14 Setting Up and Generating GL Information for CNAO Audit Files

This chapter contains the following topics:

-

Section 14.1, "Understanding GL Information Required for CNAO Audit Files"

-

Section 14.3, "Generating Subsidiary Information for Accounts Transactions"

-

Section 14.4, "Generating Report Item Data for Financial Information"

14.1 Understanding GL Information Required for CNAO Audit Files

You must generate an XML file to report your general ledger (GL) transactions. The JD Edwards EnterpriseOne software for China includes methods that enable you to easily set up the general ledger information into the GL Basic Information - China (F75C009), Account - Subsidiary Cross Reference - China (F75C011), Subsidiary Balances File - China (F75C902), and Transaction-wise Subsidiary Info - China (F75C912) tables. The system generates an XML file with this GL information:

-

GL Basic Information

-

Chart of Account

-

Subsidiary Item of Account

-

Cash Flow Items

-

Account Period Amount and Balance

-

Journal

-

Journal Related with Cash Flow Items

-

Report Sets

-

Report Item Data

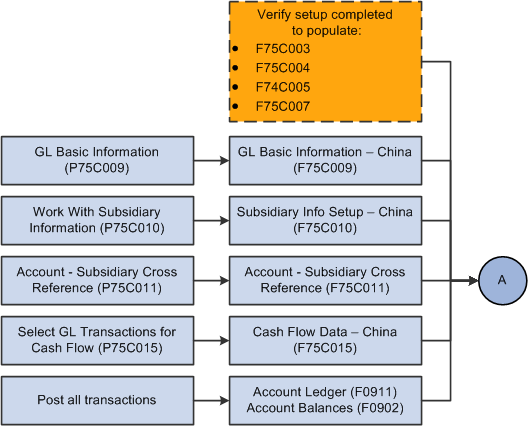

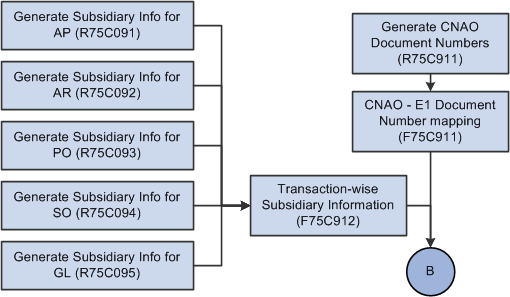

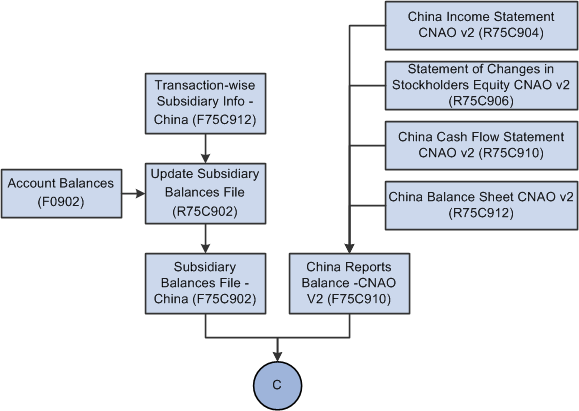

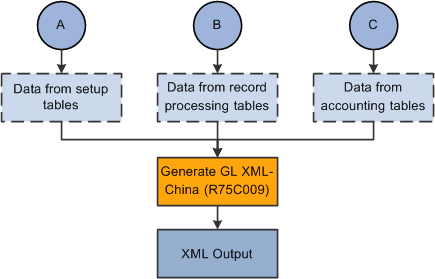

14.1.1 Process Flow for Setting Up and Generating the CNAO Audit File for GL

These process flows show the set up that you need to complete and the relationships between the setup programs to generate the GL XML file:

Figure 14-1 Process Flow for Setup for GL XML File (1 of 4)

Description of ''Figure 14-1 Process Flow for Setup for GL XML File (1 of 4)''

Figure 14-2 Process Flow for Setup for GL XML File (2 of 4)

Description of ''Figure 14-2 Process Flow for Setup for GL XML File (2 of 4)''

Figure 14-3 Process Flow for Setup for GL XML File (3 of 4)

Description of ''Figure 14-3 Process Flow for Setup for GL XML File (3 of 4)''

Figure 14-4 Process Flow for Setup for GL XML File (4 of 4)

Description of ''Figure 14-4 Process Flow for Setup for GL XML File (4 of 4)''

14.1.2 Checklist for Setting Up and Generating the CNAO Audit File for GL

Use this table to assure that you complete all necessary steps to successfully generate the CNAO audit file for GL:

| Complete | Action | Comments |

|---|---|---|

| Verify that alternate descriptions of currency code translations are set up. | You set up the alternate descriptions in the Translation (75C/TR) UDC table. | |

| Enter general ledger information. | You use the GL Basic Information - China program (P75C009) to set up the basic GL information such as company, COA rule, journal header field, and so on. | |

| Verify that the needed subsidiary items exist. | You use the Work With Subsidiary Information program (P75C010) to verify the existing subsidiary items.

