42 Generate the Purchase Book Report

This chapter contains these topics:

-

Section 42.3, "Running the Purchase Book - Step One Program (P74R0430),"

-

Section 42.4, "Running the Purchase Book - Step Two Program (P74R0431),"

-

Section 42.5, "Running the Purchase Book - Step Three Program (P74R0432),"

-

Section 42.6, "Printing Purchase Book - Final Step (P74R0433),"

-

Section 42.7, "Running the Adjustment List Sales Book Program (P74R0334),"

-

Section 42.8, "Running the Adjustment List Purchase Book Program (P74R0434)."

This chapter provides an overview of the Purchase Book report and discusses how to:

-

Run the Purchase Book Programs in sequence (P74R0430, P74R0431, P74R0432, P74R0433)

-

Set processing options for Purchase Book.

42.1 Understanding the Purchase Book Report

You use the Purchase Book report monthly to report VAT on paid vouchers (or all vouchers, depending on Suspended VAT Set Up). You use this report as a basis for reclaiming paid VAT from the tax authorities. The layout of the Purchase Book report matches the layout required by the Russian tax authority.

The Purchase Book report records vouchers after they have been paid or/and all vouchers (depending on suspended VAT setup) and the VAT amounts have been posted to the VAT account from the temporary VAT account. The report includes all purchases of goods and services for which you received and paid for the goods and services.

Additionally, the report includes or excludes the following records:

-

Paid vouchers for which an additional clause exists and the additional clause is unresolved, are excluded from the report. For instance, vouchers related to assets not commissioned yet (Hold suspended VAT)

-

Partially paid vouchers appear in the report, and are noted as partially paid (частично)

-

Reversed VAT accrued payable transactions from unapplied cash VAT calculations are included (Unapplied Cash spread to invoices)

-

VAT calculated for amount differences when the amount results in a loss

When you post vouchers, the system populates the Tax File table (F0018) with data about Russian taxes. When you run the Purchase Book report, the system reads table F0018 and selects records with paid vouchers and /or vouchers and journal entries with positive tax amounts for processing. The system summarizes the data by the following fields:

-

Company

-

Invoice Date

-

Address Number

-

Invoice Number

-

Payment Date

-

G/L Date

42.2 Processing the Purchase Book Steps

From Accounts Payable - RUSSIA (G74R04)

Generating the purchase book is a four-step process. You must complete the steps in the prescribed order.

-

Purchase Book - step one, process vouchers (P74R0430)

-

Purchase Book - step two, process payments (P74R0431)

-

Purchase Book - step three, process journal entries with tax (P74R0432)

-

Purchase Book - step four, print purchase book (P74R0433)

Note:

If it is necessary to process any of the first three steps again, you must start from the beginning. For example, if it is necessary to process step 2 again for any reason, step 1 should be executed first, followed by step 2, step 3, and step 4. Step 1 clears and the writes records to the tag file F74R0430 (Purchase Book work file). The second and third steps add selected records to the file.42.3 Running the Purchase Book - Step One Program (P74R0430)

From Accounts Payable - RUSSIA (G74R04), choose option 2 - Purchase book - Step one

This is the first process to execute. It compiles posted vouchers with VAT tax for the period. The DREAM Writer data selection is defined to include:

-

Posted vouchers

-

Reporting company

-

Range of dates to process

Every transaction that fulfills the following conditions will be included in the purchase book:

-

It is the same company as indicated in the processing option 7

-

It is within the period indicated in the processing options 1 and 2

-

Suspended VAT is not applicable to that transaction (This is the tax area setup, described in greater detail in the Working with Suspended Tax and Exchange Rate Differences section of this user guide. All exempt and non-taxable transactions will be reported in this step independently of suspended VAT set up)

If the voucher has several detail lines, only one summary line will be printed in the purchase book.

The process should be executed in final mode only after the reporting period is closed and no more transactions will be added to that period. The process prints a control report. The control report prints errors that might have occurred and total records generated.

Vouchers that have been voided in the same month as entered will not be included. If the void happened in a different month, it will be printed with the opposite sign.

42.4 Running the Purchase Book - Step Two Program (P74R0431)

From Accounts Payable - RUSSIA (G74R04), choose option 3 - Purchase book - Step two

This is the second process to execute. This program processes posted payments to include in the purchase book. The DREAM Writer data selection is defined to include:

-

Posted payments

-

Reporting company

-

G/L date lower than the end of the period

Every transaction that fulfills the following conditions will be included in the purchase book:

-

It is the same company as indicated by processing option

-

Suspended VAT is applicable to the transaction (this is a tax area setup). See Section 34.1, "Setting up AAIs for Suspended VAT Process."

