6 Print the Sequential Number Report

This chapter contains these topics:

6.1 Print the Sequential Number Report

From Italian Localization (G74Y), choose Additional Italian Tax Processing.

From Italian Reports (G74Y093152), choose Sequential Number Report

From the Italian Reports menu (G74Y093152), choose a Sequential Number Report option.

Businesses in Italy are required by law to number each original fiscal document both sequentially and chronologically. Fiscal documents are documents that include IVA taxes, such as accounts payable vouchers and accounts receivable invoices. Because each revenue and expense event must be documented in chronological order, businesses must include the numeric sequencing of each document number in the IVA registers.

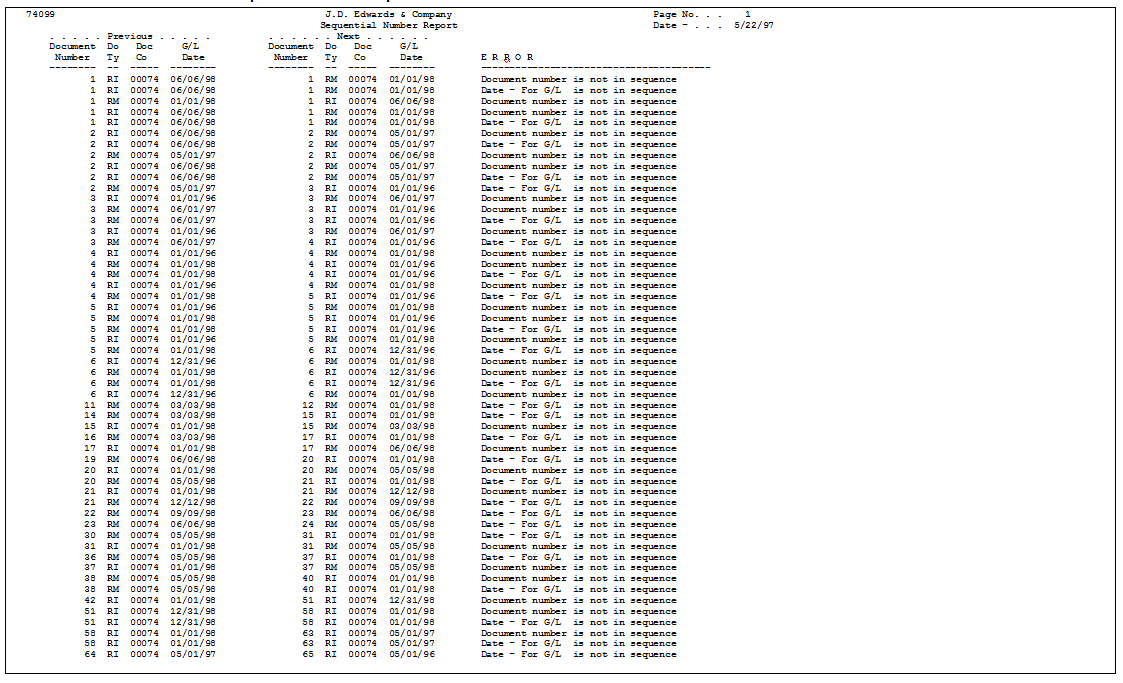

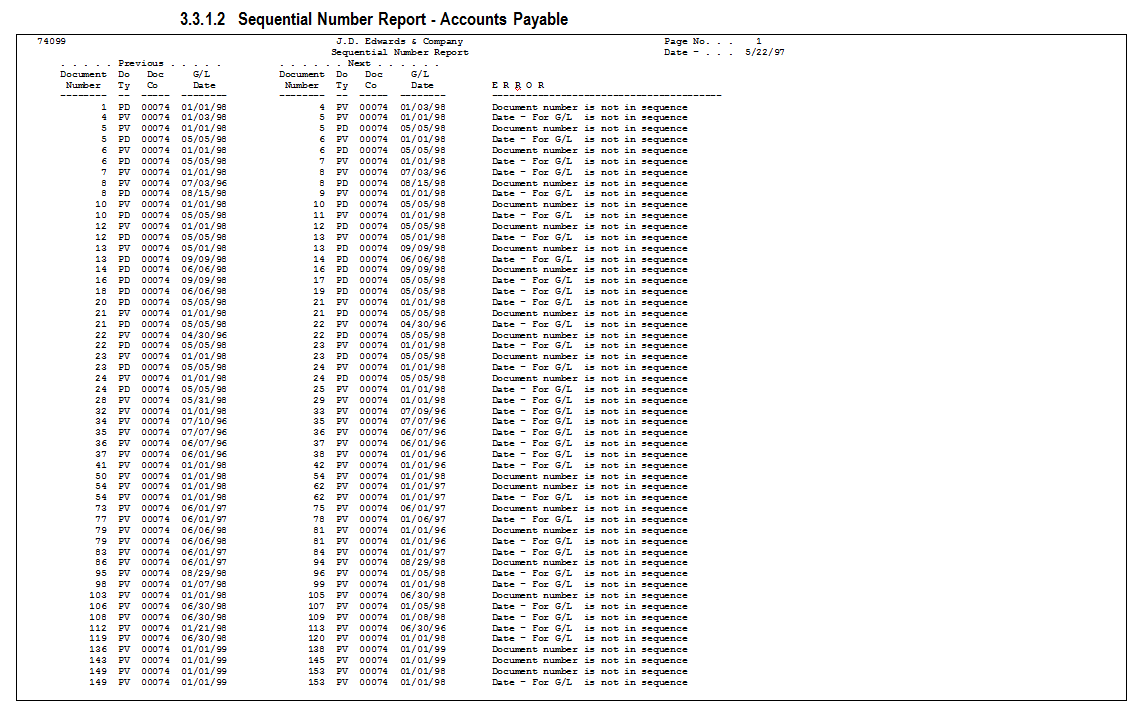

You use the Sequential Number report to identify any document numbers that are out of sequence. When you print the report, the system checks the number for each document that includes an IVA amount in the following tables:

-

Sales/Use/VAT Tax (F0018)

-

Accounts Payable Ledger (F0411)

-

Accounts Receivable Ledger (F0311)

The report prints the appropriate error message for each document that meets the following conditions:

-

The document number is not sequential.

-

The General ledger date is lower than that of the previous document.

You must manually correct any errors in the sequential numbering or justify the gap in the numbering of your documents.

JD Edwards recommends that you print the Sequential Number Report daily and if not daily, at least before you change the G/L date.

You can use processing options to indicate which file you want to perform the sequential document number validation.

| File | Description |

|---|---|