See Setting Up Subsidiary Information for the Shared Info XML File |

|

| Associate subsidiary items to an account. | You use the Account - Subsidiary Cross Reference - China program (P75C011) to associate subsidiary items to an account. | |

| Process GL information for cash flow. | You use the Select GL transactions for Cash Flow - China program (P75C015) to select GL transactions for cash flow. | |

| Generate subsidiary information for accounts transactions. | You run reports to generate subsidiary information for different transactions:

You can also run all these reports sequentially by running the Subsidiary Info Reports - China (R75C090) report. See Generating Subsidiary Information for Accounts Transactions |

|

| Generate report item data. | You run these reports to generate report item data for transactions:

|

|

| Generate the CNAO document numbers. | You use the Generate CNAO Document Numbers program (R75C911) to generate CNAO document numbers for all JD Edwards EnterpriseOne document numbers. | |

| Update subsidiary balances file. | You use the Update Subsidiary Balances File - China program (R75C902) to update the balances in the F75C902 table. | |

| Revise beginning balance for subsidiary items. | You use the Subsidiary Balances Revision - China program (P75C902) to revise the beginning balance for the subsidiary items attached to an account. | |

| Verify that the XML element names are set up for the GL file. | You use the Dynamic XML Element Names program (P75C013) to set up names for the sections headings and the section fields of the GL XML file.

For example, instead of having the system print the term Chart of Account for the heading of that section, you can enter a different string, including Chinese characters, that the system will print in the XML output file. |

|

| Generate the GL CNAO XML file. | You run the Generate GL XML - China program (R75C009) to generate the XML file. |

14.2 Setting Up Information for GL

This section provides an overview of the GL basic information and discusses how to enter the GL basic information.

14.2.1 Understanding GL Basic Information

You use the GL Basic Information - China program (P75C009) to add or update the basic GL information. You must run this program before you run the XML for the information to display on the XML. The system stores this information the F75C009 table.

In the P75C009 program, you have the Export to Excel option that you use to export data from the grid to a spreadsheet.

14.2.2 Forms Used to Enter Basic Information for GL

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with GL Basic Information | W75C009A | GL (G75C053), GL Basic Information | Review and select existing GL records. |

| GL Basic Information Revision | W75C009B | Click Add on the Work with GL Basic Information form. | Enter GL basic information. |

14.2.3 Entering GL Basic Information

Access the GL Basic Information Revision form.

Figure 14-5 GL Basic Information Revision Form

Description of ''Figure 14-5 GL Basic Information Revision Form''

- Company

-

Enter the company for which you want to enter the GL basic information.

- Separator

-

Enter a specific character that you can use as a separator in the COA rule or cash flow item rule. For example, you might enter a hyphen (-).

- COA Rule (chart of accounts rule)

-

Enter a number that signifies the length of every part of COA. For example, 4-2-2.

- Cash Flow Item Rule

-

Enter a number that signifies the length of every part of COA for cash flow.

- Journal Header Flex field

-

Enter any important information pertaining to the Journal Header Flex field. This is an optional field. The system prints this in the XML file.

- Journal Header Flex field Records

-

Enter any important information pertaining to the Journal Header Flex field. This is an optional field. The system prints this in the XML file.

- Journal Line Flex Field

-

Enter any important information pertaining to the Journal Line Flex field. This is an optional field. The system prints this in the XML file.

- Journal Line Flex Field Records

-

Enter any important information pertaining to the Journal Line Flex field records. This is an optional field. The system prints this in the XML file.

14.3 Generating Subsidiary Information for Accounts Transactions

This section provides an overview of how to generate subsidiary information and discusses how to:

-

Run the Generate Subsidiary Info for AP program.

-

Set processing options for the Generate Subsidiary Info for AP program (R75C091).

-

Run the Generate Subsidiary Info for AR program.

-

Set processing options for the Generate Subsidiary Info for AR program (R75C092).

-

Run the Generate Subsidiary Info for PO program.

-

Set processing options for the Generate Subsidiary Info for PO program (R75C093).

-

Run the Generate Subsidiary Info for SO program.

-

Set processing options for the Generate Subsidiary Info for SO program (R75C094).

-

Run the Generate Subsidiary Info for GL program.

-

Set processing options for the Generate Subsidiary Info for GL program (R75C095).

-

Run the Subsidiary Info reports - China program.

-

Set processing options for the Subsidiary Info reports - China program (R75C090).

14.3.1 Understanding How to Generate Subsidiary Information

You run various reports to generate subsidiary information for different transactions. You must run the Generate Subsidiary Info for AP, Generate Subsidiary Info for AR, Generate Subsidiary Info for PO, Generate Subsidiary Info for SO, and Generate Subsidiary Info for GL reports to generate subsidiary information for accounts payable (AP), accounts receivable (AR), purchase order (PO), sales order (SO), and GL transactions respectively. You use processing options to define company and period for which you run these reports. These reports select the corresponding transactions for which they are run and update the F75C912 table for that transaction. The system updates the transaction type for each type of transaction. The transaction type identifies the origin of the transaction.

14.3.1.1 Generate Subsidiary Info for AP Report

Based on the values in the processing options for period and company, this report selects the transactions from the Accounts Payable Ledger table (F0411) for vouchers and from Accounts Payable - Matching Document (F0413) and Accounts Payable Matching Document Detail (F0414) tables for payments. The system then retrieves the account number based on the document number in the transactions. Then, it retrieves the subsidiary IDs (identities) associated to that account from the F75C011 table. The system then inserts this data into the F75C912 table. You can associate these subsidiary items with an AP transaction:

-

Supplier

-

Project Number

-

Department

The system records the transaction type for AP transactions as 1.

