41 Generate the Sales Book Report

This chapter contains these topics:

-

Section 41.3, "Running the Sales Book- Step One Program (P74R0330),"

-

Section 41.4, "Running the Sales Book - Step Two Program (P74R0331),"

-

Section 41.5, "Running the Sales Book - Step Three Program (P74R0432),"

-

Section 41.6, "Printing Sales Book - Final Step (P74R0333)."

This chapter provides an overview of the Sales Book report and discusses how to:

-

Run the Sales Book programs (P74R0330, P74R0331, P74R0432, P74R0333).

-

Set processing options for Sales Book.

41.1 Understanding the Sales Book Report

You use the Sales Book report to report to the tax authorities all sales of goods and services for which you received payment. In some cases, you might also report the sale of goods or services for which you have not received payment. The Sales Book report registers invoices issued to customers and prepayments received from customers. It contains VAT amounts for each invoice issued to a customer, including unapplied cash receipts, the VAT calculated for amount difference vouchers and invoices if the difference results in a profit, and journal entries with negative tax amount.

If your company calculates and pays VAT on a cash basis, then the Sales Book report must include summarized data for each receipt date. If the invoice is partially paid, the system prints "Partial payment" on each line of the partial receipt.

If you receive prepayments, you must show the sum in your system as unapplied cash, and you must issue to the customer a tax invoice that shows the prepayment amount. When you provide the goods or services for which the prepayment was received, you create a sales invoice, match the invoice to the unapplied cash, and issue a tax invoice to your customer that is based on the sales invoice records.

41.2 Processing the Sales Book Steps

From Accounts Receivable - RUSSIA (G74R03)

Generating the Sales Book is a four-step process. You must complete the steps in the prescribed order.

-

Sales Book - step one (P74R0330)

-

Sales Book - step two (P74R0331)

-

Sales Book - step three (P74R0432)

-

Sales Book - step four, print Sales Book (P74R0333)

Note:

If it is necessary to process any of the first three steps again, you must start from the beginning. For example, if it is necessary to process step 2 again for any reason, step 1 should be executed first, followed by step 2, step 3, and step 4. (The first three steps write selected records in tag file F74R0330 (Sales Book workfile).41.3 Running the Sales Book- Step One Program (P74R0330)

From Accounts Receivable - RUSSIA (G74R03), choose option 6 - Sales book - Step one

This is the first process to execute. This program selects the invoices entered in the period to be included in the Sales book report.

Every transaction that fulfills the following conditions is included in the Sales Book:

-

It is the same company as indicated in processing option 7

-

It is within the period indicated in the processing option 1 and 2

-

Suspended VAT is not applicable to that transaction

-

All exempt and non-taxable transactions will be reported in this step independently of suspended VAT setup

-

All transactions must be posted

The process should be executed in final mode only after the reporting period is closed and no more transactions will be added to that period. The process prints a control report. The control report prints errors that might have occurred and total records generated.

Invoices that have been voided in the same month as entered are not included. If the void happened in a different month, it prints with the opposite sign.

41.4 Running the Sales Book - Step Two Program (P74R0331)

From Accounts Receivable - RUSSIA (G74R03), choose option 7 - Sales book - Step two

This is the second process to execute. It selects the posted receipts that are included in the Sales Book report.

Every transaction that fulfills the following conditions is included in the Sales Book:

-

It is the same company as indicated by processing option

-

Suspended VAT is applicable to the transaction

-

The suspended VAT redistribution journal entry G/L date is within the period indicated by processing option and the journal entry is posted

Receipts that have been voided in the same month as entered are not printed. If the void happened in a different month it is printed with the opposite sign.

Receipts are printed in order by suspended VAT redistribution G/L Date. The process prints a control report with errors that might have occurred and total records generated.

