4 Understanding Service Tax

This chapter contains the following topics:

-

Section 4.2, "Overview of Point of Taxation Rules for India"

-

Section 4.4, "Software Solution for Service Tax in the O2C Cycle"

-

Section 4.5, "Software Solution for Service Tax in the P2P Cycle"

-

Section 4.6, "Setup Requirements for Service Tax in the O2C Cycle"

-

Section 4.7, "Setup Requirements for Service Tax in the P2P Cycle"

4.1 Overview of Service Tax

Service tax is a central government tax that customers are charged on the services provided to them. Service providers are responsible for issuing invoices and charging service taxes to their customers. The service provider must deposit the tax amount to the tax authority after collecting the tax amount from the customer. The service provider must submit the service tax payment with the TR-6 Challan form to the designated branches. An additional surcharge called an education cess is also included in the service tax amount that the customer is charged.

Swachh Bharat Cess (SBC) is a cess which is levied and collected as service tax on all the taxable services. SBC is charged separately from service tax as a different line item in the invoice. It can be accounted and treated similarly to Education cesses. SBC is non recoverable tax. SBC is not integrated in the Cenvat Credit Chain. Therefore, credit of SBC cannot be availed. Further, SBC cannot be paid by utilizing credit of any other duty or tax. (Release 9.1 Update)

(Release 9.1 Update) Krishi Kalyan Cess (KKC) is a cess that is levied, charged, collected, and paid to the government as service tax on all the taxable services. KKC is charged separately from service tax as a different line item in the invoice. It can be accounted and treated similarly to Education cesses. KKC is a recoverable tax. KKC is integrated in the Cenvat Credit Chain. Therefore, you can use the credit of KKC. Further, cenvat credit of KKC can be utilized only for the payment of KKC.

The service tax credit can be claimed when the registered customer pays the taxes and taxable services to the service provider. The service tax for a particular period is payable on the value of the taxable service received only for that period and not on the gross amount charged. The service provider must issue a revised bill to the customer for the services received. For individual proprietor or partnership firm, the service tax must be paid on a quarterly basis. The payment should be made by the 25th day of the month following the quarter. For other entities, such as companies, the service tax should be paid on a monthly basis before the 25th day of the following month. If the service tax payment is delayed, the customer must also pay the penalty fees in addition to the tax amount.

The service provider must follow these legal provisions for the service tax:

-

If more than one location provides services, register only the centralized billing location.

-

If there is no centralized billing location, obtain registration from the appropriate tax authority for each location or office.

-

If the same location provides more than one service, submit a single application for registration to the tax authority that includes all the taxable services.

The service provide must file service tax returns in the Form ST-3 or ST-3A on a semi-annual basis to the tax authorities. The returns must be filed within 25 days of the semi-annual closing period with TR-6 Challan. If no service was provided in six months, the service provider must file a nil return.

4.2 Overview of Point of Taxation Rules for India

On March 31st, 2011, the Indian Government announced rules to introduce amendments to the new legal requirement of Point of Taxation for Services. These rules are applicable from April 1st, 2011 for services provided or received in India. These rules define principles of service taxation during various situations.

Point of taxation is the time when a service is provided, which imposes tax even if it is before the receipt of consideration for services. The relevant rule defines point of taxation as the earliest of:

-

Actual provision of a service

-

Creation of an invoice

-

Receipt of consideration

This rule shifts the service tax from cash to an accrual base. This rule also states that if you receive an advance for providing services, you must pay the tax at the time of such receipt.

The Point of Taxation is deemed on conditions in this regard.

4.2.1 Export of Services

When you receive services from abroad, the point of taxation is the date on which you receive an invoice or make a payment, whichever is earlier.

4.2.2 When Service Tax Rate Changes

The levy and collection of service tax depends on the provision of the service, creation of the invoice, or the receipt of consideration. These three events can take place at different points of time, therefore the applicable rate of service tax between these events can change. For changing applicable rates of service tax, Rule 4 defines these principles:

-

When you provide a taxable service before the tax rate changes, the taxable event is determined as follows:

-

When the invoice is issued and the payment is received after the change in rate, the point of taxation is the date of payment or issue of the invoice, whichever is earlier.

-

When the invoice is issued before the change in tax rate, but the payment is received after the change, the point of taxation is the date of issue of the invoice.