14.3.1.2 Generate Subsidiary Info for AR Report

Based on the values in the processing options for period and company, this report selects the transactions from the Customer Ledger table (F03B11) for invoices and from Receipts Header (F03B13) and Receipts Detail (F03B14) tables for receipts. The system then retrieves the account number based on the document number in the transactions. Then, it retrieves the subsidiary IDs associated to that account from the F75C011 table. The system then inserts this data into the F75C912 table. You can associate these subsidiary items with an AR transaction:

-

Project Number

-

Customer

-

Department

The system records the transaction type for AP transactions as 2.

14.3.1.3 Generate Subsidiary Info for PO Report

Based on the values in the processing options for period and company, this report selects the transactions from the Purchase Order Header (F4301) and Purchase Order Detail (F4311) tables. The system then retrieves the account number based on the document number in the transactions. Then, it retrieves the subsidiary IDs associated to that account from the F75C011 table. The system then inserts this data into the F75C912 table. You can associate these subsidiary items with a purchase order:

-

Address number

-

Cost center

-

Payment instrument

-

Item BP stocking type

-

Project number

-

Item BP category code

The system records the transaction type for purchase order transactions as 3.

14.3.1.4 Generate Subsidiary Info for SO Report

Based on the values in the processing options for period and company, this report selects the transactions from the Sales Order Header (F4201) and Sales Order Detail (F4211) tables. The system then retrieves the account number based on the document number in the transactions. Then, it retrieves the subsidiary IDs associated to that account from the F75C011 table. The system then inserts this data into the F75C912 table. You can associate these subsidiary items with a sales order:

-

Address number

-

Cost center

-

Payment instrument

-

Item BP stocking type

-

Project number

-

ItemBP category code

The system records the transaction type for sales order transactions as 4.

14.3.1.5 Generate Subsidiary Info for GL Report

Based on the values in the processing options for period, company, and document type, this report selects the transactions for travel expenses from the Account Ledger table (F0911) for subledger type A. The system then retrieves the account number based on the document number in the transactions. Then, it retrieves the subsidiary IDs associated to that account from the F75C011 table. The system then inserts this data into the F75C912 table. You can associate these subsidiary items with a general ledger:

-

Department

-

Employee number

The system records the transaction type for general ledger transactions as 5.

14.3.2 Running the Generate Subsidiary Info for AP Program

Select Subsidiary Information (G75C056), Generate Subsidiary Info for AP.

14.3.3 Setting Processing Options for the Generate Subsidiary Info for AP Program (R75C091)

|

Note: The processing options for these programs are the same, and are discussed in this section:

|

Processing options enable you to specify default values for programs and reports.

14.3.3.1 Select

- Company

-

Specify the company for which you need to update subsidiary information. You must complete this processing option.

- Beginning Date

-

Specify the starting date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

- Ending Date

-

Specify the ending date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

14.3.4 Running the Generate Subsidiary Info for AR Program

Select Subsidiary Information (G75C056), Generate Subsidiary Info for AR.

14.3.5 Setting Processing Options for the Generate Subsidiary Info for AR Program (R75C092)

The processing options for this program are identical to those for the Generate Subsidiary Info for AP program (R75C091).

See Setting Processing Options for the Generate Subsidiary Info for AP Program (R75C091)

14.3.6 Running the Generate Subsidiary Info for PO Program

Select Subsidiary Information (G75C056), Generate Subsidiary Info for PO.

14.3.7 Setting Processing Options for the Generate Subsidiary Info for PO Program (R75C093)

The processing options for this program are identical to those for the Generate Subsidiary Info for AP program (R75C091).

See Setting Processing Options for the Generate Subsidiary Info for AP Program (R75C091)

14.3.8 Running the Generate Subsidiary Info for SO Program

Select Subsidiary Information (G75C056), Generate Subsidiary Info for SO.

14.3.9 Setting Processing Options for the Generate Subsidiary Info for SO Program (R75C094)

The processing options for this program are identical to those for the Generate Subsidiary Info for AP program (R75C091).

See Setting Processing Options for the Generate Subsidiary Info for AP Program (R75C091)

14.3.10 Running the Generate Subsidiary Info for GL Program

Select Subsidiary Information (G75C056), Generate Subsidiary Info for GL.

14.3.11 Setting Processing Options for the Generate Subsidiary Info for GL Program (R75C095)

Processing options enable you to specify default values for programs and reports.

14.3.11.1 Select

- Company

-

Specify the company for which you need to update subsidiary information. You must complete this processing option.

- Date - Beginning Effective

-

Specify the starting date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

- Date - Ending Effective

-

Specify the ending date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

- Document Type

-

Specify the document type used for travel expenses transactions. If there are more than one document type for travel expenses transactions, you must run this report again for the different document type.

14.3.12 Running the Run Subsidiary Info Reports - China Program

Select Subsidiary Information (G75C056), Run Subsidiary Info Reports - China.

14.3.13 Setting Processing Options for the Run Subsidiary Info Reports - China (R75C090)

Processing options enable you to specify default values for programs and reports.

14.3.13.1 Select

- Company

-

Specify the company for which you need to update subsidiary information. You must complete this processing option.

- Date - Beginning Effective

-

Specify the starting date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

- Date - Ending Effective

-

Specify the ending date for the period for which you want to update the transactions for subsidiary information. You must complete this processing option.

- Document Type for R75C095 Only

-

Specify the document type used for travel expenses transactions. If there are more than one document type for travel expenses transactions, you must run this report again for the different document type.

Specify this option only when you run the Generate Subsidiary Info for GL report.

