to set up the additional information that you need to associate with the accounts in your chart of accounts.

|

Note: After you use the Work with Subsidiary Information program to set up the subsidiary information, you use the Account - Subsidiary Cross Reference program (P75C011) to associate the subsidiary information to general ledger records. |

This table lists the types of subsidiary information that you can set up and the source of the data in the JD Edwards EnterpriseOne system:

| Type of Information | Source |

|---|---|

| Address book | Search Type (01/ST) |

| Cost center | Business Unit Types (00/MC) |

| Item branch/plant | Stocking Type Code (41/I) |

| Payment instrument | Payment Instrument (00/PY) |

| Project number | None. You enter the project number in the Work with Subsidiary Information program. |

| Item BP Category Code | Category code number |

11.3.2 Forms Used to Set Up Subsidiary ID Information

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Subsidiary Information | W75C010A | Subsidiary Information (G75C056),Work with Subsidiary Information | Review and select existing records. |

| Subsidiary Type Selection | W75C010B | Click Add on the Work with Subsidiary Information form. | Select the type of subsidiary information to enter. |

| Subsidiary Information Revision | W75C010C | On the Subsidiary Type Selection form, enter a subsidiary ID, select an option, and then click OK. | Enter the subsidiary information. |

11.3.3 Entering Subsidiary ID Information

Access the Subsidiary Type Selection form.

Figure 11-2 Subsidiary Type Selection Form

Description of ''Figure 11-2 Subsidiary Type Selection Form''

To enter subsidiary ID information:

-

Enter an ID for the subsidiary information in the Subsidiary Id field. You can enter alpha and numeric characters. You can use the type of information that you set up. For example, if you set up subsidiary information for an address book record, enter the address book number or the address book search type in the Subsidiary ID field. Or, if you set up subsidiary information for a project, you can enter the project ID in the Subsidiary ID field.

-

Select one of these subsidiary types and click OK:

-

Address Book

-

Cost Center

-

Item Branch / Plant

-

Payment Instrument

-

Project Number

-

Item BP Category Code

-

-

Complete the fields on the Subsidiary Information Revision form and click OK.

The fields on the form differ depending on the type of subsidiary information that you set up.

- Subsidiary Name

-

Enter the name to assign to the subsidiary ID. You can enter alpha and

numeric characters.

- Output To Shared info

-

Enter Y to include the subsidiary ID and name in the Shared Info XML file. The default value is N, which prevents the system from including the record in the Shared Info XML file.

- Corresponding Records

-

Enter any additional information to associate with the record. For example, you could enter an alternative name for the subsidiary.

- Search Type

-

Note:

This field appears only if you selected Address Book, Cost Center, or Item Branch/Plant as the subsidiary type on the Subsidiary Type Selection form.Enter the search type for the subsidiary type that you selected:

For an address book subsidiary record, enter a value from the Search Type (01/ST) UDC table.

For a cost center subsidiary record, enter a value from the Business Unit Types (00/MC) UDC table.

For an item branch/plant record, enter a value from the Stocking Type Code (41/I) UDC table.

- Category Code

-

If you selected Item BP Category Code as the subsidiary type on the Subsidiary Type Selection form, enter a value from the a category code that is associated with records in the Item Branch Plant program. (P41026).

11.4 Entering Payroll Category IDs

This section provides an overview of payroll category IDs and discusses how to enter payroll category IDs.

11.4.1 Understanding Payroll Category IDs

You must set up payroll category IDs before you generate the CNAO Shared Information XML file because you must assign the codes to the employee records that you include in the shared information file.

You use the Setup Payroll Category - China program (P75C504) to set up payroll categories. Payroll categories are groups under which you classify employees, such as a classification for managers or a classification for hourly employees. You associate payroll categories to a company and currency in the Setup Payroll Category - China program.

You use the values that you set up in the Setup Payroll Category - China program when you assign a payroll category to employee records in the Employee Record Information program (P75C008). You also associate payroll category IDs to payroll elements in the Payroll Category and Payroll Elements Relation – China program (P75C501). The system writes information about payroll category IDs in the general information XML file and the payroll XML file.

The system saves the values that you enter in the Setup Payroll Category - China program to the Payroll Category table (F75C504).