-

When the payment is received before the change in tax rate, but the invoice is issued after the change, the point of taxation is the date of the payment.

-

-

When you provide a taxable service after the change in tax rate, the taxable event is determined as follows:

-

When the payment is received after the change in tax rate, but the invoice is issued before the change, the point of taxation is the date of the payment.

-

When the invoice is issued and the payment is received before the change in tax rate, the point of taxation is the date of issue of the invoice or the date of receipt of payment, whichever is earlier.

-

When the invoice is raised after the change in tax rate, but the payment is received before the change, the point of taxation is the date of issue of the invoice.

-

4.2.3 Newer Services

The amendments to rules also describe changes in the point of taxation when new services are introduced. Based on Rule 5, if an invoice is issued and payment received for a new taxable service, you do not need to pay tax for the service before the service is introduced in the taxable category. This means that if two of the events have occurred before the introduction of the new service as taxable, then you need to ignore the date of provision of service. Also, if you receive payment against a new taxable service before its introduction, and then issue an invoice within 14 days, you do not need to pay service tax.

4.2.4 Continuous Supply of Services

'Continuous supply of service' is any service that can be provided under a contract for more than three months, or any service that the Central Government has notified as such a service.

In such cases, the taxable event depends on the contract between the parties because the taxable event is the date of payment for the service as mentioned in the contract. However, if the payment is received or an invoice is issued before the date mentioned in the contract, the point of taxation is the actual date of payment or actual date of invoice, whichever is earlier.

4.2.5 Associated Enterprises and Person Required to Pay Tax as Recipients

The transactions between associated enterprises are already based on the accrual principle and therefore have not been changed much. However, payments related to use of copyrights, trade marks, and royalties are now taxable at the time of each such payment, whether or not the service was provided only once at a single point in time.

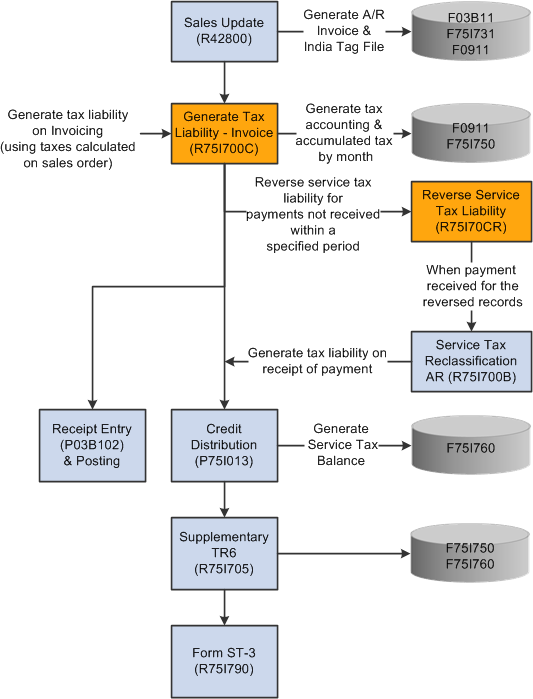

4.3 Process Flow for Service Tax

This process flow shows the steps that a service provider performs to process, generate, calculate, and remit service tax in the O2C cycle:

Figure 4-1 Service tax process flow for O2C cycle

Description of ''Figure 4-1 Service tax process flow for O2C cycle''

This process flow shows the steps that the manufacturer performs in the P2P cycle:

Figure 4-2 Service tax process flow for P2P cycle

Description of ''Figure 4-2 Service tax process flow for P2P cycle''

4.4 Software Solution for Service Tax in the O2C Cycle

To meet the service tax requirements that the tax authorities specify in the O2C cycle, the JD Edwards Enterprise One programs enable you to:

-

Create a sales order for the taxable services.

-

Calculate the service tax and print the invoice.

-

Enter cash receipts based on the payment received from the customers.

-

Generate the service tax reclassification reports.

-

Create a voucher for the service tax payable to the tax authorities.

-

Generate the TR-6 Challan report on a monthly basis and the Form ST-3 on a semi-annual basis.

-

Offset the service tax liability with credit availed from input services.

Note:

If the manufacturer is also a service provider, the service tax can be offset from input raw material and input capital goods. -

Create a voucher for the service tax payable to the tax authorities

-

Generate the TR-6 Challan report on a monthly basis and the Form ST-3 on a semi-annual basis.