14.3.13.2 Process

- Run R75C091

-

Specify whether or not you want to run the Generate Subsidiary Info for AP report to generate subsidiary information for AP transactions. Values are:

-

Blank: Do not run the Generate Subsidiary Info for AP report.

-

1: Run the Generate Subsidiary Info for PO report.

-

- Run R75C092

-

Specify whether or not you want to run the Generate Subsidiary Info for AR report to generate subsidiary information for AR transactions. Values are:

-

Blank: Do not run the Generate Subsidiary Info for AR report.

-

1: Run the Generate Subsidiary Info for PO report.

-

- Run R75C093

-

Specify whether or not you want to run the Generate Subsidiary Info for PO to generate subsidiary information for PO transactions. Values are:

-

Blank: Do not run the Generate Subsidiary Info for PO report.

-

1: Run the Generate Subsidiary Info for PO report.

-

- Run R75C094

-

Specify whether or not you want to run the Generate Subsidiary Info for SO to generate subsidiary information for SO transactions. Values are:

-

Blank: Do not run the Generate Subsidiary Info for SO report.

-

1: Run the Generate Subsidiary Info for SO report.

-

- Run R75C095

-

Specify whether or not you want to run the Generate Subsidiary Info for GL report to generate subsidiary information for GL transactions. Values are:

-

Blank: Do not run the Generate Subsidiary Info for GL report.

-

1: Run the Generate Subsidiary Info for GL report.

-

14.3.13.3 Version

- R75C091 Version Blank = XJDE0001

-

Specify the version of the Generate Subsidiary Info for AP report. If you leave it blank, the system runs the XJDE0001 version.

- R75C092 Version Blank = XJDE0001

-

Specify the version of the Generate Subsidiary Info for AR report. If you leave it blank, the system runs the XJDE0001 version.

- R75C093 Version Blank = XJDE0001

-

Specify the version of the Generate Subsidiary Info for PO report. If you leave it blank, the system runs the XJDE0001 version.

- R75C094 Version Blank = XJDE0001

-

Specify the version of the Generate Subsidiary Info for SO report. If you leave it blank, the system runs the XJDE0001 version.

- R75C095 Version Blank = XJDE0001

-

Specify the version of the Generate Subsidiary Info for GL report. If you leave it blank, the system runs the XJDE0001 version.

14.4 Generating Report Item Data for Financial Information

This section provides an overview of how to generate report item data and discusses how to:

-

Run the China Income Statement CNAO v2 program.

-

Set processing options for the China Income Statement CNAO v2 program (R75C904).

-

Run the Statement of Changes in Stockholder's equity CNAO v2 program.

-

Set processing options for the Statement of Changes in Stockholder's equity CNAO v2 program (R75C906).

-

Run the China Cash Flow Statement CNAO v2 program.

-

Set processing options for the China Cash Flow Statement CNAO v2 program (R75C910).

-

Run the China Balance Sheet CNAO v2 program.

-

Set processing options for the China Balance Sheet CNAO v2 program (R75C912).

14.4.1 Understanding How to Generate Report Item Data

You run various reports to generate report item data for different transactions. You must run the China Income Statement CNAO v2, Statement of Changes in Stockholder's Equity CNAO v2, China Cash Flow Statement CNAO v2, and China Balance Sheet CNAO v2 reports to generate income statement, statement of changes, cash flow statement, and balance sheet respectively. You use processing options to define company and period for which you run these reports. These reports select the corresponding transactions for which they are run from various tables and then store the data in the F75C910 table.

14.4.1.1 China Income Statement CNAO v2 Report

Select Subsidiary Information (G75C056), Run Subsidiary Info Reports - China. You use the China Income Statement CNAO v2 program (R75C904) to generate the income statement information in the format prescribed by CNAO. It generates the data from the JD Edwards EnterpriseOne system into a predefined PDF format. The report includes the items and amounts calculated based on the balance of each account of the JD Edwards EnterpriseOne general ledger from the Account Balances table (F0902). This report then stores the closing balance amounts in the F75C910 table.

14.4.1.2 Statement of Changes in Stockholder's Equity CNAO v2 Report

The statement of changes in stockholder's equity summarizes the revenues and expenses during the accounting period and shows the condition of accounts at the end of a particular period. You use the Statement of Changes in Stockholder's Equity CNAO v2 program (R75C906) to generate the information of the items and amounts calculated based on the corresponding JD Edwards EnterpriseOne accounts into the PDF format. You must run this report annually.

The Statement of Changes in Stockholder's Equity program retrieves data from the F0902 table and stores data in the F75C910 table. It stores only the current year balances.

14.4.1.3 China Cash Flow Statement CNAO v2 Report

The cash flow statement displays the historical changes in cash and cash equivalents during a specified period of operations for a company. You use the China Cash Flow Statement CNAO v2 program (R75C910) to generate the details of the cash flow statements from the JD Edwards EnterpriseOne system into a predefined format PDF file. The details include the items and amounts calculated based on the JD Edwards EnterpriseOne general ledger and sub-modules. You can specify if you are generating the cash flow statement for a large enterprise or for a small enterprise in the processing option of the China Cash Flow Statement CNAO v2 program. You generate this report on a monthly basis.