11.4.2 Forms Used to Enter Payroll Category IDs

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Payroll Category | W75C504A | Payroll (G75C052), Set Up Payroll Category | Review and select existing payroll category records. |

| Payroll Category Revision | W75C504B | Click Add on the Work with Payroll Category form. | Enter payroll category IDs and descriptions, and enter the company and currency for the payroll category ID. |

11.4.3 Entering Payroll Category IDs

Access the Payroll Category Revision form.

Figure 11-3 Payroll Category Revision Form

Description of ''Figure 11-3 Payroll Category Revision Form''

|

Note: After you enter a record and click OK, the system saves the record to the F75C504 table, but does not return you to the Work with Payroll Category form. Instead, the system clears the Payroll Category ID and Payroll Category Name fields on the Payroll Category Revision form. This enables you to enter another payroll category code for the same company and currency. |

- Payroll Category ID

-

Enter the payroll category ID. You can enter up to five digits.

- Payroll Category Name

-

Enter the name to associate with the payroll category ID.

- Company

-

Enter the company number to associate with the payroll category ID. The company number must exist in the Company Constants table (P0010).

- Currency

-

Enter a currency code that exists in the Currency Codes table (F0013).

11.5 Entering Employee Record Information

This section provides an overview of employee record information and discusses how to enter employee record information.

11.5.1 Understanding Employee Record Information

Some of the information that you must report for employees might not exist in the JD Edwards EnterpriseOne Address Book system. You use the Employee Record Information program (P75C008) to add information about each employee, such as name, gender, and hire status.

The system saves that data that you enter to the Employee Records Information table (F75C008). The system uses the data in the F75C008 table when you run the Generate Shared Information XML program (R75C008) and when you run the Generate Payroll XML - China program (R75C501).

Generating the CNAO Audit File for Payroll

|

Note: Some of the fields in the Employee Record Information program are validated against values in the F74C504 table. You must use the Payroll Category program to enter the types of payroll that you process before you use the Employee Record Information program to enter employee record information. |

11.5.2 Prerequisites

Before you perform the task in this section, enter values in the Payroll Category program.

11.5.3 Forms Used to Enter Employee Record Information

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Employee Record Information | W75C008A | Payroll (G75C052), Employee Record Information | Review and select existing employee records. |

| Work with Employee Record Revision | W75C008B | Use one of these navigations: Click Add on the Workwith Employee Record Information form. Select an existing record on the Work with Employee Record Information form and click Select. |

Enter employee information

that is required for CNAO reporting. |

11.5.4 Entering Employee Record Information

Access the Work with Employee Record Revision form.

Figure 11-4 Work with Employee Record Revision Form

Description of ''Figure 11-4 Work with Employee Record Revision Form''

- Employee ID

-

Enter the employee ID as it appears in the address book record for the employee.

- Employee Name

-

The system completes this field based on the employee's address book record.

- Gender

-

The system completes this field from the values in the employee's Who's Who record. You can change the value by entering a value from the Gender (75C/GD) UDC table.

- Document Type

-

Enter a value from the Employee Document Type (75C/DT) UDC table to specify the document type of the employee.

- Document Number

-

Enter the document number for the employee record.

- Payroll Category ID

-

Enter a value from the Payroll Category table (F75C504) to specify the payroll category to which the employee is assigned. You must complete this field.

- Legal Entity

-

The system populates this field with the company that is associated with the payroll category code that you entered in the Payroll Category ID field.

- Employee Category

-

Enter a value from the Employee Category (75C/EC) UDC table.

- Employee Status

-

Enter Y to include the record in the XML file. Enter N to exclude the record from the XML file. The default value is N.

- Hire Date

-

Enter the employee's hire date.

- Termination Date

-

Enter the employee's termination date.

- Date of Birth

-

The system completes this field with a value from the employee's Who's Who record. you can modify the date.

- Payroll Category Name

-

The system completes this field with the description that corresponds to the value that you entered in the Payroll Category ID field.

- Department ID

-

Enter the business unit for the employee. The value that you enter must be set up as a department for CNAO reporting in the 75C/DE UDC table.

11.6 Entering the Short Name for Supplier and Customer Address Book Records

This section provides an overview of supplier and customer address book information for CNAO audit files, lists the forms used to enter the short name for supplier and customer address book records, and discusses how to set processing options for the Address Book Additional Information-China program (P75C012).

11.6.1 Understanding Short Names for Supplier and Customer Address Book Records

You use the Address Book Additional Information-China program (P75C012) to enter a short name for suppliers and customers. The values that you enter are added to the shared information audit file, but they are not mandatory.