-

The suspended VAT redistribution journal entry G/L date is inside the period indicated by processing option and the journal entry is posted. It means, if suspended VAT applies, there is a redistribution journal entry to move VAT from transitory to final tax account. That transaction date is the one to compare against the selected range

Payments that have been voided in the same month as entered will not be printed. If the void happened in a different month it will be printed with the opposite sign.

Payments will be printed in order by suspended VAT redistribution G/L date. The process prints a control report with errors that might have occurred and total records generated.

42.5 Running the Purchase Book - Step Three Program (P74R0432)

From Accounts Payable - RUSSIA (G74R04), choose option 4 - Purchase book - Step three

This is the third process to execute. This program includes journal entries with positive tax amounts (debits) in the purchase book, such as:

-

Journal entries with tax that were entered using P09106. (This program displays a final window where the user must enter the address number associated with the transaction, this address number will be used in the Purchase Book)

-

Journal entries that were automatically created by other processes such as prepayment tax accounting

Regarding prepayments, when a prepayment is spread to an invoice, the system will create a journal entry with tax to reverse the prepayment tax accounting. That reversal will also be included in the purchase book.

The DREAM Writer data selection is defined to include:

-

Posted transactions

-

Reporting company

-

G/L date range to process

-

Journal entry line type = 'T' (tax line)

Every transaction that fulfills the following conditions will be included in the purchase book:

-

It is a debit in terms of World software and multi-currency journal entry equals 'T' (tax journal entry)

-

It is the same company as indicated in processing option

-

The G/L date is within the selected range

-

If it is a related to a prepayment (Original document type = 'RU'), this is the tax accounting for the prepayment spread to an invoice

The tax amount should be distributed according to the tax area tax rate in the corresponding column. For prepayment spreads to invoices, there is no taxable amount, because the journal entry is a tax only transaction.

The process prints a control report with errors that might have occurred and total records generated.

42.6 Printing Purchase Book - Final Step (P74R0433)

This is the process that prints the purchase book with all transactions processed by the previous steps, and adds them to the audit file to indicate that they are processed transactions (F74R0050). It also updates the flat database file (F74R0433) for downloading to excel if option 2 or 3 are selected.

If a new transaction is entered for the reporting period later, begin again with Step 1 and repeat the process so that the new transaction will be included.

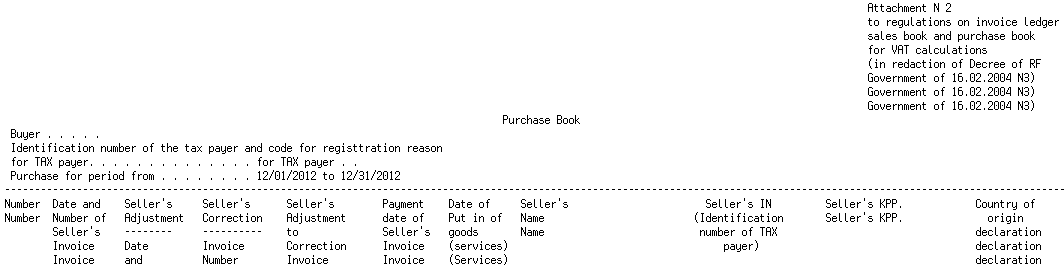

This purchase book report layout is in the format prescribed by Russian legal reporting requirements. See examples of the report layout at the end of this section. The following table lists the column numbers and description of the reporting fields in the report layout examples.

| Column Number | Explanation |

|---|---|

| 1 | Number of the invoice entry (counter). In this field the word "partial" (частично) will be printed if invoice is paid partially (based on the Partial/Full flag in the tag file). |

| 2 | Date and number of supplier's invoice. |

| 2a | Adjustment to invoice number and date. |

| 2b | Correction invoice number and date. |

| 2c | Adjustment to correction invoice number and date. |

| 3 | Invoice date of payment. |

| 4 | Goods or services receipt date. If the voucher is related to a purchase order, it is the receipt date. If it is not related to a purchase order, the invoice date will be printed. |

| 5 | Supplier's name. |

| 5a | Supplier tax identification number (INN). |

| 5b | Supplier KPP. This is taken from the localization tag file in Address Book. |

| 6 | Goods country of origin, custom declaration number. This is reported only for customs office invoices. It is taken from the localization tag file for vouchers. Country of origin + customs declaration number will be printed. The format to print the customs declaration number is xxxxxxxx/xxxxxx/xxxxxxx. |