The China Cash Flow Statement CNAO v2 program retrieves information from the Cash Flow Data table (F75C015) and the Report Format Definition table (F75C003) based on the sequence number specified in the processing options and stores the amounts in the F75C910 table. The system displays and stores the sum of the journal amounts based on the combination of natural account number and sequence number. This is an example of how the system displays the transactions when you run the report:

This table lists transactions that you have entered using the Select GL Transactions for Cash Flow - China program (P75C015):

| Journals | Natural Account | Sequence Number | Amount |

|---|---|---|---|

| Journal 1 | 1131 | 20 | 1000 |

| Journal 2 | 1131 | 20 | 2000 |

| Journal 3 | 1131 | 30 | 1500 |

| Journal 4 | 1131 | 30 | 750 |

| Journal 5 | 1131 | 40 | 500 |

Now, when you run the China Cash Flow Statement CNAO v2 program for the sequence numbers 20 and 30, the report displays and inserts in the F75C910 table these records:

| Sequence Number | Amount |

|---|---|

| 20 | 3000 |

| 30 | 2250 |

14.4.1.4 China Balance Sheet CNAO v2 Report

The JD Edwards EnterpriseOne system generates the data that includes the balance sheet items and the corresponding amount for these items from the JD Edwards EnterpriseOne general ledger into a PDF file. You use the China Balance Sheet CNAO v2 program (R75C912) to generate the PDF output for the balance sheet of a particular company, period, and fiscal year defined in the processing options.

This report selects amount balances from the F0902 table, calculates the amounts further based on the formula, and then stores the calculated amounts in the F75C910 table. This report stores all closing balances in the F75C910 table.

14.4.2 Running the China Income Statement CNAO V2 Program

Select Report Item Data Reports (G75C0531), China Income Statement CNAO v2.

14.4.3 Setting Processing Options for the China Income Statement CNAO V2 Program (R75C904)

Processing options enable you to specify default values for programs and reports.

14.4.3.1 Selection

- 1. Company

-

Specify the code that identifies your organization, fund, or other reporting entity. You must complete this processing option.

- 2. Fiscal Year

-

Specify the number that identifies the fiscal year. You must complete this processing option.

- 3. Period Number

-

Specify a number (from 1 to 14) that identifies the current accounting period. You must complete this processing option.

- 4. Domestic Ledger Types BLANK = AA

-

Specify the type of ledger used for domestic transactions. If you leave this processing option blank, the system uses ledger type AA.

- 5. Foreign Ledger Type BLANK = CA

-

Specify the type of ledger to use for foreign transactions.If you leave this processing option blank, the system uses ledger type CA.

- 6. Language Required

-

Specify the language for the report. Values are:

1: English

2: Chinese

3: Both English and Chinese

14.4.3.2 Display

- 1. Issued Organisation

-

Specify the address book number of the issuing organization.

- 2. Reporting Date

-

Specify the reporting date for your inference.

- 3. Statement Number

-

Specify the unique statement number issued to you by the government.

- 4. Monetary Unit

-

Specify a value from UDC table 75C/MU to indicate the monetary unit, which is a scale of the actual amount. For example, if the actual amount is 1, 45,000.00, a monetary unit of 1 displays the amount as $1, 45,000.00 whereas a monetary unit of 10 displays the amount as $14,500.00. Examples are:

1: One yuan

100: Hundred yuan

Note:

After scaling the values, the system rounds it to the nearest number.

14.4.4 Running the Statement of Changes in Stockholder's Equity CNAO V2 Program

Select Report Item Data Reports (G75C0531), Statement of Changes in Stockholder's equity CNAO v2.

14.4.5 Setting Processing Options for the Statement of Changes in Stockholder's Equity CNAO V2 Program (R75C906)

Processing options enable you to specify default values for programs and reports.

14.4.5.1 Selection

- 1. Company

-

Specify the code that identifies your organization, fund, or other reporting entity. You must complete this processing option.

- 2. Fiscal Year

-

Specify the number that identifies the fiscal year. You must complete this processing option.

- 3. Domestic Ledger Types

-

Specify the type of ledger used for domestic transactions. If you leave this processing option blank, the system uses ledger type AA.

- 4. Foreign Ledger Type

-

Specify the type of ledger to use for foreign transactions.If you leave this processing option blank, the system uses ledger type CA.

- 5. Language Required

-

Specify the language for the report. Values are:

1: English

2: Chinese

3: Both English and Chinese

14.4.5.2 Display

- 1. Issued Organisation

-

Specify the address book number of the issuing organization.

- 2. Reporting Date

-

Specify the reporting date for your inference.

- 3. Statement Number

-

Specify the unique statement number issued to you by the government.

- 4. Monetary Unit

-

Specify a value from UDC table 75C/MU to indicate the monetary unit, which is a scale of the actual amount. For example, if the actual amount is 1, 45,000.00, a monetary unit of 1 displays the amount as $1, 45,000.00 whereas a monetary unit of 10 displays the amount as $14,500.00. Examples are:

1: One yuan

100: Hundred yuan

Note:

After scaling the values, the system rounds it to the nearest number.

14.4.5.3 Sequence Number List

- 1. List of Sequence Number displaying "Beginning Amount"

-

Specify the list of the cell numbers in which to display the beginning amount. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

- 2. List of Sequence Number displaying "Year Positive"

-

Specify the list of the cell numbers in which to display the year positive. For example, if you want to display the amount for sequence numbers 10, 20, and30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A,25B, 30A in this processing option.

Year positive is the total positive amount of all transactions for a particular year and a specific account. These positive amounts are listed in the Account Ledger table (F0911).