41.5 Running the Sales Book - Step Three Program (P74R0432)

From Accounts Receivable - RUSSIA (G74R03), choose option 8 - Sales book - Step three

This is the third process to execute. It includes journal entries with negative tax amounts in the Sales Book, such as:

-

Journal entries with tax that were entered using P09106 (This program displays a final window where the user must enter the address book number associated with the transaction, this address book number will be used in the Sales Book)

-

Journal entries that were automatically created by prepayment tax accounting

-

Journal entries that have been voided in the same month as entered are not printed. If the void happened in a different month it is printed with the opposite sign

Every transaction that fulfills the following conditions is included in the Sales Book:

-

It is a credit in terms of JD Edwards World software and multi-currency journal entry equals 'T' (tax journal entry)

-

It is the same company as indicated in processing option

-

The G/L Date is within the selected range

-

It is a tax accounting related to prepayment (Original document type ='RU')

The process prints a control report with errors that might have occurred and total records generated.

41.6 Printing Sales Book - Final Step (P74R0333)

This is the last step. This is the process that prints the Sales Book with all transactions processed by the previous steps and updates the transactions processed file if the process is executed in final mode.

This process should be executed in final mode only after the reporting period is closed and no more transactions will be added to that period. Once the process is executed in final mode, the transactions are included in the processed transactions file (audit file F74R0050 - Legal Application Code SALBOOK).

If processing option 1 is equal to 1 or 3, the process prints the Sales Book report.

If you need to reprint the Sales Book you must set up processing option 3=2 (reprint) in Step 1 (P74R0330) and run all steps.

If processing option 1 is equal to 2 or 3, the transactions are included in the file F74R0333 - Print Sales Book. This file is a copy of the printed version.

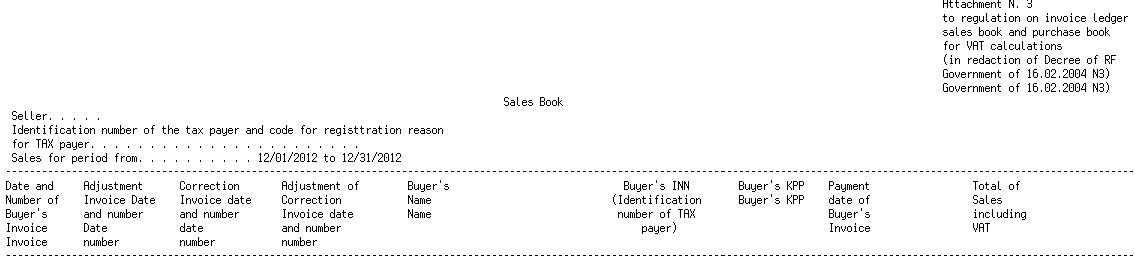

This Sales Book report layout is in the format prescribed by Russian legal reporting requirements. See examples of the report layout in English and Russian at the end of this section. The following table lists the column numbers and description of the reporting fields in the report layout examples.

| Column Number | Explanation |

|---|---|

| 1 | Date and number of the seller's invoice |

| 2 | Buyer's name |

| 2a | Adjustment to invoice number and date |

| 2b | Correction invoice number and date |

| 2c | Adjustment to correction invoice number and date |

| 3 | Buyer's tax identification number |

| 3A | Buyer's KPP |

| 3B | Date of payment of the notice |

| 4 | Total amount of sales, in accordance with the invoice, including VAT |

| 5 | Sales amount taxed at the VAT rate of 18 percent or at the settlement rates from option 4 percent |

| 5A | Sales amount without VAT |

| 5B | VAT amount computed at the rate of 18 percent or at the settlement rates from option 4 percent |

| 6 | Sales amount taxed at the VAT rate of 10 percent or at the settlement rates from option 5 percent |

| 6A | Sales amount without VAT |

| 6B | VAT amount computed at the rate of 10 percent or at the settlement rates from option 5 percent |

| 7 | Sales amount taxed at the rate of 0 percent |

| 8 | Sales amount taxed at the VAT rate of 20 percent or at the settlement rates from option 6 percent |

| 8A | Sales amount without VAT |

| 8B | VAT amount computed at the rate of 20 percent or at the settlement rates from option 6 percent |

| 9 | Tax exempt sales amount |

| 10 | Seller mailing name of the company |

| 11 | Identification number of the tax payer - seller |

| 12 | Sales for the period from the Initial date that is entered in the processing options |

| 13 | Sales for the period to the Final date that is entered in the processing options |

| 14 | Chief accountant, blank, must be written |