You access the Address Book Additional Information-China program by using the Regional Info options in the Address Book Revision program (P01012). If you add an address book record for a supplier or customer, the system launches the Address Book Additional Information-China program when you click OK after entering standard information on the Address Book Revision form. The system saves the values that you enter to the Address Book Additional Information - China table (F75C012).

If you use different versions of the Address Book Revision program (P01012), you should set up a version of the Address Book Additional Information-China program with the same name.

11.6.2 Forms Used to Enter the Short Name for Supplier and Customer Address Book Records

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with Addresses | W01012B | Address Book (G01), Address Book Revisions | Review and select existing address book records. |

| Address Book Revision | W01012A | Click Add on the Work with Addresses form. | Add standard address book information. |

| Work with Additional Information | W75C012A | Use one of these navigations: Select a record on the Work with Address form and then select Regional Info from the Row menu. Click OK on the Address Book Revisions form. |

Enter the short name for the customer or supplier. |

11.7 Generating the Shared Information XML File for CNAO Audit Files

This section provides an overview of the shared information XML file and discusses how to:

-

Run the Generate Shared Information XML program.

-

Set processing options for Generate Shared Information XML (R75C008).

11.7.1 Understanding the Shared Information XML File for CNAO

The CNAO Shared Information XML file includes the metadata that describes the data in other CNAO output files. For example, the CNAO AR/AP XML file includes the address book number of customers and suppliers, but does not include the names of the customers and suppliers. You use these programs to set up the data to include in the CNAO Shared Information XML file:

-

Electronic Accounting Book program (P75C002).

-

Company Names & Numbers program (P0010).

The system uses the accounting year and period as set up in this program.

-

Fiscal Date Patterns program (P0008).

The report uses the start and end dates as set up in this program.

-

Organization Structure Inquiry/Revisions program (P0050).

The report uses the parent/child relationships as set up in this program.

-

Setup Payroll Category program (P75C504).

You must set up payroll category codes before you can set up employee record information.

-

Address Book Additional Information program (P75C012).

-

Employee Record Information program (P75C008).

Address book records for employees must exist in the Address Book Master table (F0101) before you can add the China-specific information in the Employee Record Information program.

-

Dynamic XML Element Names program (P75C013).

You use this program to set up names for the sections headings and the section fields of the shared information XML file.

-

Work With Subsidiary Information program (P75C010).

You use this program to enter the additional information to include in the CNAO shared information XML file.

The shared information XML file includes sections for this information:

-

Electronic accounting book

-

Accounting period

-

Journal category type

-

Exchange rate type

-

Currency

-

Settlement method

-

Department records

-

Employee records

-

Customer records

-

Supplier records

-

User-defined records

-

User-defined record values

11.7.2 Running the Generate Shared Information XML Program

Select Shared Info (G75C051), Generate Shared Information XML.

11.7.3 Setting Processing Options for Generate Shared Information XML (R75C008)

The system uses the values in these processing options for data selection.

11.7.3.1 Default

- 1. Company

-

Specify the company for which you generate the report. You must complete this processing option.

- 2. Financial Reporting Year (YYYY)

-

Enter the financial reporting year for the company

11.7.3.2 Electronic Accounting

- 1. CNAO Standard Version

-

Specify the CNAO version. The system uses the value that you enter as the value for the Version in the XML output file. For example, you might enter 2.0.

11.7.3.3 Accounting Period

- 1. Start Period

-

Specify the first period in a range of periods for which you generate the report. You enter a period that exists for the company in the Company Constants table (F0010). You must complete this processing option.

- 2. End Period

-

Specify the last period in a range of periods for which you generate the report. You enter a period that exists for the company in the Company Constants table (F0010). You must complete this processing option.

11.7.3.4 Department

- 1. Organization Type Structure

-

Enter a value from the Type of Structure (00/TS) UDC table to specify the organization type.

11.7.3.5 XML File Name

- 1. XML Filepath

-

Specify the location to which the system writes the XML file. You must have write permissions for the location that you specify.

You must complete this processing option.

- 2. Chinese Characters - Beginning part of XML file name

-

Specify the Chinese characters to precede the year for which you generate the XML file. For example, if you generate the file for the year 2010, the system prints the values that you enter before the numerals 2010.