- 3. List of Sequence Number displaying "Year to this period" (Including Beginning Balance)

-

Specify the list of the cell number in which to display the year–to–date amount including the beginning balance. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

- 4. List of Sequence Number displaying "Year to this period" (Non including Beginning Balance)

-

Specify the list of the cell number in which to display the year-to-date amount, excluding the beginning balance. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

- 5. List of Sequence Number displaying "Year Negative"

-

Specify the list of the cell numbers in which to display the year negative. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

Year negative is the total negative amount of all transactions for a particular year and a specific account. These negative amounts are listed in the Account Ledger table (F0911).

- 6. List of Sequence Number displaying amount with reverse sign

-

Specify the list of the cell numbers in which to display the amount with reverse sign. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

14.4.6 Running the China Cash Flow Statement CNAO v2 Program

Select Report Item Data Reports (G75C0531), China Cash Flow Statement CNAO v2.

14.4.7 Setting Processing Options for the China Cash Flow Statement CNAO v2 Program (R75C910)

Processing options enable you to specify default values for programs and reports.

14.4.7.1 Selection

- 1. Company

-

Specify the code that identifies a specific organization, fund, or other reporting entity. You must complete this processing option.

- 2. Fiscal Year

-

Specify the number that identifies the fiscal year of the company. You must complete this processing option.

- 3. Period Number

-

Specify a number (from 1 to 14) that identifies the current accounting period. You must complete this processing option.

- 4. Domestic Ledger Types

-

Specify the type of ledger used for domestic transactions. If you leave this processing option blank, the system uses ledger type AA.

- 5. Foreign Ledger Type

-

Specify the type of ledger to use for foreign transactions. If you leave this processing option blank, the system uses ledger type CA.

- 6. Language Required

-

Specify the language for the report. Values are:

1: English

2: Chines

3: Both English and Chinese

- 7. Type of Enterprise

-

Specify if the cash flow statement is for the large enterprise or for a small enterprise. Values are:

N: Large scale enterprise.

Y: Small scale enterprise.

14.4.7.2 Display

- 1. Issued Organisation

-

Specify the address book number of the issuing organization.

- 2. Statement Number

-

Specify the unique statement number issued to you by the government.

- 3. Monetary Unit

-

Specify a value from UDC table 75C/MU to indicate the monetary unit, which is a scale of the actual amount. For example, if the actual amount is 1,45,000.00, a monetary unit of 1 displays the amount as $1, 45,000.00 whereas a monetary unit of 10 displays the amount as $14,500.00. Examples are:

1: One yuan

100: Hundred yuan

Note:

After scaling the values, the system rounds it to the nearest number. - 4. Sequence Number for "Effect of Foreign Exchange Rate Changes on Cash" Item

-

Specify the sequence number for the line item Effect of Foreign Exchange Rate Changes on Cash in the CNAO reports.

Effect of Foreign Exchange Rate Changes on Cash is a line item in the cash flow statement that is used to record the exchange gain or loss that occurs between the transaction date and the reporting date during the foreign currency transactions.

If you leave this processing option blank, the system uses 320.

- 5. Current Year Amount for "Effect of Foreign Exchange Rate Changes on Cash" Item

-

Specify the net amount result that corresponds to the changes in the foreign exchange rate in the current year.

- 6. Last Year Amount for "Effect of Foreign Exchange Rate Changes on Cash" item

-

Specify the net amount effected corresponding to the changes in the foreign exchange rate in the last year. You complete this processing option for small enterprises only.

14.4.7.3 Sequence Number List

- List of Sequence Number displaying "Period Amount"

-

Specify the list of the cell numbers in which to display the period amount. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

- List of Sequence Number displaying "Period Positive"

-

Specify the list of the cell numbers in which to display the period positive. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

Period positive is the total positive amount of all transactions for a particular period and a specific account. These positive amounts are listed in the Account Ledger table (F0911).

- List of Sequence Number displaying "Period Negative"

-

Specify the list of the cell numbers in which to display the period negative. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

Period negative is the total negative amount of all transactions for a particular period and a specific account. These negative amounts are listed in the Account Ledger table (F0911).

- List of Sequence Number displaying amount with reverse sign

-

Specify the list of the cell numbers in which to display the amount with a reverse sign. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

- List of Sequence Number displaying "Year Positive"

-

Specify the list of the cell numbers in which to display the year positive. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

Year positive is the total positive amount of all transactions for a particular year and a specific account. These positive amounts are listed in the Account Ledger table (F0911).

- List of Sequence Number displaying "Year Negative"

-

Specify the list of the cell numbers in which to display the year negative. For example, if you want to display the amount for sequence numbers 10, 20, and 30 in column A and 5, 15, 25, in column B, you enter 5B, 10A, 15B, 20A, 25B, 30A in this processing option.

Year negative is the total negative amount of all transactions for a particular year and a specific account. These negative amounts are listed in the Account Ledger table (F0911).

14.4.8 Running the China Balance Sheet CNAO v2 Program

Select Report Item Data Reports (G75C0531), China Balance Sheet CNAO v2.

14.4.9 Setting Processing Options for the China Balance Sheet CNAO v2 Program (R75C912)

Processing options enable you to specify default values for programs and reports.

14.4.9.1 Selection

- 1. Company

-

Specify the code that identifies a specific organization, fund, or other reporting entity. You must complete this processing option.

- 2. Fiscal Year

-

Specify the number that identifies the fiscal year of the company. You must complete this processing option.