4.5 Software Solution for Service Tax in the P2P Cycle

To meet the service tax requirements that the tax authorities specify in the P2P cycle, the JD Edwards Enterprise One programs enable you to:

-

Create a purchase order and receive the invoice from the service provider.

-

Generate the information related to service tax for full and partial payments.

-

Issue payment to the service provider.

-

Generate the service tax reclassification reports.

4.6 Setup Requirements for Service Tax in the O2C Cycle

This table lists the service tax setup requirements for the O2C cycle in India:

| Setup Requirement | Comments | Cross-Reference |

|---|---|---|

| Map the service tax to the business unit. | You use the Service Tax Unit definition program (P75I704) to map an excise branch/plant to a service tax operating unit. | See Mapping Business Units to Service Tax Operating Units. |

| Enter localized category codes. | You attach category code values for item price groups in the Item Branch/Plant (P41026) program. For customer groups, you attach category codes values in the Address Book (P01012) and Customer Master Information (P03013) programs. | See Assigning Localized Category Codes to Items. |

| Verify that the adjustment name is set up in UDC table 40/TY. | You use the 40/TY UDC table to set the adjustment name. | n/a |

| Set up advanced pricing tax adjustments. | You use the Price & Adjustment Details Revisions program (P4072) to enter price adjustment details. | See Entering Price Adjustment Details for India Taxes. |

| Enter tax type rule information. | You use the Tax Rules Setup program (P75I072) to define tax rules and parameters. | See Defining Tax Rules. |

| Enter tax types and tax regimes for price adjustments. | You use the Relation Adjustment Name / Tax Type program (P75I006) to enter the tax type and tax regime for a price adjustment name. | See Entering Price Adjustment Details for India Taxes. |

| Calculate the service tax using localized advanced pricing. | Use the Sales Order Entry program (P4210) to enter sales orders and the Update Price program (R42950) to recalculate prices and costs. | See Understanding Advanced Pricing for India Taxes. |

| Run the Service Tax Reclassification AR program (R75|700B). | Run the Service Tax Reclassification AR program (R75|700B) to review the receipts for a defined period and also determine whether the tax lines require classification. If the processed line corresponds to a recoverable tax line within the service tax regime number, this program generates a reclassification journal entry with credit information for the account associated with AAI item 7585 and debit information for the account associated with AAI item 4385. The system uses the GL offset in the cost rule, payment batch number, document number, and GL date to generate a reclassification journal entry. | See Generating Reclassification Journal Entries for Service Tax Receipts. |

4.7 Setup Requirements for Service Tax in the P2P Cycle

This table lists the service tax setup requirements for the P2P cycle in India:

| Setup Requirement | Comments | Cross-Reference |

|---|---|---|

| Map the service tax to the business unit. | You use the Service Tax Unit definition program (P75I704) to map an excise branch/plant to a service tax operating unit. | See Mapping Business Units to Service Tax Operating Units. |

| Enter the localized category codes. | You attach category code values for item price groups in the Item Branch/Plant (P41026) program. For customer groups, you attach category codes values in the Address Book (P01012) and Customer Master Information (P03013) programs. | See Assigning Localized Category Codes to Items. |

| Verify that landed cost rules for India taxes exist in the UDC table 41/P5. | ||

| Enter the landed cost rules. | You use the Landed Cost Revisions program (P75I791) to set up landed cost rules for one of the following:

|

See Setting Up Landed Costs. |

| Run the Service Tax Reclassification AP program (R75I700A). | Run the Service Tax Reclassification AP program (R75I700A) to review the service payments for a defined period and also determine whether the tax lines require classification. If the processed line corresponds to a recoverable tax line within the service tax regime, this program generates a reclassification journal entry with credit information for the account associated with AAI item 7530, and debit information for the account associated with AAI item 4230. The system uses the GL offset in the cost rule, payment batch number, document number, and GL date to generate a reclassification journal entry. The service tax regime number, this program generates a reclassification journal entry with credit information for the account associated with AAI item 7585, and debit information for the account associated with AAI item 4385. The system uses the GL offset in the cost rule, payment batch number, document number, and GL date to generate a reclassification journal entry. |