| Sales/Use/VAT Tax (F0018) | To run a report that verifies that document numbers are in sequential order without interruptions, leave the processing option blank. The system prints a report based on the Sales/Use/VAT Tax file (F0018).

Create one version of the report for each print version of the monthly VAT purchasing and VAT sales reports. For example, if you use the document types PV and PD to identify Italian invoices and credit memos, create a special version of the report that selects the control data for document types PV and PD only. |

| Accounts Receivable Ledger (F0311) | To run a report that verifies that document numbers are in sequential order without interruptions, enter 1 in the processing option. The system prints a report based on the Accounts Receivable Ledger (F0311).

Create one version of the report for each document number series in the monthly VAT sales report. |

| Accounts Payable Ledger (F0411) | To run a report that verifies that document numbers are in sequential order without interruptions, enter 2 in the processing option. This report is based on the Accounts Payable Ledger (F0411).

Create one version of the report for each document number series in the monthly VAT purchasing report. |

Figure 6-1 Sequential Number Report - Accounts Receivable

Description of "Figure 6-1 Sequential Number Report - Accounts Receivable"

Figure 6-2 Sequential Number Report - Accounts Payable

Description of "Figure 6-2 Sequential Number Report - Accounts Payable"

Figure 6-3 Sequential Number Report - Accounts Receivable VAT

Description of "Figure 6-3 Sequential Number Report - Accounts Receivable VAT"

Figure 6-4 Sequential Number Report - Accounts Payable VAT

Description of "Figure 6-4 Sequential Number Report - Accounts Payable VAT"

6.1.1 Processing Options for Sequential Number Report (P74099)

See Section 40.3, "Processing Options for Sequential Number Report (P74099)."