- 3. Period Number

-

Specify a number (from 1 to 14) that identifies the current accounting period. You must complete this processing option.

- 4. Domestic Ledger Types

-

Specify the type of ledger used for domestic transactions. If you leave this processing option blank, the system uses ledger type AA.

- 5. Foreign Ledger Type

-

Specify the type of ledger to use for foreign transactions. If you leave this processing option blank, the system uses ledger type CA.

- 6. Language Required

-

Specify the language for the report. Values are:

1: English

2: Chines

3: Both English and Chinese

14.4.9.2 Display

- 1. Issued Organisation

-

Specify the address book number of the issuing organization.

- 2. Reporting Date

-

Specify the reporting date for your inference.

- 3. Statement Number

-

Specify the unique statement number issued to you by the government.

- 4. Monetary Unit

-

Specify a value from UDC table 75C/MU to indicate the monetary unit, which is a scale of the actual amount. For example, if the actual amount is 1,45,000.00, a monetary unit of 1 displays the amount as $1, 45,000.00 whereas a monetary unit of 10 displays the amount as $14,500.00. Examples are:

1: One yuan

100: Hundred yuan

Note:

After scaling the values, the system rounds it to the nearest number.

14.5 Associating Subsidiary Items to an Account

This section provides an overview of the association between subsidiary items and account, lists the form used to associate subsidiary items to an account, and discusses how to associate subsidiary item identities (IDs) to an account ID.

14.5.1 Understanding the Association Between Subsidiary Items and Accounts

You use the Account - Subsidiary Cross Reference - China program (P75C011) to associate subsidiary item IDs to an account ID. The system stores this relation in the F75C011 table. You can use only those subsidiary item IDs that you have created using the P75C010 program. You must run this program before you run the XML for the information to display on the XML.

|

Note: You access this program from the Review & Revise Accounts program (P0901). |

14.5.2 Form Used to Associate Subsidiary Items to an Account

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Account - Subsidiary Cross Reference | W75C011A | Select a record on the Work with Accounts form and click Select. Then, select Regional Info from the Form menu. | Associate subsidiary item IDs to the account ID. |

14.5.3 Associating Subsidiary Item IDs to an Account ID

Access the Account - Subsidiary Cross Reference form.

Figure 14-6 Account - Subsidiary Cross Reference Form

Description of ''Figure 14-6 Account - Subsidiary Cross Reference Form''

- Account ID

-

Enter the account ID to which you want to associate the subsidiary item IDs. You access this program from the P0901 program, therefore, the system retrieves the account ID from the P0901 program.

- Subsidiary ID (1 through 30)

-

Enter the subsidiary item ID that you want to attach to the account. You can attach a maximum of 30 subsidiary items to an account.

14.6 Working With GL Information for Cash Flow

This section provides an overview of the GL information for cash flow, lists the forms used to process GL information for cash flow, and discusses how to:

-

Process GL information for cash flow.

-

Set processing options for the Select GL Transactions for Cash Flow - China Program (P75C015).

14.6.1 Understanding the GL Information for Cash Flow

You use the Select GL transactions for Cash Flow - China program to select GL transactions for cash flow. You can also use this program to delete GL transactions from cash flow. The system stores these transactions in the F75C015 table.

14.6.2 Forms Used to Process GL Information for Cash Flow

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Work with GL transactions | W75C015A | GL (G75C053), Select GL transactions for Cash Flow - China | Review the transactions for the specified account range. |

| Select GL transaction for Cash flow | W75C015B | Select a record and click Select on the Work with GL transactions form. | Select GL transaction for cash flow. |

14.6.3 Processing GL Information for Cash Flow

Access the Select GL transaction for Cash flow form.

Figure 14-7 Select GL transaction for Cash flow Form

Description of ''Figure 14-7 Select GL transaction for Cash flow Form''

- Reference

-

Enter a description for the transaction. You can enter a description of a maximum length of 25 characters.

- Sequence Number

-

Enter a sequence number for a journal. The system uses this number to summarize amounts when you run the China Cash Flow Statement CNAO v2 program (R75C910).

If you enter a sequence number defined by formula in the Report Formula Definition program (P75C003), the system displays an error.

14.7 Generating CNAO Document Numbers

This section provides an overview of the CNAO document numbers and discusses how to:

-

Run the Generate CNAO Document Numbers program.

-

Set processing options for Generate CNAO Document Numbers program (R75C911).

14.7.1 Understanding CNAO Document Numbers

You run the Generate CNAO Document Numbers program to generate CNAO document numbers for all JD Edwards EnterpriseOne document numbers. When you run this report, the system retrieves the document number from the F0911 table, generates a next number for that document number, and saves the new number in the CNAO - E1 Document Number mapping - China table (F75C911). The system repeats this process for all document numbers. The system restarts the next number series from 1 whenever there is a change in the company or the fiscal period.

You must run this report each time before running the Generate GL XML - China program.

14.7.2 Running the Generate CNAO Document Numbers Program

Select CNAO V2 (G75C05), Generate CNAO Document Numbers.

14.7.3 Setting Processing Options for Generate CNAO Document Numbers Program (R75C911)

Processing options enable you to specify default values for programs and reports.

14.7.3.1 Select

- Company

-

Specify the company for which you need to generate the journal numbers. You must complete this processing option.

- Beginning Date

-

Specify the starting date for the period for which you want to generate the CNAO document numbers. You must specify this in the MM/DD/YYYY format.