| 7 | Total supplier invoice amount including VAT. This is the gross amount of the voucher. Cost of purchases without VAT + VAT. |

| 8 | Amount of purchases taxed at the VAT rate of 18 percent or at the settlement rates from the option 4 percent. |

| 8a | Purchase amount without VAT. |

| 8b | VAT amount computed at the rate of 18 percent or at settlement rates from the option 4 percent. |

| 9 | Amount of purchases taxed at the VAT rate of 10 percent or at the settlement rates from the option 5 percent. |

| 9a | Purchase amount without VAT |

| 9b | VAT amount computed at the rate of 10 percent or at settlement rates from the option 5 percent. |

| 10 | Amount of purchases taxed at the rate of 0 percent. |

| 11 | Amount of purchases taxed at the VAT rate of 20 percent or at the settlement rates from the option 6 percent. |

| 11a | Purchase amount without VAT. |

| 11b | VAT amount computed at the rate of 20 percent or at settlement rates from the option 6 percent. |

| 12 | Tax exempt purchase amount. |

| 13 | Buyer. |

| 14 | Identification number of the tax payer - buyer. |

| 15 | Begin date for purchase period that is entered in the processing options. |

| 16 | End date for purchase period that is entered in the processing options. |

| 17 | Blanks, must be written manually. |

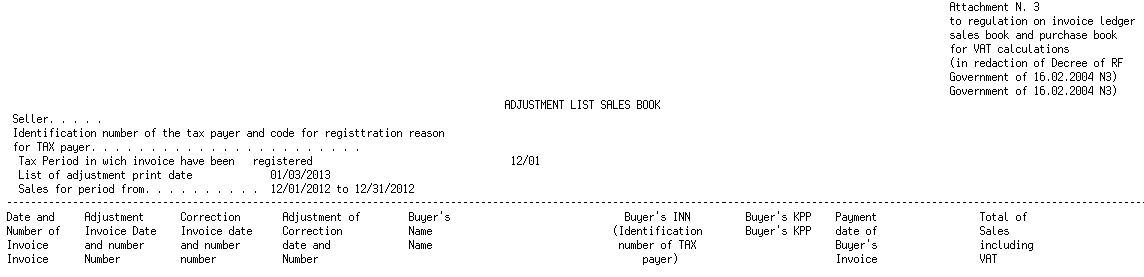

42.7 Running the Adjustment List Sales Book Program (P74R0334)

From Accounts Receivable - RUSSIA (G74R03), choose option 10 - Adjustment List

Every transaction that fulfills the following conditions will be included in the adjustment sales book:

-

Invoice adjustment document issued in a future period

-

Negative corrections for vouchers in a future period

-

Positive corrections for invoices (debit notes) in a future period

This adjustment list sales book report layout is in the format prescribed by Russian legal reporting requirements. See examples of the report layout at the end of this section.

Figure 42-2 Adjustment List Sales Book report

Description of "Figure 42-2 Adjustment List Sales Book report"

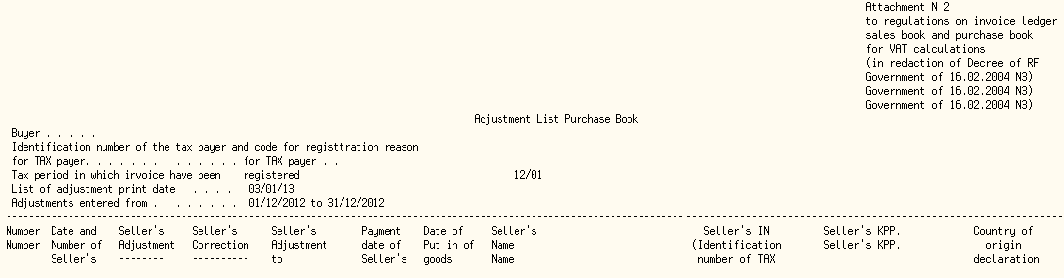

42.8 Running the Adjustment List Purchase Book Program (P74R0434)

From Accounts Payable - RUSSIA (G74R04), choose option 12 - Adjustment List

Every transaction that fulfills the following conditions will be included in the adjustment purchase book:

-

Voucher adjustment document issued in a future period

-

Negative corrections for invoices in a future period

-

Positive corrections for vouchers in a future period

This adjustment list purchase book report layout is in the format prescribed by Russian legal reporting requirements. See examples of the report layout at the end of this section.

Figure 42-3 Adjustment List Purchase Book report

Description of "Figure 42-3 Adjustment List Purchase Book report"