You must complete this processing option.

- Ending Date

-

Specify the ending date for the period for which you want to generate the CNAO document numbers. You must specify this in the MM/DD/YYYY format.

You must complete this processing option.

14.8 Updating Subsidiary Balances File

This section provides overviews of how to update the beginning balance for subsidiary items and beginning balance revision, lists the form used to update beginning balances for subsidiary items, and discusses how to:

-

Run the Update Subsidiary Balances File program.

-

Set processing options for the Update Subsidiary Balances File program (R75C902).

-

Enter beginning balance for a subsidiary item and account combination.

14.8.1 Understanding How to Update the Beginning Balance for Subsidiary Items

You run the Update Subsidiary Balances File program to update the F75C902 table with the balances for the periods for which you run this report. This report retrieves the transactions for the period that you specify in the processing options from the F0911 table and the subsidiary item IDs associated to the account number from the F75C011 table. The system retrieves and displays the relevant details for that subsidiary item. For example, if the subsidiary ID is supplier, then the system retrieves the supplier number for that transaction. Then, for the combination of account ID and subsidiary item, the system updates the beginning balance in the F75C902 table. If there is no record for a combination, the system creates a record in the F75C902 table.

14.8.2 Understanding Beginning Balance Revision

You use the Work With Subsidiary Balances Revision program (P75C902) to revise the beginning balance for the subsidiary items attached to an account. The system updates the beginning balances in the F75C902 table. You run this program only once after implementing the software. You need to run this program to ensure that the beginning balances are accurate for each item because the Update Subsidiary Balances File report calculates the balances assuming that the beginning balance for each item is zero. An example to explain this is given below:

This table lists the amounts in different periods with a beginning balance of 1000:

| Period | Beginning Balance | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Ending Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1000 | 50 | 100 | 75 | 200 | 1425 |

However, if you implement the system in June, which is period 6, the Update Subsidiary Balances File report updates the table in this way:

| Period | Beginning Balance | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Ending Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 200 | 200 |

The system has considered the amounts for the periods before the 6th period as zero. Therefore, to record the actual amounts for all periods, you must run the Work With Subsidiary Balances Revision program. When you run this program, you update the beginning balance to a total of the previous year's beginning balance and the total of amounts of all periods till the period of implementation. This example is represented below:

| Period | Beginning Balance | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | Ending Balance |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1000+225 = 1225 | 200 | 1425 |

When you enter the beginning balance, the system automatically updates the ending balance.

After you run this program and update the beginning balances once, the next time onwards the Update Subsidiary Balances File report automatically takes the revised balances as the beginning balances.

14.8.3 Form Used to Update Beginning Balances for Subsidiary Items

| Form Name | Form ID | Navigation | Usage |

|---|---|---|---|

| Subsidiary Balance Revision | W75C902A | Subsidiary Information (G75C056), Work With Subsidiary Balances Revision | Enter the beginning balance for a subsidiary item for a period. |

14.8.4 Running the Update Subsidiary Balances File Program

Select Subsidiary Information (G75C056), Update Subsidiary Balances File.

14.8.5 Setting Processing Options for Update Subsidiary Balances File Program (R75C902)

Processing options enable you to specify default values for programs and reports.

14.8.5.1 Select

- Company

-

Specify the company for which you need to select the transactions for updating the amounts. You must complete this processing option.

- Beginning Date

-

Specify the starting date for the period for which you update the balances.

You must complete this processing option.

- Ending Date

-

Specify the ending date for the period for which you update the balances.

You must complete this processing option.

14.8.6 Entering Beginning Balance for a Subsidiary Item and Account Combination

Access the Subsidiary Balance Revision form.

Figure 14-8 Subsidiary Balance Revision Form

Description of ''Figure 14-8 Subsidiary Balance Revision Form''

- Account Number

-

Enter a value that identifies an account in the general ledger. You can revise the beginning balances for the subsidiary items attached to this account.

- Beg Balance (beginning balance)

-

Enter the cumulative previous year-end balance. The system uses this amount as the beginning balance for balance sheet and job cost accounts.

14.9 Generating the CNAO Audit Files for GL

This section provides an overview of the CNAO audit file for GL and discusses how to:

-

Run the Generate GL XML - China program.

-

Set processing options for Generate GL XML - China (R75C009).

14.9.1 Understanding the CNAO Audit File for GL

You run the Generate GL XML - China program to generate the XML file to report GL information. You set processing options to specify data selection such as the GL period and company. You also use processing options to specify the location to which the program writes the XML output and the Chinese characters that the system prints in the title of the report.

The system reads these tables to obtain the data for the XML file:

-

GL Basic Information - China (F75C009)

-

CNAO - E1 Document Number mapping - China (F75C911)

-

Account Master (F0901)

-

Account Balances (F0902)

-

Account Ledger (F0911)

-

User Defined Code Values (F0005)

-

Company Constants (F0010)

14.9.3 Setting Processing Options for Generate GL XML - China (R75C009)

Processing options enable you to specify default values for programs and reports.

14.9.3.1 Select

- Company

-

Specify the company for which you generate the report. If you leave this processing option blank, the system generates the report for all companies.

- Beginning Date

-

Specify the beginning date of the period for which you generate the report. The system uses this value for data selection. The system does not print this date in the XML output file.

- Ending Date

-

Specify the end date of the period for which you generate the report. The system uses this value for data selection. The system does not print thisdate in the XML output file.